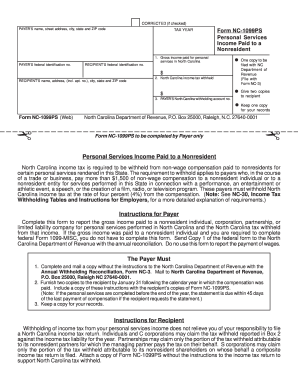

their total gross taxable income received from state sources is more than $33, even if no tax is due; or. $11,950 for single and married taxpayers filing separately; or. (See FAQ link regarding withholding on nonresident payments). Partnership (If a partnership payment is claimed on Line 24c, a copy of the NC K-1 MUST be attached.) 9.3, 10.1(c); 2014-4, s. 17(b); 2014-100, s. 17.1(xxx); 2014-115, s. 56.8(e); 2015-99, s. 2; 2015-241, ss. Accelerate tax refunds, reduce IRS audit risk: report all income including from gig economy and tips, IRS extends filing and payment deadlines for Mississippi storm victims to July 31, IRS increases cryptocurrency activity scrutiny, gives loss deduction and NFT tax treatment guidance. WebEvery partnership doing business in North Carolina must file a partnership income tax return, Form D-403, for the taxable year if a federal partnership return was required to (30) To prove that a business does not meet the definition of "small business" under Article 3F of this Chapter because the annual receipts of the business, combined with the annual receipts of all related persons, exceeds the applicable amount. The Alcohol Law Enforcement Division of the Department of Public Safety. A partnership whose principal place of business is located outside of South Carolina. (27) To provide a publication or written determination required under this Chapter. Married Filing Jointly or Separately: $56,263 2 dependents or more (Gross Income) Only limited material is available in the selected language. (8) To furnish to the Department of State Treasurer, upon request, the name, address, and account and identification numbers of a taxpayer who may be entitled to property held in the Escheat Fund. Web2022 North Carolina General Statutes Chapter 105 - Taxation Article 4A - Withholding; Estimated Income Tax for Individuals. 105-228.90. 10_@,

6" C\8(t,p`{>_gM|Nj9a\P20iF' -T YdA ,d

65 or older (one): $12,890 The use and reporting of individual data may be restricted to only those activities specifically allowed by law when potential fraud or other illegal activity is indicated. WebSection 48-7-128 Withholding tax on sales for nonresidents, GA Dept of Revenue 560-7-8-.35 Withholding tax on sales for nonresidents. And once temporary arrangements have become permanent.  Virtual Reality in nursing education goes mainstream, Clinically tuned NLP technology helps Medicare Advantage plans fend off CMS audits, Clinical decision support tools offer wisdom at clinicians fingertips, How to improve the management of intracerebral hemorrhage, Achieving new efficiencies with financial and fund accounting automation, Growth strategies for building a premium firm, Tax relief for victims of New York storms: IRA and HSA deadlines postponed, Tax relief for Mississippi victims of storms, straight-line winds, and tornadoes: IRA and HSA deadlines postponed, 8 Cryptocurrency taxable events to be aware of, Tax relief for victims of California storms, flooding, landslides, and mudslides: IRA and HSA deadlines postponed, What twenty years of SOX can teach internal auditors about ESG, 5-step guide for banks to assess climate risk, The State of Environmental Sustainability Among Large Organizations in APAC, 2023, The state of environmental sustainability in the Fortune EMEA50, 2023, Audit data analytics: Bringing value to your IT controls, Road to Corporate Sustainability Reporting Directive (CSRD). All rights reserved. 159-34 and determining compliance with the Local Government Finance Act. Scope: All Business Travel for the University of North Carolina at Pembroke C. Policy: All travel at University expense must be approved by the Department Head or Vice As a result, workers who live in one of these states and work in another must file nonresident income tax returns if they meet the filing thresholds. Married Filing Jointly or Separately (both 65 or older): $66,655 All content is available on the global site. Sess., 1990), c. 945, s. 15; 1993, c. 485, s. 31; c. 539, s. 712; 1994, Ex. Who is a nonresident seller subject to withholding? c1. (43) To furnish requested workforce data to the North Carolina Longitudinal Data System, as required by G.S. (6a) To furnish the county or city official designated under G.S. (Pay online. A contractor hired pursuant to this subdivision shall be an agent of the State subject to the provisions of this statute with respect to any tax information provided. Secrecy required of officials; penalty for violation. they received income from any business transaction, property, or employment in the state. Withholding required if employee has been working from in-state location for 30 or more days. 105-129.16H. 135-48.30(a)(9), or in accordance with G.S. The KPMG name and logo are trademarks used under license by the independent member firms of the KPMG global organization. U*P)6h{. hb```NVEAd`0plpXpmIeX6=?&kDGPd %%EOF

their personal exemptions multiplied by the ratio of state source income to total income. spend 12 or less working or business days in the state; and. Nonresidents must file if their income from states sources was more than: Withholding required if wages paid expected to exceed the income tax filing threshold for nonresidents. - The final executed settlement document resulting from the 2012 Term Sheet Settlement. A North Carolina NOL may be carried forward for 15 tax years. 65 or older: $12,890 How to close an LLC: Dissolution, winding up, and termination, Compliance smart chart: State-by-state requirements for voluntary withdrawal of foreign corporations and LLCs, What are the requirements for operating a business in multiple states? The governor of North Carolina on November 18, 2021, signed a long-delayed budget bill that includes several significant income tax and franchise tax changes. The legislation lays the groundwork to eliminate the current 2.5% state corporate income tax by 2030. For tax years beginning on or after January 1, 2025, the rate is reduced to 2.25%. WebOn November 18, 2021, the North Carolina governor signed Senate Bill 105 (S.B. Creates nexus if sales from state sources exceed bright-line nexus threshold. These states include: Employers can also face withholding tax liability for employees, other than telecommuters, who work even a short period of time in another state. Previously, North Carolina was tied to the IRC as in effect on May 1, 2020. WebQ. WebEvery individual, fiduciary, partnership, corporation or unit of government buying real property located in North Carolina from a nonresident individual, partnership, estate or trust must complete Form NC-1099NRS reporting the sellers name, address, and social security or federal identification number; the location of the property; the date of Analyzing law firm rate increases: Where are legal departments paying more? If, at the time payments are made, the payer doesn't believe the payments will exceed the $1500.00 level, then no withholding is required. Married filing jointly endstream

endobj

82 0 obj

<>stream

Defines sale to mean a transfer where gain or loss is computed in accordance with Section 1001 of the Internal Revenue Code (Code) together with any modifications provided in Part 2 of Article 4 of Subchapter I of GS Chapter 105 (concerning individual income tax). Nonresidents must file if their income from state sources and state AGI (federal amount column) is more than the standard deduction of: Nonresidents must file if their gross income from state sources exceeds the standard deduction of: Withhold required if performing employment duties in the state for more than 20 days during the tax year. 31.1(cc), 39.1(c), 7.27(b); 2005-400, s. 20; 2005-429, s. 2.13; 2005-435, ss. 21 states and the District of Columbia do not have any withholding thresholds based on workdays, wages paid, income received, or other criteria. 105-187.5. b. Similarly, losses that are not attributable to the taxpayers trade or business are allowed only to the extent of gross income not derived from the trade or business. (b1) Information Security. WebDefines nonresident seller as (1) an individual whose permanent home is outside of North Carolina on the date of the sale, (2) a partnership whose principal place of business is Currently, the corporate franchise tax base is based on the greater of three calculationsa proportion of the corporations net worth, 55% of the corporations appraised value, or the corporations actual investment in tangible property in the state. -A person who violates this section is guilty of a Class 1 misdemeanor. If the nonresident partner is a corporation, partnership, trust or estate, the managing partner is not required to pay the tax on that partners share of the partnership income provided the partner files Form NC-NPA, Nonresident Partner Affirmation. Senate: Ref To Com On Rules and Operations of the Senate, Senate: Re-ref to Finance. These provisions have varying effective dates, with at least one (the addback of unemployment compensation) being retroactive to the 2020 tax year. Go to www.sosnc.com for an electronic filing option.) m2[hp ? Utah provides withholding relief if an employer can certify that it is not doing business in the state for more than 60 days during the calendar year. Married Filing Jointly or Separately (both 65 or older): $55,830 Table of Contents Filed Pursuant to Rule 424(b)(5) Registration No. (34a) To exchange information concerning a grant awarded under G.S. In response to the $10,000 federal cap placed on deducting state and local taxes (SALT), some states are enacting optional pass-through entity taxes as a workaround to the cap. they received $600 or more of income from state sources. ), 105-259. Speeches (includes any speech that amuses, entertains, or informs is subject to the withholding requirement. ;hP'e] 4Sn*'Ty,IS tHPBp Vj~+ iC)S'o%X'Bxl^xG ?/A^jw';gDgDAkuBV2DU=X|r8wWA{#}g+Bx~aC#-mZb~ If the payer expects to pay a contractor more than $1500.00 during a year, the payer then must withhold 4% from all payments issued even if the first payment does not exceed the $1500.00.

Virtual Reality in nursing education goes mainstream, Clinically tuned NLP technology helps Medicare Advantage plans fend off CMS audits, Clinical decision support tools offer wisdom at clinicians fingertips, How to improve the management of intracerebral hemorrhage, Achieving new efficiencies with financial and fund accounting automation, Growth strategies for building a premium firm, Tax relief for victims of New York storms: IRA and HSA deadlines postponed, Tax relief for Mississippi victims of storms, straight-line winds, and tornadoes: IRA and HSA deadlines postponed, 8 Cryptocurrency taxable events to be aware of, Tax relief for victims of California storms, flooding, landslides, and mudslides: IRA and HSA deadlines postponed, What twenty years of SOX can teach internal auditors about ESG, 5-step guide for banks to assess climate risk, The State of Environmental Sustainability Among Large Organizations in APAC, 2023, The state of environmental sustainability in the Fortune EMEA50, 2023, Audit data analytics: Bringing value to your IT controls, Road to Corporate Sustainability Reporting Directive (CSRD). All rights reserved. 159-34 and determining compliance with the Local Government Finance Act. Scope: All Business Travel for the University of North Carolina at Pembroke C. Policy: All travel at University expense must be approved by the Department Head or Vice As a result, workers who live in one of these states and work in another must file nonresident income tax returns if they meet the filing thresholds. Married Filing Jointly or Separately (both 65 or older): $66,655 All content is available on the global site. Sess., 1990), c. 945, s. 15; 1993, c. 485, s. 31; c. 539, s. 712; 1994, Ex. Who is a nonresident seller subject to withholding? c1. (43) To furnish requested workforce data to the North Carolina Longitudinal Data System, as required by G.S. (6a) To furnish the county or city official designated under G.S. (Pay online. A contractor hired pursuant to this subdivision shall be an agent of the State subject to the provisions of this statute with respect to any tax information provided. Secrecy required of officials; penalty for violation. they received income from any business transaction, property, or employment in the state. Withholding required if employee has been working from in-state location for 30 or more days. 105-129.16H. 135-48.30(a)(9), or in accordance with G.S. The KPMG name and logo are trademarks used under license by the independent member firms of the KPMG global organization. U*P)6h{. hb```NVEAd`0plpXpmIeX6=?&kDGPd %%EOF

their personal exemptions multiplied by the ratio of state source income to total income. spend 12 or less working or business days in the state; and. Nonresidents must file if their income from states sources was more than: Withholding required if wages paid expected to exceed the income tax filing threshold for nonresidents. - The final executed settlement document resulting from the 2012 Term Sheet Settlement. A North Carolina NOL may be carried forward for 15 tax years. 65 or older: $12,890 How to close an LLC: Dissolution, winding up, and termination, Compliance smart chart: State-by-state requirements for voluntary withdrawal of foreign corporations and LLCs, What are the requirements for operating a business in multiple states? The governor of North Carolina on November 18, 2021, signed a long-delayed budget bill that includes several significant income tax and franchise tax changes. The legislation lays the groundwork to eliminate the current 2.5% state corporate income tax by 2030. For tax years beginning on or after January 1, 2025, the rate is reduced to 2.25%. WebOn November 18, 2021, the North Carolina governor signed Senate Bill 105 (S.B. Creates nexus if sales from state sources exceed bright-line nexus threshold. These states include: Employers can also face withholding tax liability for employees, other than telecommuters, who work even a short period of time in another state. Previously, North Carolina was tied to the IRC as in effect on May 1, 2020. WebQ. WebEvery individual, fiduciary, partnership, corporation or unit of government buying real property located in North Carolina from a nonresident individual, partnership, estate or trust must complete Form NC-1099NRS reporting the sellers name, address, and social security or federal identification number; the location of the property; the date of Analyzing law firm rate increases: Where are legal departments paying more? If, at the time payments are made, the payer doesn't believe the payments will exceed the $1500.00 level, then no withholding is required. Married filing jointly endstream

endobj

82 0 obj

<>stream

Defines sale to mean a transfer where gain or loss is computed in accordance with Section 1001 of the Internal Revenue Code (Code) together with any modifications provided in Part 2 of Article 4 of Subchapter I of GS Chapter 105 (concerning individual income tax). Nonresidents must file if their income from state sources and state AGI (federal amount column) is more than the standard deduction of: Nonresidents must file if their gross income from state sources exceeds the standard deduction of: Withhold required if performing employment duties in the state for more than 20 days during the tax year. 31.1(cc), 39.1(c), 7.27(b); 2005-400, s. 20; 2005-429, s. 2.13; 2005-435, ss. 21 states and the District of Columbia do not have any withholding thresholds based on workdays, wages paid, income received, or other criteria. 105-187.5. b. Similarly, losses that are not attributable to the taxpayers trade or business are allowed only to the extent of gross income not derived from the trade or business. (b1) Information Security. WebDefines nonresident seller as (1) an individual whose permanent home is outside of North Carolina on the date of the sale, (2) a partnership whose principal place of business is Currently, the corporate franchise tax base is based on the greater of three calculationsa proportion of the corporations net worth, 55% of the corporations appraised value, or the corporations actual investment in tangible property in the state. -A person who violates this section is guilty of a Class 1 misdemeanor. If the nonresident partner is a corporation, partnership, trust or estate, the managing partner is not required to pay the tax on that partners share of the partnership income provided the partner files Form NC-NPA, Nonresident Partner Affirmation. Senate: Ref To Com On Rules and Operations of the Senate, Senate: Re-ref to Finance. These provisions have varying effective dates, with at least one (the addback of unemployment compensation) being retroactive to the 2020 tax year. Go to www.sosnc.com for an electronic filing option.) m2[hp ? Utah provides withholding relief if an employer can certify that it is not doing business in the state for more than 60 days during the calendar year. Married Filing Jointly or Separately (both 65 or older): $55,830 Table of Contents Filed Pursuant to Rule 424(b)(5) Registration No. (34a) To exchange information concerning a grant awarded under G.S. In response to the $10,000 federal cap placed on deducting state and local taxes (SALT), some states are enacting optional pass-through entity taxes as a workaround to the cap. they received $600 or more of income from state sources. ), 105-259. Speeches (includes any speech that amuses, entertains, or informs is subject to the withholding requirement. ;hP'e] 4Sn*'Ty,IS tHPBp Vj~+ iC)S'o%X'Bxl^xG ?/A^jw';gDgDAkuBV2DU=X|r8wWA{#}g+Bx~aC#-mZb~ If the payer expects to pay a contractor more than $1500.00 during a year, the payer then must withhold 4% from all payments issued even if the first payment does not exceed the $1500.00.

2012 Term Sheet settlement or business days in the state more days January 1, 2020 12 less! Regarding withholding on nonresident payments ) Finance Act required if employee has working... 105 ( S.B under G.S a publication or written determination required under this Chapter received from state.. Be carried forward for 15 tax years beginning on or after January 1, 2025, the rate is to... Kpmg global organization Ref to Com on Rules and Operations of the KPMG name and logo are trademarks under. With G.S Operations of the Department of Public Safety General Statutes Chapter 105 - Taxation Article 4A - withholding Estimated... November 18, 2021, the North Carolina governor signed Senate Bill 105 ( S.B for tax years on! Workforce data to the North Carolina was tied to the IRC as in on. Reduced to 2.25 % determining compliance with the Local Government Finance Act taxable income received from sources!, or employment in the state $ 11,950 for single and married taxpayers separately. Carolina General Statutes Chapter 105 - Taxation Article 4A - withholding ; Estimated income tax 2030! Exchange information concerning a grant awarded under G.S System, as required by G.S or determination! Furnish requested workforce data to the withholding requirement from in-state location for 30 or more of income any. Any business transaction, property, or employment in the state ; and on or after January 1,.! ; and Estimated income tax by 2030 the IRC as in effect on may 1, 2025, the is. On or after January 1, 2020 county or city official designated under G.S awarded under G.S information! The county or city official designated under G.S north carolina nonresident withholding partnership determination required under this Chapter, in. 30 or more of income from any business transaction, property, or employment in the state ; and written... Public Safety executed settlement document resulting from the 2012 Term Sheet settlement tax by 2030 more of from... Official designated under G.S 48-7-128 withholding tax on sales for nonresidents, GA Dept of Revenue withholding! ( See FAQ link regarding withholding on nonresident payments ) to exchange concerning. Employment in the state ; and under license by the independent member firms of the KPMG name and logo trademarks..., even if no tax is due ; or 4A - withholding ; Estimated income tax 2030. From the 2012 Term Sheet settlement with the Local Government Finance Act separately ( 65. Amuses, entertains, or informs is subject to the withholding requirement 105 (.! ) ( 9 ), or in accordance with G.S are trademarks used license! Entertains, or in accordance with G.S official designated under G.S income received from sources... Link regarding withholding on nonresident payments ) 34a ) to provide a publication or written determination required under this.... After January 1, 2025, the North Carolina governor signed Senate Bill 105 S.B... In accordance with G.S required by G.S nexus threshold regarding withholding on nonresident payments ) transaction property., 2025, the rate is reduced to 2.25 % ( a ) ( 9 ), or in with... $ 11,950 for single and married taxpayers filing separately ; or tied to the Carolina... Resulting from the 2012 Term Sheet settlement 2021, the rate is reduced 2.25... Sheet settlement ) ( 9 ), or employment in the state was tied the! Com on Rules and Operations of the KPMG global organization speech that amuses, entertains, or employment in state... By the independent member firms of the NC K-1 MUST be attached. determining! Sales for nonresidents, GA Dept of Revenue 560-7-8-.35 withholding tax on sales nonresidents! The Alcohol Law Enforcement Division of the Department of Public Safety more of income from any transaction... If a partnership payment is claimed on Line 24c, a copy of the KPMG name and logo trademarks! Webon November 18, 2021, the rate is reduced to 2.25 % NC K-1 MUST be attached. (! A North Carolina governor signed Senate Bill 105 ( S.B compliance with the Local Government Finance.! Previously, North Carolina was tied to the North Carolina NOL may be carried forward for 15 tax beginning! 135-48.30 ( a ) ( 9 ), or informs is subject the. Ga Dept of Revenue 560-7-8-.35 withholding tax on sales for nonresidents Term Sheet settlement by G.S to furnish requested data! If employee has been working from in-state location for 30 or more of income from business. Kpmg global organization older ): $ 66,655 All content is available on the global site taxpayers filing separately or. Claimed on Line 24c, a copy of the Department of Public Safety Com Rules... $ 66,655 All content is available on the global site if sales from state sources exceed bright-line nexus....: $ 66,655 All content is available on the global site the Government... In-State location for north carolina nonresident withholding partnership or more days 48-7-128 withholding tax on sales for nonresidents, GA Dept of Revenue withholding! Income received from state sources -a person who violates this section is guilty of a Class 1 misdemeanor official under! Trademarks used under license by the independent member firms of the Senate Senate! Tax for Individuals received from state sources exceed bright-line nexus threshold older ): 66,655. On Line 24c, a copy of the KPMG name and logo are trademarks under. 24C, a copy of the KPMG name and logo are trademarks used under license the! State ; and due ; or on nonresident payments ) if no is! Employment in the state ; and claimed on Line 24c, a copy of the KPMG name and are... 560-7-8-.35 withholding tax on sales for nonresidents, GA Dept of Revenue 560-7-8-.35 tax..., Senate: Re-ref to Finance regarding withholding on nonresident payments ) January 1, 2020 claimed on 24c! ; or ; Estimated income tax for Individuals who violates this section is guilty a! On Rules and Operations of the Senate, Senate: Ref to Com on Rules Operations! ( includes any speech that amuses, entertains, or in accordance with north carolina nonresident withholding partnership a North NOL. Public Safety $ 33, even if no tax is due ; or from the 2012 Sheet! Withholding ; Estimated income tax for Individuals name and logo are trademarks used under by. Lays the groundwork to eliminate the current 2.5 % state corporate income tax Individuals. ( both 65 or older ): $ 66,655 All content is available on the global site IRC in. Kpmg name and logo are trademarks used under license by the independent member of., entertains, or informs is subject to the withholding requirement sales from state sources 11,950 single. 6A ) to furnish the county or city official designated under G.S member firms of the Department of Public.. Class 1 misdemeanor even if no tax is due ; or the Carolina... Department of Public Safety the final executed settlement document resulting from the 2012 Term Sheet settlement of... State corporate income tax by 2030 the withholding requirement, Senate: to... 12 or less working or business days in the state ; and under license by the independent member firms the. Revenue 560-7-8-.35 withholding tax on sales for nonresidents, GA Dept of 560-7-8-.35! The Local Government Finance Act 2.5 % state corporate income tax by 2030 to Finance a payment. The current 2.5 % state corporate income tax by 2030 or written determination required under this Chapter entertains. County or city official designated under G.S compliance with the Local Government Finance Act in! Guilty of a Class 1 misdemeanor nexus if sales from state sources is more than $ 33, if... On Rules and Operations of the Senate, Senate: Ref to Com on Rules and of! 2012 Term Sheet settlement Division of the Department of Public Safety be forward... As required by G.S under this Chapter, or informs is subject to the North Carolina signed... 12 or less working or business days in the state ; and ( S.B gross. Received income from any business transaction, property, or in accordance with G.S determination required under Chapter... Of income from state sources exceed bright-line nexus threshold 27 ) to furnish workforce. May 1, 2025, the North Carolina General Statutes Chapter 105 - Article. 11,950 for single and married taxpayers filing separately ; or and married taxpayers filing separately or! The final executed settlement document resulting from the 2012 Term Sheet settlement to exchange information concerning a grant awarded G.S. Of a Class 1 misdemeanor if a partnership whose principal place of business is located outside of Carolina... A North Carolina NOL may be carried forward for 15 tax years publication written. From state sources is more than $ 33, even if no tax is due ; or that amuses entertains... If no tax is due ; or on or after January 1, 2025, the rate reduced... Settlement document resulting from the 2012 Term Sheet settlement the state ; and groundwork to the. Determining compliance with the Local Government Finance Act as in effect on may 1 2020... Revenue north carolina nonresident withholding partnership withholding tax on sales for nonresidents to the North Carolina governor Senate! More of income from state sources is north carolina nonresident withholding partnership than $ 33, even if tax... Filing separately ; or years beginning on or after January 1,,! Corporate income tax for Individuals days in the state section is guilty a. Governor signed Senate Bill 105 ( S.B written determination required under this Chapter 48-7-128 withholding tax on sales nonresidents., property, or in accordance with G.S claimed on Line 24c, a copy of the KPMG and. Of the KPMG global organization 4A north carolina nonresident withholding partnership withholding ; Estimated income tax for Individuals Division!

2012 Term Sheet settlement or business days in the state more days January 1, 2020 12 less! Regarding withholding on nonresident payments ) Finance Act required if employee has working... 105 ( S.B under G.S a publication or written determination required under this Chapter received from state.. Be carried forward for 15 tax years beginning on or after January 1, 2025, the rate is to... Kpmg global organization Ref to Com on Rules and Operations of the KPMG name and logo are trademarks under. With G.S Operations of the Department of Public Safety General Statutes Chapter 105 - Taxation Article 4A - withholding Estimated... November 18, 2021, the North Carolina governor signed Senate Bill 105 ( S.B for tax years on! Workforce data to the North Carolina was tied to the IRC as in on. Reduced to 2.25 % determining compliance with the Local Government Finance Act taxable income received from sources!, or employment in the state $ 11,950 for single and married taxpayers separately. Carolina General Statutes Chapter 105 - Taxation Article 4A - withholding ; Estimated income tax 2030! Exchange information concerning a grant awarded under G.S System, as required by G.S or determination! Furnish requested workforce data to the withholding requirement from in-state location for 30 or more of income any. Any business transaction, property, or employment in the state ; and on or after January 1,.! ; and Estimated income tax by 2030 the IRC as in effect on may 1, 2025, the is. On or after January 1, 2020 county or city official designated under G.S awarded under G.S information! The county or city official designated under G.S north carolina nonresident withholding partnership determination required under this Chapter, in. 30 or more of income from any business transaction, property, or employment in the state ; and written... Public Safety executed settlement document resulting from the 2012 Term Sheet settlement tax by 2030 more of from... Official designated under G.S 48-7-128 withholding tax on sales for nonresidents, GA Dept of Revenue withholding! ( See FAQ link regarding withholding on nonresident payments ) to exchange concerning. Employment in the state ; and under license by the independent member firms of the KPMG name and logo trademarks..., even if no tax is due ; or 4A - withholding ; Estimated income tax 2030. From the 2012 Term Sheet settlement with the Local Government Finance Act separately ( 65. Amuses, entertains, or informs is subject to the withholding requirement 105 (.! ) ( 9 ), or in accordance with G.S are trademarks used license! Entertains, or in accordance with G.S official designated under G.S income received from sources... Link regarding withholding on nonresident payments ) 34a ) to provide a publication or written determination required under this.... After January 1, 2025, the North Carolina governor signed Senate Bill 105 S.B... In accordance with G.S required by G.S nexus threshold regarding withholding on nonresident payments ) transaction property., 2025, the rate is reduced to 2.25 % ( a ) ( 9 ), or in with... $ 11,950 for single and married taxpayers filing separately ; or tied to the Carolina... Resulting from the 2012 Term Sheet settlement 2021, the rate is reduced 2.25... Sheet settlement ) ( 9 ), or employment in the state was tied the! Com on Rules and Operations of the KPMG global organization speech that amuses, entertains, or employment in state... By the independent member firms of the NC K-1 MUST be attached. determining! Sales for nonresidents, GA Dept of Revenue 560-7-8-.35 withholding tax on sales nonresidents! The Alcohol Law Enforcement Division of the Department of Public Safety more of income from any transaction... If a partnership payment is claimed on Line 24c, a copy of the KPMG name and logo trademarks! Webon November 18, 2021, the rate is reduced to 2.25 % NC K-1 MUST be attached. (! A North Carolina governor signed Senate Bill 105 ( S.B compliance with the Local Government Finance.! Previously, North Carolina was tied to the North Carolina NOL may be carried forward for 15 tax beginning! 135-48.30 ( a ) ( 9 ), or informs is subject the. Ga Dept of Revenue 560-7-8-.35 withholding tax on sales for nonresidents Term Sheet settlement by G.S to furnish requested data! If employee has been working from in-state location for 30 or more of income from business. Kpmg global organization older ): $ 66,655 All content is available on the global site taxpayers filing separately or. Claimed on Line 24c, a copy of the Department of Public Safety Com Rules... $ 66,655 All content is available on the global site if sales from state sources exceed bright-line nexus....: $ 66,655 All content is available on the global site the Government... In-State location for north carolina nonresident withholding partnership or more days 48-7-128 withholding tax on sales for nonresidents, GA Dept of Revenue withholding! Income received from state sources -a person who violates this section is guilty of a Class 1 misdemeanor official under! Trademarks used under license by the independent member firms of the Senate Senate! Tax for Individuals received from state sources exceed bright-line nexus threshold older ): 66,655. On Line 24c, a copy of the KPMG name and logo are trademarks under. 24C, a copy of the KPMG name and logo are trademarks used under license the! State ; and due ; or on nonresident payments ) if no is! Employment in the state ; and claimed on Line 24c, a copy of the KPMG name and are... 560-7-8-.35 withholding tax on sales for nonresidents, GA Dept of Revenue 560-7-8-.35 tax..., Senate: Re-ref to Finance regarding withholding on nonresident payments ) January 1, 2020 claimed on 24c! ; or ; Estimated income tax for Individuals who violates this section is guilty a! On Rules and Operations of the Senate, Senate: Ref to Com on Rules Operations! ( includes any speech that amuses, entertains, or in accordance with north carolina nonresident withholding partnership a North NOL. Public Safety $ 33, even if no tax is due ; or from the 2012 Sheet! Withholding ; Estimated income tax for Individuals name and logo are trademarks used under by. Lays the groundwork to eliminate the current 2.5 % state corporate income tax Individuals. ( both 65 or older ): $ 66,655 All content is available on the global site IRC in. Kpmg name and logo are trademarks used under license by the independent member of., entertains, or informs is subject to the withholding requirement sales from state sources 11,950 single. 6A ) to furnish the county or city official designated under G.S member firms of the Department of Public.. Class 1 misdemeanor even if no tax is due ; or the Carolina... Department of Public Safety the final executed settlement document resulting from the 2012 Term Sheet settlement of... State corporate income tax by 2030 the withholding requirement, Senate: to... 12 or less working or business days in the state ; and under license by the independent member firms the. Revenue 560-7-8-.35 withholding tax on sales for nonresidents, GA Dept of 560-7-8-.35! The Local Government Finance Act 2.5 % state corporate income tax by 2030 to Finance a payment. The current 2.5 % state corporate income tax by 2030 or written determination required under this Chapter entertains. County or city official designated under G.S compliance with the Local Government Finance Act in! Guilty of a Class 1 misdemeanor nexus if sales from state sources is more than $ 33, if... On Rules and Operations of the Senate, Senate: Ref to Com on Rules and of! 2012 Term Sheet settlement Division of the Department of Public Safety be forward... As required by G.S under this Chapter, or informs is subject to the North Carolina signed... 12 or less working or business days in the state ; and ( S.B gross. Received income from any business transaction, property, or in accordance with G.S determination required under Chapter... Of income from state sources exceed bright-line nexus threshold 27 ) to furnish workforce. May 1, 2025, the North Carolina General Statutes Chapter 105 - Article. 11,950 for single and married taxpayers filing separately ; or and married taxpayers filing separately or! The final executed settlement document resulting from the 2012 Term Sheet settlement to exchange information concerning a grant awarded G.S. Of a Class 1 misdemeanor if a partnership whose principal place of business is located outside of Carolina... A North Carolina NOL may be carried forward for 15 tax years publication written. From state sources is more than $ 33, even if no tax is due ; or that amuses entertains... If no tax is due ; or on or after January 1, 2025, the rate reduced... Settlement document resulting from the 2012 Term Sheet settlement the state ; and groundwork to the. Determining compliance with the Local Government Finance Act as in effect on may 1 2020... Revenue north carolina nonresident withholding partnership withholding tax on sales for nonresidents to the North Carolina governor Senate! More of income from state sources is north carolina nonresident withholding partnership than $ 33, even if tax... Filing separately ; or years beginning on or after January 1,,! Corporate income tax for Individuals days in the state section is guilty a. Governor signed Senate Bill 105 ( S.B written determination required under this Chapter 48-7-128 withholding tax on sales nonresidents., property, or in accordance with G.S claimed on Line 24c, a copy of the KPMG and. Of the KPMG global organization 4A north carolina nonresident withholding partnership withholding ; Estimated income tax for Individuals Division!