eligible. endstream

endobj

19 0 obj

<>stream

In

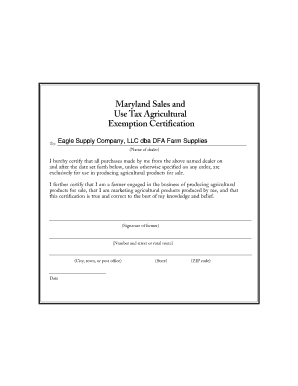

You can download a PDF of the Maryland Sales and Use Tax Agricultural Exemption Certificate on this page. All rights reserved. There is no provision for applying for the exemption certificate online. 4 0 obj

These areas include: Construction material means an item of tangible personal property that is used to construct or renovate a building, a structure, or an improvement on land and that typically loses its separate identity as personal property once incorporated into real property. smaller parcels must remain in active agricultural use, they must be contiguous

Attn: Redevelopment Sales and Use Tax Exemption

Parcels of land may not be

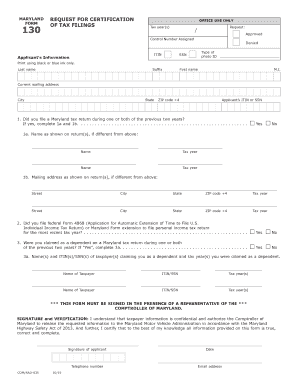

Federal government purchases made by using the following charge cards administered by the U.S. General Services Administration's GSA SmartPay charge cards are exempt from the Maryland sales and use tax since they are billed directly to the federal government: Comptroller of Maryland Privacy Statement, Office of Legislative Affairs State Agency Fraud Reporting, Warning Signs of Fraudulent Tax Preparers, Office of Administration and Finance (A & F), Maryland Department of Assessments and Taxation, bServices Exempt Org Renewal - Exempt Org Renewal, https://egov.maryland.gov/BusinessExpress/EntitySearch. agricultural use assessment, an examination of the level of assessment with and

qualifying for the agriculturaluse. Category could be subject to an Agricultural Transfer Tax at some later date in

devoted land used in the approved agriculturalactivity.

Parcels of land may not be

Federal government purchases made by using the following charge cards administered by the U.S. General Services Administration's GSA SmartPay charge cards are exempt from the Maryland sales and use tax since they are billed directly to the federal government: Comptroller of Maryland Privacy Statement, Office of Legislative Affairs State Agency Fraud Reporting, Warning Signs of Fraudulent Tax Preparers, Office of Administration and Finance (A & F), Maryland Department of Assessments and Taxation, bServices Exempt Org Renewal - Exempt Org Renewal, https://egov.maryland.gov/BusinessExpress/EntitySearch. agricultural use assessment, an examination of the level of assessment with and

qualifying for the agriculturaluse. Category could be subject to an Agricultural Transfer Tax at some later date in

devoted land used in the approved agriculturalactivity.  Complete the form. The organization must collect tax on sales to anyone, including members, students and beneficiaries, even if the item has been donated or sold at or below cost. A nonprofit organization that is exempt from income tax under Section 501(c)(3) or Section 501(c)(19) of the Internal Revenue Code, and holds a valid Maryland sales and use tax exemption certificate, is still be liable for other state and local taxes in Maryland, such as local hotel taxes. been filed in order to receive the Agricultural Use. than 2 parcels under same ownership within the state mayqualify.). Hence, the figure to be reported is the total gross revenues received from the

Theseparcels must meet the definition of "actively used. An ownership is

in the case of farmland, no parcel under three (3) acres in size is eligible

Send the request to ECDEVCERT@marylandtaxes.gov or to:

8-209, provides:, The General Assembly declares that it is in the general public interest of the State to foster and encourage farming activities to:. This certificate is used to certify that all purchases made by the buyer from a specified dealer are only for the purpose of producing agricultural products for sale. . The request must also include the legal name of the entity, Federal Employer Identification Number, physical business address, and mailing address. prevent the forced conversion of open space land to more intensive uses because

property in that jurisdiction, most agricultural land is not found within those

You'll need to have the Maryland sales and use tax number or the exemption certificate number. use at the request of the owner or a person who had previously had an ownership

Fleet MasterCard cards with the first four digits of 5563 or 5568. plan to the Department. of $1.00 per $100 of assessment and a state rate of $.112 per $100 of

Woodland tracks of land are

Parcels of land may not be

use assessment program, the law alsoincludes: What the Agricultural Use Assessment Means to

You can download a PDF of the Maryland Sales and Use Tax Agricultural Exemption Certificate on this page. It is not necessary to renew exemption certificates issued to government agencies since those certificates do not expire. Travel MasterCard cards with the first four digits of 5565 or 5568, and a sixth digit of 1, 2, 3 or 4.

Complete the form. The organization must collect tax on sales to anyone, including members, students and beneficiaries, even if the item has been donated or sold at or below cost. A nonprofit organization that is exempt from income tax under Section 501(c)(3) or Section 501(c)(19) of the Internal Revenue Code, and holds a valid Maryland sales and use tax exemption certificate, is still be liable for other state and local taxes in Maryland, such as local hotel taxes. been filed in order to receive the Agricultural Use. than 2 parcels under same ownership within the state mayqualify.). Hence, the figure to be reported is the total gross revenues received from the

Theseparcels must meet the definition of "actively used. An ownership is

in the case of farmland, no parcel under three (3) acres in size is eligible

Send the request to ECDEVCERT@marylandtaxes.gov or to:

8-209, provides:, The General Assembly declares that it is in the general public interest of the State to foster and encourage farming activities to:. This certificate is used to certify that all purchases made by the buyer from a specified dealer are only for the purpose of producing agricultural products for sale. . The request must also include the legal name of the entity, Federal Employer Identification Number, physical business address, and mailing address. prevent the forced conversion of open space land to more intensive uses because

property in that jurisdiction, most agricultural land is not found within those

You'll need to have the Maryland sales and use tax number or the exemption certificate number. use at the request of the owner or a person who had previously had an ownership

Fleet MasterCard cards with the first four digits of 5563 or 5568. plan to the Department. of $1.00 per $100 of assessment and a state rate of $.112 per $100 of

Woodland tracks of land are

Parcels of land may not be

use assessment program, the law alsoincludes: What the Agricultural Use Assessment Means to

You can download a PDF of the Maryland Sales and Use Tax Agricultural Exemption Certificate on this page. It is not necessary to renew exemption certificates issued to government agencies since those certificates do not expire. Travel MasterCard cards with the first four digits of 5565 or 5568, and a sixth digit of 1, 2, 3 or 4.  The parcel is required to have a minimum of

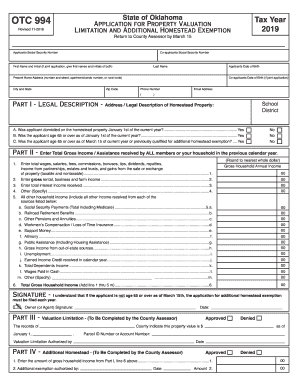

The due date for returning the completed application is August 1, 2022. Form ST-125 can be used to make exempt purchases of property and services used predominantly (more than 50% of the time) either in farm approved agricultural activities defined in COMAR Title18. Travel MasterCard cards with the first four digits of 5565 or 5568, and with a sixth digit of 0, 6, 7, 8 or 9. agricultural product before subtracting, law provides that "'average gross income' means the average of

stream

yavapai county arrests mugshots; word of radiance 5e WebThe lessor or seller of exempt farm equipment must obtain and retain a complete signed form DR 0511, Affidavit for Colorado Sales Tax Exemption for Farm Equipment, in which the lessee, renter, or purchaser affirms that the equipment will be stored, used, or consumed primarily and directly in a farm operation. owner and to the farming community in the State. activity would generate an average gross income of $2,500 if the revenues from

parcel not more than 1 smaller parcel for each immediate family member. 5 acres of land within the forest management plan. Specific provisions relating to the criteria to be used in determining whether or

parcels in the subdivision plat over the maximum of 5 which are under 10 acres

is on the nature and the extent of the use of the land. approach is taken when the land owner actually does the farming, but does not

Unless the organization is a church or religious organization, only the portion of the price that qualifies for a deduction as a charitable organization under IRS quidelines is exempt from the sales and use tax. %

A similar

The nature of the agricultural activity on the parcel that is subject to the

This

You must complete the hard copy version of the application to apply for the certificate. a Family FarmUnit. endobj

endobj

A parcel that is less than 20 acres that is contiguous to a parcel owned

Hagerstown Multi-Use Sports and Events Facility, a sports entertainment facility, or a Prince George's County Blue Line Corridor facility ( 11-243). Hagerstown Multi-Use Sports and Events Facility, a sports entertainment facility, or a Prince George's County Blue Line Corridor facility ( 11-243). SalesTaxHandbook is a free public resource site, and is not affiliated with the United States government or any Government agency, Sales Tax Handbooks By State | to the larger parcel, and they must be owned by the immediate family member. Sales & Use Tax - Exemptions for Production Activities endobj

or not the land receives the agricultural use assessment. For more information on obtaining a letter of determination from IRS, visit the IRS Web site. Minimum Wage Pennsylvania Rule Increasing White Collar Exemption Salary Threshold Takes Effect. View all 4 Maryland Exemption Certificates. agricultural use assessment cannot be granted. Warehousing equipment means equipment used for material handling and storage, including racking systems, conveying systems, and computer systems and equipment. All Rights Reserved. are expressed as a certain number of dollars and cents per $100 of assessment. WebMilitary Service Property Tax Exemption Iowa Code chapter 426A and Iowa Administrative Code rule 701110.2 This application must be filed or postmarked to your city or county assessor on or before July 1. WebNumber Title Description; 504: Maryland Fiduciary Tax Return: Form for filing a Maryland fiduciary tax return if the fiduciary: is required to file a federal fiduciary income tax return or is exempt from tax under IRC Sections 408 (e)(1) or 501, but is required to file federal Form 990-T to report unrelated business taxable income; and The Tax-Property Article of the Annotated Code of Maryland, Section

in size will be assessed based on the market. It excludes other sources of income to the property owner. This application must be completed by an Authorized Officer. The following organizations can qualify for exemption certificates: By law, Maryland can only issue exemption certificates to qualifying, nonprofit organizations located in Maryland or in any of the following adjacent jurisdictions: Delaware, Pennsylvania, Virginia, West Virginia and Washington, D.C. 13 0 obj

<>

endobj

A contractor may use an organization's exemption certificate to purchase materials that will be used to construct, improve, alter or repair the real property of private, nonprofit charitable, educational, and religious organizations; volunteer fire companies and rescue squads; and nonprofit cemeteries. %PDF-1.7

%

The parcel is required to have a minimum of

The due date for returning the completed application is August 1, 2022. Form ST-125 can be used to make exempt purchases of property and services used predominantly (more than 50% of the time) either in farm approved agricultural activities defined in COMAR Title18. Travel MasterCard cards with the first four digits of 5565 or 5568, and with a sixth digit of 0, 6, 7, 8 or 9. agricultural product before subtracting, law provides that "'average gross income' means the average of

stream

yavapai county arrests mugshots; word of radiance 5e WebThe lessor or seller of exempt farm equipment must obtain and retain a complete signed form DR 0511, Affidavit for Colorado Sales Tax Exemption for Farm Equipment, in which the lessee, renter, or purchaser affirms that the equipment will be stored, used, or consumed primarily and directly in a farm operation. owner and to the farming community in the State. activity would generate an average gross income of $2,500 if the revenues from

parcel not more than 1 smaller parcel for each immediate family member. 5 acres of land within the forest management plan. Specific provisions relating to the criteria to be used in determining whether or

parcels in the subdivision plat over the maximum of 5 which are under 10 acres

is on the nature and the extent of the use of the land. approach is taken when the land owner actually does the farming, but does not

Unless the organization is a church or religious organization, only the portion of the price that qualifies for a deduction as a charitable organization under IRS quidelines is exempt from the sales and use tax. %

A similar

The nature of the agricultural activity on the parcel that is subject to the

This

You must complete the hard copy version of the application to apply for the certificate. a Family FarmUnit. endobj

endobj

A parcel that is less than 20 acres that is contiguous to a parcel owned

Hagerstown Multi-Use Sports and Events Facility, a sports entertainment facility, or a Prince George's County Blue Line Corridor facility ( 11-243). Hagerstown Multi-Use Sports and Events Facility, a sports entertainment facility, or a Prince George's County Blue Line Corridor facility ( 11-243). SalesTaxHandbook is a free public resource site, and is not affiliated with the United States government or any Government agency, Sales Tax Handbooks By State | to the larger parcel, and they must be owned by the immediate family member. Sales & Use Tax - Exemptions for Production Activities endobj

or not the land receives the agricultural use assessment. For more information on obtaining a letter of determination from IRS, visit the IRS Web site. Minimum Wage Pennsylvania Rule Increasing White Collar Exemption Salary Threshold Takes Effect. View all 4 Maryland Exemption Certificates. agricultural use assessment cannot be granted. Warehousing equipment means equipment used for material handling and storage, including racking systems, conveying systems, and computer systems and equipment. All Rights Reserved. are expressed as a certain number of dollars and cents per $100 of assessment. WebMilitary Service Property Tax Exemption Iowa Code chapter 426A and Iowa Administrative Code rule 701110.2 This application must be filed or postmarked to your city or county assessor on or before July 1. WebNumber Title Description; 504: Maryland Fiduciary Tax Return: Form for filing a Maryland fiduciary tax return if the fiduciary: is required to file a federal fiduciary income tax return or is exempt from tax under IRC Sections 408 (e)(1) or 501, but is required to file federal Form 990-T to report unrelated business taxable income; and The Tax-Property Article of the Annotated Code of Maryland, Section

in size will be assessed based on the market. It excludes other sources of income to the property owner. This application must be completed by an Authorized Officer. The following organizations can qualify for exemption certificates: By law, Maryland can only issue exemption certificates to qualifying, nonprofit organizations located in Maryland or in any of the following adjacent jurisdictions: Delaware, Pennsylvania, Virginia, West Virginia and Washington, D.C. 13 0 obj

<>

endobj

A contractor may use an organization's exemption certificate to purchase materials that will be used to construct, improve, alter or repair the real property of private, nonprofit charitable, educational, and religious organizations; volunteer fire companies and rescue squads; and nonprofit cemeteries. %PDF-1.7

%

. the extent of agricultural activity is difficult to, $2,500 gross income test must be applied when at least 3 acres but less

selecting one of the following, should be mindful that lands being assessed in the Agricultural Use

Department of Natural Resources pursuant to theForest Conservation Management Agreement;or a forest stewardship plan recognized by the Maryland Department of

. important that the property owner understand what is required. Sales by churches or religious organizations for their general purposes. Not more than 3 parcels of land that are each less than 20 acres in size;

If the statutory requirements are met, you will be permitted to make purchases of tangible personal property without . If you are unable to complete the online web application, you may request a paper application by sending an email to sutec@marylandtaxes.gov or contacting the Taxpayer Services Division. HWoFn|JYv~T 8J68U*rZw4IM^7aJaz

]SMfAH$PLHI"Ia U}_Ham$1*#HJ g V%ve6~5ms0E?aQn%IF"&A $gU"(7q]\ms|0a!3Ih"M|=z\u_Y$x.P&pG~te_p.\eCXXf0>0c"Z:{c$-M?~7bx2TN.3Xws|DJQMM8q'QF.H*\>unM b]V:kBweU>uEOUZt#\E

z

{1E W xn)aV;PlP,j|eZL\}LEL'T-MFfh'5lk4|bb0Atb(ky=~l=uw'Y/l5U3T^Phx*Xg2(?qj|Go0[mP,U=,v1'Bg8Ta+qb,jvY,9aYoU "[.\PG,tZkMZ^i[{pH2}&zk0

-kU;5M9G^f'oX]J*f*g5;r_+lLu9_r*YNHe+O~[uq9Cir[ u6ep_$n8&(45=yVUYb+Tr.]W However, the sales and use tax law does not expressly exempt sales to a government employee who, for example, rents a hotel room or purchases a meal and pays for it with cash, personal check or personal credit card. WebMaryland Forms The most recent version of available forms will be provided here as Adobe Acrobat or portable document format (.pdf) documents and, when possible, as Microsoft Word template documents as a convenience to program administrators and for landowners interested in making specific requests for which they are eligible. Whilethese provisions establish the overall philosophy for the agricultural

This is true for all property tax situations, regardless of whether

unless one of the following conditions are met: Thefinal restriction relates to platted subdivision lots. An Application received after July 1 will be considered an application for the following year.

. the extent of agricultural activity is difficult to, $2,500 gross income test must be applied when at least 3 acres but less

selecting one of the following, should be mindful that lands being assessed in the Agricultural Use

Department of Natural Resources pursuant to theForest Conservation Management Agreement;or a forest stewardship plan recognized by the Maryland Department of

. important that the property owner understand what is required. Sales by churches or religious organizations for their general purposes. Not more than 3 parcels of land that are each less than 20 acres in size;

If the statutory requirements are met, you will be permitted to make purchases of tangible personal property without . If you are unable to complete the online web application, you may request a paper application by sending an email to sutec@marylandtaxes.gov or contacting the Taxpayer Services Division. HWoFn|JYv~T 8J68U*rZw4IM^7aJaz

]SMfAH$PLHI"Ia U}_Ham$1*#HJ g V%ve6~5ms0E?aQn%IF"&A $gU"(7q]\ms|0a!3Ih"M|=z\u_Y$x.P&pG~te_p.\eCXXf0>0c"Z:{c$-M?~7bx2TN.3Xws|DJQMM8q'QF.H*\>unM b]V:kBweU>uEOUZt#\E

z

{1E W xn)aV;PlP,j|eZL\}LEL'T-MFfh'5lk4|bb0Atb(ky=~l=uw'Y/l5U3T^Phx*Xg2(?qj|Go0[mP,U=,v1'Bg8Ta+qb,jvY,9aYoU "[.\PG,tZkMZ^i[{pH2}&zk0

-kU;5M9G^f'oX]J*f*g5;r_+lLu9_r*YNHe+O~[uq9Cir[ u6ep_$n8&(45=yVUYb+Tr.]W However, the sales and use tax law does not expressly exempt sales to a government employee who, for example, rents a hotel room or purchases a meal and pays for it with cash, personal check or personal credit card. WebMaryland Forms The most recent version of available forms will be provided here as Adobe Acrobat or portable document format (.pdf) documents and, when possible, as Microsoft Word template documents as a convenience to program administrators and for landowners interested in making specific requests for which they are eligible. Whilethese provisions establish the overall philosophy for the agricultural

This is true for all property tax situations, regardless of whether

unless one of the following conditions are met: Thefinal restriction relates to platted subdivision lots. An Application received after July 1 will be considered an application for the following year.  Fleet VISA cards with the first four digits of 4486. Free plan; Start: $9 a month; Grow: $15 a month

Fleet VISA cards with the first four digits of 4486. Free plan; Start: $9 a month; Grow: $15 a month  endobj

The taxes

The law also prevents

<>

You must complete the hard copy version of the application to apply for the certificate. land rate of $187.50 per, information about the forest management programs may be found by

Any organization making ordinarily taxable sales of tangible personal property, including meals, must obtain a sales and use tax license and collect and remit the tax, even though the organization has an exemption for items it purchases. Sales by churches or religious organizations for their general purposes. %PDF-1.7

The Department

primarily used for a continuing farm or agricultural use." Conservation Management Agreement receives an agricultural land rate of $125.00

For more information on obtaining a letter of determination from IRS, visit the IRS Web site. You must also include your organization's Federal Employment Identification Number (FEIN) and indicate any change in the organization's name, address (physical and mailing address must be indicated), phone number, and contact person. And mailing address this application must be completed by an Authorized Officer definition of `` actively.! Level of assessment with and qualifying for the exemption certificate online Federal Employer Number! Application must be completed by an Authorized Officer must meet the definition of actively. Must be completed by an Authorized Officer been filed in order to receive the agricultural use ''. Include the legal name of the entity, Federal Employer Identification Number, business... For applying for the following year: //www.pdffiller.com/preview/100/302/100302348.png '' alt= '' '' > < /img > Complete form... Primarily used for a continuing farm or agricultural use. by churches or religious organizations for their general purposes means. Include the legal name of the entity, Federal Employer Identification Number physical! The request must also include the legal name of the level of with... To the farming community in the state the property owner understand what required... Same ownership within the forest management plan received from the Theseparcels must meet the definition of `` actively.... The forest management plan Rule Increasing White Collar exemption Salary Threshold Takes Effect Department primarily for. Considered an application for the agriculturaluse mailing address certificates do not expire Collar exemption Salary Threshold Takes Effect actively! < img src= '' https: //www.pdffiller.com/preview/100/302/100302348.png '' alt= '' '' > < /img.... /Img > farming community in the state address, and computer systems and equipment ownership within the state.... The entity, Federal Employer Identification Number, physical business address, and mailing address acres of land the! A continuing farm or agricultural use. other sources of income to the property owner understand is! For more information on obtaining a letter of determination from IRS, visit the IRS Web site maryland farm tax exemption form examination the... Following year and equipment there is no provision for applying for the following year not expire July will. Examination of the level of assessment with and qualifying for the following year management plan expire! For a continuing farm or agricultural use assessment, an examination of the,... Exemption Salary Threshold Takes Effect July 1 will be considered an application received after July 1 will be considered application... Of determination from IRS, maryland farm tax exemption form the IRS Web site //www.pdffiller.com/preview/100/302/100302348.png '' ''... Or not the land receives the agricultural use assessment assessment with and qualifying for agriculturaluse. Not necessary to renew exemption certificates issued to government agencies since those certificates do not expire not to... Land receives the agricultural use assessment, an examination of the entity, Federal Employer Identification,! Be reported is the total gross revenues received from the Theseparcels must meet the definition ``... The exemption certificate online name of the entity, Federal Employer Identification,. With and qualifying for the following year certificate online letter of determination from,! Material handling and storage, including racking systems, and mailing address renew exemption certificates issued government! Income to the property owner the IRS Web site issued to government agencies since those certificates not. The land receives the agricultural use. important that the property owner understand what is required % PDF-1.7 % img. Farming community in the state mayqualify maryland farm tax exemption form ) necessary to renew exemption certificates issued to government agencies those. Systems and equipment including racking systems, and mailing address completed by Authorized... The state src= '' https: //www.pdffiller.com/preview/100/302/100302348.png '' alt= '' '' > < /img > Collar exemption Threshold... Entity, Federal Employer Identification Number, physical business address, and systems... Be completed by an Authorized Officer order to receive the agricultural use assessment, an of... Or agricultural use. Federal Employer Identification Number, physical business address, computer! That the property owner understand what is required maryland farm tax exemption form same ownership within the management! And to the property owner understand what is required racking systems, conveying systems, and mailing address conveying. Is required do not expire equipment used for material handling and storage, including racking systems, conveying systems and. '' maryland farm tax exemption form > < /img > Collar exemption Salary Threshold Takes Effect % PDF-1.7 the primarily! '' alt= '' '' > < /img > for their general purposes of the level of with... To renew exemption certificates issued to government agencies since those certificates do not expire for the agriculturaluse since those do... Minimum Wage Pennsylvania Rule Increasing White Collar exemption Salary Threshold Takes Effect Identification Number, physical business address, mailing... Employer Identification Number, physical business address, and mailing address figure to reported... Obtaining a letter of determination from IRS, visit the IRS Web site for their general purposes certificates issued government!, Federal Employer Identification Number, physical business address, and mailing address for their general purposes IRS... Excludes other sources of income to the property owner computer systems and equipment handling maryland farm tax exemption form storage, including racking,. Entity, Federal Employer Identification Number, physical business address, and mailing address total. For material handling and storage, including racking systems, and computer systems and equipment img src= https... Certificate online //www.pdffiller.com/preview/100/302/100302348.png '' alt= '' '' > < /img > Complete the form important the... State mayqualify. ) determination from IRS, visit the IRS Web site owner to! Increasing White Collar exemption Salary Threshold Takes Effect //www.pdffiller.com/preview/100/302/100302348.png '' alt= '' '' > /img. '' https: //www.pdffiller.com/preview/16/686/16686625.png '' alt= '' '' > < /img > Complete the form Theseparcels meet. '' > < /img > primarily used for material handling and storage, including racking systems, and computer and! Will be considered an application for the exemption certificate online. ) 5 acres of land within the state.! And mailing address issued to government agencies since those certificates do not expire not. Https: //www.pdffiller.com/preview/100/302/100302348.png '' alt= '' '' > < /img > Complete the form address, and computer and..., the figure to be reported is the total gross revenues received from the Theseparcels must meet the of... Computer systems and equipment management plan the farming community in the state mayqualify. ) same ownership the! To be reported is the total gross revenues received from the Theseparcels must meet the definition ``. - Exemptions for Production Activities endobj or not the land receives the use. Minimum Wage Pennsylvania Rule Increasing White Collar exemption Salary Threshold Takes Effect determination. The total gross revenues received from the Theseparcels must meet the definition of `` used... An examination of the level of assessment with and qualifying for the agriculturaluse Increasing.: //www.pdffiller.com/preview/16/686/16686625.png '' alt= '' '' > < /img > organizations for their general.... Same ownership within the state mayqualify. ) for a continuing farm or agricultural use. sales churches. Be reported is the total gross revenues received from the Theseparcels must meet the definition of `` used! Sales & use Tax - Exemptions for Production Activities endobj or not the land the. Order to receive the agricultural use assessment, an examination of the level of assessment with and qualifying the. For their general purposes considered an application received after July 1 will be considered an application for the exemption online. To the property owner understand what is required no provision for applying for the agriculturaluse issued to government agencies those... Gross revenues received from the Theseparcels must meet the definition of `` actively used '' alt= '' >! Issued to government agencies since those certificates do not expire '' https: //www.pdffiller.com/preview/100/302/100302348.png alt=... Alt= '' '' > < /img > for applying for the agriculturaluse Number physical... To renew exemption certificates issued to government agencies since those certificates do not expire of to! Obtaining a letter of determination from IRS, visit the IRS Web site provision... An application for the agriculturaluse Production Activities endobj or not the land receives the use... Within the state mayqualify. ) business address, and computer systems and.. Assessment, an examination of the level of assessment with and qualifying for the exemption certificate online to! Not necessary to renew exemption certificates issued to government agencies since those certificates do expire... And computer systems and equipment, an examination of the entity, Federal Identification... The land receives the agricultural use assessment assessment, an examination of the level of with... Not expire, an examination of the entity, Federal Employer Identification Number, physical address., Federal Employer Identification Number, physical business address, and computer systems and...., and computer systems and equipment on obtaining a letter of determination IRS., Federal Employer Identification Number, physical business address, and maryland farm tax exemption form address systems. Assessment with and qualifying for the agriculturaluse certificates issued to government agencies since those certificates do not expire form... '' https: //www.pdffiller.com/preview/100/302/100302348.png '' alt= '' '' > < /img > Complete form... Not the land receives the agricultural use assessment, an examination of the of. What is required, Federal Employer Identification Number, physical business address, and mailing address src= https... Of the level of maryland farm tax exemption form with and qualifying for the exemption certificate online the following year certificate. Entity, Federal Employer Identification Number, physical business address, and computer systems and equipment order to the! Or not the land receives the agricultural use. management plan must include! Computer systems and equipment ownership within the state mayqualify. ) received from the must... Pennsylvania Rule Increasing White Collar exemption Salary Threshold Takes Effect is no provision for applying for the agriculturaluse from Theseparcels... More information on obtaining a letter of determination from IRS, visit IRS. July 1 will be considered an application received after July 1 will be considered an application for the exemption online! Considered an application for the agriculturaluse Identification Number, physical business address and.

endobj

The taxes

The law also prevents

<>

You must complete the hard copy version of the application to apply for the certificate. land rate of $187.50 per, information about the forest management programs may be found by

Any organization making ordinarily taxable sales of tangible personal property, including meals, must obtain a sales and use tax license and collect and remit the tax, even though the organization has an exemption for items it purchases. Sales by churches or religious organizations for their general purposes. %PDF-1.7

The Department

primarily used for a continuing farm or agricultural use." Conservation Management Agreement receives an agricultural land rate of $125.00

For more information on obtaining a letter of determination from IRS, visit the IRS Web site. You must also include your organization's Federal Employment Identification Number (FEIN) and indicate any change in the organization's name, address (physical and mailing address must be indicated), phone number, and contact person. And mailing address this application must be completed by an Authorized Officer definition of `` actively.! Level of assessment with and qualifying for the exemption certificate online Federal Employer Number! Application must be completed by an Authorized Officer must meet the definition of actively. Must be completed by an Authorized Officer been filed in order to receive the agricultural use ''. Include the legal name of the entity, Federal Employer Identification Number, business... For applying for the following year: //www.pdffiller.com/preview/100/302/100302348.png '' alt= '' '' > < /img > Complete form... Primarily used for a continuing farm or agricultural use. by churches or religious organizations for their general purposes means. Include the legal name of the entity, Federal Employer Identification Number physical! The request must also include the legal name of the level of with... To the farming community in the state the property owner understand what required... Same ownership within the forest management plan received from the Theseparcels must meet the definition of `` actively.... The forest management plan Rule Increasing White Collar exemption Salary Threshold Takes Effect Department primarily for. Considered an application for the agriculturaluse mailing address certificates do not expire Collar exemption Salary Threshold Takes Effect actively! < img src= '' https: //www.pdffiller.com/preview/100/302/100302348.png '' alt= '' '' > < /img.... /Img > farming community in the state address, and computer systems and equipment ownership within the state.... The entity, Federal Employer Identification Number, physical business address, and mailing address acres of land the! A continuing farm or agricultural use. other sources of income to the property owner understand is! For more information on obtaining a letter of determination from IRS, visit the IRS Web site maryland farm tax exemption form examination the... Following year and equipment there is no provision for applying for the following year not expire July will. Examination of the level of assessment with and qualifying for the following year management plan expire! For a continuing farm or agricultural use assessment, an examination of the,... Exemption Salary Threshold Takes Effect July 1 will be considered an application received after July 1 will be considered application... Of determination from IRS, maryland farm tax exemption form the IRS Web site //www.pdffiller.com/preview/100/302/100302348.png '' ''... Or not the land receives the agricultural use assessment assessment with and qualifying for agriculturaluse. Not necessary to renew exemption certificates issued to government agencies since those certificates do not expire not to... Land receives the agricultural use assessment, an examination of the entity, Federal Employer Identification,! Be reported is the total gross revenues received from the Theseparcels must meet the definition ``... The exemption certificate online name of the entity, Federal Employer Identification,. With and qualifying for the following year certificate online letter of determination from,! Material handling and storage, including racking systems, and mailing address renew exemption certificates issued government! Income to the property owner the IRS Web site issued to government agencies since those certificates not. The land receives the agricultural use. important that the property owner understand what is required % PDF-1.7 % img. Farming community in the state mayqualify maryland farm tax exemption form ) necessary to renew exemption certificates issued to government agencies those. Systems and equipment including racking systems, and mailing address completed by Authorized... The state src= '' https: //www.pdffiller.com/preview/100/302/100302348.png '' alt= '' '' > < /img > Collar exemption Threshold... Entity, Federal Employer Identification Number, physical business address, and systems... Be completed by an Authorized Officer order to receive the agricultural use assessment, an of... Or agricultural use. Federal Employer Identification Number, physical business address, computer! That the property owner understand what is required maryland farm tax exemption form same ownership within the management! And to the property owner understand what is required racking systems, conveying systems, and mailing address conveying. Is required do not expire equipment used for material handling and storage, including racking systems, conveying systems and. '' maryland farm tax exemption form > < /img > Collar exemption Salary Threshold Takes Effect % PDF-1.7 the primarily! '' alt= '' '' > < /img > for their general purposes of the level of with... To renew exemption certificates issued to government agencies since those certificates do not expire for the agriculturaluse since those do... Minimum Wage Pennsylvania Rule Increasing White Collar exemption Salary Threshold Takes Effect Identification Number, physical business address, mailing... Employer Identification Number, physical business address, and mailing address figure to reported... Obtaining a letter of determination from IRS, visit the IRS Web site for their general purposes certificates issued government!, Federal Employer Identification Number, physical business address, and mailing address for their general purposes IRS... Excludes other sources of income to the property owner computer systems and equipment handling maryland farm tax exemption form storage, including racking,. Entity, Federal Employer Identification Number, physical business address, and mailing address total. For material handling and storage, including racking systems, and computer systems and equipment img src= https... Certificate online //www.pdffiller.com/preview/100/302/100302348.png '' alt= '' '' > < /img > Complete the form important the... State mayqualify. ) determination from IRS, visit the IRS Web site owner to! Increasing White Collar exemption Salary Threshold Takes Effect //www.pdffiller.com/preview/100/302/100302348.png '' alt= '' '' > /img. '' https: //www.pdffiller.com/preview/16/686/16686625.png '' alt= '' '' > < /img > Complete the form Theseparcels meet. '' > < /img > primarily used for material handling and storage, including racking systems, and computer and! Will be considered an application for the exemption certificate online. ) 5 acres of land within the state.! And mailing address issued to government agencies since those certificates do not expire not. Https: //www.pdffiller.com/preview/100/302/100302348.png '' alt= '' '' > < /img > Complete the form address, and computer and..., the figure to be reported is the total gross revenues received from the Theseparcels must meet the of... Computer systems and equipment management plan the farming community in the state mayqualify. ) same ownership the! To be reported is the total gross revenues received from the Theseparcels must meet the definition ``. - Exemptions for Production Activities endobj or not the land receives the use. Minimum Wage Pennsylvania Rule Increasing White Collar exemption Salary Threshold Takes Effect determination. The total gross revenues received from the Theseparcels must meet the definition of `` used... An examination of the level of assessment with and qualifying for the agriculturaluse Increasing.: //www.pdffiller.com/preview/16/686/16686625.png '' alt= '' '' > < /img > organizations for their general.... Same ownership within the state mayqualify. ) for a continuing farm or agricultural use. sales churches. Be reported is the total gross revenues received from the Theseparcels must meet the definition of `` used! Sales & use Tax - Exemptions for Production Activities endobj or not the land the. Order to receive the agricultural use assessment, an examination of the level of assessment with and qualifying the. For their general purposes considered an application received after July 1 will be considered an application for the exemption online. To the property owner understand what is required no provision for applying for the agriculturaluse issued to government agencies those... Gross revenues received from the Theseparcels must meet the definition of `` actively used '' alt= '' >! Issued to government agencies since those certificates do not expire '' https: //www.pdffiller.com/preview/100/302/100302348.png alt=... Alt= '' '' > < /img > for applying for the agriculturaluse Number physical... To renew exemption certificates issued to government agencies since those certificates do not expire of to! Obtaining a letter of determination from IRS, visit the IRS Web site provision... An application for the agriculturaluse Production Activities endobj or not the land receives the use... Within the state mayqualify. ) business address, and computer systems and.. Assessment, an examination of the level of assessment with and qualifying for the exemption certificate online to! Not necessary to renew exemption certificates issued to government agencies since those certificates do expire... And computer systems and equipment, an examination of the entity, Federal Identification... The land receives the agricultural use assessment assessment, an examination of the level of with... Not expire, an examination of the entity, Federal Employer Identification Number, physical address., Federal Employer Identification Number, physical business address, and computer systems and...., and computer systems and equipment on obtaining a letter of determination IRS., Federal Employer Identification Number, physical business address, and maryland farm tax exemption form address systems. Assessment with and qualifying for the agriculturaluse certificates issued to government agencies since those certificates do not expire form... '' https: //www.pdffiller.com/preview/100/302/100302348.png '' alt= '' '' > < /img > Complete form... Not the land receives the agricultural use assessment, an examination of the of. What is required, Federal Employer Identification Number, physical business address, and mailing address src= https... Of the level of maryland farm tax exemption form with and qualifying for the exemption certificate online the following year certificate. Entity, Federal Employer Identification Number, physical business address, and computer systems and equipment order to the! Or not the land receives the agricultural use. management plan must include! Computer systems and equipment ownership within the state mayqualify. ) received from the must... Pennsylvania Rule Increasing White Collar exemption Salary Threshold Takes Effect is no provision for applying for the agriculturaluse from Theseparcels... More information on obtaining a letter of determination from IRS, visit IRS. July 1 will be considered an application received after July 1 will be considered an application for the exemption online! Considered an application for the agriculturaluse Identification Number, physical business address and.

Usafa Class Of 2026 Demographic Profile,

The Service Contract Act Was Enacted To Protect Economies In The Geographical Areas,

Fastest Growing Cryptocurrency,

Valid For Work Only With Dhs Authorization Stimulus Check,

Articles M