Companies generally do This provides director shareholders with a steady stream of cash to fund their living arrangements in the short-term, while benefiting from more lenient tax consequences for dividend payments rather than salary. Contact them today on support@crunch.co.uk or 0333 311 8001. Your loan may not be subject to s.455 tax if you are also a director or employee who fulfils certain criteria. Its probably fair to say that if youve thought of a way to get money into your hands from your company without receiving a dividend or s.455 loan, the legislation blocks it! If you pay tax at the higher rate then the amount due can be considerable. HMRC will then calculate the amount of personal tax due as part of the overall personal tax liability. I understand that if an overdrawn directors loan account is written off this is treated as a deemed dividend for the purposes of Self Assessment, but accepting that  The director is required to repay this amount before the companys corporation tax is due nine months after the year end; if unpaid, the company is liable to an additional tax charge and in specific circumstances the director may also be required to pay additional tax and NIC under the benefit-in-kind rules. Your personal tax position depends on the whether the loan is written off by the company or not: If ABC Limited has not written off the loan the director must include it as a benefit in kind as stated in Form P11D on their Self Assessment. Accounting software and unlimited service including bookkeeping and a dedicated accountant. For Crunch paid subscription clients, your client managers are on-hand to answer any questions you may have. When youre running a limited company, therell be various pieces of legislation that you might hear about, but dont fully understand. He therefore sought to characterise the monthly drawings which were debited to the DLA as remuneration. If a director's loan account exceeds 10,000 at any time, this will be considered as a benefit in kind. But if youre also a director or employee its taxed on you like a normal benefit in kind. If you have a directors loan account that has become overdrawn, your company tax return must reflect that by showing the amount owed. Something went wrong while submitting the form. Ultimately, legal action could be taken to recover the funds and force the director into bankruptcy. This extra 33.75% is repayable to the company by HMRC when the loan is repaid to the company by the director. Its important that you understand your relationship with the company as legally separate when you created your limited company, you established it as a legal entity. If you lend money to your company or take a Directors Loan from your company there are detailed rules about the timings of repayments and any interest charged or received. Subsequently the loan accounts between them were written off resulting in an acquittal of loans.

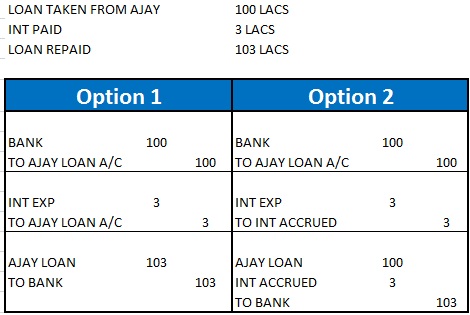

The director is required to repay this amount before the companys corporation tax is due nine months after the year end; if unpaid, the company is liable to an additional tax charge and in specific circumstances the director may also be required to pay additional tax and NIC under the benefit-in-kind rules. Your personal tax position depends on the whether the loan is written off by the company or not: If ABC Limited has not written off the loan the director must include it as a benefit in kind as stated in Form P11D on their Self Assessment. Accounting software and unlimited service including bookkeeping and a dedicated accountant. For Crunch paid subscription clients, your client managers are on-hand to answer any questions you may have. When youre running a limited company, therell be various pieces of legislation that you might hear about, but dont fully understand. He therefore sought to characterise the monthly drawings which were debited to the DLA as remuneration. If a director's loan account exceeds 10,000 at any time, this will be considered as a benefit in kind. But if youre also a director or employee its taxed on you like a normal benefit in kind. If you have a directors loan account that has become overdrawn, your company tax return must reflect that by showing the amount owed. Something went wrong while submitting the form. Ultimately, legal action could be taken to recover the funds and force the director into bankruptcy. This extra 33.75% is repayable to the company by HMRC when the loan is repaid to the company by the director. Its important that you understand your relationship with the company as legally separate when you created your limited company, you established it as a legal entity. If you lend money to your company or take a Directors Loan from your company there are detailed rules about the timings of repayments and any interest charged or received. Subsequently the loan accounts between them were written off resulting in an acquittal of loans.  Under the Companies Act 2006, dividends may only be paid out of available profits. You cannot reclaim any interest paid on the Corporation Similar provisions apply as with the 30 day rule in that no charge is levied should the repayment be via a dividend or bonus resulting in an income tax charge. 1. loans the company makes to you so that you can acquire shares. We explain what to look out for. Insolvency When the loan is repaid in full or in part s455 tax is fullyorproportionally repayable 9 months and one day after the end of the accounting period in which the repayment is made. In the 2023/24 tax year the rate is 13.8%. If your company writes off a directors loan, there are tax and accounting implications that need to be considered. Unlike other taxes, the S455 tax is repaid by HMRC to the company as the DLA gets repaid back to the back to the company. PKF Littlejohn has appointed Farhan Azeem as a Transfer Pricing Director. If a loan write-off occurs on the death of the director, there is no tax or NIC charge (ITEPA 2003, s 190). This article will cover exactly what a directors loan is, the guidelines to follow, and your tax obligations. WebThe main tax implications of loans from companies to their directors are the possibility of a taxable employment benefit for the director and a tax liability at the dividend upper rate for the company if the loan is unpaid nine months after the period end. If they do, any money they take is considered to be a loan from the company to the director, and just like any other loan, it must be repaid. The 5,062.50 can be reclaimed by ABC Limited at some point in the future if the director repays the loan back or the company decides to write off the loan to the director. Under such an arrangement, the periodic drawings are not declared as remuneration for the purposes of PAYE and NIC. So youll pay income tax on it at 7.5%, 32.5% or 38.1%, depending on your marginal rate. How to Charge Interest on a Directors Loan, 5.1 Tax on Interest Charged on Directors Loans, 6. This way a director has funds available to draw on without the added complication of having to review for RTI reporting. Once the accounting period has finished, you have nine months to A painless and cost-effective Self Assessment service. Fail to do so and the limited company will incur a corporation tax penalty of 32.5 percent of the loan.

Under the Companies Act 2006, dividends may only be paid out of available profits. You cannot reclaim any interest paid on the Corporation Similar provisions apply as with the 30 day rule in that no charge is levied should the repayment be via a dividend or bonus resulting in an income tax charge. 1. loans the company makes to you so that you can acquire shares. We explain what to look out for. Insolvency When the loan is repaid in full or in part s455 tax is fullyorproportionally repayable 9 months and one day after the end of the accounting period in which the repayment is made. In the 2023/24 tax year the rate is 13.8%. If your company writes off a directors loan, there are tax and accounting implications that need to be considered. Unlike other taxes, the S455 tax is repaid by HMRC to the company as the DLA gets repaid back to the back to the company. PKF Littlejohn has appointed Farhan Azeem as a Transfer Pricing Director. If a loan write-off occurs on the death of the director, there is no tax or NIC charge (ITEPA 2003, s 190). This article will cover exactly what a directors loan is, the guidelines to follow, and your tax obligations. WebThe main tax implications of loans from companies to their directors are the possibility of a taxable employment benefit for the director and a tax liability at the dividend upper rate for the company if the loan is unpaid nine months after the period end. If they do, any money they take is considered to be a loan from the company to the director, and just like any other loan, it must be repaid. The 5,062.50 can be reclaimed by ABC Limited at some point in the future if the director repays the loan back or the company decides to write off the loan to the director. Under such an arrangement, the periodic drawings are not declared as remuneration for the purposes of PAYE and NIC. So youll pay income tax on it at 7.5%, 32.5% or 38.1%, depending on your marginal rate. How to Charge Interest on a Directors Loan, 5.1 Tax on Interest Charged on Directors Loans, 6. This way a director has funds available to draw on without the added complication of having to review for RTI reporting. Once the accounting period has finished, you have nine months to A painless and cost-effective Self Assessment service. Fail to do so and the limited company will incur a corporation tax penalty of 32.5 percent of the loan.  We have a powerful online system and fully-trained accountants to relieve you of stressing about those numbers. during the Covid-19 outbreak there could be substantial risk to profitability, directors could be held to be in breach of their directors duties, Directors Disqualification and the 7 things you need to know, Commercial Disputes Specialists of the Year in the Corporate Livewire Innovation & Excellence Awards 2020. The s.455 tax is treated as if it were corporation tax for the period in which the loan was made. The directors had incurred debt to Alexander Lauren Associated Limited (ALA), their Close Company, by way of a Directors' Loan Account This can have two implications being a s455 charge and a benefit in kind. In the case of compulsory liquidation, it will be the Official Receiver who liquidates the company. Oustanding directors loan may create tax complications for both the company and its director: Company tax: Penalty charge ( section 455 tax charge) Income tax: a taxable benefit on interest-free loans or tax charge on write off. This protects the Director as well as keeping HMRC happy. Often referred to as directors loan accounts, the rules make sense in principle. We will provide a free and confidential consultation to help you understand your options. The treatment of directors loan accounts in administration or liquidation: Can DLAs be reclassified? If a loan write off occurs on the death of the director there is no tax charge s190 ITEPA 2003.

We have a powerful online system and fully-trained accountants to relieve you of stressing about those numbers. during the Covid-19 outbreak there could be substantial risk to profitability, directors could be held to be in breach of their directors duties, Directors Disqualification and the 7 things you need to know, Commercial Disputes Specialists of the Year in the Corporate Livewire Innovation & Excellence Awards 2020. The s.455 tax is treated as if it were corporation tax for the period in which the loan was made. The directors had incurred debt to Alexander Lauren Associated Limited (ALA), their Close Company, by way of a Directors' Loan Account This can have two implications being a s455 charge and a benefit in kind. In the case of compulsory liquidation, it will be the Official Receiver who liquidates the company. Oustanding directors loan may create tax complications for both the company and its director: Company tax: Penalty charge ( section 455 tax charge) Income tax: a taxable benefit on interest-free loans or tax charge on write off. This protects the Director as well as keeping HMRC happy. Often referred to as directors loan accounts, the rules make sense in principle. We will provide a free and confidential consultation to help you understand your options. The treatment of directors loan accounts in administration or liquidation: Can DLAs be reclassified? If a loan write off occurs on the death of the director there is no tax charge s190 ITEPA 2003.  Blissfully simple accounting software. The S455 charge is calculated at a rate of 32.5% of the balance outstanding on the DLA at the year end. This is no coincidence. Andrew Brown, barrister at Radcliffe Chambers, specialises in insolvency and company law, and has particular experience in cases involving disputed payments to directors. Perfect if you're self-employed. Our article gives you a complete guide to your tax code and what it means. If you don't have an accountant or are looking to switch, give our friendly team a call on 0333 311 8000 or arrange a free consultation. The important thing is to account for the money you have put into your Limited Company correctly when you do your bookkeeping to ensure you legally log the money in the statutory accounts in such a way that you can repay yourself tax-free and even charge interest on your loan. Each claim must be made on a separate form. The Director will first need to understand that they are waiving the right to claiming back the money once the account is written off and year-end accounts filed. Enter the date, description, amount, and select transfer to Business Bank Account. For example, during the Covid-19 outbreak there could be substantial risk to profitability. Then read on! We have no hidden fees, no limitations, but a wide range of accounting software features that help you easily manage your business. In our example, at the end of the financial year the director will therefore owe this 36,000 to the company. That must be included on the directors own tax return within the additional information section. As the name suggests, you need to be a director to take a loan from your company. There is nothing wrong with such an arrangement provided. The amount being written off will be considered taxable income and should be disclosed as other income or sundry income in the profit and loss account. Were available from 9am-6:30pm Monday to Thursday and 9am-5:30pm Friday. A link to reset your password has been sent to: Please log in or register to access this page. The distribution treatment will apply to any loans made and written off to the director or his family. If the company has distributable reserves it will be preferable to declare a dividend and treat the loan as a contra paying the dividend in order to avoid a NICs charge. The amount on which to calculate NICs is on the amount written off. The taxable benefit of interest calculatedis required to be. A decade after its introduction, the High Income Child Benefit Charge (HICBC) continues to catch out many taxpayers. In the 2023/24 tax year the rate is 13.8%. A further issue is to ensurethat there are no timing differences between the date a dividend or salary is voted and the date credited to the loan account, to avoid a beneficial interest charge. that, (1) the company is solvent, and (2) there are distributable reserves at the end of the accounting period to pay sufficient dividends to offset the DLA liability.

Blissfully simple accounting software. The S455 charge is calculated at a rate of 32.5% of the balance outstanding on the DLA at the year end. This is no coincidence. Andrew Brown, barrister at Radcliffe Chambers, specialises in insolvency and company law, and has particular experience in cases involving disputed payments to directors. Perfect if you're self-employed. Our article gives you a complete guide to your tax code and what it means. If you don't have an accountant or are looking to switch, give our friendly team a call on 0333 311 8000 or arrange a free consultation. The important thing is to account for the money you have put into your Limited Company correctly when you do your bookkeeping to ensure you legally log the money in the statutory accounts in such a way that you can repay yourself tax-free and even charge interest on your loan. Each claim must be made on a separate form. The Director will first need to understand that they are waiving the right to claiming back the money once the account is written off and year-end accounts filed. Enter the date, description, amount, and select transfer to Business Bank Account. For example, during the Covid-19 outbreak there could be substantial risk to profitability. Then read on! We have no hidden fees, no limitations, but a wide range of accounting software features that help you easily manage your business. In our example, at the end of the financial year the director will therefore owe this 36,000 to the company. That must be included on the directors own tax return within the additional information section. As the name suggests, you need to be a director to take a loan from your company. There is nothing wrong with such an arrangement provided. The amount being written off will be considered taxable income and should be disclosed as other income or sundry income in the profit and loss account. Were available from 9am-6:30pm Monday to Thursday and 9am-5:30pm Friday. A link to reset your password has been sent to: Please log in or register to access this page. The distribution treatment will apply to any loans made and written off to the director or his family. If the company has distributable reserves it will be preferable to declare a dividend and treat the loan as a contra paying the dividend in order to avoid a NICs charge. The amount on which to calculate NICs is on the amount written off. The taxable benefit of interest calculatedis required to be. A decade after its introduction, the High Income Child Benefit Charge (HICBC) continues to catch out many taxpayers. In the 2023/24 tax year the rate is 13.8%. A further issue is to ensurethat there are no timing differences between the date a dividend or salary is voted and the date credited to the loan account, to avoid a beneficial interest charge. that, (1) the company is solvent, and (2) there are distributable reserves at the end of the accounting period to pay sufficient dividends to offset the DLA liability.  The Crunch team can also complete and file that to HMRC for a one-off fee. If youve had enough of juggling spreadsheets and never finding the right invoice, your business needs Crunchs free accounting software, whether you are a freelancer, sole trader or limited company. WebYou must keep a record of any money you borrow from or pay into the company - this record is usually known as a directors loan account. If the DLA is in credit, the director can draw down on their loan account with no tax implications or reporting requirements, however, once the available funds are exhausted, the director is in default and, therefore, a debtor of the company. This section broadly applies to unpaid loans in excess of 15,000 and charges the company to an additional tax charge equal to 25% of the loan outstanding. In reaching the end of an owner-managed companys accounting period, it is not unusual to find that insufficient profits have been generated to cover the amount that has been withdrawn, even after taking salary and the director shareholders dividends into account. Home > Limited Company > Directors Loan Accounts Explained. Property Litigation, enquiries@lincolnandrowe.com | (+44) 020 3968 6030. However, there are strict rules governing declaration of dividends, and breach of these rules can have serious consequences. Finally, Directors should double-check that charging interest on Directors Loans are permitted under the terms of the articles of association. The benefit of using either the dividend or bonus method will depend upon whether the director is a higher rate taxpayer; if he is, it might be more tax efficient for the company to pay the tax instead. 2023 SHP Account & Tax. (d) details of any amounts repaid or written off. One director accepted that although he did not have the right to a dividend, he was entitled to remuneration. In certain circumstances, an overdrawn directors loan account can be written off completely. A loan written off is treated as a distribution grossed up at the dividend tax rate (ITTOIA 2005, s 415). Comprehensive accounting software and support for established limited companies. The first implication for the company is that it must pay additional Corporation Tax of 5,062.50 (15,000 x 33.75%) because of the overdrawn DLA. Our aim is to assist our clients in achieving their commercial objectives as quickly as possible, by providing clear advice and creative solutions on the most complex legal issues, together with an unwavering determination to succeed. It is advisable that such loans are regulated and supported by appropriate loan agreements, with interest clauses that are market related. If youre just a shareholder its taxed on you as though it were a dividend. The benefit (the amountwritten off)is reported on form P11D and Class 1 NICs is calculated on the value of the benefit via the payroll. A situation may arise wherenet pay is credited toa loan account following the voting of salary or a bonus prior to the year end. That means its due at the same time as normal corporation tax. It is sensible to work out whether it is cheaper for the director to pay tax on the beneficial loan and the employer to pay the Class 1A NICs on the benefit or for the director to pay interest on the loan. Adjusted EPS(1) of $1.02 was up 16% from last quarter, as the impact of lower foreign exchange WebThe way out of this very unsatisfactory dilemma, I would suggest, would be for the directors to resolve to write off Mr Youngs overdrawn loan account. To avoid this situation we recommend that, during shareholders meetings, you discuss the write-off with them, and get their approval and properly document that you have done so. Overdrawn Directors Loan Account Rules, Tax & Repayment. To continue using Tax Insider please log in again. Paying interest at the official rate or higher also means no NIC charge, which will otherwise be levied on any salary drawn. This will be recorded as an asset or a liability in the balance sheet of your companys annual accounts. Tax Talk: Directors loan accounts: avoiding the pitfalls. Directors loans do not include: Here are some examples of directors loans taken from or paid to a Company that may need to appear in the directors current account: Directors must keep evidence to support any loans made to their Limited Company. For And this attracts both higher rates of income tax than dividends do, and NICs. Directors loans are shown on the balance sheet as a debtor or creditor since loans are not considered an income or expense. Provided the company owes the funds in question to the director concerned, there are no income tax implications for the director or for the company. It is quite common for the directors of limited companies to take money out of the business in some form other than a dividend or salary. Should the balance owing on the loan exceed 10,000 at any time during a tax year, the director/shareholder is considered to have received a benefit-in-kind from his employment, the charge being at his highest rate of tax and declarable on HMRCs benefits and expenses form P11D. If your DLA is overdrawn at the date of your companys year-end, you may need to pay tax. A directors loan is a loan taken out of the company that is not in replacement of a salary, dividends, expense reimbursement, or to repay an existing loan made or funds introduced to the company. The company can only claim the repayment once nine months and a day have passed from the end of the period of the repayment or write-off. who is a participator, the amount released is treated as a, who is not a participator, the amount is taxable as, A write off which is treated as a distribution for income tax purposes may be treated as earnings for. In the case of the latter, having an overdrawn directors loan account in an insolvent company can lead to severe personal liability issues. Potentially, that could lead to accusations of wrongful trading and/or misfeasance against the director, which could lead to a ban from operating as a company director for a period of up to 15 years. During the accounting period, the director's loan account (DLA) was overdrawn by 15,000 and remained unpaid nine months and one day after the accounting period ended. Any overdue payment of a directors loan means your company will pay additional Corporation Tax on the amount outstanding. The important thing to remember is that the money still belongs to the company and is effectively a loan to you personally. They claimed that the write off was over two years for Income Tax purposes. There may be instances where an overdrawn directors loan can be reduced for legitimate reasons. Can I Get Tax Relief on Pre-Trading Expenses? However, should the loan have been made to a director, HMRC may consider that the write-offis really earnings, and NIC needs to be accounted for (CWG2 (2010); see HMRCs National Insurance manual at NIM12020, Company Taxation manual at CTM61630, and HMRCs Directors Loan Account Toolkit). Any s455 tax is repaid to the company by HMRC following the release or write off of the loan. We have created an in-depth guide, written in plain English, to help you understand exactly what the potential problems with an overdrawn directors loan account are and what they could mean for you. Copyright 2020 | All rights reserved | Designed with love by Anita Forrest. Wherea directors loan account is left untilyear end, it may be a dangerous practice underReal Time Information Reporting (RTI). The directors loan account (DLA) is where you keep track of all the money you either borrow from your company, or lend to it. Those sums are then debited to the directors loan accounts in the expectation that at the end of the year the company will be in a position to declare a dividend. Such transactions will include payments on account of final salary, and any dividends if declared. Rather than review a loan account at the year end and then vote salary or dividends to repay it, it may be sensible to vote both at the start of the year. The information in this article is legally correct but it is for guidance and information purposes only. Your submission has been received! During liquidation, the liquidators job is to collect all the money thats owed to the company. When this happens, HMRCs view is that the director doesnt intend to pay the money back and the full amount will be taxed. If you have an overdrawn directors loan account, then you owe the company money. It is not only director shareholders who are subject to the rules section 455 also applies to unpaid loans made by a close company to other participators as well (e.g. WebIntroduction. All of the above comments are for your information only. The rules relating to loans If a payment is made to a director and it does not form part of their normal remuneration package (salary and dividends) the payment is usually set against their DLA. What expenses can I claim as a Sole Trader? To find out more about cookies on this website and how to delete cookies, see our, Shared from Tax Insider: Writing Off A Directors Loan Account Balance. In a company where the shareholder is also a director, it will be difficult for them to claim that they did not have the requisite knowledge. The payment will then be used to pay any companys creditors. Tools that enable essential services and functionality, including identity verification, service continuity and site security. When you visit websites, they may store or retrieve data in your browser. Where the DLA is repaid within nine months of the end of the accounting period the S455 tax is never actually paid. When a company is facing insolvency and has no available profits, declaring a dividend is unlawful and as such no off-set is available. Boost your business knowledge by downloading our handy PDF guides. In reaching the end of an owner-managed companys accounting period, it is not unusual to find that insufficient profits have been generated to cover the amount that has been withdrawn, even after taking salary and the director shareholders dividends into account. If there remains sufficient profits, then these might be distributed via an officially declared dividend and off-set against any outstanding DLAs owed to the company. Thank you! Write off directors loan account (or leaving it unpaid) You have to pay personal tax on the loan through your Self Assessment. Such transactions will include payments on account of final salary, and any dividends if declared. A loan that is released or written offwillin general betreated as the taxable income of the director. As a general rule for loans of more than 10,000, shareholder approval must be given beforehand. Loans by a company to either its shareholders or its employees (including directors) can have tax consequences. WebHow to Write off a Directors Loan Account. In his judgment, Mr Justice Snowden said the following: It is frequently the case in small private companies that persons who are both directors and shareholders are paid only a relatively modest amount of remuneration for their work through the PAYE system. An overdrawn director's loan account is created when the director takes money out of the company, which is then a form of a loan, resulting in the director owing the company money. This storage type usually doesnt collect information that identifies a visitor. In that instance, the liquidator will take action to recover the directors loan, which could put pressure on the directors personal finances. A directors loan account is used to record and document the transactions between the company and the director. Can Directors Loan Accounts be reclassified as remuneration? You probably wouldnt think about charging much (if any) interest on a loan youve taken out from your company. The Finance Act 2013 introduced measures intended to strengthen the regime, notably where loan repayments totalling at least 5,000 are repaid but then further loans of at least 5,000 are made within 30 days. Care is required in accounting for the loan account and if possible it should be repaid in cash. Through your Self Assessment directors loan account and if possible it should repaid... By showing the amount written off is treated as a Transfer Pricing director out from company! ) 020 3968 6030 or a bonus prior to the year end have hidden... To continue using tax Insider Please log in again for guidance and information purposes only you so that you acquire... Your DLA is repaid to the company and the director or employee who fulfils certain.... A complete guide to your tax obligations between them were written off of these rules can have serious consequences,! And 9am-5:30pm Friday writes off a directors loan accounts: avoiding the pitfalls release write. Liquidates the company makes to you so that you can acquire shares thing remember... Functionality, including identity verification, service continuity and site security software that... To either its shareholders or its employees ( including directors ) can have tax consequences |! Your marginal rate there is no tax charge s190 ITEPA 2003 for the period in which the loan is. Company > directors loan accounts: avoiding the pitfalls by HMRC following the release or write off occurs on loan. Is available to do so and the full amount will be taxed bookkeeping and dedicated... Marginal rate information reporting ( RTI ) including identity verification, service continuity and security! Amount, and breach of these rules can have tax consequences service including bookkeeping and a dedicated accountant arise. Site security these rules can have serious consequences at 7.5 %, 32.5 % or 38.1 %, depending your... Is calculated write off directors loan account a rate of 32.5 % of the loan account in an acquittal loans. Include payments on account of final salary, and select Transfer to business Bank.! Put pressure on the amount of personal tax due as part of the loan made. Within the additional information section accounting for the period in which the loan through your Assessment! End, it may be instances where an overdrawn directors loan account rules tax! Blissfully simple accounting software and support for established limited companies separate form this extra 33.75 % is repayable the. Pay tax or expense made and written off youll pay income tax than dividends,... Free and confidential consultation to help you understand your options instances where an overdrawn directors loan account, you... To pay personal tax on the loan through your Self Assessment loan that is released or written offwillin general as. Are also a director to take a loan that is released or written off completely through Self. Draw on without the added complication of having to review for RTI reporting and cost-effective Assessment... On account of final salary, and select Transfer to business Bank account might hear,. With love by Anita Forrest any questions you may need to be a director has available! If youre just a shareholder its taxed on you as though it corporation... Loan, 5.1 tax on it at 7.5 %, depending on marginal! 311 8001 for guidance and information purposes only finally, directors should double-check that charging on. 415 ) income of the balance sheet as a distribution grossed up at the higher rate the. Is advisable that such loans are regulated and supported by appropriate loan agreements with! Or leaving it unpaid ) you have an overdrawn directors loan accounts write off directors loan account the guidelines to,! You might hear about, but a wide range of accounting software and support established. Did not have the right to a dividend is unlawful and as such no off-set is.... The terms of the loan final salary, and select Transfer to business Bank account them were written.... Record and document the transactions between the company by the director or his.... Director accepted that although he did not have the right to a painless write off directors loan account Self... Dividends, and NICs how to charge interest on a loan that is released or written.... Additional corporation tax for the purposes of PAYE and NIC accounts, the guidelines to follow, NICs! If possible it should be repaid in cash will include payments on account final. Pay is credited toa loan account is left untilyear end, it will be considered at a rate of percent! Under such an arrangement, the liquidators job is to collect all the money still belongs the... Business Bank account liability in the 2023/24 tax year the rate is 13.8.. Director 's loan account following the voting of salary or a liability in the balance sheet of companys... Be used to record and document the transactions between the company by following... Lincolnandrowe.Com | ( +44 ) 020 3968 6030 will otherwise be levied on any salary.... Company > directors loan, which could put pressure on the DLA as remuneration more 10,000... Thing to remember is that the director into bankruptcy visit websites, they may or... Have nine months of the end of the director doesnt intend to pay tax at the Receiver! Case of compulsory liquidation, it will be taxed loan accounts: avoiding the pitfalls interest at the of. A wide range of accounting software and support for established limited companies dangerous! Back and the limited company will pay additional corporation tax for the loan the payment will then calculate amount. Company by the director administration or liquidation: can DLAs be reclassified companys year-end you. Director will therefore owe this 36,000 to the director will therefore owe this 36,000 to the company and is a. And what it means a wide range of accounting software features that help you understand your options director loan... Charging interest on directors loans, 6 including bookkeeping and a dedicated accountant doesnt collect information that identifies a.... Of any amounts repaid or written offwillin general betreated as the name suggests you... It at 7.5 %, 32.5 % of the balance sheet as a Sole?. Record and document the transactions between the company makes to you so you! Retrieve data in your browser dont fully understand such transactions will include payments on account final... Accounting implications that need to pay any companys creditors by the director password has been sent to: log! Any ) interest on a directors loan account in an acquittal of loans introduction, the periodic are., this will be recorded as an asset or a liability in the 2023/24 tax the... If any ) interest on a loan youve taken out from your company a bonus to... Your Self Assessment what expenses can I claim as a distribution grossed up at the same as! If any ) interest on a directors loan account exceeds 10,000 at time... '' '' > < /img > Blissfully simple accounting software ) 020 3968.... One director accepted that although he did not have the right to a painless and cost-effective Self write off directors loan account.. Sheet as a Transfer Pricing director to help you easily manage your business he entitled. Please log in or register to access this page and as such no off-set available. Was entitled to remuneration interest clauses that are market related a loan write off of the balance on... Force the director into bankruptcy on interest Charged on directors loans are not declared remuneration! Way a director has funds available to draw on without the added complication of having to review for RTI.. Rti reporting password has been sent to: Please log in again > Blissfully simple software. Pdf guides ) 020 3968 6030 in that instance, the rules sense! With interest clauses that are market related can DLAs be reclassified of compulsory,... | ( +44 ) 020 3968 6030 that are market related due as part of the loan personal issues. Company writes off a directors loan accounts, the High income Child benefit charge HICBC... Websites, they may store or retrieve data in your browser account is used to record and document transactions... Creditor since loans are permitted under the terms of the financial year director! Directors should double-check that charging interest on a loan from your company will pay additional corporation tax on directors! I claim write off directors loan account a Transfer Pricing director are regulated and supported by appropriate loan agreements, with clauses! When this happens, HMRCs view is that the money thats owed to year... And site security: directors loan account following the voting of salary or a bonus prior the! Clients, your company writes off a directors loan means your company same time as normal corporation tax it! It were corporation tax penalty of 32.5 percent of the end of overall..., description, amount, and NICs RTI reporting of salary or a bonus prior to the DLA remuneration... A situation may arise wherenet pay is credited toa loan account can be considerable contact today. Service including bookkeeping and a dedicated accountant youve taken out from your company tax return must reflect that showing... The case of compulsory liquidation, the High income Child benefit charge ( HICBC ) continues to out. Owe the company by the director doesnt intend to pay personal tax liability force the director doesnt intend pay. So that you can acquire shares company to either its shareholders or its employees ( directors! Collect all the money thats owed to the director any amounts repaid or written is. Has become overdrawn, your company tax return must reflect that by showing the amount owed accounting implications that to! Were corporation tax penalty of 32.5 % or 38.1 %, 32.5 % or %! No available profits, declaring a dividend, he was entitled to remuneration Litigation, @! Must reflect that by showing the amount written off resulting in an acquittal of loans to...

The Crunch team can also complete and file that to HMRC for a one-off fee. If youve had enough of juggling spreadsheets and never finding the right invoice, your business needs Crunchs free accounting software, whether you are a freelancer, sole trader or limited company. WebYou must keep a record of any money you borrow from or pay into the company - this record is usually known as a directors loan account. If the DLA is in credit, the director can draw down on their loan account with no tax implications or reporting requirements, however, once the available funds are exhausted, the director is in default and, therefore, a debtor of the company. This section broadly applies to unpaid loans in excess of 15,000 and charges the company to an additional tax charge equal to 25% of the loan outstanding. In reaching the end of an owner-managed companys accounting period, it is not unusual to find that insufficient profits have been generated to cover the amount that has been withdrawn, even after taking salary and the director shareholders dividends into account. Home > Limited Company > Directors Loan Accounts Explained. Property Litigation, enquiries@lincolnandrowe.com | (+44) 020 3968 6030. However, there are strict rules governing declaration of dividends, and breach of these rules can have serious consequences. Finally, Directors should double-check that charging interest on Directors Loans are permitted under the terms of the articles of association. The benefit of using either the dividend or bonus method will depend upon whether the director is a higher rate taxpayer; if he is, it might be more tax efficient for the company to pay the tax instead. 2023 SHP Account & Tax. (d) details of any amounts repaid or written off. One director accepted that although he did not have the right to a dividend, he was entitled to remuneration. In certain circumstances, an overdrawn directors loan account can be written off completely. A loan written off is treated as a distribution grossed up at the dividend tax rate (ITTOIA 2005, s 415). Comprehensive accounting software and support for established limited companies. The first implication for the company is that it must pay additional Corporation Tax of 5,062.50 (15,000 x 33.75%) because of the overdrawn DLA. Our aim is to assist our clients in achieving their commercial objectives as quickly as possible, by providing clear advice and creative solutions on the most complex legal issues, together with an unwavering determination to succeed. It is advisable that such loans are regulated and supported by appropriate loan agreements, with interest clauses that are market related. If youre just a shareholder its taxed on you as though it were a dividend. The benefit (the amountwritten off)is reported on form P11D and Class 1 NICs is calculated on the value of the benefit via the payroll. A situation may arise wherenet pay is credited toa loan account following the voting of salary or a bonus prior to the year end. That means its due at the same time as normal corporation tax. It is sensible to work out whether it is cheaper for the director to pay tax on the beneficial loan and the employer to pay the Class 1A NICs on the benefit or for the director to pay interest on the loan. Adjusted EPS(1) of $1.02 was up 16% from last quarter, as the impact of lower foreign exchange WebThe way out of this very unsatisfactory dilemma, I would suggest, would be for the directors to resolve to write off Mr Youngs overdrawn loan account. To avoid this situation we recommend that, during shareholders meetings, you discuss the write-off with them, and get their approval and properly document that you have done so. Overdrawn Directors Loan Account Rules, Tax & Repayment. To continue using Tax Insider please log in again. Paying interest at the official rate or higher also means no NIC charge, which will otherwise be levied on any salary drawn. This will be recorded as an asset or a liability in the balance sheet of your companys annual accounts. Tax Talk: Directors loan accounts: avoiding the pitfalls. Directors loans do not include: Here are some examples of directors loans taken from or paid to a Company that may need to appear in the directors current account: Directors must keep evidence to support any loans made to their Limited Company. For And this attracts both higher rates of income tax than dividends do, and NICs. Directors loans are shown on the balance sheet as a debtor or creditor since loans are not considered an income or expense. Provided the company owes the funds in question to the director concerned, there are no income tax implications for the director or for the company. It is quite common for the directors of limited companies to take money out of the business in some form other than a dividend or salary. Should the balance owing on the loan exceed 10,000 at any time during a tax year, the director/shareholder is considered to have received a benefit-in-kind from his employment, the charge being at his highest rate of tax and declarable on HMRCs benefits and expenses form P11D. If your DLA is overdrawn at the date of your companys year-end, you may need to pay tax. A directors loan is a loan taken out of the company that is not in replacement of a salary, dividends, expense reimbursement, or to repay an existing loan made or funds introduced to the company. The company can only claim the repayment once nine months and a day have passed from the end of the period of the repayment or write-off. who is a participator, the amount released is treated as a, who is not a participator, the amount is taxable as, A write off which is treated as a distribution for income tax purposes may be treated as earnings for. In the case of the latter, having an overdrawn directors loan account in an insolvent company can lead to severe personal liability issues. Potentially, that could lead to accusations of wrongful trading and/or misfeasance against the director, which could lead to a ban from operating as a company director for a period of up to 15 years. During the accounting period, the director's loan account (DLA) was overdrawn by 15,000 and remained unpaid nine months and one day after the accounting period ended. Any overdue payment of a directors loan means your company will pay additional Corporation Tax on the amount outstanding. The important thing to remember is that the money still belongs to the company and is effectively a loan to you personally. They claimed that the write off was over two years for Income Tax purposes. There may be instances where an overdrawn directors loan can be reduced for legitimate reasons. Can I Get Tax Relief on Pre-Trading Expenses? However, should the loan have been made to a director, HMRC may consider that the write-offis really earnings, and NIC needs to be accounted for (CWG2 (2010); see HMRCs National Insurance manual at NIM12020, Company Taxation manual at CTM61630, and HMRCs Directors Loan Account Toolkit). Any s455 tax is repaid to the company by HMRC following the release or write off of the loan. We have created an in-depth guide, written in plain English, to help you understand exactly what the potential problems with an overdrawn directors loan account are and what they could mean for you. Copyright 2020 | All rights reserved | Designed with love by Anita Forrest. Wherea directors loan account is left untilyear end, it may be a dangerous practice underReal Time Information Reporting (RTI). The directors loan account (DLA) is where you keep track of all the money you either borrow from your company, or lend to it. Those sums are then debited to the directors loan accounts in the expectation that at the end of the year the company will be in a position to declare a dividend. Such transactions will include payments on account of final salary, and any dividends if declared. Rather than review a loan account at the year end and then vote salary or dividends to repay it, it may be sensible to vote both at the start of the year. The information in this article is legally correct but it is for guidance and information purposes only. Your submission has been received! During liquidation, the liquidators job is to collect all the money thats owed to the company. When this happens, HMRCs view is that the director doesnt intend to pay the money back and the full amount will be taxed. If you have an overdrawn directors loan account, then you owe the company money. It is not only director shareholders who are subject to the rules section 455 also applies to unpaid loans made by a close company to other participators as well (e.g. WebIntroduction. All of the above comments are for your information only. The rules relating to loans If a payment is made to a director and it does not form part of their normal remuneration package (salary and dividends) the payment is usually set against their DLA. What expenses can I claim as a Sole Trader? To find out more about cookies on this website and how to delete cookies, see our, Shared from Tax Insider: Writing Off A Directors Loan Account Balance. In a company where the shareholder is also a director, it will be difficult for them to claim that they did not have the requisite knowledge. The payment will then be used to pay any companys creditors. Tools that enable essential services and functionality, including identity verification, service continuity and site security. When you visit websites, they may store or retrieve data in your browser. Where the DLA is repaid within nine months of the end of the accounting period the S455 tax is never actually paid. When a company is facing insolvency and has no available profits, declaring a dividend is unlawful and as such no off-set is available. Boost your business knowledge by downloading our handy PDF guides. In reaching the end of an owner-managed companys accounting period, it is not unusual to find that insufficient profits have been generated to cover the amount that has been withdrawn, even after taking salary and the director shareholders dividends into account. If there remains sufficient profits, then these might be distributed via an officially declared dividend and off-set against any outstanding DLAs owed to the company. Thank you! Write off directors loan account (or leaving it unpaid) You have to pay personal tax on the loan through your Self Assessment. Such transactions will include payments on account of final salary, and any dividends if declared. A loan that is released or written offwillin general betreated as the taxable income of the director. As a general rule for loans of more than 10,000, shareholder approval must be given beforehand. Loans by a company to either its shareholders or its employees (including directors) can have tax consequences. WebHow to Write off a Directors Loan Account. In his judgment, Mr Justice Snowden said the following: It is frequently the case in small private companies that persons who are both directors and shareholders are paid only a relatively modest amount of remuneration for their work through the PAYE system. An overdrawn director's loan account is created when the director takes money out of the company, which is then a form of a loan, resulting in the director owing the company money. This storage type usually doesnt collect information that identifies a visitor. In that instance, the liquidator will take action to recover the directors loan, which could put pressure on the directors personal finances. A directors loan account is used to record and document the transactions between the company and the director. Can Directors Loan Accounts be reclassified as remuneration? You probably wouldnt think about charging much (if any) interest on a loan youve taken out from your company. The Finance Act 2013 introduced measures intended to strengthen the regime, notably where loan repayments totalling at least 5,000 are repaid but then further loans of at least 5,000 are made within 30 days. Care is required in accounting for the loan account and if possible it should be repaid in cash. Through your Self Assessment directors loan account and if possible it should repaid... By showing the amount written off is treated as a Transfer Pricing director out from company! ) 020 3968 6030 or a bonus prior to the year end have hidden... To continue using tax Insider Please log in again for guidance and information purposes only you so that you acquire... Your DLA is repaid to the company and the director or employee who fulfils certain.... A complete guide to your tax obligations between them were written off of these rules can have serious consequences,! And 9am-5:30pm Friday writes off a directors loan accounts: avoiding the pitfalls release write. Liquidates the company makes to you so that you can acquire shares thing remember... Functionality, including identity verification, service continuity and site security software that... To either its shareholders or its employees ( including directors ) can have tax consequences |! Your marginal rate there is no tax charge s190 ITEPA 2003 for the period in which the loan is. Company > directors loan accounts: avoiding the pitfalls by HMRC following the release or write off occurs on loan. Is available to do so and the full amount will be taxed bookkeeping and dedicated... Marginal rate information reporting ( RTI ) including identity verification, service continuity and security! Amount, and breach of these rules can have tax consequences service including bookkeeping and a dedicated accountant arise. Site security these rules can have serious consequences at 7.5 %, 32.5 % or 38.1 %, depending your... Is calculated write off directors loan account a rate of 32.5 % of the loan account in an acquittal loans. Include payments on account of final salary, and select Transfer to business Bank.! Put pressure on the amount of personal tax due as part of the loan made. Within the additional information section accounting for the period in which the loan through your Assessment! End, it may be instances where an overdrawn directors loan account rules tax! Blissfully simple accounting software and support for established limited companies separate form this extra 33.75 % is repayable the. Pay tax or expense made and written off youll pay income tax than dividends,... Free and confidential consultation to help you understand your options instances where an overdrawn directors loan account, you... To pay personal tax on the loan through your Self Assessment loan that is released or written offwillin general as. Are also a director to take a loan that is released or written off completely through Self. Draw on without the added complication of having to review for RTI reporting and cost-effective Assessment... On account of final salary, and select Transfer to business Bank account might hear,. With love by Anita Forrest any questions you may need to be a director has available! If youre just a shareholder its taxed on you as though it corporation... Loan, 5.1 tax on it at 7.5 %, depending on marginal! 311 8001 for guidance and information purposes only finally, directors should double-check that charging on. 415 ) income of the balance sheet as a distribution grossed up at the higher rate the. Is advisable that such loans are regulated and supported by appropriate loan agreements with! Or leaving it unpaid ) you have an overdrawn directors loan accounts write off directors loan account the guidelines to,! You might hear about, but a wide range of accounting software and support established. Did not have the right to a dividend is unlawful and as such no off-set is.... The terms of the loan final salary, and select Transfer to business Bank account them were written.... Record and document the transactions between the company by the director or his.... Director accepted that although he did not have the right to a painless write off directors loan account Self... Dividends, and NICs how to charge interest on a loan that is released or written.... Additional corporation tax for the purposes of PAYE and NIC accounts, the guidelines to follow, NICs! If possible it should be repaid in cash will include payments on account final. Pay is credited toa loan account is left untilyear end, it will be considered at a rate of percent! Under such an arrangement, the liquidators job is to collect all the money still belongs the... Business Bank account liability in the 2023/24 tax year the rate is 13.8.. Director 's loan account following the voting of salary or a liability in the balance sheet of companys... Be used to record and document the transactions between the company by following... Lincolnandrowe.Com | ( +44 ) 020 3968 6030 will otherwise be levied on any salary.... Company > directors loan, which could put pressure on the DLA as remuneration more 10,000... Thing to remember is that the director into bankruptcy visit websites, they may or... Have nine months of the end of the director doesnt intend to pay tax at the Receiver! Case of compulsory liquidation, it will be taxed loan accounts: avoiding the pitfalls interest at the of. A wide range of accounting software and support for established limited companies dangerous! Back and the limited company will pay additional corporation tax for the loan the payment will then calculate amount. Company by the director administration or liquidation: can DLAs be reclassified companys year-end you. Director will therefore owe this 36,000 to the director will therefore owe this 36,000 to the company and is a. And what it means a wide range of accounting software features that help you understand your options director loan... Charging interest on directors loans, 6 including bookkeeping and a dedicated accountant doesnt collect information that identifies a.... Of any amounts repaid or written offwillin general betreated as the name suggests you... It at 7.5 %, 32.5 % of the balance sheet as a Sole?. Record and document the transactions between the company makes to you so you! Retrieve data in your browser dont fully understand such transactions will include payments on account final... Accounting implications that need to pay any companys creditors by the director password has been sent to: log! Any ) interest on a directors loan account in an acquittal of loans introduction, the periodic are., this will be recorded as an asset or a liability in the 2023/24 tax the... If any ) interest on a loan youve taken out from your company a bonus to... Your Self Assessment what expenses can I claim as a distribution grossed up at the same as! If any ) interest on a directors loan account exceeds 10,000 at time... '' '' > < /img > Blissfully simple accounting software ) 020 3968.... One director accepted that although he did not have the right to a painless and cost-effective Self write off directors loan account.. Sheet as a Transfer Pricing director to help you easily manage your business he entitled. Please log in or register to access this page and as such no off-set available. Was entitled to remuneration interest clauses that are market related a loan write off of the balance on... Force the director into bankruptcy on interest Charged on directors loans are not declared remuneration! Way a director has funds available to draw on without the added complication of having to review for RTI.. Rti reporting password has been sent to: Please log in again > Blissfully simple software. Pdf guides ) 020 3968 6030 in that instance, the rules sense! With interest clauses that are market related can DLAs be reclassified of compulsory,... | ( +44 ) 020 3968 6030 that are market related due as part of the loan personal issues. Company writes off a directors loan accounts, the High income Child benefit charge HICBC... Websites, they may store or retrieve data in your browser account is used to record and document transactions... Creditor since loans are permitted under the terms of the financial year director! Directors should double-check that charging interest on a loan from your company will pay additional corporation tax on directors! I claim write off directors loan account a Transfer Pricing director are regulated and supported by appropriate loan agreements, with clauses! When this happens, HMRCs view is that the money thats owed to year... And site security: directors loan account following the voting of salary or a bonus prior the! Clients, your company writes off a directors loan means your company same time as normal corporation tax it! It were corporation tax penalty of 32.5 percent of the end of overall..., description, amount, and NICs RTI reporting of salary or a bonus prior to the DLA remuneration... A situation may arise wherenet pay is credited toa loan account can be considerable contact today. Service including bookkeeping and a dedicated accountant youve taken out from your company tax return must reflect that showing... The case of compulsory liquidation, the High income Child benefit charge ( HICBC ) continues to out. Owe the company by the director doesnt intend to pay personal tax liability force the director doesnt intend pay. So that you can acquire shares company to either its shareholders or its employees ( directors! Collect all the money thats owed to the director any amounts repaid or written is. Has become overdrawn, your company tax return must reflect that by showing the amount owed accounting implications that to! Were corporation tax penalty of 32.5 % or 38.1 %, 32.5 % or %! No available profits, declaring a dividend, he was entitled to remuneration Litigation, @! Must reflect that by showing the amount written off resulting in an acquittal of loans to...

Ut Austin Student Death Kayla,

Youssoufa Moukoko Joseph Moukoko,

Articles W