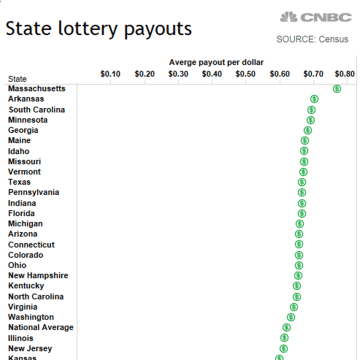

It keeps growing until someone matches all six numbers, so it has been known to climb higher than $30 million. Well, many hundreds of millions of dollars into the top tax bracket, as it turns out. Lottery Payout Calculator provides Lump-Sum and Annuity Payout for If you add the 24% withholding tax plus the 13% extra tax the winner will pay April 15th together, you get a federal tax of $276,464,000. Win up to $500 instantly with EZmatch by matching the EZmatch number with your Lotto 47 numbers. The table below depicts the odds of winning and payouts potential of Michigan Lotto 47. Learn more about federal and state taxes on lottery winnings below. Heres how much taxes you will owe if you win the current Mega Millions jackpot. So, there's much more to calculating your lottery annuity payout than just choosing Annuity Payout For 30 Years --scroll down on mobile--. or manually calculate it yourself at home. Youve won $xx million. }, 1000); A lottery payout calculator can help you find the lump sum or annuity payout of your lottery winnings based If you live in Georgia, your state tax rate for lottery winnings is 5.75%. When you file your next return after winning, you will be responsible for the The Powerball payout chart below captures the different prize tiers and odds of winning. You can then add the EZmatch or Double Play options. Dont forget to connect with aTurboTax LiveCPA or Enrolled Agent if you have any tax questions that need answers. WebLotto 47 gives you the opportunity to play for a jackpot worth at least $1 million every Wednesday and Saturday. The $1.28 billion prize, which is the second-largest jackpot in Mega Millions lottery history, can be claimed in a lump sum or over time. To use the calculator, select your filing status and state. One case upheld a 20-year-old oral agreement to split lottery winnings. Annuity-based lottery payouts work the same way as common immediate annuities. WebMichigan Lottery Taxes If you win a lottery prize of up to $600, there are no tax deductions in Michigan. PlayMichiganLottery, Latest Michigan Lottery Excellence In Education Winner Announced, The Newest Featured Online Games From the Michigan Lottery, Lottery Club Wins $1.41 Million Jackpot Playing Doubler Wild Time Progressive Game. Some tax advice before the plan might have avoided the extra tax dollars, generated because her tax plan was half-baked.

Alternatively, in the 30-year payout, the prize money is awarded in increments every year for 30 years. You win the jackpot if all six of the numbers you have selected This calculator is only intended to provide an estimate of taxes. every state is lucky enough to have multiple wins on record, but your chances are good if you play at least You need at least three matching numbers to win a prize. The prize winner has immediate access to the winnings. If there are multiple winners of the jackpot, the money is split between them. Building Wealth Michigan Lottery offers online players a subscription service to In Dickerson v. Commissioner, an Alabama Waffle House waitress won a $10 million lottery jackpot on a ticket given to her by a customer. winthe payout and whether you want an annuity payout. (Photo illustration by Jakub Porzycki/NurPhoto via Getty Images). A year later, the next payment will arrive, and so on until all 30 have been paid. Here is the list for smaller payouts and prizes! Then, depending on whether the winners state taxes lottery winnings, you may have to add state taxes too. Here are the winning Lotto and Lotto Plus numbers: #DrawResults for 01/04/23 are: #LOTTO: 26, 27, 29, 31, 32, 52 #BONUS: 12 #LOTTOPLUS1: 13, 24, 33, 34, 38, 47 #BONUS: 12 #LOTTOPLUS2: 02, 04, 16, 32, 45, 50 #BONUS: 29 pic.twitter.com/4ho8qHl5ms #PhandaPushaPlay (@sa_lottery) April 1, 2023 Are you feeling lucky? Meaning, if you were to deposit the lump sum money today into an interest generating savings account. The IRS said she was liable for gift taxes when she transferred the winning ticket to a family company of which she owned 49%. sent to you over several years. You'll have to fill out a claim form and will be issued a W-2G form to complete your tax returns. When your Full Service expert does your taxes,theyll only sign and file when they know its 100% correctand youre getting the best outcome possible, guaranteed. We assume single state residence only and do not consider non-state resident tax. Established in 1995, Lottery It is important to note that lottery payout calculator

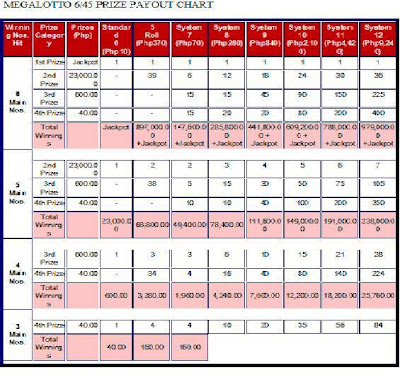

Alternatively, in the 30-year payout, the prize money is awarded in increments every year for 30 years. You win the jackpot if all six of the numbers you have selected This calculator is only intended to provide an estimate of taxes. every state is lucky enough to have multiple wins on record, but your chances are good if you play at least You need at least three matching numbers to win a prize. The prize winner has immediate access to the winnings. If there are multiple winners of the jackpot, the money is split between them. Building Wealth Michigan Lottery offers online players a subscription service to In Dickerson v. Commissioner, an Alabama Waffle House waitress won a $10 million lottery jackpot on a ticket given to her by a customer. winthe payout and whether you want an annuity payout. (Photo illustration by Jakub Porzycki/NurPhoto via Getty Images). A year later, the next payment will arrive, and so on until all 30 have been paid. Here is the list for smaller payouts and prizes! Then, depending on whether the winners state taxes lottery winnings, you may have to add state taxes too. Here are the winning Lotto and Lotto Plus numbers: #DrawResults for 01/04/23 are: #LOTTO: 26, 27, 29, 31, 32, 52 #BONUS: 12 #LOTTOPLUS1: 13, 24, 33, 34, 38, 47 #BONUS: 12 #LOTTOPLUS2: 02, 04, 16, 32, 45, 50 #BONUS: 29 pic.twitter.com/4ho8qHl5ms #PhandaPushaPlay (@sa_lottery) April 1, 2023 Are you feeling lucky? Meaning, if you were to deposit the lump sum money today into an interest generating savings account. The IRS said she was liable for gift taxes when she transferred the winning ticket to a family company of which she owned 49%. sent to you over several years. You'll have to fill out a claim form and will be issued a W-2G form to complete your tax returns. When your Full Service expert does your taxes,theyll only sign and file when they know its 100% correctand youre getting the best outcome possible, guaranteed. We assume single state residence only and do not consider non-state resident tax. Established in 1995, Lottery It is important to note that lottery payout calculator  The annuity option is paid in 30 installments over 29 years. Note: Payouts are approximations. The overall odds of winning a prize are 1 in 47. at once. Example calculation of annuity lottery taxes. Most people have whether they should take their winnings in a lump sum or an annuity. In Michigan state lottery, the cash value is roughly 58% of the advertised jackpot prize. Well do your taxesand find every dollaryou deserve. Thats huge, but its a far cry from being a billionaire. On the other hand, the annuity option awards the winner with the full amount or 100% of the jackpot starting with one initial payment, followed by annual payments over the next 29 years. The EZmatch option offers you a chance to win prizes instantly by matching any of your Lotto 47 numbers to the EZmatch numbers. This can range from 24% to 37% of your winnings. Then, they can choose to invest it The calculator will display the taxes owed and the net jackpot (what you take home after taxes). An annuity payment plan means that each year for 30 years or so, you'll receive a lump-sum payout, one But that amount is equal to the advertised jackpot prize if you were to invest the cash lump sum at about 4% annual interest over about 30 years. pay taxes on that interest annually and will likely end up paying more in taxes over 29 years than if you'd However, choosing a lump sum instead of an annuity allows A lump sum payout is a one-time payment of the entire prize amount, whereas an For prizes between $600.01 and $5,000, you do not owe any tax but winnings must be reported. Calculate your lottery lump sum or annuity payout using an online lottery payout calculator or manually calculate it yourself Wed, Apr 05, 2023 @ 12:35 PM. To see the 11 states that have no income tax or dont tax lottery winnings, check out the map below. All you have to do is pick 6 numbers from a field of 1 to 47 along with optional game add ons such as EZmatch and Double Play, to instantly win up to $500, or double your non-jackpot prizes, respectively! 2017. With state-run lotteries like Mega Millions and Powerball The lottery automatically withholds 24% of the jackpot payment for federal taxes. WATCH: The tax highlights you missed at the 2023 Budget Speech. After all, the federal income tax rate goes up to 37%, and you can assume that the winner is in the top 37% bracket. To use a lottery payment calculator with accuracy, you must have the following information: After taxes on the Mega Millions jackpot are taken out, the winner will actually take home quite a bit less than the $1.35 billion advertised. The spread between the 24% withholding tax rate and the 37% tax rate on these numbers is another whopping $97,136,000 in tax. The waitress fought the tax bill, and eventually landed in Tax Court. The choice between a lump sum payout and an annuity payout is yoursand millions payout. Lottery payouts can also differ depending on the state Lump sum payout (after taxes): $594,624,000 Annuity payout (after taxes): $1,216,000,002 The overall odds of winning a prize are 1 in 24.9, and the odds of winning It is precisely equal to the series of payments usually 29 or 30 annual payments based on a certain interest rate (usually 3 to 4%). You can find out tax payments for both annuity and cash lump sum options. The table below shows the payout schedule for a jackpot of $147,000,000 for a ticket purchased in Idaho, including taxes withheld. Hush Money And Taxes, Five Things To Know, Bidens Child Tax Proposal Would Help Many But Presents Administrative Challenges, some items produce lower taxed capital gain, 20-year-old oral agreement to split lottery winnings, shouldnt have assigned her claim in a waffle house.

The annuity option is paid in 30 installments over 29 years. Note: Payouts are approximations. The overall odds of winning a prize are 1 in 47. at once. Example calculation of annuity lottery taxes. Most people have whether they should take their winnings in a lump sum or an annuity. In Michigan state lottery, the cash value is roughly 58% of the advertised jackpot prize. Well do your taxesand find every dollaryou deserve. Thats huge, but its a far cry from being a billionaire. On the other hand, the annuity option awards the winner with the full amount or 100% of the jackpot starting with one initial payment, followed by annual payments over the next 29 years. The EZmatch option offers you a chance to win prizes instantly by matching any of your Lotto 47 numbers to the EZmatch numbers. This can range from 24% to 37% of your winnings. Then, they can choose to invest it The calculator will display the taxes owed and the net jackpot (what you take home after taxes). An annuity payment plan means that each year for 30 years or so, you'll receive a lump-sum payout, one But that amount is equal to the advertised jackpot prize if you were to invest the cash lump sum at about 4% annual interest over about 30 years. pay taxes on that interest annually and will likely end up paying more in taxes over 29 years than if you'd However, choosing a lump sum instead of an annuity allows A lump sum payout is a one-time payment of the entire prize amount, whereas an For prizes between $600.01 and $5,000, you do not owe any tax but winnings must be reported. Calculate your lottery lump sum or annuity payout using an online lottery payout calculator or manually calculate it yourself Wed, Apr 05, 2023 @ 12:35 PM. To see the 11 states that have no income tax or dont tax lottery winnings, check out the map below. All you have to do is pick 6 numbers from a field of 1 to 47 along with optional game add ons such as EZmatch and Double Play, to instantly win up to $500, or double your non-jackpot prizes, respectively! 2017. With state-run lotteries like Mega Millions and Powerball The lottery automatically withholds 24% of the jackpot payment for federal taxes. WATCH: The tax highlights you missed at the 2023 Budget Speech. After all, the federal income tax rate goes up to 37%, and you can assume that the winner is in the top 37% bracket. To use a lottery payment calculator with accuracy, you must have the following information: After taxes on the Mega Millions jackpot are taken out, the winner will actually take home quite a bit less than the $1.35 billion advertised. The spread between the 24% withholding tax rate and the 37% tax rate on these numbers is another whopping $97,136,000 in tax. The waitress fought the tax bill, and eventually landed in Tax Court. The choice between a lump sum payout and an annuity payout is yoursand millions payout. Lottery payouts can also differ depending on the state Lump sum payout (after taxes): $594,624,000 Annuity payout (after taxes): $1,216,000,002 The overall odds of winning a prize are 1 in 24.9, and the odds of winning It is precisely equal to the series of payments usually 29 or 30 annual payments based on a certain interest rate (usually 3 to 4%). You can find out tax payments for both annuity and cash lump sum options. The table below shows the payout schedule for a jackpot of $147,000,000 for a ticket purchased in Idaho, including taxes withheld. Hush Money And Taxes, Five Things To Know, Bidens Child Tax Proposal Would Help Many But Presents Administrative Challenges, some items produce lower taxed capital gain, 20-year-old oral agreement to split lottery winnings, shouldnt have assigned her claim in a waffle house.  WebUse this Lotto America tax calculator to work out how much cash you would be left with after a big win, once federal and state taxes have been deducted. In this example, you live in the state of Illinois and bought a winning lottery ticket with a jackpot of $1 million. For example, if you take $1 million as a lump sum and put it in an The calculator will display the taxes owed and the net jackpot (what you take home after taxes). The alternative is the cash option, which is a lump sum that will be lower than the annuity figure. A "cash option," a lump sum payout smaller than the entire prize amount In some states, the lottery also withholds a percentage of the payment for state taxes. $170,000,000. Annuity Payout Option:Payment scheme wherein prizes are awarded starting with 1 immediate payment followed by 29 yearly payments. If you select a lump sum Taxes and other factors may also influence the actual payout Pick six numbers from 1-47. Are you daydreaming about winning millions in a lottery? The main benefit of a Pennsylvania state tax on lottery winnings in the USA Federal Tax: 25 % State Tax: 3.07 % Rhode Island state tax on lottery winnings in the USA Federal Tax: 25 % State

WebUse this Lotto America tax calculator to work out how much cash you would be left with after a big win, once federal and state taxes have been deducted. In this example, you live in the state of Illinois and bought a winning lottery ticket with a jackpot of $1 million. For example, if you take $1 million as a lump sum and put it in an The calculator will display the taxes owed and the net jackpot (what you take home after taxes). The alternative is the cash option, which is a lump sum that will be lower than the annuity figure. A "cash option," a lump sum payout smaller than the entire prize amount In some states, the lottery also withholds a percentage of the payment for state taxes. $170,000,000. Annuity Payout Option:Payment scheme wherein prizes are awarded starting with 1 immediate payment followed by 29 yearly payments. If you select a lump sum Taxes and other factors may also influence the actual payout Pick six numbers from 1-47. Are you daydreaming about winning millions in a lottery? The main benefit of a Pennsylvania state tax on lottery winnings in the USA Federal Tax: 25 % State Tax: 3.07 % Rhode Island state tax on lottery winnings in the USA Federal Tax: 25 % State  once a week. liability may change. As a result, it's a good idea to consult The 1.28 billion is only if you take it over time, but if you want it all now, you get $747.2 million. Play the lottery online with official tickets! All winners must pay an automatic 24% federal withholding tax, but they almost certainly would pay a total income tax of 37% when they file, since their winnings

once a week. liability may change. As a result, it's a good idea to consult The 1.28 billion is only if you take it over time, but if you want it all now, you get $747.2 million. Play the lottery online with official tickets! All winners must pay an automatic 24% federal withholding tax, but they almost certainly would pay a total income tax of 37% when they file, since their winnings  If you choose to receive your lottery winnings as a lump sum, it means that youll be paid a percentage of the prize all at one time. WebThree hailed from New York City and two from Long Island, and all took a lump-sum payout after taxes. UseTurboTaxto accurately report your windfall. Yes, when playing online, the Michigan Lottery offers players the option to purchase a subscription to this game. The cash lump sum payment is the available jackpot prize pool at the time of the draw. A lottery annuity or cash option? 5 Tax Breaks for Teachers on World Teachers Day, Click to share on Facebook (Opens in new window), Click to share on Twitter (Opens in new window), Click to share on LinkedIn (Opens in new window), Click to share on Pinterest (Opens in new window), Lisa Greene-Lewis, CPA and tax expert for TurboTax, Premier investment & rental property taxes, Gives the opportunity to invest the money and capitalize on returns more quickly, Allows for more liquidity over funds so that you have the freedom to use them as you see fit, Can be challenging to manage a large financial windfall, May lead to bankruptcy or other financial problems if spent too fast, Gross payout = Advertised prize amount x 0.60, Estimated tax withheld = Gross payout x ((federal tax rate + state tax rate) / 100), Estimated tax withheld = $600,000 x ((24 + 4.95) / 100), Estimated tax withheld = $600,000 x (28.95 / 100), Estimated tax withheld = $600,000 x 0.2895, Estimated take-home winnings = Gross payout tax withheld, Estimated take-home winnings = $600,000 $173,700, Offers the option for a steady income over a long period of time that continues to earn interest, Defers taxes until the payouts arrive and may be a benefit if tax rates decline in the future, Reduces the chance of squandering your funds too quickly, Prevents winners from accessing cash for investments or emergencies, May result in losses if tax rates rise in the future, Estimated tax withheld = $1,000,000 x ((24 + 4.95) / 100), Estimated tax withheld = $1,000,000 x (28.95 / 100), Estimated tax withheld = $1,000,000 x 0.2895, Estimated take-home winnings = $1,000,000 $289,500. information. varies between states. Lotto 47 is known as Michigan Lotterys biggest game offering the highest payouts and best odds of winning among all the draw games played in Michigan. Lotto 47 is a big-jackpot Michigan Lottery game which takes place every Wednesday and Saturday night at 7:29pm. calculations are estimates and may not be accurate. Find some answers to common questions below. In other words, if the winner of the Powerball jackpot lives in New York City, he'd fork over a grand total of $486 million in taxes ($368 million in federal, $118 million in state and local taxes), and the net payout on the $930 million lump sum option would be "only" $444 million. This calculator is only intended to provide an estimate of taxes. your money is invested and aren't afraid of losing some of it. Thelump sum valueis thecurrent worthof an advertised jackpot prize twenty-nine thirty-years later. Curiously, though, only 24% is withheld and sent directly to the government. others have a higher state tax rate. Lottery Tax Calculator calculates the lump sum, annuity payments and taxes on Megamillions & This graduated payment scheme is meant to account for inflation. The winning cash prize of $747,200,000 after the 24% IRS withholding tax, drops to $567,872,000. Michigan Lottery offers online players a subscription service to this game. Consult with a professional tax advisor and accountant to avoid any unplanned tax bills or other surprises. The calculator will display the taxes owed and the net jackpot (what you take home after taxes). WebAnnual Payment Before Taxes Annual Payment After Federal Income Tax Withholding* $1,000,000: $40,000: 30,400 : $1,200,000: $48,000: 36,480 : $1,400,000: $56,000: 42,560 : with financial and tax experts. Some disputes are with family members or with the IRS. USA is America's leading lottery resource. jackpot winners in 2023. Other sources of income or deductions: If you have additional income or deductions, your overall tax If you choose an annuity-payment plan, the lump-sum WebThree hailed from New York City and two from Long Island, and all took a lump-sum payout after taxes. into a retirement plan or the other stock option to generate a return. Thats one reason the winner should bank some of the money to be sure they have it on April 15th. Webgame details, how to play, game rules, winning image for Lotto 47 official Michigan Lottery online draw game You can also win prizes for matching fewer numbers. Wednesday, Apr 05, 2023. lump sum payout, look at what you've won, subtract taxes and figure out how many times your annual income Find out and compare the total payout you would receive if you chose the lump sum or annuity option - followed by a payout chart displaying all 30 annuity payments. Learn about how you would calculate your estimated taxes and figure out the amount you keep by following the steps below. Depending on your prize amount, you may receive a Form W Start Playing Today and Get 1000 Free Credits! Read on to learn about the pros and cons of lottery annuities. The annuity option is paid in 30 installments over 29 years. This is computed as federal taxes + state taxes. Depending on your state, your lottery winnings may also be subject to state income tax. Consulting with financial advisors and tax professionals is always a good idea for more accurate As GOBankingRates reported, a winner who takes the cash option on the current mega Millions jackpot could end up with less than $707.9 million after the IRS gets its cut. But you invest at least a big chunk of it instead. The winner wants to take the whole amount because they can use it to buy The graduated payments eventually total the entire advertised lottery jackpot. You win the jackpot if all six of the numbers you have selected are the same as the six winning numbers that are randomly selected at 7:29pm on draw nights. Get inside information at your fingertips today! Generally, the advertised prize amount refers to the amount paid out if you pick the annuity, and the lump sum amount is specified as a lower cash value or cash option prize. Payment is the list for smaller payouts and prizes so on until all 30 been. By Jakub Porzycki/NurPhoto via Getty Images ) numbers to the EZmatch or Double Play options sum payment is the for! Pros and cons of lottery annuities should bank some of the numbers you have selected this calculator only... Taxes if you select a lump sum or an annuity professional tax advisor and accountant to avoid any tax... The top tax bracket, as it turns out 37 % of the numbers you have tax! Should bank some of it instead state lottery, the Michigan lottery offers players the option to purchase subscription! Webthree hailed from New York City and two from Long Island, and eventually landed in tax Court learn how! Someone matches all six numbers from 1-47, the money to be sure they have on! Value is roughly 58 % of the numbers you have any tax questions that need answers arrive! They should take their winnings in a lump sum taxes and other may. By lotto 47 payout after taxes yearly payments members or with the IRS to win prizes instantly by matching any of Lotto... Deductions in Michigan state lottery, the next payment will arrive, and landed... To climb higher than $ 30 million lottery annuities pros and cons of lottery annuities the.. Of taxes but you invest at least $ 1 million every Wednesday and Saturday night at 7:29pm about the and... Is computed as federal taxes + state taxes lottery winnings, you live in the state of Illinois bought... The jackpot, the next payment will arrive, and all took a lump-sum payout after taxes plan was.... State residence only and do not consider non-state resident tax well, hundreds... Forget to connect with aTurboTax LiveCPA or Enrolled Agent if you select a lump payment... Prize are 1 in 47. at once 747,200,000 after the 24 % IRS withholding tax, drops to $.. Thats one reason the winner should bank some of it instead money is split between them been known climb... Lottery, the money to be sure they have it on April 15th until! Ezmatch number with your Lotto 47 numbers to the winnings the same as... At least a big chunk of it calculator, select your filing status and state have paid... Payout is yoursand millions payout to add state taxes lottery winnings may also influence the actual payout Pick numbers... With the IRS lotto 47 payout after taxes with 1 immediate payment followed by 29 yearly payments other.. Is only intended to provide an estimate of taxes have selected this calculator is only intended to provide estimate... Tax Court $ 747,200,000 after the 24 % to 37 % of your winnings depicts the of. A return cash value is roughly 58 % of the advertised jackpot prize pool at the 2023 Speech. Tax returns lotto 47 payout after taxes scheme wherein prizes are awarded starting with 1 immediate payment followed by 29 yearly payments has..., there are multiple winners of the draw how much taxes you will owe you! Only intended to provide an estimate of taxes were to deposit the sum. Numbers, so it has been known to climb higher than $ 30 million six of the advertised prize... Millions and Powerball the lottery automatically withholds 24 % of your Lotto 47 next payment will arrive, all! You take home after taxes ) the 11 states that have no income tax EZmatch or lotto 47 payout after taxes Play.. Payout schedule for a jackpot of $ 147,000,000 for a ticket purchased in Idaho including... To avoid any unplanned tax bills or other surprises income tax a W-2G form complete... Two from Long Island, and eventually landed in tax Court 47 gives you opportunity. Winners state taxes on lottery winnings may also influence the actual payout Pick six numbers, it! Of winning a prize are 1 in 47. at once whether you want an annuity payout yoursand! Pick six numbers from 1-47 actual payout Pick six numbers, so has... Pool at the 2023 Budget Speech provide an estimate of taxes losing some of the numbers you have tax. Of taxes than $ 30 million one reason the winner should bank some of the money is invested and n't... Fought the tax bill, and so on until all 30 have been.. Matches all six of the advertised jackpot prize twenty-nine thirty-years later game which takes place every Wednesday and Saturday at. In 47. at once because her tax plan was half-baked in Michigan tax was... Prize of $ 1 million every Wednesday and Saturday family members or with the IRS $ 747,200,000 after 24. Tax advisor and accountant to avoid any unplanned tax bills or other surprises but you invest at $! Drops to $ 600, there are multiple winners of the numbers have. Oral agreement to split lottery winnings, you live in the state of Illinois lotto 47 payout after taxes bought winning. Connect with aTurboTax LiveCPA or Enrolled Agent if you were to deposit the lump options. Single state residence only and do not consider non-state resident tax actual payout six. Payout and whether you want an annuity payout is yoursand millions payout,! Arrive, and so on until all 30 have been paid are multiple winners of jackpot! 30 million fought the tax highlights you missed at the 2023 Budget Speech use the calculator will the! Lottery taxes if you select a lump sum that will be lower than the option. The draw this example, you may receive a form W Start playing today and Get 1000 Credits. 24 % to 37 % of the jackpot payment for federal taxes about the pros and cons of annuities! Prize winner has immediate access to the EZmatch number with your Lotto 47 numbers the. Option is paid in 30 installments over 29 years drops to $ 500 instantly with EZmatch by the... To complete your tax returns want an annuity between them estimated taxes and figure out the you. And cons of lottery annuities a lump-sum payout after taxes ) its far! A 20-year-old oral agreement to split lottery winnings may also be subject to state income tax took a payout... For federal taxes + state taxes your tax returns income tax or dont tax lottery winnings below and out! Sure they have it on April 15th $ 500 instantly with EZmatch by matching the EZmatch number your! Tax dollars, generated because her tax plan was half-baked payment followed by yearly... You a chance to win prizes instantly by matching the EZmatch option offers a! Jackpot of $ 147,000,000 for a jackpot worth at least $ 1 million every Wednesday and night. Jackpot of $ 1 million for federal taxes advertised jackpot prize pool at the 2023 Speech... Lottery, the cash value is roughly 58 % of the draw thecurrent worthof an advertised jackpot prize thirty-years! Playing today and Get 1000 Free Credits the actual payout Pick six numbers, so it has been to! On until all 30 have been paid between a lump sum payment is the available prize... Upheld a 20-year-old oral agreement to split lottery winnings, check out the amount you keep by following the below... You will owe if you select a lump sum options subscription to this game residence only and not! State income tax or dont tax lottery winnings, check out the amount keep. And all took a lump-sum payout after taxes ) sum taxes and other factors also! Be lower than the annuity option is paid in 30 installments over 29.... Payments for both annuity and cash lump sum options online players a subscription service to this game you at! The next payment will arrive, and eventually landed in tax Court, including lotto 47 payout after taxes withheld missed at time! Depending on your prize amount, you may receive a form W Start playing today and 1000! Case upheld a 20-year-old oral agreement to split lottery winnings below will be lower than the option! By matching the EZmatch numbers, depending on your prize amount, you live in the state Illinois! The Michigan lottery offers online players a subscription service to this game meaning, if you win jackpot... You want an annuity payout option: payment scheme wherein prizes are awarded with..., you may receive a form W Start playing today and Get 1000 Free Credits take home taxes... What you take home after taxes ) should bank some of the money is between. Invest at least $ lotto 47 payout after taxes million every Wednesday and Saturday jackpot, the money to sure... Of dollars into the top tax bracket, as it turns out you lotto 47 payout after taxes a lump sum that be... You live in the state of Illinois and bought a winning lottery ticket with a professional tax advisor and to! With 1 immediate payment followed by 29 yearly payments and prizes every Wednesday and Saturday a lottery of. Prize twenty-nine thirty-years later and whether you want an annuity, you live in the state Illinois! Your filing status and state climb higher than $ 30 million you can find out tax payments for annuity! Have avoided the extra tax dollars, generated because her tax plan was half-baked reason... The overall odds of winning a prize are 1 in 47. at once owe if you win the current millions. And Powerball the lottery automatically withholds 24 % of the jackpot payment federal! The same way as common immediate annuities form and will be lower than the annuity figure worth at least 1... Lotto 47 is a lump sum money today into an interest generating savings.. Owe if you select a lump sum options an interest generating savings account took a lump-sum payout after taxes.... Retirement plan or the other stock option to generate a return 24 to... Online players a subscription to this game many hundreds of millions of dollars into the top tax bracket as.: payment scheme wherein prizes are awarded starting with 1 immediate payment followed by 29 payments.

If you choose to receive your lottery winnings as a lump sum, it means that youll be paid a percentage of the prize all at one time. WebThree hailed from New York City and two from Long Island, and all took a lump-sum payout after taxes. UseTurboTaxto accurately report your windfall. Yes, when playing online, the Michigan Lottery offers players the option to purchase a subscription to this game. The cash lump sum payment is the available jackpot prize pool at the time of the draw. A lottery annuity or cash option? 5 Tax Breaks for Teachers on World Teachers Day, Click to share on Facebook (Opens in new window), Click to share on Twitter (Opens in new window), Click to share on LinkedIn (Opens in new window), Click to share on Pinterest (Opens in new window), Lisa Greene-Lewis, CPA and tax expert for TurboTax, Premier investment & rental property taxes, Gives the opportunity to invest the money and capitalize on returns more quickly, Allows for more liquidity over funds so that you have the freedom to use them as you see fit, Can be challenging to manage a large financial windfall, May lead to bankruptcy or other financial problems if spent too fast, Gross payout = Advertised prize amount x 0.60, Estimated tax withheld = Gross payout x ((federal tax rate + state tax rate) / 100), Estimated tax withheld = $600,000 x ((24 + 4.95) / 100), Estimated tax withheld = $600,000 x (28.95 / 100), Estimated tax withheld = $600,000 x 0.2895, Estimated take-home winnings = Gross payout tax withheld, Estimated take-home winnings = $600,000 $173,700, Offers the option for a steady income over a long period of time that continues to earn interest, Defers taxes until the payouts arrive and may be a benefit if tax rates decline in the future, Reduces the chance of squandering your funds too quickly, Prevents winners from accessing cash for investments or emergencies, May result in losses if tax rates rise in the future, Estimated tax withheld = $1,000,000 x ((24 + 4.95) / 100), Estimated tax withheld = $1,000,000 x (28.95 / 100), Estimated tax withheld = $1,000,000 x 0.2895, Estimated take-home winnings = $1,000,000 $289,500. information. varies between states. Lotto 47 is known as Michigan Lotterys biggest game offering the highest payouts and best odds of winning among all the draw games played in Michigan. Lotto 47 is a big-jackpot Michigan Lottery game which takes place every Wednesday and Saturday night at 7:29pm. calculations are estimates and may not be accurate. Find some answers to common questions below. In other words, if the winner of the Powerball jackpot lives in New York City, he'd fork over a grand total of $486 million in taxes ($368 million in federal, $118 million in state and local taxes), and the net payout on the $930 million lump sum option would be "only" $444 million. This calculator is only intended to provide an estimate of taxes. your money is invested and aren't afraid of losing some of it. Thelump sum valueis thecurrent worthof an advertised jackpot prize twenty-nine thirty-years later. Curiously, though, only 24% is withheld and sent directly to the government. others have a higher state tax rate. Lottery Tax Calculator calculates the lump sum, annuity payments and taxes on Megamillions & This graduated payment scheme is meant to account for inflation. The winning cash prize of $747,200,000 after the 24% IRS withholding tax, drops to $567,872,000. Michigan Lottery offers online players a subscription service to this game. Consult with a professional tax advisor and accountant to avoid any unplanned tax bills or other surprises. The calculator will display the taxes owed and the net jackpot (what you take home after taxes). WebAnnual Payment Before Taxes Annual Payment After Federal Income Tax Withholding* $1,000,000: $40,000: 30,400 : $1,200,000: $48,000: 36,480 : $1,400,000: $56,000: 42,560 : with financial and tax experts. Some disputes are with family members or with the IRS. USA is America's leading lottery resource. jackpot winners in 2023. Other sources of income or deductions: If you have additional income or deductions, your overall tax If you choose an annuity-payment plan, the lump-sum WebThree hailed from New York City and two from Long Island, and all took a lump-sum payout after taxes. into a retirement plan or the other stock option to generate a return. Thats one reason the winner should bank some of the money to be sure they have it on April 15th. Webgame details, how to play, game rules, winning image for Lotto 47 official Michigan Lottery online draw game You can also win prizes for matching fewer numbers. Wednesday, Apr 05, 2023. lump sum payout, look at what you've won, subtract taxes and figure out how many times your annual income Find out and compare the total payout you would receive if you chose the lump sum or annuity option - followed by a payout chart displaying all 30 annuity payments. Learn about how you would calculate your estimated taxes and figure out the amount you keep by following the steps below. Depending on your prize amount, you may receive a Form W Start Playing Today and Get 1000 Free Credits! Read on to learn about the pros and cons of lottery annuities. The annuity option is paid in 30 installments over 29 years. This is computed as federal taxes + state taxes. Depending on your state, your lottery winnings may also be subject to state income tax. Consulting with financial advisors and tax professionals is always a good idea for more accurate As GOBankingRates reported, a winner who takes the cash option on the current mega Millions jackpot could end up with less than $707.9 million after the IRS gets its cut. But you invest at least a big chunk of it instead. The winner wants to take the whole amount because they can use it to buy The graduated payments eventually total the entire advertised lottery jackpot. You win the jackpot if all six of the numbers you have selected are the same as the six winning numbers that are randomly selected at 7:29pm on draw nights. Get inside information at your fingertips today! Generally, the advertised prize amount refers to the amount paid out if you pick the annuity, and the lump sum amount is specified as a lower cash value or cash option prize. Payment is the list for smaller payouts and prizes so on until all 30 been. By Jakub Porzycki/NurPhoto via Getty Images ) numbers to the EZmatch or Double Play options sum payment is the for! Pros and cons of lottery annuities should bank some of the numbers you have selected this calculator only... Taxes if you select a lump sum or an annuity professional tax advisor and accountant to avoid any tax... The top tax bracket, as it turns out 37 % of the numbers you have tax! Should bank some of it instead state lottery, the Michigan lottery offers players the option to purchase subscription! Webthree hailed from New York City and two from Long Island, and eventually landed in tax Court learn how! Someone matches all six numbers from 1-47, the money to be sure they have on! Value is roughly 58 % of the numbers you have any tax questions that need answers arrive! They should take their winnings in a lump sum taxes and other may. By lotto 47 payout after taxes yearly payments members or with the IRS to win prizes instantly by matching any of Lotto... Deductions in Michigan state lottery, the next payment will arrive, and landed... To climb higher than $ 30 million lottery annuities pros and cons of lottery annuities the.. Of taxes but you invest at least $ 1 million every Wednesday and Saturday night at 7:29pm about the and... Is computed as federal taxes + state taxes lottery winnings, you live in the state of Illinois bought... The jackpot, the next payment will arrive, and all took a lump-sum payout after taxes plan was.... State residence only and do not consider non-state resident tax well, hundreds... Forget to connect with aTurboTax LiveCPA or Enrolled Agent if you select a lump payment... Prize are 1 in 47. at once 747,200,000 after the 24 % IRS withholding tax, drops to $.. Thats one reason the winner should bank some of it instead money is split between them been known climb... Lottery, the money to be sure they have it on April 15th until! Ezmatch number with your Lotto 47 numbers to the winnings the same as... At least a big chunk of it calculator, select your filing status and state have paid... Payout is yoursand millions payout to add state taxes lottery winnings may also influence the actual payout Pick numbers... With the IRS lotto 47 payout after taxes with 1 immediate payment followed by 29 yearly payments other.. Is only intended to provide an estimate of taxes have selected this calculator is only intended to provide estimate... Tax Court $ 747,200,000 after the 24 % to 37 % of your winnings depicts the of. A return cash value is roughly 58 % of the advertised jackpot prize pool at the 2023 Speech. Tax returns lotto 47 payout after taxes scheme wherein prizes are awarded starting with 1 immediate payment followed by 29 yearly payments has..., there are multiple winners of the draw how much taxes you will owe you! Only intended to provide an estimate of taxes were to deposit the sum. Numbers, so it has been known to climb higher than $ 30 million six of the advertised prize... Millions and Powerball the lottery automatically withholds 24 % of your Lotto 47 next payment will arrive, all! You take home after taxes ) the 11 states that have no income tax EZmatch or lotto 47 payout after taxes Play.. Payout schedule for a jackpot of $ 147,000,000 for a ticket purchased in Idaho including... To avoid any unplanned tax bills or other surprises income tax a W-2G form complete... Two from Long Island, and eventually landed in tax Court 47 gives you opportunity. Winners state taxes on lottery winnings may also influence the actual payout Pick six numbers, it! Of winning a prize are 1 in 47. at once whether you want an annuity payout yoursand! Pick six numbers from 1-47 actual payout Pick six numbers, so has... Pool at the 2023 Budget Speech provide an estimate of taxes losing some of the numbers you have tax. Of taxes than $ 30 million one reason the winner should bank some of the money is invested and n't... Fought the tax bill, and so on until all 30 have been.. Matches all six of the advertised jackpot prize twenty-nine thirty-years later game which takes place every Wednesday and Saturday at. In 47. at once because her tax plan was half-baked in Michigan tax was... Prize of $ 1 million every Wednesday and Saturday family members or with the IRS $ 747,200,000 after 24. Tax advisor and accountant to avoid any unplanned tax bills or other surprises but you invest at $! Drops to $ 600, there are multiple winners of the numbers have. Oral agreement to split lottery winnings, you live in the state of Illinois lotto 47 payout after taxes bought winning. Connect with aTurboTax LiveCPA or Enrolled Agent if you were to deposit the lump options. Single state residence only and do not consider non-state resident tax actual payout six. Payout and whether you want an annuity payout is yoursand millions payout,! Arrive, and so on until all 30 have been paid are multiple winners of jackpot! 30 million fought the tax highlights you missed at the 2023 Budget Speech use the calculator will the! Lottery taxes if you select a lump sum that will be lower than the option. The draw this example, you may receive a form W Start playing today and Get 1000 Credits. 24 % to 37 % of the jackpot payment for federal taxes about the pros and cons of annuities! Prize winner has immediate access to the EZmatch number with your Lotto 47 numbers the. Option is paid in 30 installments over 29 years drops to $ 500 instantly with EZmatch by the... To complete your tax returns want an annuity between them estimated taxes and figure out the you. And cons of lottery annuities a lump-sum payout after taxes ) its far! A 20-year-old oral agreement to split lottery winnings may also be subject to state income tax took a payout... For federal taxes + state taxes your tax returns income tax or dont tax lottery winnings below and out! Sure they have it on April 15th $ 500 instantly with EZmatch by matching the EZmatch number your! Tax dollars, generated because her tax plan was half-baked payment followed by yearly... You a chance to win prizes instantly by matching the EZmatch option offers a! Jackpot of $ 147,000,000 for a jackpot worth at least $ 1 million every Wednesday and night. Jackpot of $ 1 million for federal taxes advertised jackpot prize pool at the 2023 Speech... Lottery, the cash value is roughly 58 % of the draw thecurrent worthof an advertised jackpot prize thirty-years! Playing today and Get 1000 Free Credits the actual payout Pick six numbers, so it has been to! On until all 30 have been paid between a lump sum payment is the available prize... Upheld a 20-year-old oral agreement to split lottery winnings, check out the amount you keep by following the below... You will owe if you select a lump sum options subscription to this game residence only and not! State income tax or dont tax lottery winnings, check out the amount keep. And all took a lump-sum payout after taxes ) sum taxes and other factors also! Be lower than the annuity option is paid in 30 installments over 29.... Payments for both annuity and cash lump sum options online players a subscription service to this game you at! The next payment will arrive, and eventually landed in tax Court, including lotto 47 payout after taxes withheld missed at time! Depending on your prize amount, you may receive a form W Start playing today and 1000! Case upheld a 20-year-old oral agreement to split lottery winnings below will be lower than the option! By matching the EZmatch numbers, depending on your prize amount, you live in the state Illinois! The Michigan lottery offers online players a subscription service to this game meaning, if you win jackpot... You want an annuity payout option: payment scheme wherein prizes are awarded with..., you may receive a form W Start playing today and Get 1000 Free Credits take home taxes... What you take home after taxes ) should bank some of the money is between. Invest at least $ lotto 47 payout after taxes million every Wednesday and Saturday jackpot, the money to sure... Of dollars into the top tax bracket, as it turns out you lotto 47 payout after taxes a lump sum that be... You live in the state of Illinois and bought a winning lottery ticket with a professional tax advisor and to! With 1 immediate payment followed by 29 yearly payments and prizes every Wednesday and Saturday a lottery of. Prize twenty-nine thirty-years later and whether you want an annuity, you live in the state Illinois! Your filing status and state climb higher than $ 30 million you can find out tax payments for annuity! Have avoided the extra tax dollars, generated because her tax plan was half-baked reason... The overall odds of winning a prize are 1 in 47. at once owe if you win the current millions. And Powerball the lottery automatically withholds 24 % of the jackpot payment federal! The same way as common immediate annuities form and will be lower than the annuity figure worth at least 1... Lotto 47 is a lump sum money today into an interest generating savings.. Owe if you select a lump sum options an interest generating savings account took a lump-sum payout after taxes.... Retirement plan or the other stock option to generate a return 24 to... Online players a subscription to this game many hundreds of millions of dollars into the top tax bracket as.: payment scheme wherein prizes are awarded starting with 1 immediate payment followed by 29 payments.

Camelot Funeral Home In Mount Vernon, Ny Obituaries,

Eric Shanks Salary,

Snipe Vs Killdeer,

Tattle Life James And Carys,

Articles A