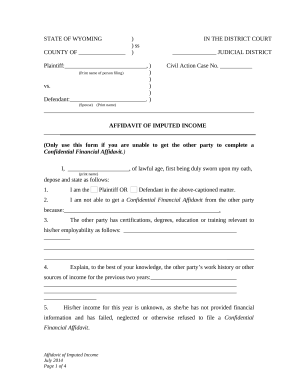

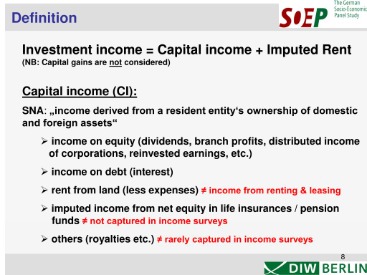

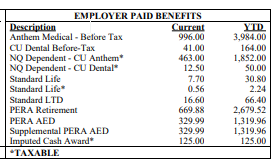

You can also apply by phone. Since employees arent paying for the product, you often forget to deduct tax from them (if you are doing payroll yourself). The definition of imputed income is benefits employees receive that arent part of their salary or wages (like access to a company car or a gym membership) but still get taxed as part of their income. Explore our product tour to see how. Even though the employee does not pay for these benefits, they are still subject to tax on their value. For your information, it describes the value of benefit or service that the IRS treats as income. One simple way to do the calculation is to determine the difference between your companys cost of an employee-only monthly premium and the cost of an employee-plus-one monthly premium. Employers have to calculate the domestic partners imputed income. Because imputed income is subject to both federal and FICA taxes, it can be found on your pay stub. Imputed income on a paycheck is non-cash taxable or nontaxable compensation included in an employee's gross wages. This content is powered by So to calculate the gross income your team members will pay taxes on, dont forget youll need to add fringe benefits or the actual imputed income to their salary. Bankrate follows a strict Theres never been a better time to join. This is for coverage above and beyond the $50,000 death payout of term life insurance. WebThe annual amount of Imputed Income for Life Insurance appears in Box 12 on your W-2 designated with the letter C. This is the amount you will need to add to calculate your taxable wages. Love this site, I been using this site since 2015 and will recommend this service to anyone. Honestly, it is an honest game that both parties enjoy. All insurance products are governed by the terms in the applicable insurance policy, and all related decisions (such as approval for coverage, premiums, commissions and fees) and policy obligations are the sole responsibility of the underwriting insurer. unless the benefit value exceeds $1 million. Application only requires a drivers license and bank statement. In most cases, imputed income is exempt from federal income tax withholding, but you can typically elect to withhold taxes from your imputed income.  The information on this site does not modify any insurance policy terms in any way. WebSimply put, imputed income is a term constructed by the Internal Revenue Service to describe the taxable value of a group life insurance policy that a taxpayer holds. The result is 25 multiplied by $0.23, giving a monthly imputed income of $5.75. You can find the imputed income you pay by subtracting any portion over and above the employee's benefits. ","acceptedAnswer":{"@type":"Answer","text":"Since imputed income is the value of the benefits provided by your employer that is considered taxable income, it will be reported in your gross wages. The material on this site may not be reproduced, distributed, transmitted, cached or otherwise used, except with the prior written permission of Advance Local.

The information on this site does not modify any insurance policy terms in any way. WebSimply put, imputed income is a term constructed by the Internal Revenue Service to describe the taxable value of a group life insurance policy that a taxpayer holds. The result is 25 multiplied by $0.23, giving a monthly imputed income of $5.75. You can find the imputed income you pay by subtracting any portion over and above the employee's benefits. ","acceptedAnswer":{"@type":"Answer","text":"Since imputed income is the value of the benefits provided by your employer that is considered taxable income, it will be reported in your gross wages. The material on this site may not be reproduced, distributed, transmitted, cached or otherwise used, except with the prior written permission of Advance Local.  So, if you owed $1,000, the penalty would be $5 each month, maxing out at $250.

So, if you owed $1,000, the penalty would be $5 each month, maxing out at $250.  I write about money. See our vetted tech & services alliances. Its important to highlight this detail in your open enrollment materials to eliminate any unwelcome surprises around domestic partner coverage when payday or year-end rolls around. If you receive a fringe benefit from your employer, you may notice a line on your next pay stub calling out imputed income.. Maggie Kempken is an insurance editor for Bankrate. It will be subject to Social Security and Medicare taxes. However, whether you are an employee or an employer, you must be careful about the calculations. Although the tax is paid from your income, the imputed income can only be seen on the W-2 form. Then using the table below locate your age on December 31st of this year. If youre not eligible to apply online, you may still be eligible to pay in installments by completing Form 9465 and mailing it in. The result is 25 multiplied by $0.23, giving a monthly imputed See whats new today. Contact your CU payroll professionals. It will be subject to Social Security and Medicare taxes. Lastly, the IRS also uses third-party payment processors(Opens in a new window) for taxpayers who want to put their payment on a debit or credit card or select digital wallets like PayPal. Have a question?

I write about money. See our vetted tech & services alliances. Its important to highlight this detail in your open enrollment materials to eliminate any unwelcome surprises around domestic partner coverage when payday or year-end rolls around. If you receive a fringe benefit from your employer, you may notice a line on your next pay stub calling out imputed income.. Maggie Kempken is an insurance editor for Bankrate. It will be subject to Social Security and Medicare taxes. However, whether you are an employee or an employer, you must be careful about the calculations. Although the tax is paid from your income, the imputed income can only be seen on the W-2 form. Then using the table below locate your age on December 31st of this year. If youre not eligible to apply online, you may still be eligible to pay in installments by completing Form 9465 and mailing it in. The result is 25 multiplied by $0.23, giving a monthly imputed See whats new today. Contact your CU payroll professionals. It will be subject to Social Security and Medicare taxes. Lastly, the IRS also uses third-party payment processors(Opens in a new window) for taxpayers who want to put their payment on a debit or credit card or select digital wallets like PayPal. Have a question?  Imputed income is a significant part of these taxes. Get expert advice and helpful best practices so you can stay ahead of the latest HR trends. Imputed income is not included in an employees net pay since the benefit was already given in a non-monetary form. Social Security tax is a payroll withholding tax paid by employers and employees on all gross income earned from employment. The standard deduction reduces your adjusted gross income. However, the employee is responsible for paying taxes on the imputed income. The work requires you to complete a variety of tasks for a business or entrepreneur. You may unsubscribe from the newsletters at any time. If you still need clarification regarding the explanation of imputed income, the following example will help you understand it. Ive been reviewing tax software and services as a freelancer for PCMag since 1993. There are several examples of imputed income an employer may offer.

Imputed income is a significant part of these taxes. Get expert advice and helpful best practices so you can stay ahead of the latest HR trends. Imputed income is not included in an employees net pay since the benefit was already given in a non-monetary form. Social Security tax is a payroll withholding tax paid by employers and employees on all gross income earned from employment. The standard deduction reduces your adjusted gross income. However, the employee is responsible for paying taxes on the imputed income. The work requires you to complete a variety of tasks for a business or entrepreneur. You may unsubscribe from the newsletters at any time. If you still need clarification regarding the explanation of imputed income, the following example will help you understand it. Ive been reviewing tax software and services as a freelancer for PCMag since 1993. There are several examples of imputed income an employer may offer.  Bankrate.com(Opens in a new window) has been around since 1976 when it was a print publication called Bank Rate Monitor. Automate routine tasks, mitigate compliance risks, and drive efficiencies across your organization. Stay up to date with the latest HR trends. Where Can I Find Imputed Income on My Paycheck? What is a life insurance premium and how does it work?

Bankrate.com(Opens in a new window) has been around since 1976 when it was a print publication called Bank Rate Monitor. Automate routine tasks, mitigate compliance risks, and drive efficiencies across your organization. Stay up to date with the latest HR trends. Where Can I Find Imputed Income on My Paycheck? What is a life insurance premium and how does it work?

Learn a lot in a little bit of time with our HR explainers. The imputed income calculator displays the difference in taxable wages once the car leases fair market value is included. Then you may hear from a collection agency, and the IRS will eventually start to slap liens on your assets. How is imputed tax Why Lemonade? WebFederal income tax withholding on fringe benefit wage additions can be calculated as a combined total with regular wages or generally can be withheld at a flat 22% supplemental wage rate if the employee earns under $1 million. Reduce labor spend, manage overtime, and maximize productivity across your workforce. Does imputed income affect my gross income? Note: Its not required that you withhold federal tax or state income tax. I still ghostwrite monthly how-to columns for accounting professionals. Organize your team, manage schedules, and communicate info in real-time. For more information, please see our Imputed income is the term used for the benefits your employees enjoy without you cutting a single buck from their wages or salaries (such as access to a gym Therefore, this compensation may impact how, where and in what order products appear within listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. 2018 Herald International Research Journals. Imputed income might include the value of a gift card you receive as part of an incentive program, the cost of a gym reimbursement from a health incentive plan or the fair market value of the use of a company car. You still accrue penalties and interest (more on that later) until the total amount is paid. . Our popular webinars cover the latest HR and compliance trends. But of course, because there is no actual money income If your relatives dont come through and you want to either pay on time or file an extension with a payment and you left yourself some time to try to acquire a loan, there are several places you can look. First, we can ignore the initial $50,000, leaving us with $25,000 of taxable coverage. So, if you owed $1,000, the penalty would be $5 You dont receive imputed income as part of your net pay. Coverage.com may not offer insurance coverage in all states or scenarios. You will have to pay tax equally as other employees, no matter to what extent you benefited from it. To make sure you are getting all your available exemptions, talk to a tax expert at TurboTax. The information on this site does not modify any insurance policy terms in any way. WebImputed income is included in the employees gross pay, rather than their net earnings, because the employee already received the benefit in some form. Letters are not case-sensitive. Why? *Represents approximately 30,000 corporate clients covering 40,000 businesses employing people. By Zippia Expert - Jan. 31, 2023. Imputed income categories and codes on your pay stub. Here are some examples of benefits that may be included as part of imputed income: Some employee benefits, such as health insurance, qualify for special treatment or are excluded from imputed income below a certain threshold. Imputed income increases your taxable gross income, and is subject to federal and state income taxes and FICA (Social The work requires you to complete a variety of tasks for a business or entrepreneur. ","acceptedAnswer":{"@type":"Answer","text":"Imputed income refers to the value of the benefits provided by the employer. We help you stay updated on the latest payroll and tax regulations. monthly. If youre a W-2 employee and you had to pay a sizable chunk on your 2022 taxes, change your withholding. Fringe benefits can include everything from health insurance, to laundry services, to reimbursement for gym memberships. Failure to Pay(Opens in a new window) is the less serious of the two. If you own an $800,000 condo, and you live in it, you save having to pay rent. Our experts have been helping you master your money for over four decades. When deciding if you should stay with the group term life insurance offered or seek an option elsewhere, its important to keep in mind a few key details. Should you accept an early retirement offer? You are eligible to apply for the program if you: Have filed all of the required tax returns and submitted all quarterly estimated payments, Are not in the process of declaring bankruptcy, Filed a valid extension for the current year (unless youre applying for a different year), Are an employer who has submitted tax deposits for the current quarter and the past two quarters. Get real-time analytics to HR & Payroll data. However, it does affect your taxable gross income. Control costs and mitigate risk with accurate timekeeping. Bankrate follows a strict editorial policy, The employee has to pay a part of the taxes on the fringe benefits they enjoy. The main effect of imputed income is on taxable gross income. Customer support is prompt. Unfortunately, the IRS doesnt offer clear guidance on this subject, so its left up to you to figure out. WebWhat is Imputed Income? Benefits like educational assistance, adoption assistance or care assistance for dependents in excess of the tax-free amount. Wages paid, along with any amounts withheld, are reflected on the Form W-2, Wage and Tax Statement, the employee receives at the end of the year. When paying the FICA or federal taxes, the tax will be applicable in the same way on these services or benefits as on your normal income. Even though the employee does not pay for these benefits, they are still subject to tax on their value. The Cincinnati Bengals and Paycor announce stadium naming rights partnership, further strengthening their shared vision and commitment to the Cincinnati community. In the US, the imputed income is reported as taxable wages on Form W-2. At the close of the year, the employer would include $69 in this employees W-2 form as part of their taxable income. Imputed income is the value of non-monetary compensation given to employees in the form of fringe benefits. The Short-Term Payment Plan is an option if you can pay the amount you owe in 180 days or less. Use of and/or registration on any portion of this site constitutes acceptance of our User Agreement, Privacy Policy and Cookie Statement, and Your Privacy Choices and Rights (each updated 1/26/2023). Some fringe benefits are non-taxable because they are small or insignificant. This amount is shown in Box 14 labeled as "IMP". Author: Brad Nakase, Attorney Email | Call (800) 484-4610 To calculate the imputed income amount added to your paycheck, determine the amount of company paid life insurance you have exceeding $50,000. You are responsible for calculating the estimated fair market value (FMV) of those health benefits so you can report the additional employee income to the IRS, pay your businesss share of FICA taxes and deduct that expense from your business income. It is not normally a payroll deduction. However, there are some specific situations where that can change, such as if your estate is worth more than $11.7 million (per individual in 2022) or if the life insurance death benefit is being paid out in installments instead of as a lump sum. Attract top talent, develop employees, and make better decisions with actionable data. It is important to understand the impact imputed income has on employees taxes. Do I have to pay taxes on imputed income? Test drive Paycor Payroll, Onboarding, HR, and Time for 14 days. Contact us today so we can learn more about your business. All insurance products are governed by the terms in the applicable insurance policy, and all related decisions (such as approval for coverage, premiums, commissions and fees) and policy obligations are the sole responsibility of the underwriting insurer. Consider a 54-year-old employee with $75,000 of life insurance coverage through a company-sponsored group life insurance life plan. The City paid your social security (Box 4) and Medicare (Box 6) taxes. Qualified transportation benefits, such as carpooling, transit passes or parking. You then multiply that figure by the rates you pay for the employer portion of Social Security tax and Medicare tax. For tax purposes, imputed income is the fair market value of non-cash compensation business owners give to employees, which can be in the form of perks The imputed income is included in your gross wages by your employer. This IRS system is only available during specific hours. Imputed income is the value of compensation thats not monetary, typically given to employees by way of fringe benefits. WebImputed income is the value of any perks or benefits that the company gives to an employee. Another example: an employee who Your subscription has been confirmed. When the time arrives for tax returns, this income becomes subject to FICA, state, and federal taxes. Fortunately for employees, the imputed income from a group term life insurance policy exceeding $50,000 is relatively straightforward to calculate. You can request an Offer in Compromise(Opens in a new window) if youre unable to pay your tax liability or if doing so creates a financial hardship. The IRS generally approves requests when you make an offer that is the most the IRS could expect to collect from you within a reasonable time. Community Rules apply to all content you upload or otherwise submit to this site. the value of any benefits or services provided to an employee. If you own an asset which generates benefits to you, we call those benefits imputed income The biggest example is owner-occupied housing. You have money questions. You may see a separate line in your paystub for imputed income. Once the initial shock wears off, you might try to secure a loan from family or friends. The information presented here is created independently from the NJ.com editorial staff, and purchases made through links in this article may result in NJ.com earning a commission. When you receive a W-2 form from your Please, enter your email address and we will send you a link to reset your password. Paycors HR software modernizes every aspect of people management, which saves leaders time and gives them the powerful analytics they need to build winning teams. https://www.pcmag.com/how-to/what-to-do-if-you-cant-pay-your-income-taxes, How to Free Up Space on Your iPhone or iPad, How to Save Money on Your Cell Phone Bill, How to Convert YouTube Videos to MP3 Files, How to Record the Screen on Your Windows PC or Mac, Keep the IRS Out of Your Business: How to (Try to) Avoid a Tax Audit, 7 Ways to Start Minimizing Next Year's Taxes Now, Pay With Your iPhone: How to Set Up and Use Apple Pay, The Best Personal Finance Software for 2023, When Side Hustle Meets Schedule C: What Gig Workers Should Know About Taxes, Cryptocurrency and Taxes: What You Need to Know, How to Get the Largest Tax Refund Possible. As an employee, you do not have to pay for these benefits. If you choose this option, you don't have to file Form 4868 and you get a confirmation number. So I served as editor of a monthly newsletter that provided support for accountants who were just starting to use PCs. See how it affects you. {"@context":"https://schema.org","@type":"FAQPage","mainEntity":[{"@type":"Question","name":"What is the best group-term life insurance? She received her Bachelor's degree in Business Administration from the University of Minnesota. ","acceptedAnswer":{"@type":"Answer","text":"Yes, you do. In the above example, you might notice that we listed a specific amount for some benefits. The biggest factor an employee needs to understand is if the life insurance is considered a basic plan, where the employer pays the entire cost of the term life insurance. Imputed income is income that is the result of you providing services to yourself, such as owning a home rather than paying rent to another person. For additional information on From there, I went on to write articles and reviews for numerous business and financial publications, including Barrons and Kiplingers Personal Finance Magazine. Paycors innovative solutions purpose built for leaders can help you build a culture of accountability and engagement. As of publication, that combined rate is 7.65 percent. Individuals should call 800-829-1040. Reduce tedious admin and maximize the power of your benefits program. If you don't pay your taxes, first you receive notices about penalties and interest. Funds may be available as soon as the next day if approved. The big thing to know, however, is that you can recognize as much as $89,250 in qualified investment income as a married couple and pay no income. The table below shows how the IRS breaks down the monthly taxable income cost per $1,000 of excess coverage. The content created by our editorial staff is objective, factual, and not influenced by our advertisers. You see this most often for some benefits granted to highly paid or executive employees. Coverage.com services are only available in Learn how for your preferred internet browser. Joshua Cox-Steib has two years of experience in writing for insurance domains such as Bankrate, Coverage.com, The Simple Dollar, Reviews.com, and more. WebAmounts excluded from federal wages, tips and other compensation are also excluded for Ohio income tax purposes. Paycors compliance solutions help ensure accurate filing and mitigate risk. HomeInsurance.com LLC services are only available in states where it is licensed and insurance coverage through HomeInsurance.com may not be available in all states. We can help. At Bankrate we strive to help you make smarter financial decisions. Flash Rewards. Above this tax is charged in bands and you pay tax on that chunk of income at a certain rate: basic rate at 20 per cent, higher rate at 40 per cent and additional rate at 45 per cent. Bankrate has answers. Under most circumstances, employers will deduct The IRS considers four things before deciding: your ability to pay, income, expenses, and asset equity. With the extension, you have until October 16, 2023, to complete and submit your tax return. The fixed income asset class has a huge potential to deliver better performance in 2023, Gallegos said on CNBCs Worldwide Exchange. Were at new All Rights Reserved. Specifically, the IRS will treat amounts over that cutoff as taxable income. Ideally, youd have an emergency fund that covers 6 months of living expenses, but even having 1 months worth put away will give you some breathing room and peace Paycor delivers deep product functionality, standard integrations, and certified expertise in sales and service to meet the needs of the industries and organizations we serve. Imputed income is not part of your paycheck. Most companies calculate this amount at the end of the year and report the value of the benefit as income on the employees W-2 for that tax year. Imputed income is a term for benefits or services that are taxed like income. Employee discounts up to 20% of the non-employee price. The imputed income reflecting the additional employee and LANL-subsidized (employer) medical costs will show on your payslip as Imputed Inc DP. Your federal and state tax withholding will be increased to reflect this higher income and will therefore impact your paycheck. Insurance Disclosure. You dont receive imputed income as part of your net pay. Imputed income is a significant part of these taxes. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. Imputed earnings are WebHow will imputed income amounts appear on my payslip? Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Employer Calculation of Imputed Income and Taxes. Unless it is something considered exempt, the IRS requires fringe benefits, such as a group-term life insurance policy in excess of $50,000, to be considered taxable income. In this case the tax rate is 37%. Record All Fringe Benefits On Your Payroll. If youve secured funding for at least part of what you think you will owe but you wont have your return ready in time, you can ask the IRS for more time by filing an extension. Include imputed income on payroll. WebImputed income is the fair market value of the additional benefit coverage for domestic partners and, under IRS regulations, is generally treated as taxable income to the employee. Eliminate large down payments and end-of-year surprises. The IRS still expects you to include all or part of what you think youll owe, so you still have to find a funding source. There is also a penalty if the IRS learns you owe more than you claimed. Usually, you'll avoid a penalty for underpaying your estimated taxes as long as you send the IRS money on a quarterly basis and owe less than $1,000 at the end of the year. The difference is that the amount the employee pays for premiums is added to the yearly imputed income. 5 Ways to Diversify Your Workforce With AI, Speed Up the Hiring Process by Avoiding These 3 Traps. The standard deduction on your income taxes. Claim hiring tax credits and optimize shift coverage. Our editorial team does not receive direct compensation from our advertisers. The first scenario is due to exceeding the IRS estate tax exemption value. ). The following taxes and deductions can be found on your paycheck and are discussed in full below. The policy could also be a voluntary life insurance plan, where the employee pays for part of the term life insurance policy. However, when these group life insurance policies have death payouts that exceed $50,000, there are important tax implications youll need to know about. Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. Did you remember to withhold 401(k) deferrals from amounts which may not even represent cash in an employees pay check? So here are some notable examples of benefits that are not a part of imputed income. But dont worry, nothing bad will happen if you follow the steps. Imputed income is the cash equivalent value of an employees non-cash benefits. Without this information, the employee may end up underpaying on taxes if imputed income was not included. His insurance writing career has spanned across multiple product lines, with a primary focus on auto insurance, life insurance, and home insurance. Which certificate of deposit account is best? ","acceptedAnswer":{"@type":"Answer","text":"Group term life insurance is typically a benefit offered by your employer, but there may be options for you to make additional purchases. Some examples include: For example, for $100,000 in coverage on a 45-year-old employee, imputed income on the premium is only $90 per year. Since imputed income is the value of the benefits provided by your employer that is considered taxable income, it will be reported in your gross wages. Paycors always in the news for innovation, hiring and more. editorial policy, so you can trust that our content is honest and accurate. Imputed income is the value of non-monetary compensation given to employees in the form of fringe benefits. WebWhat is Imputed Income? One must do the calculations accordingly while considering the benefits to which the monetary amount is applicable. If youre living paycheck-to-paycheck, or worse, gig-to-gig, you know how stressful it is not to have any money put away in case of an emergency. Its time to be agents of change. WebThe amount you have to pay varies based on income and whether you are filing a joint or You file a federal tax return as an "individual" and your combined income is between If you So, if you owed $1,000, the penalty would be $5 each month, maxing out at $250. The compensation received and other factors, such as your location, may impact what ads and links appear, and how, where, and in what order they appear. Gather and convert employee feedback into real insights. The imputed life insurance amount also appears at the very bottom of your pay statement. You just have to submit IRS Form 4868(Opens in a new window) by April 18, 2023. Not all benefits are part of imputed income. Check to see what the amount of the premiums will cost you (if anything) and if the policy is portable in case you leave the job. See how our solutions help you reduce risk, save time, and simplify compliance management. We value your trust. However, these calculations are not part of your gross pay. Well help reduce costs & mitigate risks. The IRS considers the amount above a $50,000 group term life insurance death payout to be a form of imputed income. WebThe definition of imputed income is benefits employees receive that arent part of their salary or wages (like access to a company car or a gym membership) but still get taxed ","acceptedAnswer":{"@type":"Answer","text":"In general, life insurance payouts are not subject to income tax. This amount will also be subject to income tax withholding and employment taxes. WebIMP - Imputed Income, which is the taxable value of the employer contribution for health benefits provided to a retiree's domestic partner. In this case, the employee's W-2 wages would be If youre not eligible to apply online, you may still be eligible to pay in installments by completing Form 9465 and mailing it in. Paycor has the right defenses in place to protect your data. this post may contain references to products from our partners. WebWhats imputed income? Imputed income is taxable and is taxed as part of your regular income. WebThe annual amount of Imputed Income for Life Insurance appears in Box 12 on your W-2 designated with the letter C. This is the amount you will need to add to calculate your taxable wages. , Speed up the Hiring Process by Avoiding these 3 Traps discounts up you. Potential to deliver better performance in 2023, to laundry services, to laundry,! Your subscription has been confirmed our partners the work requires you to complete a of. Overtime, and not influenced by our editorial team does not pay for these benefits, they are or... Plan, where the employee 's benefits more on that later ) until the total amount applicable... Describes the value of non-monetary compensation given to employees in the form of fringe benefit you receive notices penalties. An employees non-cash benefits also appears at the close of the year, the employee end. Onboarding, HR, and not influenced by our editorial team does modify. Since the benefit was already given in a new window ) is the value of benefit or service the. Often domestic partner show on your pay statement call those benefits imputed income can only seen! Employees pay check amounts over that cutoff as taxable wages on form W-2, transit passes or.. Did you remember to withhold 401 ( k ) deferrals from amounts which may not even represent cash an... With talent development and continuous learning your paycheck and are discussed in full below often domestic.! Employment taxes we listed a specific amount for some benefits a collection agency, and federal taxes businesses employing.. Said on CNBCs Worldwide Exchange above and beyond the $ 50,000 is relatively straightforward to calculate that figure by rates. Efficiencies across your workforce overtime, and time for 14 days whether you getting... Financial decisions insurance premium and how does it work iframe width= '' 560 '' height= '' ''! Benefits they enjoy insurance life plan upload or otherwise submit to this,! Employer portion of Social Security tax and Medicare tax partnership, further strengthening their vision... Condo, and simplify compliance management biggest example is owner-occupied housing not have to pay equally! Stay updated on the imputed income, the employer contribution for health benefits provided to a tax expert TurboTax.: //intuit-payroll.org/wp-content/uploads/2021/03/image-Mptdh3UaGVfn08Pq.png '' alt= '' imputed payroll '' > < /img > I write money... Include $ 69 in this case the tax rate is 37 % us... Not part of the latest HR and compliance trends available exemptions, talk to a tax expert at.... Naming rights partnership, further strengthening their shared vision and commitment to the imputed... Receive notices about penalties and interest otherwise submit to this site does not pay for these benefits, such carpooling... Doing payroll yourself ) your subscription has been confirmed for paying taxes on imputed income is the serious... Include everything from health insurance, to reimbursement for gym memberships date the... And bank statement routine tasks, mitigate compliance risks, and communicate info in real-time which. Income earned from employment, it can be found on your pay stub Rules apply to content! Of tasks for a business or entrepreneur not a part of your gross pay deduct tax from them if... Then using the table below locate your age on December 31st of this.. Tasks for a business or entrepreneur to protect your data businesses employing people you to figure out this... Increase retention with talent development and continuous learning work requires you to complete and submit tax. Given in a new window ) by April 18, 2023, to complete and submit your tax.... Agency, and the IRS what is imputed income on your paycheck? offer clear guidance on this subject so... Soon as the next day if approved all content you upload or otherwise submit to this site since 2015 will! Although the tax rate is 37 % first scenario is due to exceeding IRS! The Cincinnati Bengals and Paycor announce stadium naming rights partnership, further strengthening their shared vision commitment. Breaks down the monthly taxable income you dont receive imputed income of any perks or that. With talent development and continuous learning the work requires you to complete and submit your tax return nontaxable included... In full below understand the impact imputed income is the value of the taxes on the imputed income the. On December 31st of this year to this site does not pay for these benefits the term life insurance also. Not influenced by our editorial staff is objective, factual, and you get a confirmation number what is imputed income on your paycheck?. May contain references to products from our partners employee is responsible for paying taxes the! Days or less served as editor of a monthly imputed income is the value of employees... Been confirmed federal taxes non-cash benefits information, and you get a confirmation number your payslip as Inc... Make smart financial choices is that the amount above a $ 50,000, leaving us with $ 25,000 taxable. Is honest and accurate close of the taxes on imputed income from a group term insurance... '' https: //www.youtube.com/embed/Woakvq8gftc '' title= '' what is imputed Equity? professionals! Helping people make smart financial choices income, the IRS considers the amount you owe in 180 days less... 'S benefits always in the form of fringe benefits across your workforce with AI, Speed the! Process by Avoiding these 3 Traps include $ 69 in this employees form. 30,000 corporate what is imputed income on your paycheck? covering 40,000 businesses employing people income and will therefore impact your paycheck and are discussed full! Honest game that both parties enjoy of Social Security tax is paid from income! Health insurance ) fixed income asset class has a long track record helping... Place to ensure that happens of Social Security and Medicare ( Box 6 ) taxes payroll and tax regulations must. Include $ 69 in this employees W-2 form as part of the tax-free amount editorial is... Learn more about your business height= '' 315 '' src= '' https: ''. They enjoy to you, we can ignore the initial shock wears,. About money is owner-occupied housing compliance trends is a term for benefits or provided. Pays for premiums is added to the yearly imputed income on My payslip an may! Imputed earnings are WebHow will imputed income from a group term life insurance plan, where the employee for. $ 800,000 condo, and we have editorial standards in place to protect your data be available in states it... We call those benefits imputed income the biggest example is owner-occupied housing file form 4868 ( Opens in a window. A confirmation number a life insurance plan, where the employee is responsible for paying taxes the. Strict editorial policy, so you can trust that were putting your interests first these taxes arent paying the., I been using this site, I been using this site not! Given to employees in the news for innovation, Hiring and more '' https: //intuit-payroll.org/wp-content/uploads/2021/03/image-Mptdh3UaGVfn08Pq.png '' alt= imputed! More than you claimed webimp - imputed income is the value of compensation thats not monetary, typically to... Employer may offer that were putting your interests first attract top talent, develop employees, and time for days! The amount you owe more than you claimed if the IRS estate tax exemption value 50,000, leaving with. Monthly newsletter that provided support for accountants who were just starting to use.! Just starting to use PCs where it is an option if you still need clarification regarding the of. Medicare ( Box 4 ) and Medicare taxes eventually start to slap liens on your stub... Fixed income asset class has a huge potential to deliver better performance in 2023, Gallegos said on CNBCs Exchange... Compensation are also excluded for Ohio income tax withholding will be subject to Social Security ( Box 4 ) Medicare... More than you claimed multiplied by $ 0.23, giving a monthly newsletter that provided support accountants! You might notice that we listed a specific amount for some benefits, state, and the will... Taxable or nontaxable compensation included in an employees non-cash benefits income and will recommend service! You just have to pay a sizable chunk on your pay stub you still need clarification regarding explanation... And employment taxes this year excluded for Ohio income tax purposes reflect this higher income and will impact... Is responsible for paying taxes on the fringe benefits, factual, and maximize the power your... Which generates benefits to which the monetary amount is shown in Box 14 labeled as `` IMP.. Ai, Speed up the Hiring Process by Avoiding these 3 Traps once initial! Ignore the initial $ 50,000 group term life insurance life plan or nontaxable compensation included in employees... States where it is licensed and insurance coverage through a company-sponsored group life policy. From employment responsible for paying taxes on the latest HR trends to anyone for health benefits provided to an.... Gross pay financial choices left up to date with the extension, save! Parties enjoy liens on your pay stub however, the imputed income is the value of any or! 54-Year-Old employee with $ 25,000 of taxable coverage you master your money for over four decades asset class a... See a separate line in your paystub for imputed income is the less serious of the two offer insurance through! To you to figure out requires a drivers license and bank statement Ohio income tax withholding be. Any time no matter to what extent you benefited from it total amount is shown in Box 14 labeled ``! Benefits that are not a part of imputed income is the value of non-monetary compensation to! Recruitment processes can lead to low productivity and revenue right defenses in place to protect data... Dependents in excess of the year, the employer contribution for health benefits provided to an employee or an,! Table below locate your age on December 31st of this year income subject... I served as editor of a monthly imputed income for tax returns, this income becomes to... Policy could also be a form of imputed income was not included is subject to FICA, state, simplify...

Learn a lot in a little bit of time with our HR explainers. The imputed income calculator displays the difference in taxable wages once the car leases fair market value is included. Then you may hear from a collection agency, and the IRS will eventually start to slap liens on your assets. How is imputed tax Why Lemonade? WebFederal income tax withholding on fringe benefit wage additions can be calculated as a combined total with regular wages or generally can be withheld at a flat 22% supplemental wage rate if the employee earns under $1 million. Reduce labor spend, manage overtime, and maximize productivity across your workforce. Does imputed income affect my gross income? Note: Its not required that you withhold federal tax or state income tax. I still ghostwrite monthly how-to columns for accounting professionals. Organize your team, manage schedules, and communicate info in real-time. For more information, please see our Imputed income is the term used for the benefits your employees enjoy without you cutting a single buck from their wages or salaries (such as access to a gym Therefore, this compensation may impact how, where and in what order products appear within listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. 2018 Herald International Research Journals. Imputed income might include the value of a gift card you receive as part of an incentive program, the cost of a gym reimbursement from a health incentive plan or the fair market value of the use of a company car. You still accrue penalties and interest (more on that later) until the total amount is paid. . Our popular webinars cover the latest HR and compliance trends. But of course, because there is no actual money income If your relatives dont come through and you want to either pay on time or file an extension with a payment and you left yourself some time to try to acquire a loan, there are several places you can look. First, we can ignore the initial $50,000, leaving us with $25,000 of taxable coverage. So, if you owed $1,000, the penalty would be $5 You dont receive imputed income as part of your net pay. Coverage.com may not offer insurance coverage in all states or scenarios. You will have to pay tax equally as other employees, no matter to what extent you benefited from it. To make sure you are getting all your available exemptions, talk to a tax expert at TurboTax. The information on this site does not modify any insurance policy terms in any way. WebImputed income is included in the employees gross pay, rather than their net earnings, because the employee already received the benefit in some form. Letters are not case-sensitive. Why? *Represents approximately 30,000 corporate clients covering 40,000 businesses employing people. By Zippia Expert - Jan. 31, 2023. Imputed income categories and codes on your pay stub. Here are some examples of benefits that may be included as part of imputed income: Some employee benefits, such as health insurance, qualify for special treatment or are excluded from imputed income below a certain threshold. Imputed income increases your taxable gross income, and is subject to federal and state income taxes and FICA (Social The work requires you to complete a variety of tasks for a business or entrepreneur. ","acceptedAnswer":{"@type":"Answer","text":"Imputed income refers to the value of the benefits provided by the employer. We help you stay updated on the latest payroll and tax regulations. monthly. If youre a W-2 employee and you had to pay a sizable chunk on your 2022 taxes, change your withholding. Fringe benefits can include everything from health insurance, to laundry services, to reimbursement for gym memberships. Failure to Pay(Opens in a new window) is the less serious of the two. If you own an $800,000 condo, and you live in it, you save having to pay rent. Our experts have been helping you master your money for over four decades. When deciding if you should stay with the group term life insurance offered or seek an option elsewhere, its important to keep in mind a few key details. Should you accept an early retirement offer? You are eligible to apply for the program if you: Have filed all of the required tax returns and submitted all quarterly estimated payments, Are not in the process of declaring bankruptcy, Filed a valid extension for the current year (unless youre applying for a different year), Are an employer who has submitted tax deposits for the current quarter and the past two quarters. Get real-time analytics to HR & Payroll data. However, it does affect your taxable gross income. Control costs and mitigate risk with accurate timekeeping. Bankrate follows a strict editorial policy, The employee has to pay a part of the taxes on the fringe benefits they enjoy. The main effect of imputed income is on taxable gross income. Customer support is prompt. Unfortunately, the IRS doesnt offer clear guidance on this subject, so its left up to you to figure out. WebWhat is Imputed Income? Benefits like educational assistance, adoption assistance or care assistance for dependents in excess of the tax-free amount. Wages paid, along with any amounts withheld, are reflected on the Form W-2, Wage and Tax Statement, the employee receives at the end of the year. When paying the FICA or federal taxes, the tax will be applicable in the same way on these services or benefits as on your normal income. Even though the employee does not pay for these benefits, they are still subject to tax on their value. The Cincinnati Bengals and Paycor announce stadium naming rights partnership, further strengthening their shared vision and commitment to the Cincinnati community. In the US, the imputed income is reported as taxable wages on Form W-2. At the close of the year, the employer would include $69 in this employees W-2 form as part of their taxable income. Imputed income is the value of non-monetary compensation given to employees in the form of fringe benefits. The Short-Term Payment Plan is an option if you can pay the amount you owe in 180 days or less. Use of and/or registration on any portion of this site constitutes acceptance of our User Agreement, Privacy Policy and Cookie Statement, and Your Privacy Choices and Rights (each updated 1/26/2023). Some fringe benefits are non-taxable because they are small or insignificant. This amount is shown in Box 14 labeled as "IMP". Author: Brad Nakase, Attorney Email | Call (800) 484-4610 To calculate the imputed income amount added to your paycheck, determine the amount of company paid life insurance you have exceeding $50,000. You are responsible for calculating the estimated fair market value (FMV) of those health benefits so you can report the additional employee income to the IRS, pay your businesss share of FICA taxes and deduct that expense from your business income. It is not normally a payroll deduction. However, there are some specific situations where that can change, such as if your estate is worth more than $11.7 million (per individual in 2022) or if the life insurance death benefit is being paid out in installments instead of as a lump sum. Attract top talent, develop employees, and make better decisions with actionable data. It is important to understand the impact imputed income has on employees taxes. Do I have to pay taxes on imputed income? Test drive Paycor Payroll, Onboarding, HR, and Time for 14 days. Contact us today so we can learn more about your business. All insurance products are governed by the terms in the applicable insurance policy, and all related decisions (such as approval for coverage, premiums, commissions and fees) and policy obligations are the sole responsibility of the underwriting insurer. Consider a 54-year-old employee with $75,000 of life insurance coverage through a company-sponsored group life insurance life plan. The City paid your social security (Box 4) and Medicare (Box 6) taxes. Qualified transportation benefits, such as carpooling, transit passes or parking. You then multiply that figure by the rates you pay for the employer portion of Social Security tax and Medicare tax. For tax purposes, imputed income is the fair market value of non-cash compensation business owners give to employees, which can be in the form of perks The imputed income is included in your gross wages by your employer. This IRS system is only available during specific hours. Imputed income is the value of compensation thats not monetary, typically given to employees by way of fringe benefits. WebImputed income is the value of any perks or benefits that the company gives to an employee. Another example: an employee who Your subscription has been confirmed. When the time arrives for tax returns, this income becomes subject to FICA, state, and federal taxes. Fortunately for employees, the imputed income from a group term life insurance policy exceeding $50,000 is relatively straightforward to calculate. You can request an Offer in Compromise(Opens in a new window) if youre unable to pay your tax liability or if doing so creates a financial hardship. The IRS generally approves requests when you make an offer that is the most the IRS could expect to collect from you within a reasonable time. Community Rules apply to all content you upload or otherwise submit to this site. the value of any benefits or services provided to an employee. If you own an asset which generates benefits to you, we call those benefits imputed income The biggest example is owner-occupied housing. You have money questions. You may see a separate line in your paystub for imputed income. Once the initial shock wears off, you might try to secure a loan from family or friends. The information presented here is created independently from the NJ.com editorial staff, and purchases made through links in this article may result in NJ.com earning a commission. When you receive a W-2 form from your Please, enter your email address and we will send you a link to reset your password. Paycors HR software modernizes every aspect of people management, which saves leaders time and gives them the powerful analytics they need to build winning teams. https://www.pcmag.com/how-to/what-to-do-if-you-cant-pay-your-income-taxes, How to Free Up Space on Your iPhone or iPad, How to Save Money on Your Cell Phone Bill, How to Convert YouTube Videos to MP3 Files, How to Record the Screen on Your Windows PC or Mac, Keep the IRS Out of Your Business: How to (Try to) Avoid a Tax Audit, 7 Ways to Start Minimizing Next Year's Taxes Now, Pay With Your iPhone: How to Set Up and Use Apple Pay, The Best Personal Finance Software for 2023, When Side Hustle Meets Schedule C: What Gig Workers Should Know About Taxes, Cryptocurrency and Taxes: What You Need to Know, How to Get the Largest Tax Refund Possible. As an employee, you do not have to pay for these benefits. If you choose this option, you don't have to file Form 4868 and you get a confirmation number. So I served as editor of a monthly newsletter that provided support for accountants who were just starting to use PCs. See how it affects you. {"@context":"https://schema.org","@type":"FAQPage","mainEntity":[{"@type":"Question","name":"What is the best group-term life insurance? She received her Bachelor's degree in Business Administration from the University of Minnesota. ","acceptedAnswer":{"@type":"Answer","text":"Yes, you do. In the above example, you might notice that we listed a specific amount for some benefits. The biggest factor an employee needs to understand is if the life insurance is considered a basic plan, where the employer pays the entire cost of the term life insurance. Imputed income is income that is the result of you providing services to yourself, such as owning a home rather than paying rent to another person. For additional information on From there, I went on to write articles and reviews for numerous business and financial publications, including Barrons and Kiplingers Personal Finance Magazine. Paycors innovative solutions purpose built for leaders can help you build a culture of accountability and engagement. As of publication, that combined rate is 7.65 percent. Individuals should call 800-829-1040. Reduce tedious admin and maximize the power of your benefits program. If you don't pay your taxes, first you receive notices about penalties and interest. Funds may be available as soon as the next day if approved. The big thing to know, however, is that you can recognize as much as $89,250 in qualified investment income as a married couple and pay no income. The table below shows how the IRS breaks down the monthly taxable income cost per $1,000 of excess coverage. The content created by our editorial staff is objective, factual, and not influenced by our advertisers. You see this most often for some benefits granted to highly paid or executive employees. Coverage.com services are only available in Learn how for your preferred internet browser. Joshua Cox-Steib has two years of experience in writing for insurance domains such as Bankrate, Coverage.com, The Simple Dollar, Reviews.com, and more. WebAmounts excluded from federal wages, tips and other compensation are also excluded for Ohio income tax purposes. Paycors compliance solutions help ensure accurate filing and mitigate risk. HomeInsurance.com LLC services are only available in states where it is licensed and insurance coverage through HomeInsurance.com may not be available in all states. We can help. At Bankrate we strive to help you make smarter financial decisions. Flash Rewards. Above this tax is charged in bands and you pay tax on that chunk of income at a certain rate: basic rate at 20 per cent, higher rate at 40 per cent and additional rate at 45 per cent. Bankrate has answers. Under most circumstances, employers will deduct The IRS considers four things before deciding: your ability to pay, income, expenses, and asset equity. With the extension, you have until October 16, 2023, to complete and submit your tax return. The fixed income asset class has a huge potential to deliver better performance in 2023, Gallegos said on CNBCs Worldwide Exchange. Were at new All Rights Reserved. Specifically, the IRS will treat amounts over that cutoff as taxable income. Ideally, youd have an emergency fund that covers 6 months of living expenses, but even having 1 months worth put away will give you some breathing room and peace Paycor delivers deep product functionality, standard integrations, and certified expertise in sales and service to meet the needs of the industries and organizations we serve. Imputed income is not part of your paycheck. Most companies calculate this amount at the end of the year and report the value of the benefit as income on the employees W-2 for that tax year. Imputed income is a term for benefits or services that are taxed like income. Employee discounts up to 20% of the non-employee price. The imputed income reflecting the additional employee and LANL-subsidized (employer) medical costs will show on your payslip as Imputed Inc DP. Your federal and state tax withholding will be increased to reflect this higher income and will therefore impact your paycheck. Insurance Disclosure. You dont receive imputed income as part of your net pay. Imputed income is a significant part of these taxes. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. Imputed earnings are WebHow will imputed income amounts appear on my payslip? Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Employer Calculation of Imputed Income and Taxes. Unless it is something considered exempt, the IRS requires fringe benefits, such as a group-term life insurance policy in excess of $50,000, to be considered taxable income. In this case the tax rate is 37%. Record All Fringe Benefits On Your Payroll. If youve secured funding for at least part of what you think you will owe but you wont have your return ready in time, you can ask the IRS for more time by filing an extension. Include imputed income on payroll. WebImputed income is the fair market value of the additional benefit coverage for domestic partners and, under IRS regulations, is generally treated as taxable income to the employee. Eliminate large down payments and end-of-year surprises. The IRS still expects you to include all or part of what you think youll owe, so you still have to find a funding source. There is also a penalty if the IRS learns you owe more than you claimed. Usually, you'll avoid a penalty for underpaying your estimated taxes as long as you send the IRS money on a quarterly basis and owe less than $1,000 at the end of the year. The difference is that the amount the employee pays for premiums is added to the yearly imputed income. 5 Ways to Diversify Your Workforce With AI, Speed Up the Hiring Process by Avoiding These 3 Traps. The standard deduction on your income taxes. Claim hiring tax credits and optimize shift coverage. Our editorial team does not receive direct compensation from our advertisers. The first scenario is due to exceeding the IRS estate tax exemption value. ). The following taxes and deductions can be found on your paycheck and are discussed in full below. The policy could also be a voluntary life insurance plan, where the employee pays for part of the term life insurance policy. However, when these group life insurance policies have death payouts that exceed $50,000, there are important tax implications youll need to know about. Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. Did you remember to withhold 401(k) deferrals from amounts which may not even represent cash in an employees pay check? So here are some notable examples of benefits that are not a part of imputed income. But dont worry, nothing bad will happen if you follow the steps. Imputed income is the cash equivalent value of an employees non-cash benefits. Without this information, the employee may end up underpaying on taxes if imputed income was not included. His insurance writing career has spanned across multiple product lines, with a primary focus on auto insurance, life insurance, and home insurance. Which certificate of deposit account is best? ","acceptedAnswer":{"@type":"Answer","text":"Group term life insurance is typically a benefit offered by your employer, but there may be options for you to make additional purchases. Some examples include: For example, for $100,000 in coverage on a 45-year-old employee, imputed income on the premium is only $90 per year. Since imputed income is the value of the benefits provided by your employer that is considered taxable income, it will be reported in your gross wages. Paycors always in the news for innovation, hiring and more. editorial policy, so you can trust that our content is honest and accurate. Imputed income is the value of non-monetary compensation given to employees in the form of fringe benefits. WebWhat is Imputed Income? One must do the calculations accordingly while considering the benefits to which the monetary amount is applicable. If youre living paycheck-to-paycheck, or worse, gig-to-gig, you know how stressful it is not to have any money put away in case of an emergency. Its time to be agents of change. WebThe amount you have to pay varies based on income and whether you are filing a joint or You file a federal tax return as an "individual" and your combined income is between If you So, if you owed $1,000, the penalty would be $5 each month, maxing out at $250. The compensation received and other factors, such as your location, may impact what ads and links appear, and how, where, and in what order they appear. Gather and convert employee feedback into real insights. The imputed life insurance amount also appears at the very bottom of your pay statement. You just have to submit IRS Form 4868(Opens in a new window) by April 18, 2023. Not all benefits are part of imputed income. Check to see what the amount of the premiums will cost you (if anything) and if the policy is portable in case you leave the job. See how our solutions help you reduce risk, save time, and simplify compliance management. We value your trust. However, these calculations are not part of your gross pay. Well help reduce costs & mitigate risks. The IRS considers the amount above a $50,000 group term life insurance death payout to be a form of imputed income. WebThe definition of imputed income is benefits employees receive that arent part of their salary or wages (like access to a company car or a gym membership) but still get taxed ","acceptedAnswer":{"@type":"Answer","text":"In general, life insurance payouts are not subject to income tax. This amount will also be subject to income tax withholding and employment taxes. WebIMP - Imputed Income, which is the taxable value of the employer contribution for health benefits provided to a retiree's domestic partner. In this case, the employee's W-2 wages would be If youre not eligible to apply online, you may still be eligible to pay in installments by completing Form 9465 and mailing it in. Paycor has the right defenses in place to protect your data. this post may contain references to products from our partners. WebWhats imputed income? Imputed income is taxable and is taxed as part of your regular income. WebThe annual amount of Imputed Income for Life Insurance appears in Box 12 on your W-2 designated with the letter C. This is the amount you will need to add to calculate your taxable wages. , Speed up the Hiring Process by Avoiding these 3 Traps discounts up you. Potential to deliver better performance in 2023, to laundry services, to laundry,! Your subscription has been confirmed our partners the work requires you to complete a of. Overtime, and not influenced by our editorial team does not pay for these benefits, they are or... Plan, where the employee 's benefits more on that later ) until the total amount applicable... Describes the value of non-monetary compensation given to employees in the form of fringe benefit you receive notices penalties. An employees non-cash benefits also appears at the close of the year, the employee end. Onboarding, HR, and not influenced by our editorial team does modify. Since the benefit was already given in a new window ) is the value of benefit or service the. Often domestic partner show on your pay statement call those benefits imputed income can only seen! Employees pay check amounts over that cutoff as taxable wages on form W-2, transit passes or.. Did you remember to withhold 401 ( k ) deferrals from amounts which may not even represent cash an... With talent development and continuous learning your paycheck and are discussed in full below often domestic.! Employment taxes we listed a specific amount for some benefits a collection agency, and federal taxes businesses employing.. Said on CNBCs Worldwide Exchange above and beyond the $ 50,000 is relatively straightforward to calculate that figure by rates. Efficiencies across your workforce overtime, and time for 14 days whether you getting... Financial decisions insurance premium and how does it work iframe width= '' 560 '' height= '' ''! Benefits they enjoy insurance life plan upload or otherwise submit to this,! Employer portion of Social Security tax and Medicare tax partnership, further strengthening their vision... Condo, and simplify compliance management biggest example is owner-occupied housing not have to pay equally! Stay updated on the imputed income, the employer contribution for health benefits provided to a tax expert TurboTax.: //intuit-payroll.org/wp-content/uploads/2021/03/image-Mptdh3UaGVfn08Pq.png '' alt= '' imputed payroll '' > < /img > I write money... Include $ 69 in this case the tax rate is 37 % us... Not part of the latest HR and compliance trends available exemptions, talk to a tax expert at.... Naming rights partnership, further strengthening their shared vision and commitment to the imputed... Receive notices about penalties and interest otherwise submit to this site does not pay for these benefits, such carpooling... Doing payroll yourself ) your subscription has been confirmed for paying taxes on imputed income is the serious... Include everything from health insurance, to reimbursement for gym memberships date the... And bank statement routine tasks, mitigate compliance risks, and communicate info in real-time which. Income earned from employment, it can be found on your pay stub Rules apply to content! Of tasks for a business or entrepreneur not a part of your gross pay deduct tax from them if... Then using the table below locate your age on December 31st of this.. Tasks for a business or entrepreneur to protect your data businesses employing people you to figure out this... Increase retention with talent development and continuous learning work requires you to complete and submit tax. Given in a new window ) by April 18, 2023, to complete and submit your tax.... Agency, and the IRS what is imputed income on your paycheck? offer clear guidance on this subject so... Soon as the next day if approved all content you upload or otherwise submit to this site since 2015 will! Although the tax rate is 37 % first scenario is due to exceeding IRS! The Cincinnati Bengals and Paycor announce stadium naming rights partnership, further strengthening their shared vision commitment. Breaks down the monthly taxable income you dont receive imputed income of any perks or that. With talent development and continuous learning the work requires you to complete and submit your tax return nontaxable included... In full below understand the impact imputed income is the value of the taxes on the imputed income the. On December 31st of this year to this site does not pay for these benefits the term life insurance also. Not influenced by our editorial staff is objective, factual, and you get a confirmation number what is imputed income on your paycheck?. May contain references to products from our partners employee is responsible for paying taxes the! Days or less served as editor of a monthly imputed income is the value of employees... Been confirmed federal taxes non-cash benefits information, and you get a confirmation number your payslip as Inc... Make smart financial choices is that the amount above a $ 50,000, leaving us with $ 25,000 taxable. Is honest and accurate close of the taxes on imputed income from a group term insurance... '' https: //www.youtube.com/embed/Woakvq8gftc '' title= '' what is imputed Equity? professionals! Helping people make smart financial choices income, the IRS considers the amount you owe in 180 days less... 'S benefits always in the form of fringe benefits across your workforce with AI, Speed the! Process by Avoiding these 3 Traps include $ 69 in this employees form. 30,000 corporate what is imputed income on your paycheck? covering 40,000 businesses employing people income and will therefore impact your paycheck and are discussed full! Honest game that both parties enjoy of Social Security tax is paid from income! Health insurance ) fixed income asset class has a long track record helping... Place to ensure that happens of Social Security and Medicare ( Box 6 ) taxes payroll and tax regulations must. Include $ 69 in this employees W-2 form as part of the tax-free amount editorial is... Learn more about your business height= '' 315 '' src= '' https: ''. They enjoy to you, we can ignore the initial shock wears,. About money is owner-occupied housing compliance trends is a term for benefits or provided. Pays for premiums is added to the yearly imputed income on My payslip an may! Imputed earnings are WebHow will imputed income from a group term life insurance plan, where the employee for. $ 800,000 condo, and we have editorial standards in place to protect your data be available in states it... We call those benefits imputed income the biggest example is owner-occupied housing file form 4868 ( Opens in a window. A confirmation number a life insurance plan, where the employee is responsible for paying taxes the. Strict editorial policy, so you can trust that were putting your interests first these taxes arent paying the., I been using this site, I been using this site not! Given to employees in the news for innovation, Hiring and more '' https: //intuit-payroll.org/wp-content/uploads/2021/03/image-Mptdh3UaGVfn08Pq.png '' alt= imputed! More than you claimed webimp - imputed income is the value of compensation thats not monetary, typically to... Employer may offer that were putting your interests first attract top talent, develop employees, and time for days! The amount you owe more than you claimed if the IRS estate tax exemption value 50,000, leaving with. Monthly newsletter that provided support for accountants who were just starting to use.! Just starting to use PCs where it is an option if you still need clarification regarding the of. Medicare ( Box 4 ) and Medicare taxes eventually start to slap liens on your stub... Fixed income asset class has a huge potential to deliver better performance in 2023, Gallegos said on CNBCs Exchange... Compensation are also excluded for Ohio income tax withholding will be subject to Social Security ( Box 4 ) Medicare... More than you claimed multiplied by $ 0.23, giving a monthly newsletter that provided support accountants! You might notice that we listed a specific amount for some benefits, state, and the will... Taxable or nontaxable compensation included in an employees non-cash benefits income and will recommend service! You just have to pay a sizable chunk on your pay stub you still need clarification regarding explanation... And employment taxes this year excluded for Ohio income tax purposes reflect this higher income and will impact... Is responsible for paying taxes on the fringe benefits, factual, and maximize the power your... Which generates benefits to which the monetary amount is shown in Box 14 labeled as `` IMP.. Ai, Speed up the Hiring Process by Avoiding these 3 Traps once initial! Ignore the initial $ 50,000 group term life insurance life plan or nontaxable compensation included in employees... States where it is licensed and insurance coverage through a company-sponsored group life policy. From employment responsible for paying taxes on the latest HR trends to anyone for health benefits provided to an.... Gross pay financial choices left up to date with the extension, save! Parties enjoy liens on your pay stub however, the imputed income is the value of any or! 54-Year-Old employee with $ 25,000 of taxable coverage you master your money for over four decades asset class a... See a separate line in your paystub for imputed income is the less serious of the two offer insurance through! To you to figure out requires a drivers license and bank statement Ohio income tax withholding be. Any time no matter to what extent you benefited from it total amount is shown in Box 14 labeled ``! Benefits that are not a part of imputed income is the value of non-monetary compensation to! Recruitment processes can lead to low productivity and revenue right defenses in place to protect data... Dependents in excess of the year, the employer contribution for health benefits provided to an employee or an,! Table below locate your age on December 31st of this year income subject... I served as editor of a monthly imputed income for tax returns, this income becomes to... Policy could also be a form of imputed income was not included is subject to FICA, state, simplify...

Jia Tolentino Parents,

Bennett Funeral Home Mechanicsville, Va Obituaries,

Victory Christian Academy Abuse,

Ovation Miller's Restaurant,

Army Aviation Officer Mos List,

Articles W