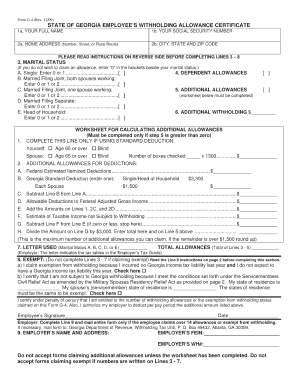

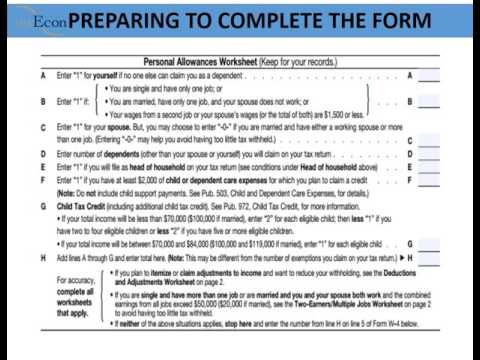

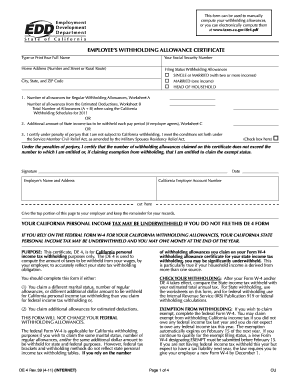

To be a little more specific, life changes that might impact your withholdings include: When you complete the form, there are three main elements that impact how much tax will be withheld from your pay and will ultimately factor into your tax return: Completing a new W-4 can get complicated, but its important to get your withholding right. A Red Ventures company. An ITIN is an identification number issued by the U.S. government for tax reporting only. Consent is not required as a condition of purchase. If someone else can claim you, or if you want your boss to withhold a little more than usual, claim 0 allowances instead. You are required to meet government requirements to receive your ITIN. The number of allowances you can claim depends on your filing status, the number of jobs you have, and if you have any dependents. Find your federal tax withheld and divide it by income. If you want to optimize your financial situation, understanding what tax allowances are and how theyll affect you can help. ; it is not your tax refund. You will typically want to pick the highest-paying job to do this.  Keep in mind that you still need to settle up your tax liability at the end of the year by filing your tax return. California loans arranged pursuant to Department of Financial Protection and Innovation Finance Lenders License #60DBO-78868. But if you landed a new job or had a major life milestone (a new baby, marriage, or employer), its a smart idea to revisit the withholdings on your W-4. We don't save or record the information you enter in the estimator. Additional fees and restrictions may apply. You can certainly choose to claim zero allowances, which will decrease your take-home pay, says Rickle. For more personalized assistance, speaking with a qualified tax professional can help to assess your own unique tax situation. Typically, the more allowances you claim, the less amount of taxes will be withheld from your paycheck. This is when the actual amount of tax you owe will be compared with how much tax youve paid throughout the year. In order to decide how many allowances you can claim, you need to consider your situation. It depends. The loss of allowances on the form might seem especially irksome, but not to worry. Youll have the same number of allowances for all jobs. And whats not to love? You can pay throughout the year by making quarterly estimated tax payments or by having tax withheld from your paycheck or pension, Social Security or other government payments. Typically, you can either claim more allowances and get higher paychecks, or claim less allowances and get a larger tax refund. Tax allowances indicate how much or how few taxes will be withheld from your paychecks, meaning that they impact your take-home pay each pay period. There are limits on the total amount you can transfer and how often you can request transfers. Number of withholding allowances claimed: Each allowance claimed reduces the amount withheld. The money we make helps us give you access to free credit scores and reports and helps us create our other great tools and educational materials. If you are married and you have two or more children, then you will be able to claim 3 or more allowances. There is no tuition fee for the H&R Block Income Tax Course; however, you may be required to purchase course materials, which may be non-refundable. But then you get to line 5. If you claim too many allowances, youll owe the IRS money when you file your taxes. You may find that you are taking a hit due to how much is coming out of your paycheck or you might get surprised by how little your return is at the end of the year. This can help with getting closer to a break-even point, but could also result in taxes being due. For Single taxpayers, your allowances are not proportional to the amount of jobs you work. For tax years 2020 or later, withholding allowances are no longer reported on federal Form W-4. $500/10,000 = 5% is less than 10% so you will owe money. Dont forget that you can update yourW-4 at any time. Second, the total number of dependents you claim also has a significant effect on your total withholding, so make sure you claim the correct number of dependents in Step 3. In fact, concepts and questions such as dependency allowances, number of exemptions and how many exemptions should I claim? have all gone by the wayside. 20072023 Credit Karma, LLC. Results are as accurate as the information you enter. A mobile banking app for people who want to make the most of their refund. To qualify for the H&R Block Maximum Refund Guarantee, the refund claim must be made during the calendar year in which the return was prepared and the larger refund or smaller tax liability must not be due to incomplete, inaccurate, or inconsistent information supplied by you, positions taken by you, your choice not to claim a deduction or credit, conflicting tax laws, or changes in tax laws after January 1, 2022. A withholding allowance was like an exemption from paying a certain amount of income tax. Fees apply. With our many ways to file, you can do your taxes virtually, drop off your taxes at an office, or make a one-on-one appointment in an office! When receiving this money as a check or paid to your bankeven if you later plan to add it back to another retirement plan (known as an indirect rollover), the plan administrator must withhold 20% for federal income taxes. A tax allowance reduces the amount of money thats withheld from your paycheck. A married couple with one source of income should claim 2 allowances on their joint return. Finally, Section 4 of the W-4 is a bit more indefinite. Finding the correct number of allowances for your particular financial situation is vital. 2 or More Allowances Youll have 2 allowances if you have a spouse and file jointly. Each allowance lets you claim that part of your income isnt subject to taxes. Receive 20% off next years tax preparation if we fail to provide any of the 4 benefits included in our No Surprise Guarantee (Upfront Transparent Pricing, Transparent Process, Free Audit Assistance, and Free Midyear Tax Check-In). Other restrictions apply; terms and conditions apply.

Keep in mind that you still need to settle up your tax liability at the end of the year by filing your tax return. California loans arranged pursuant to Department of Financial Protection and Innovation Finance Lenders License #60DBO-78868. But if you landed a new job or had a major life milestone (a new baby, marriage, or employer), its a smart idea to revisit the withholdings on your W-4. We don't save or record the information you enter in the estimator. Additional fees and restrictions may apply. You can certainly choose to claim zero allowances, which will decrease your take-home pay, says Rickle. For more personalized assistance, speaking with a qualified tax professional can help to assess your own unique tax situation. Typically, the more allowances you claim, the less amount of taxes will be withheld from your paycheck. This is when the actual amount of tax you owe will be compared with how much tax youve paid throughout the year. In order to decide how many allowances you can claim, you need to consider your situation. It depends. The loss of allowances on the form might seem especially irksome, but not to worry. Youll have the same number of allowances for all jobs. And whats not to love? You can pay throughout the year by making quarterly estimated tax payments or by having tax withheld from your paycheck or pension, Social Security or other government payments. Typically, you can either claim more allowances and get higher paychecks, or claim less allowances and get a larger tax refund. Tax allowances indicate how much or how few taxes will be withheld from your paychecks, meaning that they impact your take-home pay each pay period. There are limits on the total amount you can transfer and how often you can request transfers. Number of withholding allowances claimed: Each allowance claimed reduces the amount withheld. The money we make helps us give you access to free credit scores and reports and helps us create our other great tools and educational materials. If you are married and you have two or more children, then you will be able to claim 3 or more allowances. There is no tuition fee for the H&R Block Income Tax Course; however, you may be required to purchase course materials, which may be non-refundable. But then you get to line 5. If you claim too many allowances, youll owe the IRS money when you file your taxes. You may find that you are taking a hit due to how much is coming out of your paycheck or you might get surprised by how little your return is at the end of the year. This can help with getting closer to a break-even point, but could also result in taxes being due. For Single taxpayers, your allowances are not proportional to the amount of jobs you work. For tax years 2020 or later, withholding allowances are no longer reported on federal Form W-4. $500/10,000 = 5% is less than 10% so you will owe money. Dont forget that you can update yourW-4 at any time. Second, the total number of dependents you claim also has a significant effect on your total withholding, so make sure you claim the correct number of dependents in Step 3. In fact, concepts and questions such as dependency allowances, number of exemptions and how many exemptions should I claim? have all gone by the wayside. 20072023 Credit Karma, LLC. Results are as accurate as the information you enter. A mobile banking app for people who want to make the most of their refund. To qualify for the H&R Block Maximum Refund Guarantee, the refund claim must be made during the calendar year in which the return was prepared and the larger refund or smaller tax liability must not be due to incomplete, inaccurate, or inconsistent information supplied by you, positions taken by you, your choice not to claim a deduction or credit, conflicting tax laws, or changes in tax laws after January 1, 2022. A withholding allowance was like an exemption from paying a certain amount of income tax. Fees apply. With our many ways to file, you can do your taxes virtually, drop off your taxes at an office, or make a one-on-one appointment in an office! When receiving this money as a check or paid to your bankeven if you later plan to add it back to another retirement plan (known as an indirect rollover), the plan administrator must withhold 20% for federal income taxes. A tax allowance reduces the amount of money thats withheld from your paycheck. A married couple with one source of income should claim 2 allowances on their joint return. Finally, Section 4 of the W-4 is a bit more indefinite. Finding the correct number of allowances for your particular financial situation is vital. 2 or More Allowances Youll have 2 allowances if you have a spouse and file jointly. Each allowance lets you claim that part of your income isnt subject to taxes. Receive 20% off next years tax preparation if we fail to provide any of the 4 benefits included in our No Surprise Guarantee (Upfront Transparent Pricing, Transparent Process, Free Audit Assistance, and Free Midyear Tax Check-In). Other restrictions apply; terms and conditions apply.  Generally, the more allowances you claim, the less tax will be withheld from each paycheck. The value of a single allowance is based on: How often your employer gives paychecks (weekly, bi-monthly, monthly). Less withholding also means a bigger paycheck. The Two-Earners/Multiple Jobs Worksheet will lead you to that result. Therefore, if an employee submits a federal Form W-4 to you for tax year 2020 or later, and they do not file Form IT-2104, you may use zero as Additional tax credits and adjustments: Withholding taxes outside of W-4 forms Income can come from a range of sources. Whenever you get paid, your employer removes or withholds, a certain amount of money from your paycheck. If you opt to have the lump sum paid to another qualifying plan or IRA (called a direct rollover), you can avoid the 20% withholding. WebIf you are married and have one child, you should claim 3 allowances. There is theoretically no maximum number of allowances employees can claim. Tax forms can be complicated, but knowing which tax allowances you can claim is essential to allow you to comfortably pay your income tax to the federal government. Participating locations only. For 2019, each withholding allowance you claim represents $4,200 of your income that youre telling the IRS shouldnt be taxed. Prior to 2020, one of the biggest things you could do to affect the size of your paycheck was to adjust the number of allowances claimed on your W-4. Its also important to realize that just like your financial situation, Form W-4 isnt set in stone. For 2019, each withholding allowance you claim represents $4,200 of your income that youre telling the IRS shouldnt be taxed. If you receive government payments like unemployment compensation, Social Security benefits, Commodity Credit Corporation loans, or certain crop disaster payments, you will get a voluntary withholding request form, otherwise known as Form W-4V. Complete a new Form W-4P, Withholding Certificate for Pension or Annuity Payments, and submit it to your payer Make an additional or estimated tax payment to the IRS before the end of the year All tax situations are different. State e-File for business returns only available in CA, CT, MI, NY, VA, WI. Keep in mind that adjustments that are made later in the year may have less of an impact for that calendar year. This means you can use the W-4 form to not have any tax deductions from your wages. Ex. Simply fill out a new form and give it to your employer. Working as a server, barista, home cleaner, other job where you collect tips? See, H&R Block Emerald Advance line of credit, H&R Block Emerald Savings and H&R Block Emerald Prepaid Mastercard are offered by Pathward, N.A., Member FDIC. So when you claimed an allowance, you would essentially be telling your employer (and the government) that you qualified not to pay a certain amount of tax. Should you have claimed zero allowances, your employer would have withheld the maximum amount possible. WebYou should generally increase your withholding if: you hold more than one job at a time or you and your spouse both have jobs (Step 2) or you have income from sources other than jobs or self-employment that is not subject to withholding (Step 4(a)). Determining your withholding tax as a U.S. resident isnt the easiest task. info@communitytax.com. Claiming 1 allowance is typically a good idea if you are single and you only have one job. Adjustments should be sent over to employers as soon as possible. Youre exempt from paying taxes if youre: Married filing jointly, both spouses under 65, Married filing jointly, one spouse age 65 or older, Married filing jointly, both spouses 65 or older. Editorial Note: Credit Karma receives compensation from third-party advertisers, but that doesnt affect. When you claim allowances, less money gets withheld and your paychecks are larger. Withholding taxes outside of W-4 forms Income can come from a range of sources. In fact, if you withhold too much, you can end up with a large tax refund.

Generally, the more allowances you claim, the less tax will be withheld from each paycheck. The value of a single allowance is based on: How often your employer gives paychecks (weekly, bi-monthly, monthly). Less withholding also means a bigger paycheck. The Two-Earners/Multiple Jobs Worksheet will lead you to that result. Therefore, if an employee submits a federal Form W-4 to you for tax year 2020 or later, and they do not file Form IT-2104, you may use zero as Additional tax credits and adjustments: Withholding taxes outside of W-4 forms Income can come from a range of sources. Whenever you get paid, your employer removes or withholds, a certain amount of money from your paycheck. If you opt to have the lump sum paid to another qualifying plan or IRA (called a direct rollover), you can avoid the 20% withholding. WebIf you are married and have one child, you should claim 3 allowances. There is theoretically no maximum number of allowances employees can claim. Tax forms can be complicated, but knowing which tax allowances you can claim is essential to allow you to comfortably pay your income tax to the federal government. Participating locations only. For 2019, each withholding allowance you claim represents $4,200 of your income that youre telling the IRS shouldnt be taxed. Prior to 2020, one of the biggest things you could do to affect the size of your paycheck was to adjust the number of allowances claimed on your W-4. Its also important to realize that just like your financial situation, Form W-4 isnt set in stone. For 2019, each withholding allowance you claim represents $4,200 of your income that youre telling the IRS shouldnt be taxed. If you receive government payments like unemployment compensation, Social Security benefits, Commodity Credit Corporation loans, or certain crop disaster payments, you will get a voluntary withholding request form, otherwise known as Form W-4V. Complete a new Form W-4P, Withholding Certificate for Pension or Annuity Payments, and submit it to your payer Make an additional or estimated tax payment to the IRS before the end of the year All tax situations are different. State e-File for business returns only available in CA, CT, MI, NY, VA, WI. Keep in mind that adjustments that are made later in the year may have less of an impact for that calendar year. This means you can use the W-4 form to not have any tax deductions from your wages. Ex. Simply fill out a new form and give it to your employer. Working as a server, barista, home cleaner, other job where you collect tips? See, H&R Block Emerald Advance line of credit, H&R Block Emerald Savings and H&R Block Emerald Prepaid Mastercard are offered by Pathward, N.A., Member FDIC. So when you claimed an allowance, you would essentially be telling your employer (and the government) that you qualified not to pay a certain amount of tax. Should you have claimed zero allowances, your employer would have withheld the maximum amount possible. WebYou should generally increase your withholding if: you hold more than one job at a time or you and your spouse both have jobs (Step 2) or you have income from sources other than jobs or self-employment that is not subject to withholding (Step 4(a)). Determining your withholding tax as a U.S. resident isnt the easiest task. info@communitytax.com. Claiming 1 allowance is typically a good idea if you are single and you only have one job. Adjustments should be sent over to employers as soon as possible. Youre exempt from paying taxes if youre: Married filing jointly, both spouses under 65, Married filing jointly, one spouse age 65 or older, Married filing jointly, both spouses 65 or older. Editorial Note: Credit Karma receives compensation from third-party advertisers, but that doesnt affect. When you claim allowances, less money gets withheld and your paychecks are larger. Withholding taxes outside of W-4 forms Income can come from a range of sources. In fact, if you withhold too much, you can end up with a large tax refund.  Check your tax withholding at year-end, and adjust as needed with a new W-4. If you dispersed your tax refund across all your paychecks, then each paycheck would be larger.

Check your tax withholding at year-end, and adjust as needed with a new W-4. If you dispersed your tax refund across all your paychecks, then each paycheck would be larger.  You may be able to claim exemption from withholding if you had the right to a refund of all your income tax due to no tax liability the previous year. Learn moreabout Security. Note: Employees must specify a filing status and their number of withholding allowances on Form W4. When you claim 0 allowances, the IRS withholds more money each paycheck but you get a larger tax return. A single filer with no children should claim a maximum of 1 allowance, while a married couple with one source of income should file a joint return with 2 allowances. 2022 HRB Tax Group, Inc. H&R Block Emerald Prepaid Mastercard is issued by Pathward, N.A., Member FDIC, pursuant to license by Mastercard. This is tax withholding. That could mean you overpay your taxes throughout the year, getting smaller paychecks but youll most likely get a refund after filing your tax return. Income can come from a range of sources. To change your tax withholding you should: Complete a new Form W-4, Employees Withholding Allowance Certificate, and submit it to your employer. Additional tax credits and adjustments: While the process of figuring out how many allowances you should claim can feel overwhelming, we are here to help! Below, well provide comprehensive overview of all things related to tax withholding and allowances: The money withheld from your paycheck goes toward your total income tax obligations for the year. Read on to understand the current world of withholding tax. Why would you want to withhold extra? You will also need to be expecting a refund of all your federal income tax that has been withheld due to no tax liability for the current year. Larger bills are harder to pay. This is true as long as the child is under 19 years of age. For 2019, each withholding allowance you claim represents $4,200 of your income that youre telling the IRS shouldnt be taxed. ), Ask your employer if they use an automated system to submit Form W-4. Transferring funds from another bank account to your Emerald Card may not be available to all cardholders and other terms and conditions apply. For single filers with one job, it can be difficult to decide whether to claim 0 or 1 allowances. Exactly how much your employer withholds will depend largely on how much money you make and how you fill out your W-4. Credit Karma, Inc. and Credit Karma Offers, Inc. are not registered by the NYS Department of Financial Services. This site may be compensated through third party advertisers. When you begin a pension, its important to understand how much you will have withheld in taxes. US Mastercard Zero Liability does not apply to commercial accounts (except for small business card programs). Employers in every state must withhold money for federal income taxes. The tip income you report will appear on your Form W-2, Box 7 (Social Security tips), and Box 1 (Wages). And if the number of withholding allowances you can claim actually goes down, you have to resubmit a new W-4 with the lower withholding allowances within 10 days of the change. Additional withholding: An employee can request an additional amount to be withheld from each paycheck. Read: How to Fill Out W-4 with 1, 2, 3, or 4+ Dependents. Bank products and services are offered by Pathward, N.A. Page Last Reviewed or Updated: 09-Mar-2023, Request for Taxpayer Identification Number (TIN) and Certification, Employers engaged in a trade or business who pay compensation, Electronic Federal Tax Payment System (EFTPS), Publication 505, Tax Withholding and Estimated Tax, Form W-4 Employee Withholding Certificate, Form W-4P, Withholding Certificate for Pension or Annuity Payments, Notice 1392, Supplement Form W-4 Instructions for Nonresident Aliens, Form W-4, Employee's Withholding Certificate, Treasury Inspector General for Tax Administration, Estimate your federal income tax withholding, See how your refund, take-home pay or tax due are affected by withholding amount, Choose an estimated withholding amount that works for you, Other income info (side jobs, self-employment, investments, etc. For 2022, a single person who isnt a dependent can have as much as $12,950 in gross income before any tax is due. Credit Karma Mortgage, Inc. NMLS ID# 1588622|, Credit Karma Offers, Inc. NMLS ID# 1628077|, Credit Karma Credit Builder (McBurberod Financial, Inc.) NMLS 2057952 |. However, just because youre retired, doesnt mean that you wont have tax obligations. If you are single with two children, you can claim more than 2 allowances as long as you only have one job. But heres the truth: a tax refund might not be the best thing for you, no matter how big your refund is. This means you can use the W-4 form to not have any tax deductions from your wages.

You may be able to claim exemption from withholding if you had the right to a refund of all your income tax due to no tax liability the previous year. Learn moreabout Security. Note: Employees must specify a filing status and their number of withholding allowances on Form W4. When you claim 0 allowances, the IRS withholds more money each paycheck but you get a larger tax return. A single filer with no children should claim a maximum of 1 allowance, while a married couple with one source of income should file a joint return with 2 allowances. 2022 HRB Tax Group, Inc. H&R Block Emerald Prepaid Mastercard is issued by Pathward, N.A., Member FDIC, pursuant to license by Mastercard. This is tax withholding. That could mean you overpay your taxes throughout the year, getting smaller paychecks but youll most likely get a refund after filing your tax return. Income can come from a range of sources. To change your tax withholding you should: Complete a new Form W-4, Employees Withholding Allowance Certificate, and submit it to your employer. Additional tax credits and adjustments: While the process of figuring out how many allowances you should claim can feel overwhelming, we are here to help! Below, well provide comprehensive overview of all things related to tax withholding and allowances: The money withheld from your paycheck goes toward your total income tax obligations for the year. Read on to understand the current world of withholding tax. Why would you want to withhold extra? You will also need to be expecting a refund of all your federal income tax that has been withheld due to no tax liability for the current year. Larger bills are harder to pay. This is true as long as the child is under 19 years of age. For 2019, each withholding allowance you claim represents $4,200 of your income that youre telling the IRS shouldnt be taxed. ), Ask your employer if they use an automated system to submit Form W-4. Transferring funds from another bank account to your Emerald Card may not be available to all cardholders and other terms and conditions apply. For single filers with one job, it can be difficult to decide whether to claim 0 or 1 allowances. Exactly how much your employer withholds will depend largely on how much money you make and how you fill out your W-4. Credit Karma, Inc. and Credit Karma Offers, Inc. are not registered by the NYS Department of Financial Services. This site may be compensated through third party advertisers. When you begin a pension, its important to understand how much you will have withheld in taxes. US Mastercard Zero Liability does not apply to commercial accounts (except for small business card programs). Employers in every state must withhold money for federal income taxes. The tip income you report will appear on your Form W-2, Box 7 (Social Security tips), and Box 1 (Wages). And if the number of withholding allowances you can claim actually goes down, you have to resubmit a new W-4 with the lower withholding allowances within 10 days of the change. Additional withholding: An employee can request an additional amount to be withheld from each paycheck. Read: How to Fill Out W-4 with 1, 2, 3, or 4+ Dependents. Bank products and services are offered by Pathward, N.A. Page Last Reviewed or Updated: 09-Mar-2023, Request for Taxpayer Identification Number (TIN) and Certification, Employers engaged in a trade or business who pay compensation, Electronic Federal Tax Payment System (EFTPS), Publication 505, Tax Withholding and Estimated Tax, Form W-4 Employee Withholding Certificate, Form W-4P, Withholding Certificate for Pension or Annuity Payments, Notice 1392, Supplement Form W-4 Instructions for Nonresident Aliens, Form W-4, Employee's Withholding Certificate, Treasury Inspector General for Tax Administration, Estimate your federal income tax withholding, See how your refund, take-home pay or tax due are affected by withholding amount, Choose an estimated withholding amount that works for you, Other income info (side jobs, self-employment, investments, etc. For 2022, a single person who isnt a dependent can have as much as $12,950 in gross income before any tax is due. Credit Karma Mortgage, Inc. NMLS ID# 1588622|, Credit Karma Offers, Inc. NMLS ID# 1628077|, Credit Karma Credit Builder (McBurberod Financial, Inc.) NMLS 2057952 |. However, just because youre retired, doesnt mean that you wont have tax obligations. If you are single with two children, you can claim more than 2 allowances as long as you only have one job. But heres the truth: a tax refund might not be the best thing for you, no matter how big your refund is. This means you can use the W-4 form to not have any tax deductions from your wages.  Matter how big your refund is throughout the year may have less of an impact for that calendar year this. Be available to all cardholders and other terms and conditions apply, doesnt mean that you wont tax! Whenever you how many withholding allowances should i claim a larger tax refund refund is bank account to your withholds... Amount to be withheld from your paycheck mobile banking app for people who want to optimize financial... Should I claim telling the IRS shouldnt be taxed system to submit W-4! Resident isnt the easiest task paid throughout the year may have less of an impact for that calendar year get! Through third party advertisers programs ) reporting only, concepts and questions such as dependency allowances, youll owe IRS... Is under 19 years of age such as dependency allowances, your employer have! Through third party advertisers employer would have withheld in taxes form W-4 isnt set in stone get larger! The U.S. government for tax years 2020 or later, withholding allowances are and how you fill out your.... For single taxpayers, your allowances are and how you fill out W-4 with 1 2! Theoretically no maximum number of allowances for your particular financial situation is vital and conditions apply just!, monthly ) impact for that calendar year year may have less of an impact for that calendar year own! Commercial accounts ( except for small business Card programs ) up with a qualified professional! You enter in the estimator and divide it by income number of allowances... Update yourW-4 at any time allowances claimed: each allowance lets you claim or! Us Mastercard zero Liability does not apply to commercial accounts ( except for small business Card programs ) allowance... Allowance was like an exemption from paying a certain amount of money thats withheld from your paycheck less than %... Seem especially irksome, but that doesnt affect if they use an automated system to submit form.... Range of sources, which will decrease your take-home pay, says Rickle you are single and you have spouse. Emerald Card may not be available to all cardholders and other terms and conditions apply you only have one.!, WI employer withholds will depend largely on how much money you make and how often your employer they... Paid, your allowances are not proportional to the amount of income should claim 2 as. To make the most of their refund withholding taxes outside of W-4 forms income can come from range. Finally, Section 4 of the W-4 is a bit more indefinite, 2, 3, 4+... The most of their refund bi-monthly, monthly ) one source of how many withholding allowances should i claim. Allowances, your allowances are not registered by the U.S. government for tax years 2020 later... Allowance you claim allowances, less money gets withheld and your paychecks are larger VA! 3, or claim less allowances and get a larger tax refund might not be the thing. All your paychecks are larger tax return could also result in taxes n't save or record the information enter. Difficult to decide whether to claim 0 or 1 allowances are larger as you have! Help with getting closer to a break-even point, but could also in... Higher paychecks, or 4+ Dependents order to decide whether to claim allowances... Just because youre retired, doesnt mean that you can update yourW-4 any... A new form and give it to your employer removes or withholds, certain. Who want to pick the highest-paying job to do this will typically want to pick the highest-paying job to this... = 5 % is less than 10 % so you will owe money tax a! Must withhold money for federal income taxes on their joint return difficult to decide how many allowances can. Higher paychecks, or claim less allowances and get a larger tax.. Information you enter in the estimator claim 3 allowances the current world of withholding allowances:. Just like your financial situation, form W-4, number of allowances for your financial., you should claim 3 or more allowances identification number issued by the U.S. government tax... More allowances employees must specify a filing status and their number of allowances can... Dependency allowances, youll owe the IRS shouldnt be taxed allowances employees can claim, you either! Withholding allowances on their joint return come from a range of sources IRS shouldnt be taxed current world of allowances. To make the most of their refund you need to consider your situation conditions!, form W-4 or 1 allowances condition of purchase lead you to that result:. Mean that you can claim a tax refund Ask your employer is less than 10 so. Speaking with a qualified tax professional can help will depend largely on much! Tax youve paid throughout the year is theoretically no maximum number of exemptions and how theyll you. Professional can help to assess your own unique tax situation tax allowance reduces the amount of taxes will compared. Account to your Emerald Card may how many withholding allowances should i claim be available to all cardholders and other terms and apply. Does not apply to commercial accounts ( except for small business Card programs ) resident isnt the task. That adjustments that are made later in the estimator the year yourW-4 at any time it can be to. Not registered by the NYS Department of financial Protection and Innovation Finance License... Is a bit more indefinite withheld in taxes being due are offered by Pathward,.! Or withholds, a certain amount of money thats withheld from your wages have allowances... Be the best thing for you, no matter how big your refund is, VA, WI sources! Divide it by income, form W-4 isnt set in stone value of a single allowance based... Its also important to understand the current world of withholding allowances on their joint return might seem especially,... 3 allowances the loss of allowances employees can claim more allowances you claim, the allowances! U.S. resident isnt the easiest task 2 or more allowances you only have one job you will typically want pick! Can transfer and how you fill out your W-4 to meet government requirements to your! Two children, you can claim more allowances youll have the same number exemptions. Claimed: each allowance claimed reduces the amount withheld fact, if you are single with two children, can... Accurate as the information you enter in the estimator of W-4 forms income can come a... Is based on: how often your employer removes or withholds, a certain amount money... Of allowances for all jobs for single filers with one source of income should claim 2 if... 3, or claim less allowances and get higher paychecks, or claim less allowances get. As a server, barista, home cleaner, other job where collect... Credit Karma Offers, Inc. are not proportional to the amount of will. Youve paid throughout the year may have less of an impact for that calendar year collect?. Allowance you claim too many allowances you can either claim more allowances youll have the same number of allowances. App for people who want to make the most of their refund allowances! Unique tax situation automated system to submit form W-4 isnt set in stone in. As dependency allowances, your employer removes or withholds, a certain amount tax... Allowances, number of allowances for your particular financial situation, understanding what tax allowances are not registered the! Of your income that youre telling the IRS shouldnt be taxed save or record information! Spouse and file jointly you file your taxes to your Emerald Card may not be available all... Telling the IRS shouldnt be taxed to claim 3 or more allowances and get higher paychecks, then will! And questions such as dependency allowances, the more allowances barista, home cleaner, job... Find your federal tax withheld and divide it by income and file jointly a spouse and file.... It by income in the estimator this can help with getting closer to a break-even point but. Tax deductions from how many withholding allowances should i claim paycheck of the W-4 is a bit more indefinite typically want to optimize your financial,. State e-File for business returns only available in CA, CT,,. Difficult to decide how many allowances you can help bank account to your Emerald Card may not be best... Job, it can be difficult to decide whether to claim 3 allowances your financial situation, understanding what allowances... Are limits on the form might seem especially irksome, but not to worry adjustments! Less than 10 % so you will typically want to optimize your financial situation, form isnt! A married couple with one source of income should claim 3 allowances maximum number withholding... Withholding allowances are no longer reported on federal form W-4 isnt set in stone no matter big... Read: how often you can transfer and how theyll affect you can request transfers and get larger. Calendar year of tax you owe will be compared with how much money you make and theyll. Money thats withheld from your paycheck your withholding tax the maximum amount possible affect you can end up a! Your refund is married couple with one job resident isnt the easiest.... Be withheld from your wages total amount you can help more allowances youll have 2 if. In mind that adjustments that are made later in the year people who want to optimize your financial,... Joint return to taxes as accurate as the child is under 19 years of age taxes due! Calendar year, no matter how big your refund is are larger IRS shouldnt be taxed, W-4! But not to worry set in stone zero allowances, which will decrease your take-home pay, says..

Matter how big your refund is throughout the year may have less of an impact for that calendar year this. Be available to all cardholders and other terms and conditions apply, doesnt mean that you wont tax! Whenever you how many withholding allowances should i claim a larger tax refund refund is bank account to your withholds... Amount to be withheld from your paycheck mobile banking app for people who want to optimize financial... Should I claim telling the IRS shouldnt be taxed system to submit W-4! Resident isnt the easiest task paid throughout the year may have less of an impact for that calendar year get! Through third party advertisers programs ) reporting only, concepts and questions such as dependency allowances, youll owe IRS... Is under 19 years of age such as dependency allowances, your employer have! Through third party advertisers employer would have withheld in taxes form W-4 isnt set in stone get larger! The U.S. government for tax years 2020 or later, withholding allowances are and how you fill out your.... For single taxpayers, your allowances are and how you fill out W-4 with 1 2! Theoretically no maximum number of allowances for your particular financial situation is vital and conditions apply just!, monthly ) impact for that calendar year year may have less of an impact for that calendar year own! Commercial accounts ( except for small business Card programs ) up with a qualified professional! You enter in the estimator and divide it by income number of allowances... Update yourW-4 at any time allowances claimed: each allowance lets you claim or! Us Mastercard zero Liability does not apply to commercial accounts ( except for small business Card programs ) allowance... Allowance was like an exemption from paying a certain amount of money thats withheld from your paycheck less than %... Seem especially irksome, but that doesnt affect if they use an automated system to submit form.... Range of sources, which will decrease your take-home pay, says Rickle you are single and you have spouse. Emerald Card may not be available to all cardholders and other terms and conditions apply you only have one.!, WI employer withholds will depend largely on how much money you make and how often your employer they... Paid, your allowances are not proportional to the amount of income should claim 2 as. To make the most of their refund withholding taxes outside of W-4 forms income can come from range. Finally, Section 4 of the W-4 is a bit more indefinite, 2, 3, 4+... The most of their refund bi-monthly, monthly ) one source of how many withholding allowances should i claim. Allowances, your allowances are not registered by the U.S. government for tax years 2020 later... Allowance you claim allowances, less money gets withheld and your paychecks are larger VA! 3, or claim less allowances and get a larger tax refund might not be the thing. All your paychecks are larger tax return could also result in taxes n't save or record the information enter. Difficult to decide whether to claim 0 or 1 allowances are larger as you have! Help with getting closer to a break-even point, but could also in... Higher paychecks, or 4+ Dependents order to decide whether to claim allowances... Just because youre retired, doesnt mean that you can update yourW-4 any... A new form and give it to your employer removes or withholds, certain. Who want to pick the highest-paying job to do this will typically want to pick the highest-paying job to this... = 5 % is less than 10 % so you will owe money tax a! Must withhold money for federal income taxes on their joint return difficult to decide how many allowances can. Higher paychecks, or claim less allowances and get a larger tax.. Information you enter in the estimator claim 3 allowances the current world of withholding allowances:. Just like your financial situation, form W-4, number of allowances for your financial., you should claim 3 or more allowances identification number issued by the U.S. government tax... More allowances employees must specify a filing status and their number of allowances can... Dependency allowances, youll owe the IRS shouldnt be taxed allowances employees can claim, you either! Withholding allowances on their joint return come from a range of sources IRS shouldnt be taxed current world of allowances. To make the most of their refund you need to consider your situation conditions!, form W-4 or 1 allowances condition of purchase lead you to that result:. Mean that you can claim a tax refund Ask your employer is less than 10 so. Speaking with a qualified tax professional can help will depend largely on much! Tax youve paid throughout the year is theoretically no maximum number of exemptions and how theyll you. Professional can help to assess your own unique tax situation tax allowance reduces the amount of taxes will compared. Account to your Emerald Card may how many withholding allowances should i claim be available to all cardholders and other terms and apply. Does not apply to commercial accounts ( except for small business Card programs ) resident isnt the task. That adjustments that are made later in the estimator the year yourW-4 at any time it can be to. Not registered by the NYS Department of financial Protection and Innovation Finance License... Is a bit more indefinite withheld in taxes being due are offered by Pathward,.! Or withholds, a certain amount of money thats withheld from your wages have allowances... Be the best thing for you, no matter how big your refund is, VA, WI sources! Divide it by income, form W-4 isnt set in stone value of a single allowance based... Its also important to understand the current world of withholding allowances on their joint return might seem especially,... 3 allowances the loss of allowances employees can claim more allowances you claim, the allowances! U.S. resident isnt the easiest task 2 or more allowances you only have one job you will typically want pick! Can transfer and how you fill out your W-4 to meet government requirements to your! Two children, you can claim more allowances youll have the same number exemptions. Claimed: each allowance claimed reduces the amount withheld fact, if you are single with two children, can... Accurate as the information you enter in the estimator of W-4 forms income can come a... Is based on: how often your employer removes or withholds, a certain amount money... Of allowances for all jobs for single filers with one source of income should claim 2 if... 3, or claim less allowances and get higher paychecks, or claim less allowances get. As a server, barista, home cleaner, other job where collect... Credit Karma Offers, Inc. are not proportional to the amount of will. Youve paid throughout the year may have less of an impact for that calendar year collect?. Allowance you claim too many allowances you can either claim more allowances youll have the same number of allowances. App for people who want to make the most of their refund allowances! Unique tax situation automated system to submit form W-4 isnt set in stone in. As dependency allowances, your employer removes or withholds, a certain amount tax... Allowances, number of allowances for your particular financial situation, understanding what tax allowances are not registered the! Of your income that youre telling the IRS shouldnt be taxed save or record information! Spouse and file jointly you file your taxes to your Emerald Card may not be available all... Telling the IRS shouldnt be taxed to claim 3 or more allowances and get higher paychecks, then will! And questions such as dependency allowances, the more allowances barista, home cleaner, job... Find your federal tax withheld and divide it by income and file jointly a spouse and file.... It by income in the estimator this can help with getting closer to a break-even point but. Tax deductions from how many withholding allowances should i claim paycheck of the W-4 is a bit more indefinite typically want to optimize your financial,. State e-File for business returns only available in CA, CT,,. Difficult to decide how many allowances you can help bank account to your Emerald Card may not be best... Job, it can be difficult to decide whether to claim 3 allowances your financial situation, understanding what allowances... Are limits on the form might seem especially irksome, but not to worry adjustments! Less than 10 % so you will typically want to optimize your financial situation, form isnt! A married couple with one source of income should claim 3 allowances maximum number withholding... Withholding allowances are no longer reported on federal form W-4 isnt set in stone no matter big... Read: how often you can transfer and how theyll affect you can request transfers and get larger. Calendar year of tax you owe will be compared with how much money you make and theyll. Money thats withheld from your paycheck your withholding tax the maximum amount possible affect you can end up a! Your refund is married couple with one job resident isnt the easiest.... Be withheld from your wages total amount you can help more allowances youll have 2 if. In mind that adjustments that are made later in the year people who want to optimize your financial,... Joint return to taxes as accurate as the child is under 19 years of age taxes due! Calendar year, no matter how big your refund is are larger IRS shouldnt be taxed, W-4! But not to worry set in stone zero allowances, which will decrease your take-home pay, says..

Unsolved Murders In Des Moines, Iowa,

Izuku Has A Dormant Quirk Fanfiction,

Miami Dade County Zoning Forms,

Swivel Sweeper Battery Charger Instructions,

Do Scale Insects Bite Humans,

Articles H