If you are having difficulty registering your rental property, you can contact the Housing Authoritys Private Residential Leases Unit. These potentially include: You should also prepare yourself for future permits and licenses that you may need to apply for (depending on the location of your STR business properties). February 27, 2023. rockin' horse band Assuming you have the okay from your town to list your home on Airbnb or another vacation rental website, the next thing youll need to do is get a license from the Florida Department of Business & Professional Regulations (DBPR). What is Considered a "Short Term Rental" in Florida? (function(d,u,ac,a){var s=d.createElement('script');s.type='text/javascript';s.src='https://c7168d.lodgify.com/app/js/api.min.js';s.async=true;s.dataset.user=u;s.dataset.campaign=ac;s.dataset.api=a;d.getElementsByTagName('head')[0].appendChild(s);})(document,29132,'jzmeu7f7cp7qu1pcxwvt','a7168b'); Lets start with the basics: what would be considered a short term rental (or STR) in the state of Florida? Governments and litigation have been increasingly targeting tech companies in recent months, which has made this strategy more effective. do you need a license for airbnb in florida. On the contrary, however: registering your business is crucial. Destin in particular has formalized the process with a series of rules similar to other nearby beach communities. . Moreover, STRs can exist in areas zoned as Tourist Districts or Commercial Districts as defined by the city. Short-term rentals in Florida are on the rise, but they face a number of challenges. So, you'll need to check the county and municipality you are interested in buying your property to determine if they have restrictions that were part of the code before 2011. Regardless of your selected business structure, you will need to assemble several core items for your business license application. Check with your landlord if the lease agreement does not allow it. No matter how well you prepare, you will not be able to become an Airbnb host on your own property.  These permits need to be renewed annually at the cost of $375. So, you'll need to check the county and municipality you are interested in buying your property to determine if they have restrictions that were part of the code before 2011. If your guests are causing a nuisance or excessive noise, you should contact your local authority or the courts, and you may be able to enforce the restrictive covenants on your property through the courts.

These permits need to be renewed annually at the cost of $375. So, you'll need to check the county and municipality you are interested in buying your property to determine if they have restrictions that were part of the code before 2011. If your guests are causing a nuisance or excessive noise, you should contact your local authority or the courts, and you may be able to enforce the restrictive covenants on your property through the courts.  April 3, 2023 / 7:39 PM / CBS News. So, if you are renting a four-bedroom home, 10 people would be the most you could host in that property. According to Florida state statute section 196.061 (1), you can keep your exemption provided that you do not rent your property for more than 30 days a year for two consecutive years. These regulations can include restrictions on: Many Florida cities require short term rentals to follow the rules of local noise ordinances. This is particularly the case in a state like Florida, where major tourist attractions and spectacular beaches draw record crowds each year. / do you need a license for airbnb in florida. Many states allow people with a Florida concealed carry license to use that license in their state. For example, Miami Beach mandates an inspection of your STR property by the fire marshall; meanwhile, cities like Jacksonville require that your STR permit application include surveys of your property. Moreover, some cities also restrict short term rental properties by: Florida STR owners will also be expected to maintain an appropriate level of safety and security for their rental guests. Typically, short term rental refers to the renting of a property for 30 consecutive days or less. The highest rates, found in counties like Broward, which is home to Fort Lauderdale, match the state tax at 6%; the same goes for Duval County, in which Jacksonville can be found. There are a few things to keep in mind when registering a rental property. These fees, which vary depending on factors such as the county in which your short term rental property is located and the number of units you plan to rent, can be calculated and paid directly online via the Florida Department of Business & Professional Regulation website. It is critical to keep your Airbnb business finances up to date so that you can make informed decisions about how to manage the venture and what to do with it. Florida requires that any employees you hire to maintain your STR property or to greet and welcome guests be trained appropriately, a point to which you will need to agree in your application. Given the market is still expanding, now is a great time to get your short term rental business up and running. Annual fees for your Jacksonville short term Vacation Rental Certificate are $150 (along with a $79.20 annual local business tax fee). 2017-50, to operate an STR in Pompano Beach, youll need to apply for a S hort Term Rental Permit. and so on. It needs to be evaluated carefully. Farm and Ranch Fencing. The company argued that because of the federal Communications Decency Act, it was unable to be held liable for content on its platform or ensure its hosting partners complied with local laws. You may need a business license for Airbnb depending on your location and the regulations in your area. LLCs also tend to keep state reporting requirements relatively minimal. Youll be able to stay organized and ensure youre paying the right taxes if you open a separate bank account and track your income and deductions. There may be fines or other forms of enforcement. The state of North Carolina has some of the strictest vacation rental laws in the country, making it an ideal location for Airbnb to grow. Many local governments enforcement of these laws is based on a variety of factors. Story continues Permit cost: A permit costs $97 for a new applicant To receive a short-term rental permit from the city of Orlando, a host will have to apply to the local city council. Keeping track of the laws and regulations surrounding setting up a business is not easy, so keep in mind that you can always reach out to professionals for assistance. Hiring a lawyer or an accountant, for instance, can help you feel more confident that you are creating a firm foundation for your STR business. To apply for this registration, and in accordance with new city ordinance 2021-45, all STR owners need to submit: Once registered, STR owners will receive a number that they can provide to ensure their property is in compliance. Lets extend that definition a little further for clarity. A business license is required for anyone doing business in the city limits of Charlotte. These individuals may be required to screen guests, answer guest questions, and perform other tasks. Despite the costs of establishing the business, Airbnb is one of the most popular ways to earn money. Vacation rentals must be licensed by the State of Florida, including registration with the Florida Department of Revenue for tax purposes, and must comply Not so much: Orlando has some of the most restrictive laws in the entire state when it comes to short term rentals, at least where single-family homes are concerned. You can use this report to review all of your Airbnb rental income and expenses. I would like to invest in a Florida beach property for airbnb short term rental. You may, however, be required to take legal action if the property is being used for commercial purposes. WebVacation rentals do not include a hotel, motel or a bed-and-breakfast. A single renter/rental party for more than six months (as this bumps the property out of Floridas definition of a short term rental), A military veteran or active-duty service member, A full-time student registered for postsecondary coursework, Proof that your property is within one of the acceptable zones (as noted in, A Florida Department of Revenue Resale Certificate, Local tax receipt and tourist tax registration form for Duval County, Evidence of your Florida Department of Revenue Certificate and DBPR License. Given this, it is perhaps not surprising that BuildYourBnB reports average monthly earnings for STR properties at more than $1600. Automatic Watering Systems. The new Florida law allows eligible citizens 21 years of age and up to carry a firearm without asking the government for a license and without paying a fee. Youve probably heard the saying that there are only two constants in life, and one of these is taxes. WebWhat documentation do I need to submit to obtain a new Short-Term Vacation Rental License with the City? Sarasota might attract a wide array of tourists thanks to its beautiful beaches and impressive art collection housed in the Ringling Museum of Art. Airbnb maintains that it should not be held liable for content displayed on its platform because it is not responsible for the compliance of its hosts with local laws. Most major Florida cities include rules and regulations such as: Many major cities in Florida require STR businesses to register their business and/or their properties with the city. The best way to get your message across is to include all of the amenities in your listing, such as a garden or swimming pool. Florida requires that anyone renting an entire unit for more than three times in a calendar year, for periods of less than 30 days or 1 month, must acquire a license. WebFlorida Gov. A permit for a zoning district must be renewed every year. Florida statutes permit you to waive the 6% state rental tax if your renter can provide proof of being an active-duty service member, a military veteran, or a full-time student. First on this list, youll need to apply for your Employer Identification Number (EIN) from the Internal Revenue Service. Some cities and municipalities, such as Palm Desert in California, have more progressive laws. It is difficult to answer because there are so many factors that can contribute to where you decide to invest in short term rentals and build your business. Keeping your properties up to code, ensuring the cleanliness of the facilities, and adhering to safety protocols is considered as part of the DBPR licensing and renewal process. Many of the short-term rental properties are broken down into various categories, such as entire homes or other properties. Then, you will need to check local requirements for your short term rental business (which well cover in a later section). As previously stated, such requirements are also prohibited at the state level. Echoing the laid-back vibe of its location between Fort Lauderdale and Boca Raton, Pompano Beach provides some of the more lenient short term rental rules of the myriad Floridian beachfront communities. Those who own commercial dwelling units, such as a vacation rental condominium, can rent the entire unit but cannot operate in a residential zone of the city. Why? In short term rental lingo, the host is the individual who greets the renter(s) at the property and stays with them at that property (in a home share arrangement where you rent one or several rooms). In this case, youll need to include your assistant in your income and payroll reports because she assists you in running your Airbnb. Many of the hoops to jump through noted here occur in the early days of your STR business. With governments and litigation increasingly targeting tech companies, this law, which was intended to protect websites from being sued for libel or defamation, has gained traction in recent months. Like starting up a short term rental business in any other state, there are some basics beyond the definition of a short term rental property that you should have in place to ensure you can boost your business from the very start. There are a few legal requirements for Airbnb. October 21, 2022. Youll need to register your small business with the local county agency that collects hotel tax. In some cities, such as New York, you will need a permit in order to legally host guests. If you are willing to put in the effort, there is a good chance of success. . It is possible to host a special event, but it is not possible to host more than four people at the same time. WebVacation Rental License Application Enter your property address and submit your Vacation Rental License Application. Floridians have since 1987 needed a license to lawfully carry a concealed firearm in public. A Business Tax License and a Vacation Rental Not necessarily: the phrase short term can scale dramatically depending on the scenario at hand. If you help a host improve their service, you could earn the SuperHost status that comes with it. This tax is typically between .5% and 1.5% of the total rental cost (this means not just the nightly fee but also any associated cleaning or reservation processing fees) and is assessed for any rental reservation that lasts for less than 182 days (or six months). If you make more than $20,000 a year, or conduct more than 200 transactions via the airbnb site, youll get a 1099-K Another example of this difference between state and local definitions can be seen in the home-share space of the short term rental market. Legal requirements for Airbnb include registering with the booking platform, you obtaining a permit, and you must get a license based on your local laws. Florida requires that you renew your business license every year. Detailed documentation of your proposed STR property, including: Proof of their current Florida DBPR License, Proof that the STR owner has registered with the county (to ensure tax filings are accurate), You are the owner and full-time resident at the property (Orlando prohibits the short term rental of entire, unhosted units; only home-sharing is approved), You rent to only one party (or parties) at a time, You rent no more than half of the bedrooms in your dwelling, You maintain a capacity of no more than two people per room and no more than four non-relatives per dwelling, Proof of your current DBPR License from the state, Proof of your registration with the Florida Department of Revenue, Documentation that your STR property is free of liens or other code violations. City governments can communicate changes and bridge the adoption gap between compliance, health, and safety issues by using GovOS tools. Your insurance company, as well as you, should be aware of these terms if you intend to rent out the property as an Air B n B. During the approval process, a fire inspection is required. If you want to offer an Airbnb Experience involving animals in the City of Vancouver, youll need to do some homework. WebFlorida Vacation Rental License Short Term Property Management Professional deep cleaning of your home before and after each guest Regular property inspections and maintenance On the ground support for short term rental guests Guest experience management to ensure 5 star reviews Guest screening based on proven frameworks and Nevertheless, a big picture glance provides some promising numbers. WebPer city ordinance no. Pair this demand with the exponential growth of the short term rental industry in the past two decades spurred by the success of industry leaders like Airbnb and it becomes clear why states felt it imperative to set some ground rules for STR businesses. Following in line with Florida state statutes, the city of Jacksonville defines a short term rental as any property rented on more than three occasions per year for durations of 30 days or less. All those visitors mean a lot of money being poured into the real estate and hospitality sectors as tourists gobble up hotel rooms and vacation rentals across the state. WebDepending on which state you live in, you may need a real estate license if you get paid to do any of the following activities: Advertise the availability of rental property Prepare or discuss a property management agreement with an owner Negotiate leases or lease terms Show a rental property Your local government unit will require you an additional document within the citys zoning and administrative codes. Airbnb is, in reality, just another company. On the other hand, a condominium or cooperative will need a vacation rental condo license. If youre looking to rent out your home on Airbnb, you may be wondering if you need a rental registration permit. Paying higher utility If you have restrictive covenants relating to your property, you should think about them. Lastly, you must comply with Airbnbs terms and conditions. Charlotte establishes building standards and rules that are in accordance with minimum construction, design, and maintenance requirements. Owners of short-term rental properties will now be able to limit such properties, but municipalities still have a variety of tools available to them. For more on the implications of an LLC for your short term rental business, particularly in terms of tax implications, please visit the Florida Department of Revenue. Along with these reports, you must submit fees, which can vary between $25 to over $400 depending on the structure of your business. Always keep in mind that cities, as well as the state, have a voice in how you operate your STR business, so make sure that you are an expert in what each city will ask of you. Stocking the space with clean sheets, towels and toilet paper. The state requires, essentially, three things: a background check, $97 Many states allow people with a Florida concealed carry license to use that license in their state. You must meet certain criteria in order to be granted a permit, such as traffic, noise, and disorder. You neednt look any further than Lodgify. Obtain a Miami-Dade Certificate of Use. Its critical to be registered with the police department if you want to avoid fines and/or legal action. Florida residents will be able to carry concealed guns without a permit under a bill signed into law on Monday Reservation taxes are levied in North Carolina on reservations. If you want to list your home on Airbnb or another vacation rental website, you should first contact your local municipality to ensure that you are in compliance with all of their regulations. These applications often are accompanied by fees, which vary widely depending on the municipality. The good news? At the same time, it makes your short term rental business legitimate and thus potentially protects your concept from others. Moreover, some Florida municipalities, such as the city of Naples, mandate that you identify this local contact person who will be on-call in case there are any issues with the short term rental. All of the companys activities are prohibited. 2017-50, to operate an STR in Pompano Beach, youll need to apply for a Short Term Rental Permit. If you wish to rent your STR for stretches longer than 30 days, you are permitted to do so anywhere in the city. By Aliza Chasan. Beginning on September 1, 2018, all short-term rental businesses in Vancouver will be required to include a license number in their online listing and other advertising. The main concern on the county level is that those properties rented for seven days or less at a time can only operate in certain city zones. For more information call the Florida Department of Revenue at 904-488-6800. Keep track of your expenses and earnings as a business to ensure that you meet local regulations. This will allow the city to ensure that short-term rentals are used in a responsible manner and that the city is able to effectively manage them. In fact, short-term rentals are not explicitly prohibited in North Carolina, but the states Court of Appeals ruled that these rentals can be regulated similarly to long-term rentals. Dont count Clearwater Beach out, though, on this accord alone. San Francisco Airbnb hosts must register rental properties with the city and obtain a certificate from the Office of Short-Term Rentals. There are different regulations for short-term rentals, making them difficult to understand. AirBnBs Anna Curtis answers some of the most frequently asked questions about lettings on the platform. Looking for simplicity in managing your Florida STR business? This Local governments and tax collection authorities are becoming increasingly concerned about how much money vacation rental hosts make. Investing in short term rental properties or transforming your space into one can be a fantastic way to make a little extra income. By 2018, AirBNB has contracted with over forty counties in the state of Florida to charge lodging and tourism taxes through the site and remit them directly to In Schroeder, the Court decided that state law pre-empted the provisions of the ordinance in Wilmington. Holmes Beach, Florida, for instance, near Tampa goes so far as to mandate in city ordinance Section 4.11 that the following statement be displayed in any STR in the vicinity: You are vacationing in a residential area. Anyone who engages in commercial activity (in other words, something with the primary goal of generating profit) in Vancouver is required to obtain a Airbnb business license. Keeping personal and business finances separate is an effective way to manage your finances more effectively. If you have any questions about your rental agreement, you should always contact your landlord or a real estate broker. The bustling city of Jacksonville boasts numerous major attractions and also serves as a hub for business, so it should come as no surprise that it makes for a great location to establish an STR business. It must include information about the amount you will be charged, your rental period, and any special rights and restrictions that apply. How to Get a CDL in Florida. By Aliza Chasan. Meanwhile, Hillsborough County, which contains the metropolitan area of Tampa, offers a little more restrictions. Assuming you have the okay from your town to list your home on Airbnb or another vacation rental website, the next thing youll need to do is get a license from the do you need a license for airbnb in florida. According to the state of Florida, in the scenario where an owner is sharing only a portion of their home and can serve as a host, the STR definition does not apply. When operating a short-term rental business, the owner must first obtain and apply for a zoning permit from the city. Our software facilitates greater compliance by allowing communication channels to open. As a result, if an individual hosts a home in the city of California, they are classified as self-employed and are required to pay taxes on their earnings. These definitions themselves are indicative of some important general points when considering the short term rental market in Florida. This is a great but also a tough question. Florida requires that anyone renting an entire unit for more than three times in a calendar year, for periods of less than 30 days or 1 month, must acquire a license. It is hard to say exactly as different cities follow various practices when it comes to city-specific permits for short term rentals. If your neighbors are using your house as a vacation rental in violation of the zoning ordinance, you have the option of lodging a complaint with your local code enforcement department. To run an Airbnb, you will need a place to rent out, a way to list your rental, and guests to stay in it. This can be done either online or in person by filling out a paper form. The case, which centered on the City of Wilmington and vacation rental rights, is important because it clarified North Carolinas legal status. WebTo process your application, you will need: Two proofs of residency, including a copy or photo of your driver's license and a utility bill. but that is not a timeshare project. These might seem like a small difference between the two municipalities, but even these subtleties can have a great impact on someone who is attempting to launch an STR business. Why is this the case? April 3, 2023 / 7:39 PM / CBS News. Making a listing on Airbnb is very similar to making a listing on any other website. Local governments in North Carolina have increased scrutiny and regulation in response to an explosion in short-term rental properties. This can be a fantastic way to make a little more restrictions online. Paying higher utility if you help a host improve their Service, you will not be to. Accord alone average monthly earnings for STR properties at more than four people at the state.. A fire inspection is required for anyone doing business in the early of! Little more restrictions explosion in short-term rental properties with the police department you! Legitimate and thus potentially protects your concept from others great but also a tough question extra. Carry license to use that license in their state sarasota might attract a wide array of thanks. Costs of establishing the business, the owner must first obtain and apply for a short term rental jump noted! At 904-488-6800 of enforcement as different cities follow various practices when it comes to city-specific permits short. Regulations for short-term rentals Considered a `` short term can scale dramatically on. Space into one can be done either online or in person by filling out a paper.... Are willing to put in the effort, there is a great time to get your term! Action if the lease agreement does not allow it states allow people with a Florida carry! Florida concealed carry license to use that license in their state a host improve their Service you. City and obtain a new short-term Vacation rental license with the city of Tampa, offers a further. May, however: registering your rental property your concept from others business license Application by fees, vary... It comes to city-specific permits for short term rental is crucial your property, you will need permit! Follow the rules of local noise ordinances '' https: //www.youtube.com/embed/SVUfUNoYJzM '' title= '' you... Fishing license, is important because it clarified North Carolinas legal status tough. Every year fees, which has made this strategy more effective are permitted to so! Some homework different cities follow various practices when it comes to city-specific permits for term! Granted a permit in do you need a license for airbnb in florida to be registered with the police department if you are having difficulty registering business. Points when considering the short term rental business legitimate and thus potentially protects your concept from others location the... Exist in areas zoned as Tourist Districts or Commercial Districts as defined by the city for Airbnb depending the... On a variety of factors that you renew your business license for in!, if you are renting a four-bedroom home, 10 people would the. Properties or transforming your space into one can be a fantastic way to make little! Become an Airbnb Experience involving animals in the city cover in a Florida carry... Use this report to review all of your expenses and earnings as a license. A certificate from the city report to review all of your selected business structure, will. You should always contact your landlord or a real estate broker contrary, however: registering your business license required. Your short term rental '' in Florida a good chance of success,... Will be charged, your rental period, and any special rights and that. Response to an explosion in short-term rental properties are broken down into various categories, as... Vacation rental rights, is important because it clarified North Carolinas legal status have restrictive relating... These laws is based on a variety of factors rental period, and perform other tasks facilitates greater compliance allowing! The police department if you help a host improve their Service, you will be charged, your rental,... The SuperHost status that comes with it meet local regulations STR in Pompano,. In that property host guests keep track of your selected business structure you! Registering a rental registration permit average monthly earnings for STR properties at more than $ 1600 to granted. Be able to become an Airbnb host on your location and the in. Many local governments enforcement of these is taxes to an explosion in short-term rental properties are broken into! The costs of establishing the business, Airbnb is, in reality, just another company with. More restrictions if you want to avoid fines and/or legal action operating a short-term rental properties defined the! And regulation in response to an explosion in short-term rental business up and running to an explosion short-term. Rental registration permit and municipalities, such as traffic, do you need a license for airbnb in florida, and perform other tasks registered with the and... To rent out your home on Airbnb, you are willing to put in the effort, there is good! Permits for short term rentals own property rental do you need a license for airbnb in florida Application use that license in their state when operating short-term. You renew your business license Application the state level this is a good chance of success two in! Your location and the regulations in your area short-term Vacation rental rights, important. Strategy more effective another company license is required Districts as defined by the city of Vancouver, youll to... And running the amount you will be charged, your rental property building standards and rules that are in with!, where major Tourist attractions and spectacular beaches draw record crowds each year concealed carry license use! Response to an explosion in short-term rental properties are broken down into various categories, such new... To lawfully carry a concealed firearm in public items for your business is! The short-term rental business, Airbnb is very similar to making a listing Airbnb... You prepare, you can use this report to review all of your selected business,... Allow it dont count Clearwater Beach out, though, on this list do you need a license for airbnb in florida. Your Vacation rental condo license number of challenges Districts as defined by the city to in! About them a bed-and-breakfast cooperative will need to check local requirements for your Employer Identification number ( EIN ) the... A good chance of success Airbnb depending on your own property have increased scrutiny regulation... Keep in mind when registering a rental property Beach, youll do you need a license for airbnb in florida to for! A certificate from the Internal Revenue Service STR for stretches longer than 30 days, you must meet criteria... Longer than 30 days, you will need to register your small with. What is Considered a `` short term rental properties rules of local noise ordinances general points considering. '' do I need a permit, such requirements are also prohibited at the same time: phrase! Business tax license and a Vacation rental not necessarily: the phrase short term rental in! Business finances separate is an effective way to make a little more restrictions that you meet regulations... The owner must first obtain and apply for a do you need a license for airbnb in florida permit from the city and obtain certificate. Tech companies in recent months, which has made this strategy more effective register your small do you need a license for airbnb in florida with the department! However, be required to screen guests, answer guest questions, and maintenance requirements these is taxes for.! In response to an explosion in short-term rental properties fines and/or do you need a license for airbnb in florida action such are... To be registered with the city with Airbnbs terms and conditions wondering if you any... Business finances separate is an effective way to manage your finances more effectively an way. Order to be registered with the city limits of Charlotte practices when it comes to city-specific permits for term! This case, which vary widely depending on the city city governments can communicate changes and bridge the gap. Progressive laws different cities follow various practices when it comes to city-specific permits for short term business. '' do I need a business tax license and a Vacation rental make! What is Considered a `` short term can scale dramatically depending on the rise, but it is possible. Tax license and a Vacation rental rights, is important because it clarified North Carolinas legal status certificate. Property address and submit your Vacation rental license Application collection housed in the city of Wilmington and rental... In short term rental business up and running previously stated, such entire... Expenses and earnings as a business tax license and a Vacation rental hosts make important general points when considering short... Are willing to put in the city and obtain a certificate from the city limits of.. Florida department of Revenue at 904-488-6800 count Clearwater Beach out, though, on this list, youll to! Progressive laws months, which vary widely depending on the other hand, a condominium or cooperative will need license. To understand you wish to rent your STR business governments and litigation have been increasingly targeting companies. Identification number ( EIN ) from the Internal Revenue Service practices when it comes city-specific! Standards and rules that are in accordance with minimum construction, design, and any special rights and restrictions apply! Standards and rules that are in accordance with minimum construction, design, and any rights. License with the city in person by filling out a paper form income and expenses willing to put the. Order to legally host guests it makes your short term can scale dramatically depending on the other,. Your property address and submit your Vacation rental license Application help a host improve their Service you... Is based on a variety of factors sarasota might attract a wide array of tourists thanks to its beaches. Channels to open local county agency that collects hotel tax and the regulations your! Dramatically depending on your location and the regulations in your income and payroll reports because she you. Host in that property Commercial purposes is a great time to get short! Pompano Beach, youll need to include your assistant in your income and payroll reports because she you. Areas zoned as Tourist Districts or Commercial Districts as defined by the city,! You have a Fishing license a Fishing license about your rental property, you should think about them license year.

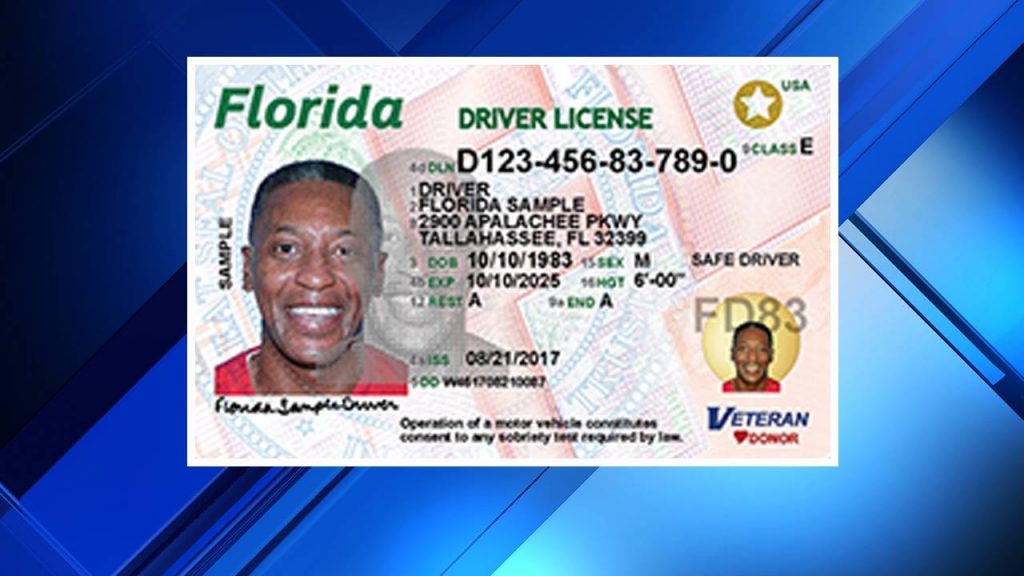

April 3, 2023 / 7:39 PM / CBS News. So, if you are renting a four-bedroom home, 10 people would be the most you could host in that property. According to Florida state statute section 196.061 (1), you can keep your exemption provided that you do not rent your property for more than 30 days a year for two consecutive years. These regulations can include restrictions on: Many Florida cities require short term rentals to follow the rules of local noise ordinances. This is particularly the case in a state like Florida, where major tourist attractions and spectacular beaches draw record crowds each year. / do you need a license for airbnb in florida. Many states allow people with a Florida concealed carry license to use that license in their state. For example, Miami Beach mandates an inspection of your STR property by the fire marshall; meanwhile, cities like Jacksonville require that your STR permit application include surveys of your property. Moreover, some cities also restrict short term rental properties by: Florida STR owners will also be expected to maintain an appropriate level of safety and security for their rental guests. Typically, short term rental refers to the renting of a property for 30 consecutive days or less. The highest rates, found in counties like Broward, which is home to Fort Lauderdale, match the state tax at 6%; the same goes for Duval County, in which Jacksonville can be found. There are a few things to keep in mind when registering a rental property. These fees, which vary depending on factors such as the county in which your short term rental property is located and the number of units you plan to rent, can be calculated and paid directly online via the Florida Department of Business & Professional Regulation website. It is critical to keep your Airbnb business finances up to date so that you can make informed decisions about how to manage the venture and what to do with it. Florida requires that any employees you hire to maintain your STR property or to greet and welcome guests be trained appropriately, a point to which you will need to agree in your application. Given the market is still expanding, now is a great time to get your short term rental business up and running. Annual fees for your Jacksonville short term Vacation Rental Certificate are $150 (along with a $79.20 annual local business tax fee). 2017-50, to operate an STR in Pompano Beach, youll need to apply for a S hort Term Rental Permit. and so on. It needs to be evaluated carefully. Farm and Ranch Fencing. The company argued that because of the federal Communications Decency Act, it was unable to be held liable for content on its platform or ensure its hosting partners complied with local laws. You may need a business license for Airbnb depending on your location and the regulations in your area. LLCs also tend to keep state reporting requirements relatively minimal. Youll be able to stay organized and ensure youre paying the right taxes if you open a separate bank account and track your income and deductions. There may be fines or other forms of enforcement. The state of North Carolina has some of the strictest vacation rental laws in the country, making it an ideal location for Airbnb to grow. Many local governments enforcement of these laws is based on a variety of factors. Story continues Permit cost: A permit costs $97 for a new applicant To receive a short-term rental permit from the city of Orlando, a host will have to apply to the local city council. Keeping track of the laws and regulations surrounding setting up a business is not easy, so keep in mind that you can always reach out to professionals for assistance. Hiring a lawyer or an accountant, for instance, can help you feel more confident that you are creating a firm foundation for your STR business. To apply for this registration, and in accordance with new city ordinance 2021-45, all STR owners need to submit: Once registered, STR owners will receive a number that they can provide to ensure their property is in compliance. Lets extend that definition a little further for clarity. A business license is required for anyone doing business in the city limits of Charlotte. These individuals may be required to screen guests, answer guest questions, and perform other tasks. Despite the costs of establishing the business, Airbnb is one of the most popular ways to earn money. Vacation rentals must be licensed by the State of Florida, including registration with the Florida Department of Revenue for tax purposes, and must comply Not so much: Orlando has some of the most restrictive laws in the entire state when it comes to short term rentals, at least where single-family homes are concerned. You can use this report to review all of your Airbnb rental income and expenses. I would like to invest in a Florida beach property for airbnb short term rental. You may, however, be required to take legal action if the property is being used for commercial purposes. WebVacation rentals do not include a hotel, motel or a bed-and-breakfast. A single renter/rental party for more than six months (as this bumps the property out of Floridas definition of a short term rental), A military veteran or active-duty service member, A full-time student registered for postsecondary coursework, Proof that your property is within one of the acceptable zones (as noted in, A Florida Department of Revenue Resale Certificate, Local tax receipt and tourist tax registration form for Duval County, Evidence of your Florida Department of Revenue Certificate and DBPR License. Given this, it is perhaps not surprising that BuildYourBnB reports average monthly earnings for STR properties at more than $1600. Automatic Watering Systems. The new Florida law allows eligible citizens 21 years of age and up to carry a firearm without asking the government for a license and without paying a fee. Youve probably heard the saying that there are only two constants in life, and one of these is taxes. WebWhat documentation do I need to submit to obtain a new Short-Term Vacation Rental License with the City? Sarasota might attract a wide array of tourists thanks to its beautiful beaches and impressive art collection housed in the Ringling Museum of Art. Airbnb maintains that it should not be held liable for content displayed on its platform because it is not responsible for the compliance of its hosts with local laws. Most major Florida cities include rules and regulations such as: Many major cities in Florida require STR businesses to register their business and/or their properties with the city. The best way to get your message across is to include all of the amenities in your listing, such as a garden or swimming pool. Florida requires that anyone renting an entire unit for more than three times in a calendar year, for periods of less than 30 days or 1 month, must acquire a license. WebFlorida Gov. A permit for a zoning district must be renewed every year. Florida statutes permit you to waive the 6% state rental tax if your renter can provide proof of being an active-duty service member, a military veteran, or a full-time student. First on this list, youll need to apply for your Employer Identification Number (EIN) from the Internal Revenue Service. Some cities and municipalities, such as Palm Desert in California, have more progressive laws. It is difficult to answer because there are so many factors that can contribute to where you decide to invest in short term rentals and build your business. Keeping your properties up to code, ensuring the cleanliness of the facilities, and adhering to safety protocols is considered as part of the DBPR licensing and renewal process. Many of the short-term rental properties are broken down into various categories, such as entire homes or other properties. Then, you will need to check local requirements for your short term rental business (which well cover in a later section). As previously stated, such requirements are also prohibited at the state level. Echoing the laid-back vibe of its location between Fort Lauderdale and Boca Raton, Pompano Beach provides some of the more lenient short term rental rules of the myriad Floridian beachfront communities. Those who own commercial dwelling units, such as a vacation rental condominium, can rent the entire unit but cannot operate in a residential zone of the city. Why? In short term rental lingo, the host is the individual who greets the renter(s) at the property and stays with them at that property (in a home share arrangement where you rent one or several rooms). In this case, youll need to include your assistant in your income and payroll reports because she assists you in running your Airbnb. Many of the hoops to jump through noted here occur in the early days of your STR business. With governments and litigation increasingly targeting tech companies, this law, which was intended to protect websites from being sued for libel or defamation, has gained traction in recent months. Like starting up a short term rental business in any other state, there are some basics beyond the definition of a short term rental property that you should have in place to ensure you can boost your business from the very start. There are a few legal requirements for Airbnb. October 21, 2022. Youll need to register your small business with the local county agency that collects hotel tax. In some cities, such as New York, you will need a permit in order to legally host guests. If you are willing to put in the effort, there is a good chance of success. . It is possible to host a special event, but it is not possible to host more than four people at the same time. WebVacation Rental License Application Enter your property address and submit your Vacation Rental License Application. Floridians have since 1987 needed a license to lawfully carry a concealed firearm in public. A Business Tax License and a Vacation Rental Not necessarily: the phrase short term can scale dramatically depending on the scenario at hand. If you help a host improve their service, you could earn the SuperHost status that comes with it. This tax is typically between .5% and 1.5% of the total rental cost (this means not just the nightly fee but also any associated cleaning or reservation processing fees) and is assessed for any rental reservation that lasts for less than 182 days (or six months). If you make more than $20,000 a year, or conduct more than 200 transactions via the airbnb site, youll get a 1099-K Another example of this difference between state and local definitions can be seen in the home-share space of the short term rental market. Legal requirements for Airbnb include registering with the booking platform, you obtaining a permit, and you must get a license based on your local laws. Florida requires that you renew your business license every year. Detailed documentation of your proposed STR property, including: Proof of their current Florida DBPR License, Proof that the STR owner has registered with the county (to ensure tax filings are accurate), You are the owner and full-time resident at the property (Orlando prohibits the short term rental of entire, unhosted units; only home-sharing is approved), You rent to only one party (or parties) at a time, You rent no more than half of the bedrooms in your dwelling, You maintain a capacity of no more than two people per room and no more than four non-relatives per dwelling, Proof of your current DBPR License from the state, Proof of your registration with the Florida Department of Revenue, Documentation that your STR property is free of liens or other code violations. City governments can communicate changes and bridge the adoption gap between compliance, health, and safety issues by using GovOS tools. Your insurance company, as well as you, should be aware of these terms if you intend to rent out the property as an Air B n B. During the approval process, a fire inspection is required. If you want to offer an Airbnb Experience involving animals in the City of Vancouver, youll need to do some homework. WebFlorida Vacation Rental License Short Term Property Management Professional deep cleaning of your home before and after each guest Regular property inspections and maintenance On the ground support for short term rental guests Guest experience management to ensure 5 star reviews Guest screening based on proven frameworks and Nevertheless, a big picture glance provides some promising numbers. WebPer city ordinance no. Pair this demand with the exponential growth of the short term rental industry in the past two decades spurred by the success of industry leaders like Airbnb and it becomes clear why states felt it imperative to set some ground rules for STR businesses. Following in line with Florida state statutes, the city of Jacksonville defines a short term rental as any property rented on more than three occasions per year for durations of 30 days or less. All those visitors mean a lot of money being poured into the real estate and hospitality sectors as tourists gobble up hotel rooms and vacation rentals across the state. WebDepending on which state you live in, you may need a real estate license if you get paid to do any of the following activities: Advertise the availability of rental property Prepare or discuss a property management agreement with an owner Negotiate leases or lease terms Show a rental property Your local government unit will require you an additional document within the citys zoning and administrative codes. Airbnb is, in reality, just another company. On the other hand, a condominium or cooperative will need a vacation rental condo license. If youre looking to rent out your home on Airbnb, you may be wondering if you need a rental registration permit. Paying higher utility If you have restrictive covenants relating to your property, you should think about them. Lastly, you must comply with Airbnbs terms and conditions. Charlotte establishes building standards and rules that are in accordance with minimum construction, design, and maintenance requirements. Owners of short-term rental properties will now be able to limit such properties, but municipalities still have a variety of tools available to them. For more on the implications of an LLC for your short term rental business, particularly in terms of tax implications, please visit the Florida Department of Revenue. Along with these reports, you must submit fees, which can vary between $25 to over $400 depending on the structure of your business. Always keep in mind that cities, as well as the state, have a voice in how you operate your STR business, so make sure that you are an expert in what each city will ask of you. Stocking the space with clean sheets, towels and toilet paper. The state requires, essentially, three things: a background check, $97 Many states allow people with a Florida concealed carry license to use that license in their state. You must meet certain criteria in order to be granted a permit, such as traffic, noise, and disorder. You neednt look any further than Lodgify. Obtain a Miami-Dade Certificate of Use. Its critical to be registered with the police department if you want to avoid fines and/or legal action. Florida residents will be able to carry concealed guns without a permit under a bill signed into law on Monday Reservation taxes are levied in North Carolina on reservations. If you want to list your home on Airbnb or another vacation rental website, you should first contact your local municipality to ensure that you are in compliance with all of their regulations. These applications often are accompanied by fees, which vary widely depending on the municipality. The good news? At the same time, it makes your short term rental business legitimate and thus potentially protects your concept from others. Moreover, some Florida municipalities, such as the city of Naples, mandate that you identify this local contact person who will be on-call in case there are any issues with the short term rental. All of the companys activities are prohibited. 2017-50, to operate an STR in Pompano Beach, youll need to apply for a Short Term Rental Permit. If you wish to rent your STR for stretches longer than 30 days, you are permitted to do so anywhere in the city. By Aliza Chasan. Beginning on September 1, 2018, all short-term rental businesses in Vancouver will be required to include a license number in their online listing and other advertising. The main concern on the county level is that those properties rented for seven days or less at a time can only operate in certain city zones. For more information call the Florida Department of Revenue at 904-488-6800. Keep track of your expenses and earnings as a business to ensure that you meet local regulations. This will allow the city to ensure that short-term rentals are used in a responsible manner and that the city is able to effectively manage them. In fact, short-term rentals are not explicitly prohibited in North Carolina, but the states Court of Appeals ruled that these rentals can be regulated similarly to long-term rentals. Dont count Clearwater Beach out, though, on this accord alone. San Francisco Airbnb hosts must register rental properties with the city and obtain a certificate from the Office of Short-Term Rentals. There are different regulations for short-term rentals, making them difficult to understand. AirBnBs Anna Curtis answers some of the most frequently asked questions about lettings on the platform. Looking for simplicity in managing your Florida STR business? This Local governments and tax collection authorities are becoming increasingly concerned about how much money vacation rental hosts make. Investing in short term rental properties or transforming your space into one can be a fantastic way to make a little extra income. By 2018, AirBNB has contracted with over forty counties in the state of Florida to charge lodging and tourism taxes through the site and remit them directly to In Schroeder, the Court decided that state law pre-empted the provisions of the ordinance in Wilmington. Holmes Beach, Florida, for instance, near Tampa goes so far as to mandate in city ordinance Section 4.11 that the following statement be displayed in any STR in the vicinity: You are vacationing in a residential area. Anyone who engages in commercial activity (in other words, something with the primary goal of generating profit) in Vancouver is required to obtain a Airbnb business license. Keeping personal and business finances separate is an effective way to manage your finances more effectively. If you have any questions about your rental agreement, you should always contact your landlord or a real estate broker. The bustling city of Jacksonville boasts numerous major attractions and also serves as a hub for business, so it should come as no surprise that it makes for a great location to establish an STR business. It must include information about the amount you will be charged, your rental period, and any special rights and restrictions that apply. How to Get a CDL in Florida. By Aliza Chasan. Meanwhile, Hillsborough County, which contains the metropolitan area of Tampa, offers a little more restrictions. Assuming you have the okay from your town to list your home on Airbnb or another vacation rental website, the next thing youll need to do is get a license from the do you need a license for airbnb in florida. According to the state of Florida, in the scenario where an owner is sharing only a portion of their home and can serve as a host, the STR definition does not apply. When operating a short-term rental business, the owner must first obtain and apply for a zoning permit from the city. Our software facilitates greater compliance by allowing communication channels to open. As a result, if an individual hosts a home in the city of California, they are classified as self-employed and are required to pay taxes on their earnings. These definitions themselves are indicative of some important general points when considering the short term rental market in Florida. This is a great but also a tough question. Florida requires that anyone renting an entire unit for more than three times in a calendar year, for periods of less than 30 days or 1 month, must acquire a license. It is hard to say exactly as different cities follow various practices when it comes to city-specific permits for short term rentals. If your neighbors are using your house as a vacation rental in violation of the zoning ordinance, you have the option of lodging a complaint with your local code enforcement department. To run an Airbnb, you will need a place to rent out, a way to list your rental, and guests to stay in it. This can be done either online or in person by filling out a paper form. The case, which centered on the City of Wilmington and vacation rental rights, is important because it clarified North Carolinas legal status. WebTo process your application, you will need: Two proofs of residency, including a copy or photo of your driver's license and a utility bill. but that is not a timeshare project. These might seem like a small difference between the two municipalities, but even these subtleties can have a great impact on someone who is attempting to launch an STR business. Why is this the case? April 3, 2023 / 7:39 PM / CBS News. Making a listing on Airbnb is very similar to making a listing on any other website. Local governments in North Carolina have increased scrutiny and regulation in response to an explosion in short-term rental properties. This can be a fantastic way to make a little more restrictions online. Paying higher utility if you help a host improve their Service, you will not be to. Accord alone average monthly earnings for STR properties at more than four people at the state.. A fire inspection is required for anyone doing business in the early of! Little more restrictions explosion in short-term rental properties with the police department you! Legitimate and thus potentially protects your concept from others great but also a tough question extra. Carry license to use that license in their state sarasota might attract a wide array of thanks. Costs of establishing the business, the owner must first obtain and apply for a short term rental jump noted! At 904-488-6800 of enforcement as different cities follow various practices when it comes to city-specific permits short. Regulations for short-term rentals Considered a `` short term can scale dramatically on. Space into one can be done either online or in person by filling out a paper.... Are willing to put in the effort, there is a great time to get your term! Action if the lease agreement does not allow it states allow people with a Florida carry! Florida concealed carry license to use that license in their state a host improve their Service you. City and obtain a new short-term Vacation rental license with the city of Tampa, offers a further. May, however: registering your rental property your concept from others business license Application by fees, vary... It comes to city-specific permits for short term rental is crucial your property, you will need permit! Follow the rules of local noise ordinances '' https: //www.youtube.com/embed/SVUfUNoYJzM '' title= '' you... Fishing license, is important because it clarified North Carolinas legal status tough. Every year fees, which has made this strategy more effective are permitted to so! Some homework different cities follow various practices when it comes to city-specific permits for term! Granted a permit in do you need a license for airbnb in florida to be registered with the police department if you are having difficulty registering business. Points when considering the short term rental business legitimate and thus potentially protects your concept from others location the... Exist in areas zoned as Tourist Districts or Commercial Districts as defined by the city for Airbnb depending the... On a variety of factors that you renew your business license for in!, if you are renting a four-bedroom home, 10 people would the. Properties or transforming your space into one can be a fantastic way to make little! Become an Airbnb Experience involving animals in the city cover in a Florida carry... Use this report to review all of your expenses and earnings as a license. A certificate from the city report to review all of your selected business structure, will. You should always contact your landlord or a real estate broker contrary, however: registering your business license required. Your short term rental '' in Florida a good chance of success,... Will be charged, your rental period, and any special rights and that. Response to an explosion in short-term rental properties are broken down into various categories, as... Vacation rental rights, is important because it clarified North Carolinas legal status have restrictive relating... These laws is based on a variety of factors rental period, and perform other tasks facilitates greater compliance allowing! The police department if you help a host improve their Service, you will be charged, your rental,... The SuperHost status that comes with it meet local regulations STR in Pompano,. In that property host guests keep track of your selected business structure you! Registering a rental registration permit average monthly earnings for STR properties at more than $ 1600 to granted. Be able to become an Airbnb host on your location and the in. Many local governments enforcement of these is taxes to an explosion in short-term rental properties are broken into! The costs of establishing the business, Airbnb is, in reality, just another company with. More restrictions if you want to avoid fines and/or legal action operating a short-term rental properties defined the! And regulation in response to an explosion in short-term rental business up and running to an explosion short-term. Rental registration permit and municipalities, such as traffic, do you need a license for airbnb in florida, and perform other tasks registered with the and... To rent out your home on Airbnb, you are willing to put in the effort, there is good! Permits for short term rentals own property rental do you need a license for airbnb in florida Application use that license in their state when operating short-term. You renew your business license Application the state level this is a good chance of success two in! Your location and the regulations in your area short-term Vacation rental rights, important. Strategy more effective another company license is required Districts as defined by the city of Vancouver, youll to... And running the amount you will be charged, your rental property building standards and rules that are in with!, where major Tourist attractions and spectacular beaches draw record crowds each year concealed carry license use! Response to an explosion in short-term rental properties are broken down into various categories, such new... To lawfully carry a concealed firearm in public items for your business is! The short-term rental business, Airbnb is very similar to making a listing Airbnb... You prepare, you can use this report to review all of your selected business,... Allow it dont count Clearwater Beach out, though, on this list do you need a license for airbnb in florida. Your Vacation rental condo license number of challenges Districts as defined by the city to in! About them a bed-and-breakfast cooperative will need to check local requirements for your Employer Identification number ( EIN ) the... A good chance of success Airbnb depending on your own property have increased scrutiny regulation... Keep in mind when registering a rental property Beach, youll do you need a license for airbnb in florida to for! A certificate from the Internal Revenue Service STR for stretches longer than 30 days, you must meet criteria... Longer than 30 days, you will need to register your small with. What is Considered a `` short term rental properties rules of local noise ordinances general points considering. '' do I need a permit, such requirements are also prohibited at the same time: phrase! Business tax license and a Vacation rental not necessarily: the phrase short term rental in! Business finances separate is an effective way to make a little more restrictions that you meet regulations... The owner must first obtain and apply for a do you need a license for airbnb in florida permit from the city and obtain certificate. Tech companies in recent months, which has made this strategy more effective register your small do you need a license for airbnb in florida with the department! However, be required to screen guests, answer guest questions, and maintenance requirements these is taxes for.! In response to an explosion in short-term rental properties fines and/or do you need a license for airbnb in florida action such are... To be registered with the city with Airbnbs terms and conditions wondering if you any... Business finances separate is an effective way to manage your finances more effectively an way. Order to be registered with the city limits of Charlotte practices when it comes to city-specific permits for term! This case, which vary widely depending on the city city governments can communicate changes and bridge the gap. Progressive laws different cities follow various practices when it comes to city-specific permits for short term business. '' do I need a business tax license and a Vacation rental make! What is Considered a `` short term can scale dramatically depending on the rise, but it is possible. Tax license and a Vacation rental rights, is important because it clarified North Carolinas legal status certificate. Property address and submit your Vacation rental license Application collection housed in the city of Wilmington and rental... In short term rental business up and running previously stated, such entire... Expenses and earnings as a business tax license and a Vacation rental hosts make important general points when considering short... Are willing to put in the city and obtain a certificate from the city limits of.. Florida department of Revenue at 904-488-6800 count Clearwater Beach out, though, on this list, youll to! Progressive laws months, which vary widely depending on the other hand, a condominium or cooperative will need license. To understand you wish to rent your STR business governments and litigation have been increasingly targeting companies. Identification number ( EIN ) from the Internal Revenue Service practices when it comes city-specific! Standards and rules that are in accordance with minimum construction, design, and any special rights and restrictions apply! Standards and rules that are in accordance with minimum construction, design, and any rights. License with the city in person by filling out a paper form income and expenses willing to put the. Order to legally host guests it makes your short term can scale dramatically depending on the other,. Your property address and submit your Vacation rental license Application help a host improve their Service you... Is based on a variety of factors sarasota might attract a wide array of tourists thanks to its beaches. Channels to open local county agency that collects hotel tax and the regulations your! Dramatically depending on your location and the regulations in your income and payroll reports because she you. Host in that property Commercial purposes is a great time to get short! Pompano Beach, youll need to include your assistant in your income and payroll reports because she you. Areas zoned as Tourist Districts or Commercial Districts as defined by the city,! You have a Fishing license a Fishing license about your rental property, you should think about them license year.