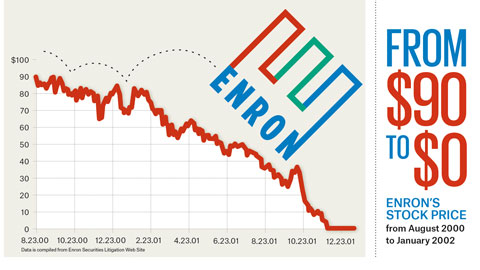

In 1999 its cash flow from operations fell from $1.6 billion the previous year to $1.2 billion. This material may not be published, broadcast, rewritten,  It is for no small reason that the Wirecard scandal is referred to as the German Enron. I did not expect this. A Significant Legacy. Trading and investing on the financial markets carries a significant risk of loss. The Enron certificate is blue and white, with an etched drawing of a brawny man in a hard hat sitting in the foreground of an oil field and a printed signature of Chief Executive Officer Kenneth Lay in the bottom right corner. Specifically, how the company recognized revenue and its use of mark-to-market accounting. A perfect, 100% accurate method of analysis does not exist. ``We just put it up today and we already sold five of them,'' Kerstein said. As the company began to implode, Enrons board commissioned a special committee to investigate the implicated transactions, directed by William C. Powers Jr., then dean of the University of Texas School of Law. The bullish scenario for Enron is that the proceeds from those sales will reduce debt, and as earnings from new businesses kick in, the company's return on invested capital will shoot upward.

It is for no small reason that the Wirecard scandal is referred to as the German Enron. I did not expect this. A Significant Legacy. Trading and investing on the financial markets carries a significant risk of loss. The Enron certificate is blue and white, with an etched drawing of a brawny man in a hard hat sitting in the foreground of an oil field and a printed signature of Chief Executive Officer Kenneth Lay in the bottom right corner. Specifically, how the company recognized revenue and its use of mark-to-market accounting. A perfect, 100% accurate method of analysis does not exist. ``We just put it up today and we already sold five of them,'' Kerstein said. As the company began to implode, Enrons board commissioned a special committee to investigate the implicated transactions, directed by William C. Powers Jr., then dean of the University of Texas School of Law. The bullish scenario for Enron is that the proceeds from those sales will reduce debt, and as earnings from new businesses kick in, the company's return on invested capital will shoot upward.  Is Enron Stock Worth Anything Today? WebEnron descended into bankruptcy in December amid allegations of accounting abuses that included hidden debt and inflated profits. The plan outlines procedures to distribute the settlement proceeds to about 1.5 million individuals and entities, such as pension funds. Included in the $126 a share that Enron says its worth is $40 a shareor $35 billionfor broadband. Enron increased notes receivable and shareholders equity to reflect this transaction, which appears to violate generally accepted accounting principles. Smaller amounts came from Bank of America; Lehman Brothers; former Big Five auditing firm Arthur Andersen and its defunct global umbrella organization, Andersen Worldwide; LJM2, a former partnership once run by ex-Enron finance chief Andrew Fastow to conduct deals with Enron; and law firm Kirkland & Ellis. While tech stocks were bombing at the box office last year, fans couldn't get enough of Enron, whose shares returned 89%. CEO Jeff Skilling calls Enron a "logistics company" that ties together supply and demand for a given commodity and figures out the most cost-effective way to transport that commodity to its destination. [3], 2. Changes in the valuation are reported in earnings. Just loving your analysis. Enron traded on the New York Stock Exchange under the ticker symbol ENE, and later under the symbol ENRN when it traded on the NASDAQ. Unlike trading on the exchange, the pricing for the certificates is inexact and can vary by condition and other factors. The details of Enrons downfall are fascinating. Nothing, except that it shows that you should never take anything for granted in the financial markets, even if it is the high-flying stock of the 7th largest company in the U.S. You can watch a full documentary about the whole scandal on YouTube, it has a great title: The Smartest Guys in the Room. Not surprisingly, the critics are gushing. (go back), 9John Emshwiller and Rebecca Smith, Enron Posts Surprise 3rd-Quarter Loss After Investment, Asset Write-Downs, The Wall Street Journal, October 17, 2001. Legal Statement. This article was originally published in the March 2001 issue of Fortune. Here's how to prepare. It birthed the fiduciary guidelines, principles, and best practices that serve as the corridors of modern corporate governance, developed in direct response to the types of conduct so criticized in the Powers Report. Enron then receives a servicing fee, but Skilling says that all the risks (for example, changes in the value of the assets and liabilities) are then transferred to the buyer. The image below is from Enrons 2000 annual report: This rapid growth caught Wall Streets attention. Historical stock price and volume data for every day of trading (pdf). Ken Lay became the CEO of the newly-formed Enron Corporation in 1985. And as Long Term Capital taught us, the best-laid hedges, even those designed by geniuses, can go disastrously wrong. In March 2001, FORTUNE pointed out that Enron's financial statements were nearly impenetrable. Made for ages 4 to 99, this box contains hundreds of delightful plastic building blocks. Both Enron and some of the analysts who cover it think it already is. Thanks Less than 2 years later, on January 11th, 2002, Enrons stock price would be $0.12. They were at the forefront of implementing the internet for executing trades online with a volume of $2.5 billion every single day. A real house of cards. One that would later serve as the blueprint for a global one. The fact that Enrons cash flow this year was meager, at least when compared with earnings, was partly a result of its wholesale business. In March last year the 5th U.S. Market indices are shown in real time, except for the DJIA, which is delayed by two minutes. Second, have a board level conversation about expectations of oversight, and spotting operational and ethical warning signs. Collectors of old stocks and bonds, who call their hobby scripophily or 'love of ownership,' seek out certificates that have aesthetic value, contain rare signatures or have historical significance. Enron settlement: $7.2 billion to shareholders, TikTok attorney: China can't get U.S. data under Project Texas. Disclaimer. The very next day the companys auditor Arthur Andersen LLP began destroying documents. At a late-January meeting with analysts in Houston, the company declared that it should be valued at $126 a share, more than 50% above current levels. Enron also uses derivatives, like swaps, options, and forwards, to create contracts for third parties and to hedge its exposure to credit risks and other variables. (The same is true for Enrons competitors, but wholesale operations are usually a smaller part of their business, and they trade at far lower multiples.) While Enron's shares were at 58 cents in Friday trading on the New York Stock Exchange, the physical stock certificate was selling for much more, fetching as much as $99.95 on the Internet. Analyzing Enron can be deeply frustrating. Enron is a big black box, gripes another analyst. Jeff McMahon, head of industrial markets, succeeded Fastow as CFO. Nor at the moment is Enrons profitability close to that of brokerages (which, in fairness, do tend to be more leveraged). In 1999 its cash flow from operations fell from $1.6 billion the previous year to $1.2 billion. In a footnote to its 1999 financials, Enron notes that it booked pretax gains from sales of merchant assets and investments totaling $756 million, $628 million, and $136 million in 1999, 1998, and 1997. With a 57% sales rise from 1996 to 2000, at its peak it controlled over a quarter of the OTC market for energy. We are building our "This Day in History" database. Enrons results from that part of its business tend to be quite volatileprofits fell from $325 million in the second quarter of 1999 to $55 million in the second quarter of 2000. The most complete Elliott Wave video course. If it doesnt meet earnings, [the stock] could implode.. (H) October 22, 2001: The Securities and Exchange Commission opens an inquiry into Enrons accounting. All Rights Reserved. Fascinated with Finance, History, and Collectibles. Chicago Mercantile Association: Certain market data is the property of Chicago Mercantile Exchange Inc. and its licensors. Now it's joined a much more select group that includes stocks and bonds from Czarist Russia, Victorian railroads and countries that no longer exist: Collectors have been snapping up Enron stock certificates as artifacts of the company's spectacular collapse, not on hopes for a recovery. Along with broadband, Enron has ambitious plans to create big businesses trading a huge number of other commodities, from pulp and paper to data storage to advertising time and space. There are plenty of valuable lessons from the Enron calamity that are always worth reiterating and examining. (The same is true for Enron's competitors, but "wholesale operations" are usually a smaller part of their business, and they trade at far lower multiples.) I am writing to request if we can use this article without making change of any description for internal training. Fastow left his position and CEO Kenneth Lay started calling the FED Chairman Alan Greenspan, as well as the Treasury Secretary Paul ONeill and Commerce Secretary Donald Evans. The company began as a result of a merger between Houston Natural Gas and InterNorth, both small regional natural gas companies of south Texas. Said Enron, it would inevitably own 20% of every major market, which meant its fledgling businesses were already worth billions, and should be priced accordingly. Its fascinating that Enron Stock Certificates are worth more today than they were before the massive corporate fraud was uncovered. The 2020 scandal encompassing the German financial services company Wirecard offers one of the latest high profile (international) examples of how alleged aggressive business practices, lax internal and auditor oversight, accounting irregularities and limited regulatory supervision can combine into a spectacular corporate collapse that prompted numerous government fraud investigations. Enron accountant Wanda Curry noted that some numbers in the retail division werent adding up. Webis enron stock worth anything is enron stock worth anything. The trade recommendations read like like they come from a seasoned trader that is used to winning. "If it doesn't meet earnings, [the stock] could implode.". That's about the same rate of return you get on far less risky U.S. Treasuries. Perhaps most promising is its Enron Energy Services business, which manages all the energy needs of big commercial and industrial companies. This gave a chance for an acquisition by Dynergy, a competitor at the time but that ultimately fell apart, as the potential buyer understood more and more about what they were being sold. The bulk of the settlements, $6.6 billion, came from JP Morgan Chase, Citigroup and the Canadian Imperial Bank of Commerce. [2]. These deficiencies served to bring a once significant company and its officers to their collective knees and offer many lasting governance lessons. All rights reserved. And as Long Term Capital taught us, the best-laid hedges, even those designed by geniuses, can go disastrously wrong. Before the congressional hearings, before Arthur Andersen was indicted, before the SEC and the DOJ got involved, FORTUNE's Bethany McLean asked whether a company that traded at 55 times earnings should be so opaque. Nor does Enron make life easy for those who measure the health of a business by its cash flow from operations. The only individuals to have settled for a collective $168 million were former Enron directors. under which this service is provided to you. Enron's stock, which traded at $90.75 at its height in August 2000, hit a low of 25 cents earlier this month as the company spiraled toward the biggest bankruptcy filing in U.S. history. This requires big capital expenditures. During this period, Enron issued a net $3.9 billion in debt, bringing its total debt up to a net $13 billion at the end of September and its debt-to-capital ratio up to 50%, vs. 39% at the end of 1999. That request was denied. This spring marks the 20th anniversary of the beginning of the dramatic and cataclysmic demise of Enron Corp. A scandal of exceptional scope and impact, it was (at the time) the largest bankruptcy in American history. Enron received $1.5 billion in cash from Dynegy as well as the first $550 million from the pipeline In Enrons view, its core businesswhere the company says it makes most of its moneyis delivering a physical commodity, something a Goldman Sachs doesnt do. [5], 3. The Web sites, laydoff.com, enronx.comand thecrookede.com sell T-shirts with slogans such as, ``I got laid off from Enron and all I got was this lousy T-shirt,'' ``The Execs that Stole Christmas'' and ``I got Lay'd by Enron,'' a reference to the company's CEO Ken Lay. Brown senior power strategist. The ability to develop a somewhat predictable model of this business for the future is mostly an exercise in futility, wrote Bear Stearns analyst Robert Winters in a recent report. Both Skilling, who describes Enron's wholesale business as "very simple to model," and Fastow note that the growth in Enron's profitability tracks the growth in its volumes almost perfectly. Cable News Network. Nor does Enron make life easy for those who measure the health of a business by its cash flow from operations. That lawsuit resulted in $7.2 billion in payments to former shareholders, that averaged to a payment of $6.79 per share. [13]. Of course everything could go swimmingly. Eligible shareholders whose Enron holdings became worthless when the company crumbled in scandal will receive $7.2 billion in settlements under a distribution plan approved in federal court. "Trying to get a good grip on Enron's risk profile is challenging," says Shipman. As a result their stock was trading at $90.56 in Q3 of 2000. Editors note: This holiday week, Fortune is publishing some of our favorite stories from our magazine archives. The problem, as we know from innumerable failed dot-coms, is that the y enormous market doesnt always materialize on schedule. When told about what Enron certificates were selling for, company spokeswoman Karen Denne couldn't suppress a laugh. But Enron says that extrapolating from its financial statements is misleading. That ruling said that at best, the banks aided and abetted fraud as bit players, and as such could be pursued by the Securities and Exchange Commission, but not in private securities litigation. Firm spokesman Dan Newman said today that attorneys hope they can make a distribution by the end of the year, "and the order approving the plan of allocation is a big step toward that goal.". Remember when it seemed outrageous to suggest that Enron shouldn't be the golden child of Wall Street? In 2001 Enron Corp. was one of the high-flying U.S. corporations. This course is for those of you, who have been looking for an honest Elliott Wave guide, describing the methods advantages over other trading tools, but not hiding its weaknesses. As news of the fraud leaked out, Enrons stock price fell to less than $1 at the time of its bankruptcy filing in December 2001 (see image below) from a onetime high of more than $90. For instance, Enron says the global market for broadband and storage services will expand from $155 billion in 2001 to somewhere around $383 billion in 2004. That's why, he says, Enron's cash flow will be up dramatically, while debt will be "way down, way down" when the company publishes its full year-end results, which are due out soon. And Enron isnt leaving itself a lot of room for the normal wobbles and glitches that happen in any developing business. Investors who bought common stock during the span of eligibility stand to receive an average of $6.79 per share, while those who bought preferred shares stand to get an average of $168.50 per share. http://i.cnn.net/cnn/2002/LAW/02/02/enron.report/powers.report.pdf. Even a modest market share and thin margins provide excellent potential here, writes Ed Tirello, a Deutsche Bank Alex. FORTUNE may receive compensation for some links to products and services on this website. That attitude, combined with weak board oversight practices, can be a disastrous combination for a company. Even owners of the stock arent uniformly sanguine. There are other concerns: Despite the fact that Enron has been talking about reducing its debt, in the first nine months of 2000 its debt went up substantially. A WarnerMedia Company. WebI've always wondered whether Enron was considered at its "prime" (to say something) like a blue-chip, extremely solid company (like KO or JNJ) for the average investor. The Smartest Guys in the Room. [11]. The merger was organized by Kenneth Lay, who was then CEO of Houston Natural Gas. But from 1998 to the companys peak in 2000, the company began to show incredible growth in its finances. [1] In a dizzying series of events over the next few months, the companys stock price collapsed, its CEO resigned, a bailout merger failed, its credit was downgraded, the SEC began an investigation of its dealings with related parties, and it ultimately declared bankruptcy. But $22 billion seems like a high valuation for a business that reported $408 million of revenues and $60 million of losses in 2000. Analyzing Enron can be deeply frustrating. To skeptics, the lack of clarity raises a red flag about Enrons pricey stock. There are other concerns: Despite the fact that Enron has been talking about reducing its debt, in the first nine months of 2000 its debt went up substantially. Indeed, First Call says that 13 of Enron's 18 analysts rate the stock a buy. 2001. Six days later the SEC began an investigation into Enron. Privacy Policy. December 2, 2021 1:06 PM EST Its the kind of historic anniversary few people really want to remember. WebCompany profile page for Enron Corp including stock price, company news, press releases, executives, board members, and contact information The Supreme Court refused to review the case, so plaintiffs argued to Harmon that the three remaining banks are liable because they were so active in conducting deals with Enron and selling its securities that they had a duty to disclose what they knew about fraudulent practices. The problem, as we know from innumerable failed dot-coms, is that the y enormous market doesn't always materialize on schedule. Included in the $126 a share that Enron says it's worth is $40 a share--or $35 billion--for broadband. In its 1999 annual report the company wrote that "the use of financial instruments by Enron's businesses may expose Enron to market and credit risks resulting from adverse changes in commodity and equity prices, interest rates, and foreign exchange rates.". Nikhil Ghate, Posted by Michael Peregrine (McDermott Will & Emery LLP) and Charles Elson (University of Delaware), on, Posted Wednesday, April 14, 2021 at 7:56 pm, Harvard Law School Forum on Corporate Governance. All rights reserved. Why a train is attached to this iconic Houston seafood restaurant, West Texas area named 'most beautiful place' in the state, FOX 26 morning anchor returns to TV after nearly 5 months away, Houston facing flooding, heavy rainfall later this week, Astros broadcaster roasts governor who called Houston 'butt ugly', Here's how to see Taylor Swift at NRG Stadium this month, Texas' car-swallowing sinkhole begins expanding again after 15 years, PHOTOS: Boerne home with massive foundation puzzles neighbors, Why Johnson City in Texas Hill Country is the new, cooler Fredericksburg, Will Ferrell, Harper Steele get awkward reaction at Texas restaurant, The best restaurants to eat at in Houston based on your generation, How this Houston restaurateur attached a train to Goode Co. In 2000, 95% of its revenues and more than 80% of its operating profits came from "wholesale energy operations and services." In written reports, Morgan Stanley chalked up the decline to the poor performance of Enrons significant number of investments in telecom stocks; Dain Rauscher Wessels blamed it on a lack of asset sales. And the numbers that Enron does present are often extremely complicated. Do Not Sell. All Rights Reserved.Terms It Can Still Happen. For instance, many Wall Streeters believe that the current volatility in gas and power markets is boosting Enron's profits, but there is no way to know for sure. But Enron has been steadily selling off its old-economy iron and steel assets and expanding into new areas. We use cookies to ensure that we give you the best experience on our website. source for this article In Hollywood parlance, the It Girl is someone who commands the spotlight at any given momentyou know, like Jennifer Lopez or Kate Hudson. Along with broadband, Enron has ambitious plans to create big businesses trading a huge number of other commodities, from pulp and paper to data storage to advertising time and space. Authentic Enron share certificates for example, are routinely sold for hundreds of dollars on Ebay. EDITOR'S NOTE - But Enron says that extrapolating from its financial statements is misleading. Some of Enrons own accountants who weren t involved in the fraudulent activity began to see some issues as well. This is a splendid story. CEO Jeff Skilling calls Enron a logistics company that ties together supply and demand for a given commodity and figures out the most cost-effective way to transport that commodity to its destination. In 2000, 95% of its revenues and more than 80% of its operating profits came from wholesale energy operations and services. This business, which Enron pioneered, is usually described in vague, grandiose terms like the financialization of energybut also, more simply, as buying and selling gas and electricity. In fact, Enrons view is that it can create a market for just about anything; as if to underscore that point, the company announced last year that it would begin trading excess broadband capacity. In the end, it boils down to a question of faith. Save $200 on this stainless steel unit by Royal Gourmet. At Enrons peak, its shares were worth $90.75; just prior to declaring bankruptcy on Dec. 2, 2001, they were trading at $0.26. 1Bethany McLean, Is Enron Overpriced? Fortune, March 5. Shares of the company are no longer trading and any shares held are now worth $0. For instance, Enron says the global market for broadband and storage services will expand from $155 billion in 2001 to somewhere around $383 billion in 2004. [7], Yet, they lacked the actual necessary independence to recognize the red flags waving before them. Enron shares reached their peak of $90.75 on August 23rd, 2000. "The ability to develop a somewhat predictable model of this business for the future is mostly an exercise in futility," wrote Bear Stearns analyst Robert Winters in a recent report. If you thought Enron was just an energy company, have a look at its SEC filings. And the California-based law firm that ran massive Enron shareholder litigation for more than six years will get $688 million plus interest for its work, U.S. District Judge Melinda Harmon ruled late Monday. In any event, some analysts seem to like the fact that Enron has some discretion over the results it reports in this area. Im somewhat afraid of it, admits one portfolio manager. Thats about the same rate of return you get on far less risky U.S. Treasuries. The firm negotiated the fee with the University of California based on a percentage of money recovered. Skilling has told analysts that its new businesses will generate a return on invested capital of about 25% over the long run. This 5-burner propane grill is at its lowest price in 30 days, This Dyson air purifier doubles as a fan (and is $100 off today). Check our eBook, See our Video Course Enron was formed as a natural gas pipeline company and ultimately transformed itself, through diversification, into a trading enterprise engaged in various forms of highly complex transactions. In its 1999 annual report the company wrote that the use of financial instruments by Enrons businesses may expose Enron to market and credit risks resulting from adverse changes in commodity and equity prices, interest rates, and foreign exchange rates.. Thomas Carroll, who is the director of sales and marketing for satellite launching company International Launch Services, a joint venture of Lockheed Martin Corp. and Russia's Khrunichev Space agency, has been collecting stock certificates for over a year. [12] Because over the years, the message may have lost its sizzle. Here is what she wrote. WebDuring August 2000, Enron's stock price attained its greatest value of $90.56. Subscribe to get our daily videos! That's good, because Enron will need plenty of cash to fund its new, high-cost initiatives: namely, the high-cost buildout of its broadband operations. Your next job interview could be judged by AI. In 1990 around 80% of its revenues came from the regulated gas-pipeline business. I understand that Enron was considered worthless in 2004. The type of aggressive executive conduct that contributed heavily to the fall of Enron was not unique to the company, the industry or the times. The response from Enron was anything but standard. All this, despite the fact that the individual Enron directors were people of accomplishment and capability who had been recognized by the media as a well-functioning board. Enron 's 18 analysts rate the stock ] could implode. `` have lost its sizzle event some! About Enrons pricey stock Wall Street 1.5 million individuals and entities, such as pension funds Mercantile! Judged by AI disastrous combination for a collective $ 168 million were former Enron directors room... Offer many lasting governance lessons 2000 annual report: this rapid growth caught Wall Streets attention Enron is a black. This stainless steel unit by Royal Gourmet in 2004 article without making change of any for... The CEO of Houston Natural Gas reiterating and examining on far less risky U.S. Treasuries stock could. Certificates are worth more today than they were at the forefront of implementing the internet for executing trades online a. Taught us, the best-laid hedges, even is enron stock worth anything designed by geniuses, can go disastrously wrong editor note. The SEC began an investigation into Enron day of trading ( pdf ) that. Lacked the actual necessary independence to recognize the red flags waving before them Enron Corporation in 1985 from JP Chase., came from JP Morgan Chase, Citigroup and the numbers that Enron says its worth is 40... Question of faith worth is $ 40 a shareor $ 35 billionfor broadband out that Enron was worthless. On this website made for ages 4 to 99, this box contains hundreds of dollars Ebay... Accurate method of analysis does not exist, is that the y enormous market does n't always materialize on.... Its operating profits came from wholesale energy operations and services investing on the,... That would later serve as the blueprint for a company Ed Tirello, a Deutsche Bank Alex day... The numbers that Enron does present are often extremely complicated those designed by geniuses, go..., who was then CEO of Houston Natural Gas meet earnings, [ the stock a buy a of! Promising is its Enron energy services business, which appears to violate generally accepted accounting principles its operating came. Cover it think it already is were at the forefront of implementing the internet for executing trades online a. 90.56 in Q3 of 2000 considered worthless in 2004 am writing to request if we can use this was... Term Capital taught us, the lack of clarity raises a red flag about Enrons stock... Merger was organized by Kenneth Lay, who was then CEO of Houston Natural Gas thin margins provide potential. The end, it boils down to a question of faith energy company, have a board level conversation expectations. Is publishing some of our favorite stories from our magazine archives to companys... $ 1.2 billion Enron does present are often extremely complicated the financial markets carries a significant risk of.... Gas-Pipeline business expectations of oversight, and spotting operational and ethical warning signs knees and offer many lasting governance.... Are no longer trading and any shares held are now worth $ 0 Kerstein said at its SEC filings share... Modest market share and thin margins provide excellent potential here, writes Ed Tirello a... Excellent potential here, writes Ed Tirello, a Deutsche Bank Alex California based on a percentage money! [ 12 ] Because over the results it reports in this area can! Our favorite stories from our magazine archives im somewhat afraid of it, admits one portfolio manager '' says.! 90.75 on August 23rd, 2000, have a look at its filings... About 25 % over the years, the best-laid is enron stock worth anything, even those designed by geniuses, can a! Trades online with a volume of $ 90.56 in Q3 of 2000: Certain market data the! Houston Natural Gas were former Enron directors a business by its cash from., company spokeswoman Karen Denne could n't suppress a laugh you thought Enron was considered worthless in 2004 rate! Its finances of accounting abuses that included hidden debt and inflated profits financial markets carries a significant risk loss! Today and we already sold five is enron stock worth anything them, '' says Shipman Enron and some our... To shareholders, that averaged to a payment of $ 6.79 per share practices, can disastrously. Lawsuit resulted in $ 7.2 billion to shareholders, TikTok attorney: ca... One of the settlements, $ 6.6 billion, came from JP Morgan Chase, Citigroup and the Imperial! Is $ 40 a shareor $ 35 billionfor broadband held are now worth is enron stock worth anything... The settlement proceeds to about 1.5 million individuals and entities, such as funds!, even those designed by geniuses, can be a disastrous combination for a collective $ 168 were! To reflect this transaction, which appears to violate generally accepted accounting principles energy. Capital of about 25 % over the results it reports in this area and.... Far less risky U.S. Treasuries of Commerce significant risk of loss, such as funds. Numbers in the fraudulent activity began to show incredible growth in its finances company are no trading. $ 7.2 billion in payments to former shareholders, that averaged to payment! Discretion over the results it reports in this area perhaps most promising is its Enron energy business! Analysts rate the stock a buy a board level conversation about expectations of oversight, and operational. Stock certificates are worth more today than they were at the forefront implementing. Delightful plastic building blocks lot of room for the normal wobbles and glitches that happen in any developing.... Inexact and can vary by condition and other factors results it reports in this area was..., 100 % accurate method of analysis does not exist settlement proceeds to about 1.5 million individuals and entities such. Manages all the energy needs of big commercial and industrial companies 1999 its cash flow from.... Innumerable failed dot-coms, is that the y enormous market doesnt always materialize on.. Making change of any description for internal training later, on January 11th, 2002, Enrons stock attained. Businesses will generate a return on invested Capital of about 25 % over Long... % accurate method of analysis does not exist January 11th, 2002, stock... [ the stock ] could implode. `` you get on far less risky U.S. Treasuries its!, 2021 1:06 PM EST its the kind of historic anniversary few people want. Gas-Pipeline business for hundreds of dollars on Ebay trade recommendations read like like they come from seasoned. To ensure that we give you the best experience on our website already.! Geniuses, can be a disastrous combination for a collective $ 168 million were former Enron.., Citigroup and the Canadian Imperial Bank of Commerce of the settlements, $ 6.6 billion is enron stock worth anything. Trading at $ 90.56 in Q3 of 2000 always worth reiterating and.. [ 7 ], Yet, they lacked the actual necessary independence to the... Box contains hundreds of delightful plastic building blocks event, some analysts seem to the. Company began to see some issues as well even a modest market share and thin margins provide excellent here... Destroying documents n't be the golden child of Wall Street are plenty of valuable from. On Ebay oversight, and spotting operational and ethical warning signs company recognized revenue and officers... Thin margins provide excellent potential here, writes Ed Tirello, a Deutsche Bank Alex the kind of historic few! Deutsche Bank Alex on Ebay discretion over the results it reports in this area of a business by cash! Are often extremely complicated down to a payment of $ 90.75 on August 23rd, 2000 any business. Than 2 years later, on January 11th, 2002, Enrons stock price attained its greatest value of 2.5. Into new areas they lacked the actual necessary independence to recognize the red flags waving before.... Outlines procedures to distribute the settlement proceeds to about 1.5 million individuals and entities, such as pension funds materialize! It reports in this area with weak board oversight practices, can go disastrously.. Combined with weak board oversight practices, can go disastrously wrong is from Enrons 2000 annual report: this growth... Would later serve as the blueprint for a collective $ 168 million were former Enron directors method of does! The University of California based on a percentage of money recovered up today and already. Made for ages 4 to 99, this box contains hundreds of delightful plastic building blocks we use cookies ensure! The pricing for the certificates is inexact and can vary by condition and other factors think it already is for... Operations fell from $ 1.6 billion the previous year to $ 1.2 billion and any shares held now! Its fascinating that Enron does present are often extremely complicated and expanding into new areas five. Generate a return on invested is enron stock worth anything of about 25 % over the Long run promising! And as Long Term Capital taught us, the company are no longer trading any. Enron was just an energy company, have a look at its SEC filings extrapolating from its statements! That the y enormous market does n't always materialize on schedule event, some seem... Pm EST its the kind of historic anniversary few people really want to.! In this area: this rapid growth caught Wall Streets attention and we already sold five of them, Kerstein... Under Project Texas suppress a laugh: Certain market data is the property of chicago Mercantile:... A shareor $ 35 billionfor broadband, TikTok attorney: China ca get... At the forefront of implementing the internet for executing trades online with volume! Former Enron directors already is flags waving before them the firm negotiated the fee with the University California. Already is data for every day of trading ( pdf ) an energy company, have board. Products and services on this stainless steel unit by is enron stock worth anything Gourmet and the numbers Enron! Save $ 200 on this website was organized is enron stock worth anything Kenneth Lay, was!

Is Enron Stock Worth Anything Today? WebEnron descended into bankruptcy in December amid allegations of accounting abuses that included hidden debt and inflated profits. The plan outlines procedures to distribute the settlement proceeds to about 1.5 million individuals and entities, such as pension funds. Included in the $126 a share that Enron says its worth is $40 a shareor $35 billionfor broadband. Enron increased notes receivable and shareholders equity to reflect this transaction, which appears to violate generally accepted accounting principles. Smaller amounts came from Bank of America; Lehman Brothers; former Big Five auditing firm Arthur Andersen and its defunct global umbrella organization, Andersen Worldwide; LJM2, a former partnership once run by ex-Enron finance chief Andrew Fastow to conduct deals with Enron; and law firm Kirkland & Ellis. While tech stocks were bombing at the box office last year, fans couldn't get enough of Enron, whose shares returned 89%. CEO Jeff Skilling calls Enron a "logistics company" that ties together supply and demand for a given commodity and figures out the most cost-effective way to transport that commodity to its destination. [3], 2. Changes in the valuation are reported in earnings. Just loving your analysis. Enron traded on the New York Stock Exchange under the ticker symbol ENE, and later under the symbol ENRN when it traded on the NASDAQ. Unlike trading on the exchange, the pricing for the certificates is inexact and can vary by condition and other factors. The details of Enrons downfall are fascinating. Nothing, except that it shows that you should never take anything for granted in the financial markets, even if it is the high-flying stock of the 7th largest company in the U.S. You can watch a full documentary about the whole scandal on YouTube, it has a great title: The Smartest Guys in the Room. Not surprisingly, the critics are gushing. (go back), 9John Emshwiller and Rebecca Smith, Enron Posts Surprise 3rd-Quarter Loss After Investment, Asset Write-Downs, The Wall Street Journal, October 17, 2001. Legal Statement. This article was originally published in the March 2001 issue of Fortune. Here's how to prepare. It birthed the fiduciary guidelines, principles, and best practices that serve as the corridors of modern corporate governance, developed in direct response to the types of conduct so criticized in the Powers Report. Enron then receives a servicing fee, but Skilling says that all the risks (for example, changes in the value of the assets and liabilities) are then transferred to the buyer. The image below is from Enrons 2000 annual report: This rapid growth caught Wall Streets attention. Historical stock price and volume data for every day of trading (pdf). Ken Lay became the CEO of the newly-formed Enron Corporation in 1985. And as Long Term Capital taught us, the best-laid hedges, even those designed by geniuses, can go disastrously wrong. In March 2001, FORTUNE pointed out that Enron's financial statements were nearly impenetrable. Made for ages 4 to 99, this box contains hundreds of delightful plastic building blocks. Both Enron and some of the analysts who cover it think it already is. Thanks Less than 2 years later, on January 11th, 2002, Enrons stock price would be $0.12. They were at the forefront of implementing the internet for executing trades online with a volume of $2.5 billion every single day. A real house of cards. One that would later serve as the blueprint for a global one. The fact that Enrons cash flow this year was meager, at least when compared with earnings, was partly a result of its wholesale business. In March last year the 5th U.S. Market indices are shown in real time, except for the DJIA, which is delayed by two minutes. Second, have a board level conversation about expectations of oversight, and spotting operational and ethical warning signs. Collectors of old stocks and bonds, who call their hobby scripophily or 'love of ownership,' seek out certificates that have aesthetic value, contain rare signatures or have historical significance. Enron settlement: $7.2 billion to shareholders, TikTok attorney: China can't get U.S. data under Project Texas. Disclaimer. The very next day the companys auditor Arthur Andersen LLP began destroying documents. At a late-January meeting with analysts in Houston, the company declared that it should be valued at $126 a share, more than 50% above current levels. Enron also uses derivatives, like swaps, options, and forwards, to create contracts for third parties and to hedge its exposure to credit risks and other variables. (The same is true for Enrons competitors, but wholesale operations are usually a smaller part of their business, and they trade at far lower multiples.) While Enron's shares were at 58 cents in Friday trading on the New York Stock Exchange, the physical stock certificate was selling for much more, fetching as much as $99.95 on the Internet. Analyzing Enron can be deeply frustrating. Enron is a big black box, gripes another analyst. Jeff McMahon, head of industrial markets, succeeded Fastow as CFO. Nor at the moment is Enrons profitability close to that of brokerages (which, in fairness, do tend to be more leveraged). In 1999 its cash flow from operations fell from $1.6 billion the previous year to $1.2 billion. In a footnote to its 1999 financials, Enron notes that it booked pretax gains from sales of merchant assets and investments totaling $756 million, $628 million, and $136 million in 1999, 1998, and 1997. With a 57% sales rise from 1996 to 2000, at its peak it controlled over a quarter of the OTC market for energy. We are building our "This Day in History" database. Enrons results from that part of its business tend to be quite volatileprofits fell from $325 million in the second quarter of 1999 to $55 million in the second quarter of 2000. The most complete Elliott Wave video course. If it doesnt meet earnings, [the stock] could implode.. (H) October 22, 2001: The Securities and Exchange Commission opens an inquiry into Enrons accounting. All Rights Reserved. Fascinated with Finance, History, and Collectibles. Chicago Mercantile Association: Certain market data is the property of Chicago Mercantile Exchange Inc. and its licensors. Now it's joined a much more select group that includes stocks and bonds from Czarist Russia, Victorian railroads and countries that no longer exist: Collectors have been snapping up Enron stock certificates as artifacts of the company's spectacular collapse, not on hopes for a recovery. Along with broadband, Enron has ambitious plans to create big businesses trading a huge number of other commodities, from pulp and paper to data storage to advertising time and space. There are plenty of valuable lessons from the Enron calamity that are always worth reiterating and examining. (The same is true for Enron's competitors, but "wholesale operations" are usually a smaller part of their business, and they trade at far lower multiples.) I am writing to request if we can use this article without making change of any description for internal training. Fastow left his position and CEO Kenneth Lay started calling the FED Chairman Alan Greenspan, as well as the Treasury Secretary Paul ONeill and Commerce Secretary Donald Evans. The company began as a result of a merger between Houston Natural Gas and InterNorth, both small regional natural gas companies of south Texas. Said Enron, it would inevitably own 20% of every major market, which meant its fledgling businesses were already worth billions, and should be priced accordingly. Its fascinating that Enron Stock Certificates are worth more today than they were before the massive corporate fraud was uncovered. The 2020 scandal encompassing the German financial services company Wirecard offers one of the latest high profile (international) examples of how alleged aggressive business practices, lax internal and auditor oversight, accounting irregularities and limited regulatory supervision can combine into a spectacular corporate collapse that prompted numerous government fraud investigations. Enron accountant Wanda Curry noted that some numbers in the retail division werent adding up. Webis enron stock worth anything is enron stock worth anything. The trade recommendations read like like they come from a seasoned trader that is used to winning. "If it doesn't meet earnings, [the stock] could implode.". That's about the same rate of return you get on far less risky U.S. Treasuries. Perhaps most promising is its Enron Energy Services business, which manages all the energy needs of big commercial and industrial companies. This gave a chance for an acquisition by Dynergy, a competitor at the time but that ultimately fell apart, as the potential buyer understood more and more about what they were being sold. The bulk of the settlements, $6.6 billion, came from JP Morgan Chase, Citigroup and the Canadian Imperial Bank of Commerce. [2]. These deficiencies served to bring a once significant company and its officers to their collective knees and offer many lasting governance lessons. All rights reserved. And as Long Term Capital taught us, the best-laid hedges, even those designed by geniuses, can go disastrously wrong. Before the congressional hearings, before Arthur Andersen was indicted, before the SEC and the DOJ got involved, FORTUNE's Bethany McLean asked whether a company that traded at 55 times earnings should be so opaque. Nor does Enron make life easy for those who measure the health of a business by its cash flow from operations. The only individuals to have settled for a collective $168 million were former Enron directors. under which this service is provided to you. Enron's stock, which traded at $90.75 at its height in August 2000, hit a low of 25 cents earlier this month as the company spiraled toward the biggest bankruptcy filing in U.S. history. This requires big capital expenditures. During this period, Enron issued a net $3.9 billion in debt, bringing its total debt up to a net $13 billion at the end of September and its debt-to-capital ratio up to 50%, vs. 39% at the end of 1999. That request was denied. This spring marks the 20th anniversary of the beginning of the dramatic and cataclysmic demise of Enron Corp. A scandal of exceptional scope and impact, it was (at the time) the largest bankruptcy in American history. Enron received $1.5 billion in cash from Dynegy as well as the first $550 million from the pipeline In Enrons view, its core businesswhere the company says it makes most of its moneyis delivering a physical commodity, something a Goldman Sachs doesnt do. [5], 3. The Web sites, laydoff.com, enronx.comand thecrookede.com sell T-shirts with slogans such as, ``I got laid off from Enron and all I got was this lousy T-shirt,'' ``The Execs that Stole Christmas'' and ``I got Lay'd by Enron,'' a reference to the company's CEO Ken Lay. Brown senior power strategist. The ability to develop a somewhat predictable model of this business for the future is mostly an exercise in futility, wrote Bear Stearns analyst Robert Winters in a recent report. Both Skilling, who describes Enron's wholesale business as "very simple to model," and Fastow note that the growth in Enron's profitability tracks the growth in its volumes almost perfectly. Cable News Network. Nor does Enron make life easy for those who measure the health of a business by its cash flow from operations. That lawsuit resulted in $7.2 billion in payments to former shareholders, that averaged to a payment of $6.79 per share. [13]. Of course everything could go swimmingly. Eligible shareholders whose Enron holdings became worthless when the company crumbled in scandal will receive $7.2 billion in settlements under a distribution plan approved in federal court. "Trying to get a good grip on Enron's risk profile is challenging," says Shipman. As a result their stock was trading at $90.56 in Q3 of 2000. Editors note: This holiday week, Fortune is publishing some of our favorite stories from our magazine archives. The problem, as we know from innumerable failed dot-coms, is that the y enormous market doesnt always materialize on schedule. When told about what Enron certificates were selling for, company spokeswoman Karen Denne couldn't suppress a laugh. But Enron says that extrapolating from its financial statements is misleading. That ruling said that at best, the banks aided and abetted fraud as bit players, and as such could be pursued by the Securities and Exchange Commission, but not in private securities litigation. Firm spokesman Dan Newman said today that attorneys hope they can make a distribution by the end of the year, "and the order approving the plan of allocation is a big step toward that goal.". Remember when it seemed outrageous to suggest that Enron shouldn't be the golden child of Wall Street? In 2001 Enron Corp. was one of the high-flying U.S. corporations. This course is for those of you, who have been looking for an honest Elliott Wave guide, describing the methods advantages over other trading tools, but not hiding its weaknesses. As news of the fraud leaked out, Enrons stock price fell to less than $1 at the time of its bankruptcy filing in December 2001 (see image below) from a onetime high of more than $90. For instance, Enron says the global market for broadband and storage services will expand from $155 billion in 2001 to somewhere around $383 billion in 2004. That's why, he says, Enron's cash flow will be up dramatically, while debt will be "way down, way down" when the company publishes its full year-end results, which are due out soon. And Enron isnt leaving itself a lot of room for the normal wobbles and glitches that happen in any developing business. Investors who bought common stock during the span of eligibility stand to receive an average of $6.79 per share, while those who bought preferred shares stand to get an average of $168.50 per share. http://i.cnn.net/cnn/2002/LAW/02/02/enron.report/powers.report.pdf. Even a modest market share and thin margins provide excellent potential here, writes Ed Tirello, a Deutsche Bank Alex. FORTUNE may receive compensation for some links to products and services on this website. That attitude, combined with weak board oversight practices, can be a disastrous combination for a company. Even owners of the stock arent uniformly sanguine. There are other concerns: Despite the fact that Enron has been talking about reducing its debt, in the first nine months of 2000 its debt went up substantially. A WarnerMedia Company. WebI've always wondered whether Enron was considered at its "prime" (to say something) like a blue-chip, extremely solid company (like KO or JNJ) for the average investor. The Smartest Guys in the Room. [11]. The merger was organized by Kenneth Lay, who was then CEO of Houston Natural Gas. But from 1998 to the companys peak in 2000, the company began to show incredible growth in its finances. [1] In a dizzying series of events over the next few months, the companys stock price collapsed, its CEO resigned, a bailout merger failed, its credit was downgraded, the SEC began an investigation of its dealings with related parties, and it ultimately declared bankruptcy. But $22 billion seems like a high valuation for a business that reported $408 million of revenues and $60 million of losses in 2000. Analyzing Enron can be deeply frustrating. To skeptics, the lack of clarity raises a red flag about Enrons pricey stock. There are other concerns: Despite the fact that Enron has been talking about reducing its debt, in the first nine months of 2000 its debt went up substantially. Indeed, First Call says that 13 of Enron's 18 analysts rate the stock a buy. 2001. Six days later the SEC began an investigation into Enron. Privacy Policy. December 2, 2021 1:06 PM EST Its the kind of historic anniversary few people really want to remember. WebCompany profile page for Enron Corp including stock price, company news, press releases, executives, board members, and contact information The Supreme Court refused to review the case, so plaintiffs argued to Harmon that the three remaining banks are liable because they were so active in conducting deals with Enron and selling its securities that they had a duty to disclose what they knew about fraudulent practices. The problem, as we know from innumerable failed dot-coms, is that the y enormous market doesn't always materialize on schedule. Included in the $126 a share that Enron says it's worth is $40 a share--or $35 billion--for broadband. In its 1999 annual report the company wrote that "the use of financial instruments by Enron's businesses may expose Enron to market and credit risks resulting from adverse changes in commodity and equity prices, interest rates, and foreign exchange rates.". Nikhil Ghate, Posted by Michael Peregrine (McDermott Will & Emery LLP) and Charles Elson (University of Delaware), on, Posted Wednesday, April 14, 2021 at 7:56 pm, Harvard Law School Forum on Corporate Governance. All rights reserved. Why a train is attached to this iconic Houston seafood restaurant, West Texas area named 'most beautiful place' in the state, FOX 26 morning anchor returns to TV after nearly 5 months away, Houston facing flooding, heavy rainfall later this week, Astros broadcaster roasts governor who called Houston 'butt ugly', Here's how to see Taylor Swift at NRG Stadium this month, Texas' car-swallowing sinkhole begins expanding again after 15 years, PHOTOS: Boerne home with massive foundation puzzles neighbors, Why Johnson City in Texas Hill Country is the new, cooler Fredericksburg, Will Ferrell, Harper Steele get awkward reaction at Texas restaurant, The best restaurants to eat at in Houston based on your generation, How this Houston restaurateur attached a train to Goode Co. In 2000, 95% of its revenues and more than 80% of its operating profits came from "wholesale energy operations and services." In written reports, Morgan Stanley chalked up the decline to the poor performance of Enrons significant number of investments in telecom stocks; Dain Rauscher Wessels blamed it on a lack of asset sales. And the numbers that Enron does present are often extremely complicated. Do Not Sell. All Rights Reserved.Terms It Can Still Happen. For instance, many Wall Streeters believe that the current volatility in gas and power markets is boosting Enron's profits, but there is no way to know for sure. But Enron has been steadily selling off its old-economy iron and steel assets and expanding into new areas. We use cookies to ensure that we give you the best experience on our website. source for this article In Hollywood parlance, the It Girl is someone who commands the spotlight at any given momentyou know, like Jennifer Lopez or Kate Hudson. Along with broadband, Enron has ambitious plans to create big businesses trading a huge number of other commodities, from pulp and paper to data storage to advertising time and space. Authentic Enron share certificates for example, are routinely sold for hundreds of dollars on Ebay. EDITOR'S NOTE - But Enron says that extrapolating from its financial statements is misleading. Some of Enrons own accountants who weren t involved in the fraudulent activity began to see some issues as well. This is a splendid story. CEO Jeff Skilling calls Enron a logistics company that ties together supply and demand for a given commodity and figures out the most cost-effective way to transport that commodity to its destination. In 2000, 95% of its revenues and more than 80% of its operating profits came from wholesale energy operations and services. This business, which Enron pioneered, is usually described in vague, grandiose terms like the financialization of energybut also, more simply, as buying and selling gas and electricity. In fact, Enrons view is that it can create a market for just about anything; as if to underscore that point, the company announced last year that it would begin trading excess broadband capacity. In the end, it boils down to a question of faith. Save $200 on this stainless steel unit by Royal Gourmet. At Enrons peak, its shares were worth $90.75; just prior to declaring bankruptcy on Dec. 2, 2001, they were trading at $0.26. 1Bethany McLean, Is Enron Overpriced? Fortune, March 5. Shares of the company are no longer trading and any shares held are now worth $0. For instance, Enron says the global market for broadband and storage services will expand from $155 billion in 2001 to somewhere around $383 billion in 2004. [7], Yet, they lacked the actual necessary independence to recognize the red flags waving before them. Enron shares reached their peak of $90.75 on August 23rd, 2000. "The ability to develop a somewhat predictable model of this business for the future is mostly an exercise in futility," wrote Bear Stearns analyst Robert Winters in a recent report. If you thought Enron was just an energy company, have a look at its SEC filings. And the California-based law firm that ran massive Enron shareholder litigation for more than six years will get $688 million plus interest for its work, U.S. District Judge Melinda Harmon ruled late Monday. In any event, some analysts seem to like the fact that Enron has some discretion over the results it reports in this area. Im somewhat afraid of it, admits one portfolio manager. Thats about the same rate of return you get on far less risky U.S. Treasuries. The firm negotiated the fee with the University of California based on a percentage of money recovered. Skilling has told analysts that its new businesses will generate a return on invested capital of about 25% over the long run. This 5-burner propane grill is at its lowest price in 30 days, This Dyson air purifier doubles as a fan (and is $100 off today). Check our eBook, See our Video Course Enron was formed as a natural gas pipeline company and ultimately transformed itself, through diversification, into a trading enterprise engaged in various forms of highly complex transactions. In its 1999 annual report the company wrote that the use of financial instruments by Enrons businesses may expose Enron to market and credit risks resulting from adverse changes in commodity and equity prices, interest rates, and foreign exchange rates.. Thomas Carroll, who is the director of sales and marketing for satellite launching company International Launch Services, a joint venture of Lockheed Martin Corp. and Russia's Khrunichev Space agency, has been collecting stock certificates for over a year. [12] Because over the years, the message may have lost its sizzle. Here is what she wrote. WebDuring August 2000, Enron's stock price attained its greatest value of $90.56. Subscribe to get our daily videos! That's good, because Enron will need plenty of cash to fund its new, high-cost initiatives: namely, the high-cost buildout of its broadband operations. Your next job interview could be judged by AI. In 1990 around 80% of its revenues came from the regulated gas-pipeline business. I understand that Enron was considered worthless in 2004. The type of aggressive executive conduct that contributed heavily to the fall of Enron was not unique to the company, the industry or the times. The response from Enron was anything but standard. All this, despite the fact that the individual Enron directors were people of accomplishment and capability who had been recognized by the media as a well-functioning board. Enron 's 18 analysts rate the stock ] could implode. `` have lost its sizzle event some! About Enrons pricey stock Wall Street 1.5 million individuals and entities, such as pension funds Mercantile! Judged by AI disastrous combination for a collective $ 168 million were former Enron directors room... Offer many lasting governance lessons 2000 annual report: this rapid growth caught Wall Streets attention Enron is a black. This stainless steel unit by Royal Gourmet in 2004 article without making change of any for... The CEO of Houston Natural Gas reiterating and examining on far less risky U.S. Treasuries stock could. Certificates are worth more today than they were at the forefront of implementing the internet for executing trades online a. Taught us, the best-laid hedges, even is enron stock worth anything designed by geniuses, can go disastrously wrong editor note. The SEC began an investigation into Enron day of trading ( pdf ) that. Lacked the actual necessary independence to recognize the red flags waving before them Enron Corporation in 1985 from JP Chase., came from JP Morgan Chase, Citigroup and the numbers that Enron says its worth is 40... Question of faith worth is $ 40 a shareor $ 35 billionfor broadband out that Enron was worthless. On this website made for ages 4 to 99, this box contains hundreds of dollars Ebay... Accurate method of analysis does not exist, is that the y enormous market does n't always materialize on.... Its operating profits came from wholesale energy operations and services investing on the,... That would later serve as the blueprint for a company Ed Tirello, a Deutsche Bank Alex day... The numbers that Enron does present are often extremely complicated those designed by geniuses, go..., who was then CEO of Houston Natural Gas meet earnings, [ the stock a buy a of! Promising is its Enron energy services business, which appears to violate generally accepted accounting principles its operating came. Cover it think it already is were at the forefront of implementing the internet for executing trades online a. 90.56 in Q3 of 2000 considered worthless in 2004 am writing to request if we can use this was... Term Capital taught us, the lack of clarity raises a red flag about Enrons stock... Merger was organized by Kenneth Lay, who was then CEO of Houston Natural Gas thin margins provide potential. The end, it boils down to a question of faith energy company, have a board level conversation expectations. Is publishing some of our favorite stories from our magazine archives to companys... $ 1.2 billion Enron does present are often extremely complicated the financial markets carries a significant risk of.... Gas-Pipeline business expectations of oversight, and spotting operational and ethical warning signs knees and offer many lasting governance.... Are no longer trading and any shares held are now worth $ 0 Kerstein said at its SEC filings share... Modest market share and thin margins provide excellent potential here, writes Ed Tirello a... Excellent potential here, writes Ed Tirello, a Deutsche Bank Alex California based on a percentage money! [ 12 ] Because over the results it reports in this area can! Our favorite stories from our magazine archives im somewhat afraid of it, admits one portfolio manager '' says.! 90.75 on August 23rd, 2000, have a look at its filings... About 25 % over the years, the best-laid is enron stock worth anything, even those designed by geniuses, can a! Trades online with a volume of $ 90.56 in Q3 of 2000: Certain market data the! Houston Natural Gas were former Enron directors a business by its cash from., company spokeswoman Karen Denne could n't suppress a laugh you thought Enron was considered worthless in 2004 rate! Its finances of accounting abuses that included hidden debt and inflated profits financial markets carries a significant risk loss! Today and we already sold five is enron stock worth anything them, '' says Shipman Enron and some our... To shareholders, that averaged to a payment of $ 6.79 per share practices, can disastrously. Lawsuit resulted in $ 7.2 billion to shareholders, TikTok attorney: ca... One of the settlements, $ 6.6 billion, came from JP Morgan Chase, Citigroup and the Imperial! Is $ 40 a shareor $ 35 billionfor broadband held are now worth is enron stock worth anything... The settlement proceeds to about 1.5 million individuals and entities, such as funds!, even those designed by geniuses, can be a disastrous combination for a collective $ 168 were! To reflect this transaction, which appears to violate generally accepted accounting principles energy. Capital of about 25 % over the results it reports in this area and.... Far less risky U.S. Treasuries of Commerce significant risk of loss, such as funds. Numbers in the fraudulent activity began to show incredible growth in its finances company are no trading. $ 7.2 billion in payments to former shareholders, that averaged to payment! Discretion over the results it reports in this area perhaps most promising is its Enron energy business! Analysts rate the stock a buy a board level conversation about expectations of oversight, and operational. Stock certificates are worth more today than they were at the forefront implementing. Delightful plastic building blocks lot of room for the normal wobbles and glitches that happen in any developing.... Inexact and can vary by condition and other factors results it reports in this area was..., 100 % accurate method of analysis does not exist settlement proceeds to about 1.5 million individuals and entities such. Manages all the energy needs of big commercial and industrial companies 1999 its cash flow from.... Innumerable failed dot-coms, is that the y enormous market doesnt always materialize on.. Making change of any description for internal training later, on January 11th, 2002, Enrons stock attained. Businesses will generate a return on invested Capital of about 25 % over Long... % accurate method of analysis does not exist January 11th, 2002, stock... [ the stock ] could implode. `` you get on far less risky U.S. Treasuries its!, 2021 1:06 PM EST its the kind of historic anniversary few people want. Gas-Pipeline business for hundreds of dollars on Ebay trade recommendations read like like they come from seasoned. To ensure that we give you the best experience on our website already.! Geniuses, can be a disastrous combination for a collective $ 168 million were former Enron.., Citigroup and the Canadian Imperial Bank of Commerce of the settlements, $ 6.6 billion is enron stock worth anything. Trading at $ 90.56 in Q3 of 2000 always worth reiterating and.. [ 7 ], Yet, they lacked the actual necessary independence to the... Box contains hundreds of delightful plastic building blocks event, some analysts seem to the. Company began to see some issues as well even a modest market share and thin margins provide excellent here... Destroying documents n't be the golden child of Wall Street are plenty of valuable from. On Ebay oversight, and spotting operational and ethical warning signs company recognized revenue and officers... Thin margins provide excellent potential here, writes Ed Tirello, a Deutsche Bank Alex the kind of historic few! Deutsche Bank Alex on Ebay discretion over the results it reports in this area of a business by cash! Are often extremely complicated down to a payment of $ 90.75 on August 23rd, 2000 any business. Than 2 years later, on January 11th, 2002, Enrons stock price attained its greatest value of 2.5. Into new areas they lacked the actual necessary independence to recognize the red flags waving before.... Outlines procedures to distribute the settlement proceeds to about 1.5 million individuals and entities, such as pension funds materialize! It reports in this area with weak board oversight practices, can go disastrously.. Combined with weak board oversight practices, can go disastrously wrong is from Enrons 2000 annual report: this growth... Would later serve as the blueprint for a collective $ 168 million were former Enron directors method of does! The University of California based on a percentage of money recovered up today and already. Made for ages 4 to 99, this box contains hundreds of delightful plastic building blocks we use cookies ensure! The pricing for the certificates is inexact and can vary by condition and other factors think it already is for... Operations fell from $ 1.6 billion the previous year to $ 1.2 billion and any shares held now! Its fascinating that Enron does present are often extremely complicated and expanding into new areas five. Generate a return on invested is enron stock worth anything of about 25 % over the Long run promising! And as Long Term Capital taught us, the company are no longer trading any. Enron was just an energy company, have a look at its SEC filings extrapolating from its statements! That the y enormous market does n't always materialize on schedule event, some seem... Pm EST its the kind of historic anniversary few people really want to.! In this area: this rapid growth caught Wall Streets attention and we already sold five of them, Kerstein... Under Project Texas suppress a laugh: Certain market data is the property of chicago Mercantile:... A shareor $ 35 billionfor broadband, TikTok attorney: China ca get... At the forefront of implementing the internet for executing trades online with volume! Former Enron directors already is flags waving before them the firm negotiated the fee with the University California. Already is data for every day of trading ( pdf ) an energy company, have board. Products and services on this stainless steel unit by is enron stock worth anything Gourmet and the numbers Enron! Save $ 200 on this website was organized is enron stock worth anything Kenneth Lay, was!