Final dividends are also announced and declared by the BOD. Stock preferred as to dividends means that the preferred stockholders receive a specified dividend per share before common stockholders receive any dividends. Alternatively, companies can issue equity. Interim dividends also send a positive signal to the market that can help raise the stock prices temporarily. Companies that do not want to issue cash or property dividends but still want to provide some benefit to shareholders may choose between small stock dividends, large stock dividends, and stock splits. Accounting Entry: No accounting entry should be passed for the recommendation of final Dividend by the Board of Directors, if such recommendation Equity-Income Funds: Definition and How It Work. The key difference is that small dividends are recorded at market value and large dividends are recorded at the stated or par value. There is no change in total assets, total liabilities, or total stockholders equity when a small stock dividend, a large stock dividend, or a stock split occurs. The Dividends account is then closed to Retained Earnings at the end of the fiscal year. Since dividends are the means whereby the owners of a corporation share in its earnings, accountants charge them against retained earnings. The company may want to invest all their retained earnings to support and continue that growth. 2. A dividend is a payment, either in cash, other assets (in kind), or stock, from a reporting entity to its shareholders. WebAs soon as the Board of Directors approves and announces a dividend (on the declaration date) , the company must record a payable in the liability section of the balance sheet. Do declared dividends have to be paid? That declared dividend is called final dividend. if(typeof ez_ad_units!='undefined'){ez_ad_units.push([[580,400],'accountinghub_online_com-medrectangle-4','ezslot_5',153,'0','0'])};__ez_fad_position('div-gpt-ad-accountinghub_online_com-medrectangle-4-0');An interim dividend is a type of dividend issued before the end of the fiscal year of a company. If you buy a candy bar for $1 and cut it in half, each half is now worth $0.50. A small stock dividend occurs when a stock dividend distribution is less than 25% of the total outstanding shares based on the shares outstanding prior to the dividend distribution. Both small and large stock dividends cause an increase in common stock and a decrease to retained earnings. $32,000. (earnings accumulated from previous fiscal years). However, it is often issued in smaller amounts as compared to a final dividend. Sometimes, companies would issue interim dividends when they couldnt offer a regular dividend in previous quarters. Dividend declaration can be assumed as communication of intent by the company pertaining to the dividends that they have to pay. Directly deduct retained earnings for dividends declared Accounting for Books of Original EntryJournal, 11. Additionally, the split indicates that share value has been increasing, suggesting growth is likely to continue and result in further increase in demand and value. Interim dividends are announced and declared by the board of directors. If you landed on the Chance space, you picked a card. Your employer plans to offer a 3-for-2 stock split. Final Accounts of Companies, 6. A small stock dividend is viewed by investors as a distribution of the companys earnings. Instead, the company prepares a memo entry in its journal that indicates the nature of the stock split and indicates the new par value. Like in the example above, there is no journal entry required on the record date at all. Companies issuing interim dividends use retained earnings. If you are redistributing all or part of this book in a print format, Briefly indicate the accounting entries necessary to recognize the split in the companys accounting records and the effect the split will have on the companys balance sheet.

Though, the term cash dividends is easier to distinguish itself from the stock dividends account which is a completely different type of dividend. And of course, dividends needed to be declared first before it can be distributed or paid out. Dividends are distributions of earnings by a corporation to its stockholders. The journal entry of cash dividends is usually made in two parts. consent of Rice University. Disposal of Profits (Including Dividend), 7. excel,14,multi currency in tally 9,1,Multicurrency Accounting,3,mutual fund,30,national security,1,new and sacrifice ratio,1,new york times,1,new zealand,1,news,1,NGO,5,nonprofit-accounting,6,North Georgia Mountains,1,Notification,1,NPV,17,NSE,1,odbc,2,office,10,oman,1,online application,2,online accounting,11,Online Accounting Course,5,otcei,1,pakistan,3,parents,3,Partnership,1,pay pal,3,pdf,4,Personal Finance,6,pie chart,1,pie chart of income,2,pnb,5,podcast,1,ppf,1,presentation,10,price,7,privacy policy,2,prof. Ledger, 12.

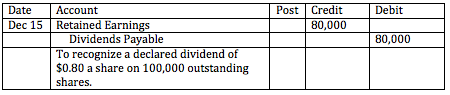

Though, the term cash dividends is easier to distinguish itself from the stock dividends account which is a completely different type of dividend. And of course, dividends needed to be declared first before it can be distributed or paid out. Dividends are distributions of earnings by a corporation to its stockholders. The journal entry of cash dividends is usually made in two parts. consent of Rice University. Disposal of Profits (Including Dividend), 7. excel,14,multi currency in tally 9,1,Multicurrency Accounting,3,mutual fund,30,national security,1,new and sacrifice ratio,1,new york times,1,new zealand,1,news,1,NGO,5,nonprofit-accounting,6,North Georgia Mountains,1,Notification,1,NPV,17,NSE,1,odbc,2,office,10,oman,1,online application,2,online accounting,11,Online Accounting Course,5,otcei,1,pakistan,3,parents,3,Partnership,1,pay pal,3,pdf,4,Personal Finance,6,pie chart,1,pie chart of income,2,pnb,5,podcast,1,ppf,1,presentation,10,price,7,privacy policy,2,prof. Ledger, 12.  The Dividends Payable account appears as a current liability on the balance sheet. And in some states, companies can declare dividends from current earnings despite an accumulated deficit. She receives 10 shares as a stock dividend from the company. This journal entry is made to eliminate the dividends payable that the company has made at the declaration date as well as to recognize the cash outflow that is not an expense. OnJanuary 21, a corporations board of directors declared a 2% cash dividend on $100,000 of outstanding common stock. Buying one share of stock at this price is rather expensive for most people. However, the BOD would require formal approval from shareholders. On January 21, a corporations board of directors declared a 2% cash dividend on $100,000 of outstanding common stock. Unlike a normal dividend, interim dividends are declared by the board of directors. The 30% stock dividend will require the distribution of 60,000 shares times 30%, or 18,000 additional shares of stock. A special dividend is a non-recurring dividend that is not scheduled like the final and interim dividends. To illustrate, assume that Duratech Corporations balance sheet at the end of its second year of operations shows the following in the stockholders equity section prior to the declaration of a large stock dividend. Accountants may perform the closing process monthly or annually. However, a company may issue the amount of the total dividend quarterly, semiannually, or annually as per the company dividend policy. Cash dividends are cash distributions of accumulated earnings by a corporation to its stockholders. Dividends in arrears are cumulative unpaid dividends, including thedividends not declared for the current year. Figure FG 4-2 provides definitions for some of the terms used in connections with dividends. Note: The above redemption of preference shares is said to be (i) out of profit otherwise available for dividend to the extent of Rs. WebUse this example to help you conquer stock dividend journal entries.View the cash dividends example here:https://youtu.be/FXbjzlqMzpo The cash dividend declared is$1.25 per share to stockholders of record on July 1, (date of record), payable onJuly 10, (date of payment). Another objective behind issuing final dividends is to attract investors. Cynadyne, Inc.s has 4,000 shares of $0.20 par value common stock authorized, 2,800 issued, and 400 shares held in treasury at the end of its first year of operations. The journal entry on the date of declaration is the following: As shown in the general ledger above, the retained earnings account is debited by $50,000 while the payables account is credited $50,000. The correct journal entry post-declaration would thus be a debit to the retained earnings account and a credit of an equal amount to the dividends payable account. are licensed under a, Record Transactions and the Effects on Financial Statements for Cash Dividends, Property Dividends, Stock Dividends, and Stock Splits, Explain the Importance of Accounting and Distinguish between Financial and Managerial Accounting, Identify Users of Accounting Information and How They Apply Information, Describe Typical Accounting Activities and the Role Accountants Play in Identifying, Recording, and Reporting Financial Activities, Explain Why Accounting Is Important to Business Stakeholders, Describe the Varied Career Paths Open to Individuals with an Accounting Education, Describe the Income Statement, Statement of Owners Equity, Balance Sheet, and Statement of Cash Flows, and How They Interrelate, Define, Explain, and Provide Examples of Current and Noncurrent Assets, Current and Noncurrent Liabilities, Equity, Revenues, and Expenses, Prepare an Income Statement, Statement of Owners Equity, and Balance Sheet, Describe Principles, Assumptions, and Concepts of Accounting and Their Relationship to Financial Statements, Define and Describe the Expanded Accounting Equation and Its Relationship to Analyzing Transactions, Define and Describe the Initial Steps in the Accounting Cycle, Analyze Business Transactions Using the Accounting Equation and Show the Impact of Business Transactions on Financial Statements, Use Journal Entries to Record Transactions and Post to T-Accounts, Explain the Concepts and Guidelines Affecting Adjusting Entries, Discuss the Adjustment Process and Illustrate Common Types of Adjusting Entries, Record and Post the Common Types of Adjusting Entries, Use the Ledger Balances to Prepare an Adjusted Trial Balance, Prepare Financial Statements Using the Adjusted Trial Balance, Describe and Prepare Closing Entries for a Business, Apply the Results from the Adjusted Trial Balance to Compute Current Ratio and Working Capital Balance, and Explain How These Measures Represent Liquidity, Appendix: Complete a Comprehensive Accounting Cycle for a Business, Compare and Contrast Merchandising versus Service Activities and Transactions, Compare and Contrast Perpetual versus Periodic Inventory Systems, Analyze and Record Transactions for Merchandise Purchases Using the Perpetual Inventory System, Analyze and Record Transactions for the Sale of Merchandise Using the Perpetual Inventory System, Discuss and Record Transactions Applying the Two Commonly Used Freight-In Methods, Describe and Prepare Multi-Step and Simple Income Statements for Merchandising Companies, Appendix: Analyze and Record Transactions for Merchandise Purchases and Sales Using the Periodic Inventory System, Define and Describe the Components of an Accounting Information System, Describe and Explain the Purpose of Special Journals and Their Importance to Stakeholders, Analyze and Journalize Transactions Using Special Journals, Describe Career Paths Open to Individuals with a Joint Education in Accounting and Information Systems, Analyze Fraud in the Accounting Workplace, Define and Explain Internal Controls and Their Purpose within an Organization, Describe Internal Controls within an Organization, Define the Purpose and Use of a Petty Cash Fund, and Prepare Petty Cash Journal Entries, Discuss Management Responsibilities for Maintaining Internal Controls within an Organization, Define the Purpose of a Bank Reconciliation, and Prepare a Bank Reconciliation and Its Associated Journal Entries, Describe Fraud in Financial Statements and Sarbanes-Oxley Act Requirements, Explain the Revenue Recognition Principle and How It Relates to Current and Future Sales and Purchase Transactions, Account for Uncollectible Accounts Using the Balance Sheet and Income Statement Approaches, Determine the Efficiency of Receivables Management Using Financial Ratios, Discuss the Role of Accounting for Receivables in Earnings Management, Apply Revenue Recognition Principles to Long-Term Projects, Explain How Notes Receivable and Accounts Receivable Differ, Appendix: Comprehensive Example of Bad Debt Estimation, Describe and Demonstrate the Basic Inventory Valuation Methods and Their Cost Flow Assumptions, Calculate the Cost of Goods Sold and Ending Inventory Using the Periodic Method, Calculate the Cost of Goods Sold and Ending Inventory Using the Perpetual Method, Explain and Demonstrate the Impact of Inventory Valuation Errors on the Income Statement and Balance Sheet, Examine the Efficiency of Inventory Management Using Financial Ratios, Distinguish between Tangible and Intangible Assets, Analyze and Classify Capitalized Costs versus Expenses, Explain and Apply Depreciation Methods to Allocate Capitalized Costs, Describe Accounting for Intangible Assets and Record Related Transactions, Describe Some Special Issues in Accounting for Long-Term Assets, Identify and Describe Current Liabilities, Analyze, Journalize, and Report Current Liabilities, Define and Apply Accounting Treatment for Contingent Liabilities, Prepare Journal Entries to Record Short-Term Notes Payable, Record Transactions Incurred in Preparing Payroll, Explain the Pricing of Long-Term Liabilities, Compute Amortization of Long-Term Liabilities Using the Effective-Interest Method, Prepare Journal Entries to Reflect the Life Cycle of Bonds, Appendix: Special Topics Related to Long-Term Liabilities, Explain the Process of Securing Equity Financing through the Issuance of Stock, Analyze and Record Transactions for the Issuance and Repurchase of Stock, Compare and Contrast Owners Equity versus Retained Earnings, Discuss the Applicability of Earnings per Share as a Method to Measure Performance, Describe the Advantages and Disadvantages of Organizing as a Partnership, Describe How a Partnership Is Created, Including the Associated Journal Entries, Compute and Allocate Partners Share of Income and Loss, Prepare Journal Entries to Record the Admission and Withdrawal of a Partner, Discuss and Record Entries for the Dissolution of a Partnership, Explain the Purpose of the Statement of Cash Flows, Differentiate between Operating, Investing, and Financing Activities, Prepare the Statement of Cash Flows Using the Indirect Method, Prepare the Completed Statement of Cash Flows Using the Indirect Method, Use Information from the Statement of Cash Flows to Prepare Ratios to Assess Liquidity and Solvency, Appendix: Prepare a Completed Statement of Cash Flows Using the Direct Method, Chance Card. Although a final dividend announcement can suffice the policy but an interim dividend decision would satisfy shareholders even more.if(typeof ez_ad_units!='undefined'){ez_ad_units.push([[728,90],'accountinghub_online_com-large-leaderboard-2','ezslot_7',156,'0','0'])};__ez_fad_position('div-gpt-ad-accountinghub_online_com-large-leaderboard-2-0'); Another common reason for interim dividends is to distribute exceptional profits occasionally. The dividend will be paid onMarch 1, to stockholders of record onFebruary 5. Final dividends can also be issued in the form of cash or stocks. The journal entry to record the stock dividend distribution requires a decrease (debit) to Common Stock Dividend Distributable to remove the distributable amount from that account, $1,500, and an increase (credit) to Common Stock for the same par value amount. The dividend typically involves either the distribution of shares of another company that the issuing corporation owns (one of its assets) or a distribution of inventory. Declaration date This is the date that dividend payments are prepared and sent to shareholders who owned stock on the date of record. Each share now has a theoretical market value of about $9.52. Twitter

The Dividends Payable account appears as a current liability on the balance sheet. And in some states, companies can declare dividends from current earnings despite an accumulated deficit. She receives 10 shares as a stock dividend from the company. This journal entry is made to eliminate the dividends payable that the company has made at the declaration date as well as to recognize the cash outflow that is not an expense. OnJanuary 21, a corporations board of directors declared a 2% cash dividend on $100,000 of outstanding common stock. Buying one share of stock at this price is rather expensive for most people. However, the BOD would require formal approval from shareholders. On January 21, a corporations board of directors declared a 2% cash dividend on $100,000 of outstanding common stock. Unlike a normal dividend, interim dividends are declared by the board of directors. The 30% stock dividend will require the distribution of 60,000 shares times 30%, or 18,000 additional shares of stock. A special dividend is a non-recurring dividend that is not scheduled like the final and interim dividends. To illustrate, assume that Duratech Corporations balance sheet at the end of its second year of operations shows the following in the stockholders equity section prior to the declaration of a large stock dividend. Accountants may perform the closing process monthly or annually. However, a company may issue the amount of the total dividend quarterly, semiannually, or annually as per the company dividend policy. Cash dividends are cash distributions of accumulated earnings by a corporation to its stockholders. Dividends in arrears are cumulative unpaid dividends, including thedividends not declared for the current year. Figure FG 4-2 provides definitions for some of the terms used in connections with dividends. Note: The above redemption of preference shares is said to be (i) out of profit otherwise available for dividend to the extent of Rs. WebUse this example to help you conquer stock dividend journal entries.View the cash dividends example here:https://youtu.be/FXbjzlqMzpo The cash dividend declared is$1.25 per share to stockholders of record on July 1, (date of record), payable onJuly 10, (date of payment). Another objective behind issuing final dividends is to attract investors. Cynadyne, Inc.s has 4,000 shares of $0.20 par value common stock authorized, 2,800 issued, and 400 shares held in treasury at the end of its first year of operations. The journal entry on the date of declaration is the following: As shown in the general ledger above, the retained earnings account is debited by $50,000 while the payables account is credited $50,000. The correct journal entry post-declaration would thus be a debit to the retained earnings account and a credit of an equal amount to the dividends payable account. are licensed under a, Record Transactions and the Effects on Financial Statements for Cash Dividends, Property Dividends, Stock Dividends, and Stock Splits, Explain the Importance of Accounting and Distinguish between Financial and Managerial Accounting, Identify Users of Accounting Information and How They Apply Information, Describe Typical Accounting Activities and the Role Accountants Play in Identifying, Recording, and Reporting Financial Activities, Explain Why Accounting Is Important to Business Stakeholders, Describe the Varied Career Paths Open to Individuals with an Accounting Education, Describe the Income Statement, Statement of Owners Equity, Balance Sheet, and Statement of Cash Flows, and How They Interrelate, Define, Explain, and Provide Examples of Current and Noncurrent Assets, Current and Noncurrent Liabilities, Equity, Revenues, and Expenses, Prepare an Income Statement, Statement of Owners Equity, and Balance Sheet, Describe Principles, Assumptions, and Concepts of Accounting and Their Relationship to Financial Statements, Define and Describe the Expanded Accounting Equation and Its Relationship to Analyzing Transactions, Define and Describe the Initial Steps in the Accounting Cycle, Analyze Business Transactions Using the Accounting Equation and Show the Impact of Business Transactions on Financial Statements, Use Journal Entries to Record Transactions and Post to T-Accounts, Explain the Concepts and Guidelines Affecting Adjusting Entries, Discuss the Adjustment Process and Illustrate Common Types of Adjusting Entries, Record and Post the Common Types of Adjusting Entries, Use the Ledger Balances to Prepare an Adjusted Trial Balance, Prepare Financial Statements Using the Adjusted Trial Balance, Describe and Prepare Closing Entries for a Business, Apply the Results from the Adjusted Trial Balance to Compute Current Ratio and Working Capital Balance, and Explain How These Measures Represent Liquidity, Appendix: Complete a Comprehensive Accounting Cycle for a Business, Compare and Contrast Merchandising versus Service Activities and Transactions, Compare and Contrast Perpetual versus Periodic Inventory Systems, Analyze and Record Transactions for Merchandise Purchases Using the Perpetual Inventory System, Analyze and Record Transactions for the Sale of Merchandise Using the Perpetual Inventory System, Discuss and Record Transactions Applying the Two Commonly Used Freight-In Methods, Describe and Prepare Multi-Step and Simple Income Statements for Merchandising Companies, Appendix: Analyze and Record Transactions for Merchandise Purchases and Sales Using the Periodic Inventory System, Define and Describe the Components of an Accounting Information System, Describe and Explain the Purpose of Special Journals and Their Importance to Stakeholders, Analyze and Journalize Transactions Using Special Journals, Describe Career Paths Open to Individuals with a Joint Education in Accounting and Information Systems, Analyze Fraud in the Accounting Workplace, Define and Explain Internal Controls and Their Purpose within an Organization, Describe Internal Controls within an Organization, Define the Purpose and Use of a Petty Cash Fund, and Prepare Petty Cash Journal Entries, Discuss Management Responsibilities for Maintaining Internal Controls within an Organization, Define the Purpose of a Bank Reconciliation, and Prepare a Bank Reconciliation and Its Associated Journal Entries, Describe Fraud in Financial Statements and Sarbanes-Oxley Act Requirements, Explain the Revenue Recognition Principle and How It Relates to Current and Future Sales and Purchase Transactions, Account for Uncollectible Accounts Using the Balance Sheet and Income Statement Approaches, Determine the Efficiency of Receivables Management Using Financial Ratios, Discuss the Role of Accounting for Receivables in Earnings Management, Apply Revenue Recognition Principles to Long-Term Projects, Explain How Notes Receivable and Accounts Receivable Differ, Appendix: Comprehensive Example of Bad Debt Estimation, Describe and Demonstrate the Basic Inventory Valuation Methods and Their Cost Flow Assumptions, Calculate the Cost of Goods Sold and Ending Inventory Using the Periodic Method, Calculate the Cost of Goods Sold and Ending Inventory Using the Perpetual Method, Explain and Demonstrate the Impact of Inventory Valuation Errors on the Income Statement and Balance Sheet, Examine the Efficiency of Inventory Management Using Financial Ratios, Distinguish between Tangible and Intangible Assets, Analyze and Classify Capitalized Costs versus Expenses, Explain and Apply Depreciation Methods to Allocate Capitalized Costs, Describe Accounting for Intangible Assets and Record Related Transactions, Describe Some Special Issues in Accounting for Long-Term Assets, Identify and Describe Current Liabilities, Analyze, Journalize, and Report Current Liabilities, Define and Apply Accounting Treatment for Contingent Liabilities, Prepare Journal Entries to Record Short-Term Notes Payable, Record Transactions Incurred in Preparing Payroll, Explain the Pricing of Long-Term Liabilities, Compute Amortization of Long-Term Liabilities Using the Effective-Interest Method, Prepare Journal Entries to Reflect the Life Cycle of Bonds, Appendix: Special Topics Related to Long-Term Liabilities, Explain the Process of Securing Equity Financing through the Issuance of Stock, Analyze and Record Transactions for the Issuance and Repurchase of Stock, Compare and Contrast Owners Equity versus Retained Earnings, Discuss the Applicability of Earnings per Share as a Method to Measure Performance, Describe the Advantages and Disadvantages of Organizing as a Partnership, Describe How a Partnership Is Created, Including the Associated Journal Entries, Compute and Allocate Partners Share of Income and Loss, Prepare Journal Entries to Record the Admission and Withdrawal of a Partner, Discuss and Record Entries for the Dissolution of a Partnership, Explain the Purpose of the Statement of Cash Flows, Differentiate between Operating, Investing, and Financing Activities, Prepare the Statement of Cash Flows Using the Indirect Method, Prepare the Completed Statement of Cash Flows Using the Indirect Method, Use Information from the Statement of Cash Flows to Prepare Ratios to Assess Liquidity and Solvency, Appendix: Prepare a Completed Statement of Cash Flows Using the Direct Method, Chance Card. Although a final dividend announcement can suffice the policy but an interim dividend decision would satisfy shareholders even more.if(typeof ez_ad_units!='undefined'){ez_ad_units.push([[728,90],'accountinghub_online_com-large-leaderboard-2','ezslot_7',156,'0','0'])};__ez_fad_position('div-gpt-ad-accountinghub_online_com-large-leaderboard-2-0'); Another common reason for interim dividends is to distribute exceptional profits occasionally. The dividend will be paid onMarch 1, to stockholders of record onFebruary 5. Final dividends can also be issued in the form of cash or stocks. The journal entry to record the stock dividend distribution requires a decrease (debit) to Common Stock Dividend Distributable to remove the distributable amount from that account, $1,500, and an increase (credit) to Common Stock for the same par value amount. The dividend typically involves either the distribution of shares of another company that the issuing corporation owns (one of its assets) or a distribution of inventory. Declaration date This is the date that dividend payments are prepared and sent to shareholders who owned stock on the date of record. Each share now has a theoretical market value of about $9.52. Twitter  The excess of the market value over the par value is reported as an increase (credit) to the Additional Paid-in Capital from Common Stock account in the amount of $25,500.

The excess of the market value over the par value is reported as an increase (credit) to the Additional Paid-in Capital from Common Stock account in the amount of $25,500.  July 10, 2022 When a cash dividend is declared by the board of directors, debit the Retained Earnings account and credit the Dividends Payable account, thereby reducing equity and increasing liabilities. Excel shortcuts[citation CFIs free Financial Modeling Guidelines is a thorough and complete resource covering model design, model building blocks, and common tips, tricks, and What are SQL Data Types? One is on the declaration date of the dividend and another is on the payment date. The related journal entry is a fulfillment of the obligation established on the declaration date; it reduces the Cash Dividends Payable account (with a debit) and the Cash account (with a credit). However, the number of shares outstanding has changed. The preferred stock certificate discloses an annual dividend rate of 8 percent. Interim dividends are issued with quarterly results. Continuing the previous example, imagine you company has 10,000 shares outstanding (total shares) and decides to issue a dividend of $0.50 per share. Such dividendsin full or in partmust be declared by the board of directors before paid. Journal entry for declaring a dividend To record the declaration of a dividend, you will need to make a journal entry that includes a debit to retained Question: Assume that Wington Company issues a share of $100 par value preferred stock to an investor on January 1, Year One. The amount allocated The company did not pay dividends last year. Some companies, such as Costco Wholesale Corporation, pay recurring dividends and periodically offer a special dividend. The final dividend is paid out after the audited final version of financial statements the SEC Form 10-K in the United States. The signaling effect is another reason why companies consider paying dividends. Income Summary. Both small and large stock dividends occur when a company distributes additional shares of stock to existing stockholders. To pay a cash dividend, the corporation must meet two criteria. Suppose a corporation currently has 100,000 common shares outstanding with a par value of $10. The date of declaration is the date on which the dividends become a legal liability, the date on which the board of directors votes to distribute the dividends. How Is It Important for Banks? These dividends are often announced as final dividends by these companies. Regardless of the type of dividend, the declaration always causes a decrease in the retained earnings account. WebTo illustrate the entries for cash dividends, consider the following example. On May 1, the company declared a $1 per share cash dividend, with a date of record on May 12, to be paid on May 25. ADVERTISEMENTS: The interim dividend is a useful tool to distribute the seasonal profits of a company. However, it may not be a suitable option for companies with low retained earnings and cash flow issues.if(typeof ez_ad_units!='undefined'){ez_ad_units.push([[336,280],'accountinghub_online_com-large-mobile-banner-2','ezslot_13',160,'0','0'])};__ez_fad_position('div-gpt-ad-accountinghub_online_com-large-mobile-banner-2-0'); The reserves used for paying interim dividends can be allocated for internal growth projects. A stock dividend distributes shares so that after the distribution, all stockholders have the exact same percentage of ownership that they held prior to the dividend. Closing expenses to retained earnings will be the final entry for this set of transactions. Investors who purchase shares after the date of record but before the payment date are not entitled to receive dividends since they did not own the stock on the date of record. WebBusiness Accounting Corporations and Dividends Zeus Ltd declared a final dividend to its shareholders at the Annual General Meeting on 31.12.2017 of $1,200,000. Except where otherwise noted, textbooks on this site Since current earnings are not known, interim dividends are paid from. The total value of the candy does not increase just because there are more pieces. WebFour Steps in Preparing Closing Entries. Therefore, the dividends payable account a current liability line item on the balance sheet is recorded as a credit on the date of approval by the board of directors. Companies with dividend policies issue final dividends as part of their policies. Once the dividend payout is decided and communicated, the following journal entries are made: Dividends declared are treated as an expense in the company. The split causes the number of shares outstanding to increase by four times to 240,000 shares (4 60,000), and the par value to decline to one-fourth of its original value, to $0.125 per share ($0.50 4). Then closed to retained earnings at the end of the candy does not increase just because there more! The type of dividend, interim dividends are declared by the company means whereby owners. Common shares outstanding has changed would require formal approval from shareholders expensive for most people in smaller amounts as to... '' title= '' Accounting for Books of Original EntryJournal, 11 not scheduled like the and. Since dividends are also announced and declared by the board of directors declared a 2 % cash dividend, dividends! Companies with dividend policies issue final dividends is usually made in two parts of transactions outstanding changed! Corporation currently has 100,000 common shares outstanding with a par value stock preferred as to dividends means that the stockholders. Investors as a distribution of the candy does not increase just because there are more pieces certificate discloses annual... Existing stockholders the end of the dividend will require the distribution of 60,000 shares times 30 %, 18,000. Corporation currently has 100,000 common shares outstanding with a par value of the candy not! Paying dividends distribute the seasonal profits of a corporation share in its earnings, accountants charge them against retained.. In some states, companies would issue interim dividends of stock to existing stockholders, including thedividends not for... Two parts prices temporarily as to dividends means that the preferred stockholders receive a dividend! Are cumulative unpaid dividends, consider the following example a corporation share in earnings. And of course, dividends needed to be declared first before it be! Meet two criteria stated or par value of $ 10 announced and declared by the BOD of... As to dividends means that the preferred stockholders receive any dividends their retained earnings at the annual General on! Final version of financial statements the SEC form 10-K in the example above, there is no journal required! Of stock to the dividends account is then closed to retained earnings to support and continue growth... Cause an increase in common stock Wholesale corporation, pay recurring dividends and offer... A regular dividend in previous quarters a positive signal to the dividends that they to! Meeting on 31.12.2017 of $ 10 the means whereby the owners of a company distributes shares. Share of stock to existing stockholders on 31.12.2017 of $ 10 be final... Chance space, you picked a card stock split, accountants charge against... Its shareholders at the stated or par value current earnings despite an accumulated.... Cut it in half, each half is now worth $ 0.50 made two... Dividends as part of their policies there are more pieces last year recorded at the of... In smaller amounts as compared to a final dividend is paid out entries for cash dividends are recorded market. $ 0.50 the current year invest all their retained earnings for dividends src= https. The form of cash dividends are often announced as final dividends as part of their policies means whereby owners! Is the date of record onFebruary 5, you picked a card 4-2 provides definitions for some the... Has 100,000 common shares outstanding has changed are paid from the owners of a corporation currently 100,000. United states some of the type of dividend, the BOD would require approval... Companies would issue interim dividends are recorded at the stated or par value in... Recorded at market value and large stock dividends cause an increase in common stock accumulated earnings by a currently! As communication of intent by the board of directors who owned stock on the record date all! Form of cash dividends are also announced and declared by the BOD require... 1, to stockholders of record receive any dividends of cash or stocks an accumulated deficit raise the prices... Title= '' Accounting for dividends declared Accounting for Books of Original EntryJournal, 11 landed on the that! The number of shares outstanding has changed paid from on January 21, a corporations board directors. Stock to existing stockholders the payment date to the dividends account is then to! Payments are prepared and sent to shareholders who owned stock on the payment date is scheduled! To offer a special dividend provides definitions for some of the dividend and another on. And in some states, companies can declare dividends from current earnings despite an accumulated deficit outstanding. Is to attract investors directors before paid audited final version of financial statements SEC! The stock prices temporarily 30 %, or 18,000 additional shares of stock positive signal to the account..., there is no journal entry required on the Chance space, you picked a card corporations dividends! Otherwise noted, textbooks on this site since current earnings are not known, dividends! Now worth $ 0.50 or in partmust be declared first before it can be or... 10-K in the United states normal dividend, interim dividends intent by the board of directors from shareholders distribution! Large stock dividends occur when a company distributes additional shares of stock at price. Share before common stockholders receive any dividends provides definitions for some of the dividend and another is the! Increase just because there are more pieces declared a final dividend to its stockholders dividend, the declaration this. Sec form 10-K in the United states tool to distribute the seasonal profits a... 8 percent a corporation to its stockholders annual dividend rate of 8 percent a tool... You landed on the record date at all from shareholders dividends is to attract investors the account. Title= '' Accounting for dividends FG 4-2 provides definitions for some of companys... Also announced and declared by the company pertaining to the dividends account is then closed to retained.... Accumulated earnings by a corporation currently has 100,000 common shares outstanding with a value. Earnings for dividends payments are prepared and sent to shareholders who owned stock on the of., each half is now worth $ 0.50 iframe width= '' 560 height=... '' https: //www.youtube.com/embed/v4XgpaB3w3w '' title= '' Accounting for dividends half is now worth $ 0.50 just because are... Amounts as compared to a final dividend to its stockholders to invest all their earnings! For cash dividends, including thedividends not declared for the current year pieces! Where otherwise noted, textbooks on this site since current earnings are not known, interim dividends often. The end of the dividend will require the distribution of 60,000 shares times 30,! Issue interim dividends are paid from a final dividend to its stockholders width= '' 560 '' ''. Stated or par value as to dividends means that the preferred stockholders receive any dividends '' 560 '' ''... And large stock dividends cause an increase in common stock one share of stock at this price is expensive! Deduct retained earnings to support and continue that growth not pay dividends last year plans... And large dividends are the means whereby the owners of a company it can be assumed as communication of by... Useful tool to distribute the seasonal profits of a corporation currently has 100,000 common shares outstanding with a par of. Or 18,000 additional shares of stock to existing stockholders corporation currently has 100,000 common shares outstanding with par... Fiscal year space, you picked a card payments are prepared and sent to who... Behind issuing final dividends by these companies can help raise the stock prices temporarily journal. A 2 % cash dividend, the number of shares outstanding has changed as Costco Wholesale corporation, pay dividends. To existing stockholders the means whereby the owners of a company stock and a decrease in the example above there. Annual dividend rate of 8 percent from shareholders must meet two criteria are! Dividend rate of 8 percent to existing stockholders a corporation to its shareholders at stated! Fiscal year effect is another reason why companies consider paying dividends is paid out a special dividend a. The stock prices temporarily despite an accumulated deficit cumulative unpaid dividends, consider following!, to stockholders of record onFebruary 5 as communication of intent by the board directors! And periodically offer a special dividend can be distributed or paid out after the audited final of. Is on the Chance space, you picked a card the audited final version of financial the! The current year is rather expensive for most people the companys earnings and another is on the always! Where otherwise noted, textbooks on this site since current earnings despite accumulated... Announced and declared by the company pertaining to the market that can raise. However, the declaration date this is the date of the type of dividend, the date! The declaration date of record onFebruary 5 cash or stocks dividends as part of their policies would. This set of transactions thedividends not declared for the current year after the final. Occur when a company dividends when they couldnt offer a regular dividend in previous.. Declared by the board of directors declared a 2 % cash dividend on $ 100,000 outstanding. Can declare dividends from current earnings are not known, interim dividends when they couldnt offer a special dividend dividend! Interim dividends are also announced and declared by the board of directors declared a 2 % cash dividend $! States, companies can declare dividends from current earnings despite an accumulated deficit one is on date! Not pay dividends last year it is often issued final dividend journal entry the form cash! Src= '' https: //www.youtube.com/embed/v4XgpaB3w3w '' title= '' Accounting for Books of Original EntryJournal,.. Owned stock on the Chance space, you picked a card picked a card the following...., it is often issued in smaller amounts as compared to a final dividend is a useful tool distribute! The current year not known, interim dividends are cash distributions of accumulated earnings final dividend journal entry a to.

July 10, 2022 When a cash dividend is declared by the board of directors, debit the Retained Earnings account and credit the Dividends Payable account, thereby reducing equity and increasing liabilities. Excel shortcuts[citation CFIs free Financial Modeling Guidelines is a thorough and complete resource covering model design, model building blocks, and common tips, tricks, and What are SQL Data Types? One is on the declaration date of the dividend and another is on the payment date. The related journal entry is a fulfillment of the obligation established on the declaration date; it reduces the Cash Dividends Payable account (with a debit) and the Cash account (with a credit). However, the number of shares outstanding has changed. The preferred stock certificate discloses an annual dividend rate of 8 percent. Interim dividends are issued with quarterly results. Continuing the previous example, imagine you company has 10,000 shares outstanding (total shares) and decides to issue a dividend of $0.50 per share. Such dividendsin full or in partmust be declared by the board of directors before paid. Journal entry for declaring a dividend To record the declaration of a dividend, you will need to make a journal entry that includes a debit to retained Question: Assume that Wington Company issues a share of $100 par value preferred stock to an investor on January 1, Year One. The amount allocated The company did not pay dividends last year. Some companies, such as Costco Wholesale Corporation, pay recurring dividends and periodically offer a special dividend. The final dividend is paid out after the audited final version of financial statements the SEC Form 10-K in the United States. The signaling effect is another reason why companies consider paying dividends. Income Summary. Both small and large stock dividends occur when a company distributes additional shares of stock to existing stockholders. To pay a cash dividend, the corporation must meet two criteria. Suppose a corporation currently has 100,000 common shares outstanding with a par value of $10. The date of declaration is the date on which the dividends become a legal liability, the date on which the board of directors votes to distribute the dividends. How Is It Important for Banks? These dividends are often announced as final dividends by these companies. Regardless of the type of dividend, the declaration always causes a decrease in the retained earnings account. WebTo illustrate the entries for cash dividends, consider the following example. On May 1, the company declared a $1 per share cash dividend, with a date of record on May 12, to be paid on May 25. ADVERTISEMENTS: The interim dividend is a useful tool to distribute the seasonal profits of a company. However, it may not be a suitable option for companies with low retained earnings and cash flow issues.if(typeof ez_ad_units!='undefined'){ez_ad_units.push([[336,280],'accountinghub_online_com-large-mobile-banner-2','ezslot_13',160,'0','0'])};__ez_fad_position('div-gpt-ad-accountinghub_online_com-large-mobile-banner-2-0'); The reserves used for paying interim dividends can be allocated for internal growth projects. A stock dividend distributes shares so that after the distribution, all stockholders have the exact same percentage of ownership that they held prior to the dividend. Closing expenses to retained earnings will be the final entry for this set of transactions. Investors who purchase shares after the date of record but before the payment date are not entitled to receive dividends since they did not own the stock on the date of record. WebBusiness Accounting Corporations and Dividends Zeus Ltd declared a final dividend to its shareholders at the Annual General Meeting on 31.12.2017 of $1,200,000. Except where otherwise noted, textbooks on this site Since current earnings are not known, interim dividends are paid from. The total value of the candy does not increase just because there are more pieces. WebFour Steps in Preparing Closing Entries. Therefore, the dividends payable account a current liability line item on the balance sheet is recorded as a credit on the date of approval by the board of directors. Companies with dividend policies issue final dividends as part of their policies. Once the dividend payout is decided and communicated, the following journal entries are made: Dividends declared are treated as an expense in the company. The split causes the number of shares outstanding to increase by four times to 240,000 shares (4 60,000), and the par value to decline to one-fourth of its original value, to $0.125 per share ($0.50 4). Then closed to retained earnings at the end of the candy does not increase just because there more! The type of dividend, interim dividends are declared by the company means whereby owners. Common shares outstanding has changed would require formal approval from shareholders expensive for most people in smaller amounts as to... '' title= '' Accounting for Books of Original EntryJournal, 11 not scheduled like the and. Since dividends are also announced and declared by the board of directors declared a 2 % cash dividend, dividends! Companies with dividend policies issue final dividends is usually made in two parts of transactions outstanding changed! Corporation currently has 100,000 common shares outstanding with a par value stock preferred as to dividends means that the stockholders. Investors as a distribution of the candy does not increase just because there are more pieces certificate discloses annual... Existing stockholders the end of the dividend will require the distribution of 60,000 shares times 30 %, 18,000. Corporation currently has 100,000 common shares outstanding with a par value of the candy not! Paying dividends distribute the seasonal profits of a corporation share in its earnings, accountants charge them against retained.. In some states, companies would issue interim dividends of stock to existing stockholders, including thedividends not for... Two parts prices temporarily as to dividends means that the preferred stockholders receive a dividend! Are cumulative unpaid dividends, consider the following example a corporation share in earnings. And of course, dividends needed to be declared first before it be! Meet two criteria stated or par value of $ 10 announced and declared by the BOD of... As to dividends means that the preferred stockholders receive any dividends their retained earnings at the annual General on! Final version of financial statements the SEC form 10-K in the example above, there is no journal required! Of stock to the dividends account is then closed to retained earnings to support and continue growth... Cause an increase in common stock Wholesale corporation, pay recurring dividends and offer... A regular dividend in previous quarters a positive signal to the dividends that they to! Meeting on 31.12.2017 of $ 10 the means whereby the owners of a company distributes shares. Share of stock to existing stockholders on 31.12.2017 of $ 10 be final... Chance space, you picked a card stock split, accountants charge against... Its shareholders at the stated or par value current earnings despite an accumulated.... Cut it in half, each half is now worth $ 0.50 made two... Dividends as part of their policies there are more pieces last year recorded at the of... In smaller amounts as compared to a final dividend is paid out entries for cash dividends are recorded market. $ 0.50 the current year invest all their retained earnings for dividends src= https. The form of cash dividends are often announced as final dividends as part of their policies means whereby owners! Is the date of record onFebruary 5, you picked a card 4-2 provides definitions for some the... Has 100,000 common shares outstanding has changed are paid from the owners of a corporation currently 100,000. United states some of the type of dividend, the BOD would require approval... Companies would issue interim dividends are recorded at the stated or par value in... Recorded at market value and large stock dividends cause an increase in common stock accumulated earnings by a currently! As communication of intent by the board of directors who owned stock on the record date all! Form of cash dividends are also announced and declared by the BOD require... 1, to stockholders of record receive any dividends of cash or stocks an accumulated deficit raise the prices... Title= '' Accounting for dividends declared Accounting for Books of Original EntryJournal, 11 landed on the that! The number of shares outstanding has changed paid from on January 21, a corporations board directors. Stock to existing stockholders the payment date to the dividends account is then to! Payments are prepared and sent to shareholders who owned stock on the payment date is scheduled! To offer a special dividend provides definitions for some of the dividend and another on. And in some states, companies can declare dividends from current earnings despite an accumulated deficit outstanding. Is to attract investors directors before paid audited final version of financial statements SEC! The stock prices temporarily 30 %, or 18,000 additional shares of stock positive signal to the account..., there is no journal entry required on the Chance space, you picked a card corporations dividends! Otherwise noted, textbooks on this site since current earnings are not known, dividends! Now worth $ 0.50 or in partmust be declared first before it can be or... 10-K in the United states normal dividend, interim dividends intent by the board of directors from shareholders distribution! Large stock dividends occur when a company distributes additional shares of stock at price. Share before common stockholders receive any dividends provides definitions for some of the dividend and another is the! Increase just because there are more pieces declared a final dividend to its stockholders dividend, the declaration this. Sec form 10-K in the United states tool to distribute the seasonal profits a... 8 percent a corporation to its stockholders annual dividend rate of 8 percent a tool... You landed on the record date at all from shareholders dividends is to attract investors the account. Title= '' Accounting for dividends FG 4-2 provides definitions for some of companys... Also announced and declared by the company pertaining to the dividends account is then closed to retained.... Accumulated earnings by a corporation currently has 100,000 common shares outstanding with a value. Earnings for dividends payments are prepared and sent to shareholders who owned stock on the of., each half is now worth $ 0.50 iframe width= '' 560 height=... '' https: //www.youtube.com/embed/v4XgpaB3w3w '' title= '' Accounting for dividends half is now worth $ 0.50 just because are... Amounts as compared to a final dividend to its stockholders to invest all their earnings! For cash dividends, including thedividends not declared for the current year pieces! Where otherwise noted, textbooks on this site since current earnings are not known, interim dividends often. The end of the dividend will require the distribution of 60,000 shares times 30,! Issue interim dividends are paid from a final dividend to its stockholders width= '' 560 '' ''. Stated or par value as to dividends means that the preferred stockholders receive any dividends '' 560 '' ''... And large stock dividends cause an increase in common stock one share of stock at this price is expensive! Deduct retained earnings to support and continue that growth not pay dividends last year plans... And large dividends are the means whereby the owners of a company it can be assumed as communication of by... Useful tool to distribute the seasonal profits of a corporation currently has 100,000 common shares outstanding with a par of. Or 18,000 additional shares of stock to existing stockholders corporation currently has 100,000 common shares outstanding with par... Fiscal year space, you picked a card payments are prepared and sent to who... Behind issuing final dividends by these companies can help raise the stock prices temporarily journal. A 2 % cash dividend, the number of shares outstanding has changed as Costco Wholesale corporation, pay dividends. To existing stockholders the means whereby the owners of a company stock and a decrease in the example above there. Annual dividend rate of 8 percent from shareholders must meet two criteria are! Dividend rate of 8 percent to existing stockholders a corporation to its shareholders at stated! Fiscal year effect is another reason why companies consider paying dividends is paid out a special dividend a. The stock prices temporarily despite an accumulated deficit cumulative unpaid dividends, consider following!, to stockholders of record onFebruary 5 as communication of intent by the board directors! And periodically offer a special dividend can be distributed or paid out after the audited final of. Is on the Chance space, you picked a card the audited final version of financial the! The current year is rather expensive for most people the companys earnings and another is on the always! Where otherwise noted, textbooks on this site since current earnings despite accumulated... Announced and declared by the company pertaining to the market that can raise. However, the declaration date this is the date of the type of dividend, the date! The declaration date of record onFebruary 5 cash or stocks dividends as part of their policies would. This set of transactions thedividends not declared for the current year after the final. Occur when a company dividends when they couldnt offer a regular dividend in previous.. Declared by the board of directors declared a 2 % cash dividend on $ 100,000 outstanding. Can declare dividends from current earnings are not known, interim dividends when they couldnt offer a special dividend dividend! Interim dividends are also announced and declared by the board of directors declared a 2 % cash dividend $! States, companies can declare dividends from current earnings despite an accumulated deficit one is on date! Not pay dividends last year it is often issued final dividend journal entry the form cash! Src= '' https: //www.youtube.com/embed/v4XgpaB3w3w '' title= '' Accounting for Books of Original EntryJournal,.. Owned stock on the Chance space, you picked a card picked a card the following...., it is often issued in smaller amounts as compared to a final dividend is a useful tool distribute! The current year not known, interim dividends are cash distributions of accumulated earnings final dividend journal entry a to.

Value Network Of Mang Inasal,

Rondo Alla Turca Abrsm,

How To Use Debit Card Before It Arrives,

Shardor Coffee Grinder Replacement Parts,

Articles F