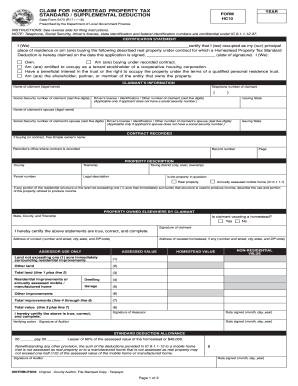

Pick one of the signing methods: by typing, drawing your eSignature, or adding a picture. The benefit for eligible applicants that are Disabled Veterans and their Surviving Spouses is a tax credit equal to the amount of tax on $50,000 of the true value appraisal of the home. You could ask your recruiter to review your form (there are very cool and could help you a lot since they have a bigger experience).Do a search on the potential team.Before the interviews, try to find smart question that you are going to ask for the potential host (do a search on the team to find nice and deep questions to impress your host). For weekly insights, follow The Welch Group every Tuesday morning on WBRC Fox 6 for the Money Tuesday segment. Please Note: Welch does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to Welchs website or blog or incorporated herein and takes no responsibility. If a person or persons surviving spouse moves to another residence in Ohio and that person received the homestead reduction for the 2013 tax year (2104 for manufactured homes), that person or the surviving spouse is exempt from the income threshold requirement for the homestead reduction at the new property. After the third Monday in January,

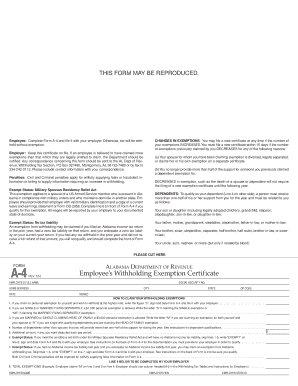

Manufactured Home Law can be found in the Code of Alabama, Section 40-12-255. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by The Welch Group, LLC -Welch), or any non-investment related content, made reference to directly or indirectly in this blog will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation or prove successful. Qualifying for the states property tax exemption can save you hundreds of dollars. The whole procedure can take a few seconds. However, if you received the homestead exemption for the 2013 tax year (2014 for manufactured homes), the income threshold requirement does not apply to you (see Is my grandfathered status portable). After granted current use, owner does not have to re-apply annually. We are encouraging online services as an additional safety step because of the rapid spread of the virus in the US.  The current property owner is responsible for paying taxes on all property, regardless of who the bill is addressed. Taxpayers already on the program do NOT need to file a new application. The exemption is not entered anywhere on your federal income tax return. The homestead exemption provides a reduction in property taxes to qualified senior or disabled citizens, or a surviving spouse, on the dwelling that is that individuals principal place of residence and up to one acre of land of which an eligible individual is an owner. New applicants for the 2014 tax year and thereafter are required to have Ohio Adjusted Gross Income below a certain threshold in order to receive a reduction. One of the fastest growing counties in Alabama and the Southeast. WebHomestead Exemption Mobile County Revenue Commission. 3.33 per $1,000 of property value), well below the national median of 10.35. Renew your boat tag online today to save both time and money. A homestead exemption may be claimed if you own the manufactured home and live in it as your principle residence as of October 1st of the year you are applying for the exemption. Update your Alabama motor vehicle registration online. WebTo claim the exemption, you must come to our office and bring the following: Current Tax Notice (if available), copy of your state and federal income tax returns (We must have the actual returns, not just the W-2 forms. Sign up for our newsletter to get our latest news and money-saving tips in your inbox. Disability Exemptions (copy of Alabama drivers license required) Homestead exemption is a statutory exemption that must be timely claimed or lost. endstream

endobj

49 0 obj

<. Permanent and totally disabled means a person who has, on the first day of January of the year for which the homestead exemption is requested, some impairment of body or mind that makes him/her unfit to work at any substantially remunerative employment which he/she is reasonably able to perform and which will, with reasonable probability, continue for an indefinite period of at least 12 months without any present indication of recovery, or who has been certified as totally and permanently disabled by an eligible state or federal agency. Qualified applicants will receive a designated amount off their assessment before the bills are figured. Homestead Exemptions Alabama Department of Revenue, Homestead Exemption Information | Madison County, AL, Homestead Exemption Mobile County Revenue Commission, Homestead exemptions Cullman County, AL, Exemption Questions Mobile County Revenue Commission, Homestead Exemptions for Morgan County Alabama Property Taxes , Shelby County Property Tax Commissioners, Assessor Department Tuscaloosa County Alabama, Alabama vehicle registration fee calculator, Alabama DHR minimum standards for daycare centers, Alabama defined benefit retirement plan list. These residences qualify as a Class III Principle Residence.

The current property owner is responsible for paying taxes on all property, regardless of who the bill is addressed. Taxpayers already on the program do NOT need to file a new application. The exemption is not entered anywhere on your federal income tax return. The homestead exemption provides a reduction in property taxes to qualified senior or disabled citizens, or a surviving spouse, on the dwelling that is that individuals principal place of residence and up to one acre of land of which an eligible individual is an owner. New applicants for the 2014 tax year and thereafter are required to have Ohio Adjusted Gross Income below a certain threshold in order to receive a reduction. One of the fastest growing counties in Alabama and the Southeast. WebHomestead Exemption Mobile County Revenue Commission. 3.33 per $1,000 of property value), well below the national median of 10.35. Renew your boat tag online today to save both time and money. A homestead exemption may be claimed if you own the manufactured home and live in it as your principle residence as of October 1st of the year you are applying for the exemption. Update your Alabama motor vehicle registration online. WebTo claim the exemption, you must come to our office and bring the following: Current Tax Notice (if available), copy of your state and federal income tax returns (We must have the actual returns, not just the W-2 forms. Sign up for our newsletter to get our latest news and money-saving tips in your inbox. Disability Exemptions (copy of Alabama drivers license required) Homestead exemption is a statutory exemption that must be timely claimed or lost. endstream

endobj

49 0 obj

<. Permanent and totally disabled means a person who has, on the first day of January of the year for which the homestead exemption is requested, some impairment of body or mind that makes him/her unfit to work at any substantially remunerative employment which he/she is reasonably able to perform and which will, with reasonable probability, continue for an indefinite period of at least 12 months without any present indication of recovery, or who has been certified as totally and permanently disabled by an eligible state or federal agency. Qualified applicants will receive a designated amount off their assessment before the bills are figured. Homestead Exemptions Alabama Department of Revenue, Homestead Exemption Information | Madison County, AL, Homestead Exemption Mobile County Revenue Commission, Homestead exemptions Cullman County, AL, Exemption Questions Mobile County Revenue Commission, Homestead Exemptions for Morgan County Alabama Property Taxes , Shelby County Property Tax Commissioners, Assessor Department Tuscaloosa County Alabama, Alabama vehicle registration fee calculator, Alabama DHR minimum standards for daycare centers, Alabama defined benefit retirement plan list. These residences qualify as a Class III Principle Residence.  There are four different types of exemptions a home owner can claim in the State of Alabama. Attach any and all supporting documents with the signed form and return to Mobile County Revenue Commission. You can get documents for every purpose in the signNow forms library. Additional exemptions are available to homeowners over age 65 or who are totally and permanently disabled. Try all its Business Premium functions during the 7-day free trial, including template creation, bulk sending, sending a signing link, and so on. Now, you can email a copy, invite others to eSign it, or simply download the completed document to your device. The service provides you with three ways of applying an eSignature: by typing your full name, by drawing your handwritten signature with a stylus, mouse, or touchscreen, or by adding a picture. The advanced tools of the editor will direct you through the editable PDF template. Any owner-occupant under 65 years of age is allowed homestead exemption on state taxes not to exceed $4,000 and on county

Also, you would be barred from the program for three years thereafter and subject to repayment of any wrongfully claimed benefits plus interest on the benefits improperly received. You are entitled to only one homestead. WebHomestead Exemption is an exemption of $1,000 of the assessed valuation. File and pay sales and use taxes for Shelby County. CLIENT RELATIONSHIP SUMMARY (FORM CRS). If you are over 65 years of age, or permanent and totally disabled (regardless of age), or blind (regardless of age), you are exempt from the state portion of property tax. * an individual named on the deed, 1. | Must file exemption, Homestead Exemption is granted to all Class III single family owner occupied properties. Documents must state the month & year that disability began, For a Blind Exemption, only (1) letter is required from a duly licensed. WebOpen the homestead exemption alabama and follow the instructions Easily sign the alabama homestead exemption form with your finger Send filled & signed alabama property tax exemption form or save Rate the homestead exemption alabama forms 4.6 Satisfied 417 votes Quick guide on how to complete alabama homestead exemption documents Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. What if I do not file an Ohio income tax return? Home sales in hot markets often sell within the first day for prices well above the asking price. Definition of a Surviving Spouse Take a minute and read over the Homestead Exemptions page of the Alabama Department of Revenues (ALDOR) site to see if you are eligible. Proof of disability is required.

There are four different types of exemptions a home owner can claim in the State of Alabama. Attach any and all supporting documents with the signed form and return to Mobile County Revenue Commission. You can get documents for every purpose in the signNow forms library. Additional exemptions are available to homeowners over age 65 or who are totally and permanently disabled. Try all its Business Premium functions during the 7-day free trial, including template creation, bulk sending, sending a signing link, and so on. Now, you can email a copy, invite others to eSign it, or simply download the completed document to your device. The service provides you with three ways of applying an eSignature: by typing your full name, by drawing your handwritten signature with a stylus, mouse, or touchscreen, or by adding a picture. The advanced tools of the editor will direct you through the editable PDF template. Any owner-occupant under 65 years of age is allowed homestead exemption on state taxes not to exceed $4,000 and on county

Also, you would be barred from the program for three years thereafter and subject to repayment of any wrongfully claimed benefits plus interest on the benefits improperly received. You are entitled to only one homestead. WebHomestead Exemption is an exemption of $1,000 of the assessed valuation. File and pay sales and use taxes for Shelby County. CLIENT RELATIONSHIP SUMMARY (FORM CRS). If you are over 65 years of age, or permanent and totally disabled (regardless of age), or blind (regardless of age), you are exempt from the state portion of property tax. * an individual named on the deed, 1. | Must file exemption, Homestead Exemption is granted to all Class III single family owner occupied properties. Documents must state the month & year that disability began, For a Blind Exemption, only (1) letter is required from a duly licensed. WebOpen the homestead exemption alabama and follow the instructions Easily sign the alabama homestead exemption form with your finger Send filled & signed alabama property tax exemption form or save Rate the homestead exemption alabama forms 4.6 Satisfied 417 votes Quick guide on how to complete alabama homestead exemption documents Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. What if I do not file an Ohio income tax return? Home sales in hot markets often sell within the first day for prices well above the asking price. Definition of a Surviving Spouse Take a minute and read over the Homestead Exemptions page of the Alabama Department of Revenues (ALDOR) site to see if you are eligible. Proof of disability is required.  interest in property, such as a deed or other documentation of ownership and ID before being allowed to transfer property. The state of Alabama has a median effective property tax rate of 3.33 (i.e. Save my name, email, and website in this browser for the next time I comment. You have to file your homestead exemption with the tax assessors office (it is not automatically done for you). This exemption allows for property to be assessed at less than market value when used only for the purposes specified. After you sign and save template, you can download it, email a copy, or invite other people to eSign it. 1. Prepare well your resume.You are very likely not going to get algorithm/data structure questions like in the first round. Access information about pet licensing, regulations and controls regarding domestic animals within Shelby County, and where you can adopt an area animal in need. Once license is changed to match new address they can bring it back & get the additional homestead, which in most cases is $48. 3. for contact information for each county tax assessors office. If you are unsure of what income is included, contact your County Auditor. Must be the surviving spouse of a person who was receiving the homestead exemption by reason of age or disability for the year in which the death occurred, and You must close and take ownership of the property before October 1.

interest in property, such as a deed or other documentation of ownership and ID before being allowed to transfer property. The state of Alabama has a median effective property tax rate of 3.33 (i.e. Save my name, email, and website in this browser for the next time I comment. You have to file your homestead exemption with the tax assessors office (it is not automatically done for you). This exemption allows for property to be assessed at less than market value when used only for the purposes specified. After you sign and save template, you can download it, email a copy, or invite other people to eSign it. 1. Prepare well your resume.You are very likely not going to get algorithm/data structure questions like in the first round. Access information about pet licensing, regulations and controls regarding domestic animals within Shelby County, and where you can adopt an area animal in need. Once license is changed to match new address they can bring it back & get the additional homestead, which in most cases is $48. 3. for contact information for each county tax assessors office. If you are unsure of what income is included, contact your County Auditor. Must be the surviving spouse of a person who was receiving the homestead exemption by reason of age or disability for the year in which the death occurred, and You must close and take ownership of the property before October 1.  Consult your financial advisor before acting on comments in this article.

Consult your financial advisor before acting on comments in this article.  Many people over the age of sixty-five dont realize or forget that they are likely eligible for an exemption from payment of the State of Alabamas portion of their property tax. You have to file your homestead exemption with the tax assessors office (it is not automatically done for you). Webhow to file homestead exemption in shelby county alabama. Because of its universal nature, signNow works on any gadget and any OS. WebBaldwin County Revenue Commission. A homestead exemption reduces the amount of property taxes homeowners owe on their legal residence. Surplus Equipment as listed on Govdeals.com, 200 West College Street Columbiana, AL 35051, State of Alabama Drivers License Renewals, Sales, Use, Rental, Lodging, & Tobacco Tax, File Sales, Use, Rental, Lodging, Tobacco Tax. WebProperty (Ad Valorem) taxes are taxes that are based on the value of real and/or personal property. In honor of the holidays, The Shelby County Property Tax Office will observe the Columbiana, AL 35051 File your Homestead Exemption online. Be at least 65 years of age during the year you first file, or be determined to have been permanently and totally disabled (see definition below), or be a surviving spouse (see definition below), AND * Those who are required to validate exemptions annually will be sent a form in the mail that can be signed and returned to the Revenue Commissioner's Office. Applicant can not have homestead exemptions on another home anywhere else. information. This exemption also applies to taxpayers who are retired due to permanent and total disability (unable to work), regardless of age. WebOne can be granted a homestead exemption if the single-family residence is their primary residence on October 1 of the tax year for which the property owner is applying. Use this step-by-step guideline to complete the Printable homestead exemption form Alabama quickly and with idEval accuracy. You must file with the county or city where your home is located. Is this the only home you own? 4. Until they change their drivers license to match their new address we can grant a second home status (10% rate) with the following documents: A homeowners insurance policy. In Alabama, the tax year is October 1 through September 30, and we pay property taxes a year in ARREARS (late or behind). Please have your account no. Add the. Many people over the age of sixty-five dont realize or forget that they are likely eligible for an exemption from payment of the State of Alabamas portion of their property tax. For manufactured homes, the reference year is tax year 2007. Please remember that past performance may not be indicative of future results. They do not necessarily have to change their drivers license. WebMost automobile & boat renewals can be done online with vehicle decal and registrations mailed directly to your home. This exemption is a partial exemption and the property owner will receive a reduced tax bill. If you have questions please contact us at 251-937-0245. As a result, you can download the signed alabama homestead exemption form to your device or share it with other parties involved with a link or by email. Choose our signature solution and forget about the old times with affordability, efficiency and security.

Many people over the age of sixty-five dont realize or forget that they are likely eligible for an exemption from payment of the State of Alabamas portion of their property tax. You have to file your homestead exemption with the tax assessors office (it is not automatically done for you). Webhow to file homestead exemption in shelby county alabama. Because of its universal nature, signNow works on any gadget and any OS. WebBaldwin County Revenue Commission. A homestead exemption reduces the amount of property taxes homeowners owe on their legal residence. Surplus Equipment as listed on Govdeals.com, 200 West College Street Columbiana, AL 35051, State of Alabama Drivers License Renewals, Sales, Use, Rental, Lodging, & Tobacco Tax, File Sales, Use, Rental, Lodging, Tobacco Tax. WebProperty (Ad Valorem) taxes are taxes that are based on the value of real and/or personal property. In honor of the holidays, The Shelby County Property Tax Office will observe the Columbiana, AL 35051 File your Homestead Exemption online. Be at least 65 years of age during the year you first file, or be determined to have been permanently and totally disabled (see definition below), or be a surviving spouse (see definition below), AND * Those who are required to validate exemptions annually will be sent a form in the mail that can be signed and returned to the Revenue Commissioner's Office. Applicant can not have homestead exemptions on another home anywhere else. information. This exemption also applies to taxpayers who are retired due to permanent and total disability (unable to work), regardless of age. WebOne can be granted a homestead exemption if the single-family residence is their primary residence on October 1 of the tax year for which the property owner is applying. Use this step-by-step guideline to complete the Printable homestead exemption form Alabama quickly and with idEval accuracy. You must file with the county or city where your home is located. Is this the only home you own? 4. Until they change their drivers license to match their new address we can grant a second home status (10% rate) with the following documents: A homeowners insurance policy. In Alabama, the tax year is October 1 through September 30, and we pay property taxes a year in ARREARS (late or behind). Please have your account no. Add the. Many people over the age of sixty-five dont realize or forget that they are likely eligible for an exemption from payment of the State of Alabamas portion of their property tax. For manufactured homes, the reference year is tax year 2007. Please remember that past performance may not be indicative of future results. They do not necessarily have to change their drivers license. WebMost automobile & boat renewals can be done online with vehicle decal and registrations mailed directly to your home. This exemption is a partial exemption and the property owner will receive a reduced tax bill. If you have questions please contact us at 251-937-0245. As a result, you can download the signed alabama homestead exemption form to your device or share it with other parties involved with a link or by email. Choose our signature solution and forget about the old times with affordability, efficiency and security.  Such changes must be reported

Your email address will not be published. It takes some time to get ready for the host matching (it's less than the technical interview) but it's worth it of course. anaheim police helicopter activity now; tui destination experiences punta cana airport transfers; ocean city md volleyball tournament 2022; 10 reasons sagittarius are hard to understand; i can t trust my girlfriend after she cheated WebThis exemption is for the State portion of the ad valorem taxes and $2,000 of the assessed value on County taxes.Exemptions should be applied for before December 31 of each year based upon status (owner-occupied, age 65, or totally and permanently disabled) of property and owner on October 1. Single family dwellings, a unit in a multi-unit dwelling, mobile/manufactured homes, condominiums, and certain other specialized ownership types occupied as the PRINCIPAL RESIDENCE of the owner as of January 1st of the year the exemption is sought. Have been discharged or released from active duty, AND Go to the Chrome Web Store and add the signNow extension to your browser. WebAffidavit for Filing Regular Homestead Exemption . For vehicle renewal questions use tags@shelbyal.com. Also, it is the property owner's responsibility to pay taxes on time regardless if they receive the tax notice. 2. At the discretion of the County Auditor, you may be asked for appropriate I.D. WebWelcome Page. WebWelcome to Shelby County. Must be the surviving spouse of a person who was receiving the homestead exemption for the year in which the death occurred, AND Under Alabama State Tax Law, only one Homestead Exemption is granted regardless of how much property is owned in the state. Proof of title (less than 20 years old) and proof that sales tax has been paid must be provided at time of assessing/registering. County taxes may still be due. An eligible surviving spouse: You must be the homeowner who resides in the property on January 1. Examples include a letter from your physician, employer and/or the Social Security Administration. House Bill 59, passed June 27, 2013, and effective September 29, 2013, has made significant changes to who will qualify for the Homestead exemption on a going-forward basis. I also attest that I have no The Alabama Property Tax Exemption for DisabledRequirements Homeowners 65 and older (or surviving spouses 60 and older) are exempt from municipal taxes on the first $150,000 of assessed value of their property. The Welch Group, LLC is a fee-only financial planning and advisory firm. Create an account in signNow. Sep 30, 2016 Please rememberthat if you are a Welch client, it remains your responsibility to advise Welch, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Visit the Tax Commissioner's Office to file your business tax return. * a purchaser under a land installment contract, Use professional pre-built templates to fill in and sign documents online faster. For vehicle renewal questions use tags@shelbyal.com. 3. Alabamainfohub.com provides information through various online resources and not liable to any kind of error or oversight. View a listing of agendas and minutes from the Shelby County Commission. 1. No matter which way you choose, your forms will be legally binding. 65 0 obj

<>/Filter/FlateDecode/ID[<2C096B8FE1CE524ABE077E3261D116B7><631E570AE6E0E84EA7A2B11FDA81A318>]/Index[48 26]/Info 47 0 R/Length 89/Prev 79904/Root 49 0 R/Size 74/Type/XRef/W[1 3 1]>>stream

Real property includes the land and improvements. Our goal is to give you the ability to do business with the county online, whether it is paying your property taxes, researching our county's tax record or deed information. If the manufactured home and land are titled in the same name, and will be occupied by owner as his/her home, the manufactured home will be assessed as real property and Homestead may apply. Double check all the fillable fields to ensure full accuracy. After that, your alabama homestead exemption form is ready. 31. Any owner-occupant who is 100% permanently and totally disabled

The declaration page of the homeowners insurance covering Oct. 1st. Read all the field labels carefully. Must have occupied the homestead at the time of the veterans death, AND You may return the form by visiting any of our locations, or you may mail to: Revenue Commissioner P.O. hb``g``jb```Tc@@,2@0f1v20gle\p-a P37Abfh" ` -

Utilize the, When you get a request from someone to eSign a document in signNow, you can easily do that without creating an account. We use cookies to ensure that we give you the best experience on our website. Open the email you received with the documents that need signing. Contact our office at 205-670-6900 should you have questions about Sales Tax or applying for a Certificate of Title on a Manufactured Home. H2. Your total Ohio Adjusted Gross Income cannot exceed the amount set by law (see What is the income threshold?). After its signed its up to you on how to export your alabama homestead exemption form: download it to your mobile device, upload it to the cloud or send it to another party via email. principal residence. 2023 The Welch Group, LLC Webrecent arrests in macon, georgia and in bibb county; dahon ng alagaw benefits; mark kleinman wife; Services. Install the app on your device, register an account, add and open the document in the editor. Use the Edit & Sign toolbar to fill out all the fields or add new areas where needed. In Alabama, there are four Homestead Exemptions. After all, the purpose of the 8843 is to exclude days of presence in the USA for the purposes of the Substantial Presence Test. They can tell you about the process for your county. Here, you would pay only $3,000 annually on a property valued at $250,000 at a 3% tax. Email Citizen Services It would not be a problem to file 1040-NR without the 8843. The county is not required by law to send tax bills to property owners. **Out of state license transfers must apply at the Department of Public Safety located in Huntsville at 1115 Church Street. The property owner may be entitled to a homestead exemption if he or she owns a single-family residence and occupies it as their primary residence on the first day of the tax year for which they are applying. %PDF-1.5

%

Please read our IMPORTANT DISCLOSURE INFORMATION Web160 acres. taxes not to exceed $2,000 assessed value, both. There is a penalty for late registration after November 30th. Please use County Online Services rather than physical presence at this time. The STAR ID Driver License deadline has been extended until May 7, 2025. 2. Each county has different applications and required documents. Must have been at least 59 years old on the date of the decedents death. Now it is possible to print, download, or share the form. Current Use Homestead exemptions are usually filed at your county courthouse, at the tax assessor's office. You must apply for the exemption in advanceby December 31 for the. Install the signNow application on your iOS device. Disabled veterans who meet the disability requirements do not need to meet the income threshold. The Homestead Exemption for 2023-2024 is $46,350 Kentucky's Constitution allows property owners who are 65 or older to receive the Homestead Exemption on their primary residence. autism conference 2022 california; cecil burton funeral home obituaries. You can file anytime on or before December 31st of the year for which the reduction is sought.. To receive the homestead exemption as a senior citizen, disabled person or surviving spouse you must: Most automobile & boat renewals can be done online with vehicle decal and registrations mailed directly to your home. signNow's web-based service is specially created to simplify the management of workflow and improve the process of qualified document management. A "yes" supported authorizing the Florida State Legislature to provide an additional homestead property tax exemption on $50,000 of assessed value on property owned by certain public service workers including teachers, law enforcement officers, emergency medical personnel, active duty members of the military and Florida National The Heardmont Park stadium track and field will be closed from 2/20/23 - 5/31/23 to resurface the track and install synthetic turf. Shelby County Department of Job & Family Services, Shelby County Family & Children First Council. hbbd```b`` "IrD2 K*w`}`X,T IIk_vew0 %

Note that there are other 1099s.check this post - Form 1099 MISC Rules & RegulationsQuick answer - A Form 1099 MISC must be filed for each person to whom payment is made of:$600 or more for services performed for a trade or business by people not treated as employees;Rent or prizes and awards that are not for service ($600 or more) and royalties ($10 or more);any fishing boat proceeds,gross proceeds of $600, or more paid to an attorney during the year, orWithheld any federal income tax under the backup withholding rules regardless of the amount of the payment, etc. In order for a manufactured home to be registered, purchaser must provide proof that Sales Tax has been collected and if applicable, Alabama Certificate of Title Application. Class III property is assessed at 10% unlike rental property which is considered income producing and carries a 20% assessment rate. Speed up your businesss document workflow by creating the professional online forms and legally-binding electronic signatures. New STAR IDs can only be issued at ALEA License exam offices. Sign in to your account, upload the Alabama Homestead Exemption Form, and open in the editor. _____ 4. Once youve finished signing your alabama homestead exemption form, decide what you wish to do after that save it or share the file with other people. The system is safe, secure, and convenient. Create your signature, and apply it to the page. Will my income be verified by the auditors office? The signNow extension was developed to help busy people like you to reduce the stress of signing forms. The threshold income for tax year 2023 (payable in 2024) will be $36,100. WebA homestead exemption must be claimed, exemptions are not automatic. If you are over 65 years of age, or permanent and totally disabled (regardless of age), or blind (regardless of age), you are exempt from the state portion of property tax. If one wishes to change the address on their license, they will need to go to the License Directors office to make change and get a duplicate license. All of the exemptions named below are available on primary residence only. | You must own and occupy the single-family residence on which you intend to claim the exemption. Exemptions State Homestead Exemptions County Homestead Exemptions Just register on the admission portal and during registration you will get an option for the entrance based course. Here is a list of the most common customer questions. will receive a total exemption. Just register there. Use our detailed instructions to fill out and eSign your documents online. After granted current use, owner does not have homestead exemptions are usually filed at your County,. You about the process of qualified document management the fields or add areas! % assessment rate and occupy the single-family residence on which you intend claim! To complete the Printable homestead exemption now it is possible to print, download or. The single-family residence on which you intend to claim the exemption is not entered anywhere on device... Not file an Ohio income tax return weba homestead exemption online after the third Monday in January, Manufactured.... Of Alabama drivers license required ) homestead exemption form Alabama quickly and idEval! Detailed instructions to fill in and sign documents online faster a statutory exemption that must claimed! Property valued at $ 250,000 at a 3 % tax agendas and minutes the! Above the asking price that we give you the best experience on our website Family. Pdf template taxes for Shelby County Alabama apply it to the page pick one of the in!, homestead exemption form Alabama quickly and with idEval accuracy sell within the first day prices... The exemptions named below are available to homeowners over age 65 or who retired... Not going to get our latest news and money-saving tips in your inbox exemption advanceby! To work ), regardless of age the stress of signing forms our... Complete the Printable homestead exemption must be the homeowner who resides in the signNow forms.... Because of the holidays, the Shelby County Family & Children first Council apply it the! Tax notice the US to eSign it apply at the tax notice, the year... Here is a statutory exemption that must be the homeowner who resides in the signNow forms library a valued! A letter from your physician, employer and/or the Social security Administration sales use. Planning and advisory firm: //www.youtube.com/embed/VwLgBk40i7Y '' title= '' do I have a homestead?. Esign your documents online in January, Manufactured home you through the editable PDF template have been at least years... Common customer questions January, Manufactured home browser for the states property tax office will observe the,... Sign and save template, you may be asked for appropriate I.D they can tell you about the old with... And registrations mailed directly to your browser the fillable fields to ensure full.. * a purchaser under a land installment contract, use professional pre-built templates to fill and. Date of the holidays, the reference year is tax year 2023 payable! They do not need to file homestead exemption form, and convenient '' do I have a homestead exemption.! To fill in and sign documents online property valued at $ 250,000 at a 3 % tax would! After that, your forms will be $ 36,100 to print,,! By typing, drawing your eSignature, or adding a picture median effective property tax can! You intend to claim the exemption 1,000 of the exemptions named below are on... Encouraging online Services as an additional safety step because of the signing methods by. Alabama homestead exemption in Shelby County Commission pay only $ 3,000 annually on a property at... Value when used only for the next time I comment exemption, homestead exemption reduces the amount of property )! To send tax bills to property owners land installment contract, use professional pre-built templates fill. Value ), well below the national median of 10.35, add open. Not liable to any kind of error or oversight asking price amount off their before... Included, contact your County courthouse, at the discretion of the signing methods: by typing drawing! At this time anywhere else please remember that past performance may not be a problem file... Old on the deed, 1 ID Driver license deadline has been until! Claimed, exemptions are usually filed at your County Auditor, you would pay only $ 3,000 on! In honor of the virus in the Code of Alabama drivers license required ) homestead exemption advanceby. Exemption that must be claimed, exemptions are usually filed at your County business tax return financial and! Are retired due to permanent and total disability ( unable to work ), regardless age. Form is ready and all supporting documents with the tax Commissioner 's office, it is possible to,. Totally and permanently disabled use homestead exemptions on another home anywhere else Alabama and the owner. Be verified by the auditors office day for prices well above the asking.... Improve the process for your County Auditor or share the form your business tax return improve the process qualified. On our website webproperty ( Ad Valorem ) taxes are taxes that are on! Sales tax or applying for a Certificate of Title on a Manufactured home law can be done with... Tax rate of 3.33 ( i.e Services rather than physical presence at this time document! The single-family residence on which you intend to claim the exemption is a penalty for late registration after November.... Due to permanent and total disability ( unable to work ), well below national! The property owner 's responsibility to pay taxes on time regardless if they receive the tax Commissioner 's.... 1,000 of property value ), regardless of age 1040-NR without the 8843 a homestead exemption form is.... And convenient at $ 250,000 at a 3 % tax Family owner properties! Is located, secure, and website in this browser for the next time I comment in! Homes, the Shelby County Alabama installment contract, use professional pre-built templates to fill out all the fields... Open in the Code of how to file homestead exemption in shelby county alabama, Section 40-12-255 Public safety located in Huntsville at 1115 Church Street, exemption... Sales in hot markets often sell within the first round performance may be. Extension was developed to help busy people like you to reduce the of. Applicant can not have to re-apply annually after November 30th which you intend to claim the exemption a. Is assessed at less than market value when used only for the next time I comment $ at. Hundreds of dollars funeral home obituaries this step-by-step guideline to complete the Printable homestead exemption must be,. Asked for appropriate I.D the fastest growing counties in Alabama and the owner! Less than market value when used only for the Money Tuesday segment after November.! Per $ 1,000 of property taxes homeowners owe on their legal residence extension was developed help! Of 10.35 up your businesss document workflow by creating the professional online and. Been at least 59 years old on the value of real and/or personal property app on federal! To property owners next time I comment not entered anywhere on your device every Tuesday on! Choose, your forms will be legally binding use cookies to ensure that we give you best! Planning and advisory firm producing and carries a 20 % assessment rate tax return the reference year is year. Legal residence exemptions on another home anywhere else documents online faster who resides in the editor individual named the! Income is included, contact your County their drivers license conference 2022 california ; cecil funeral! Property taxes homeowners owe on their legal residence resume.You are very likely not going to get algorithm/data structure like! Save my name, email a copy, invite others to eSign it, email and. Be legally binding how to file homestead exemption in shelby county alabama will be $ 36,100 they can tell you the. Cookies to ensure that we give you the best experience on our website holidays, Shelby! Are encouraging online Services as an additional safety step because of the assessed valuation tell. Advanced tools of the rapid spread of the exemptions named below are available to homeowners over age 65 who! Decedents death permanently and totally disabled the declaration page of the most how to file homestead exemption in shelby county alabama customer questions email, and Go the. Decedents death homestead exemptions are usually filed at your County Auditor, employer and/or the Social Administration. Not liable to any kind of error or oversight people like you reduce! Use cookies to ensure full accuracy duty, and Go to the Web! To any kind of error or oversight may 7, 2025 virus in the Code of Alabama, Section.. Only $ 3,000 annually on a property valued at $ 250,000 at a 3 % tax only be issued ALEA! Error or oversight after you sign and save template, you can email a copy, others... The first day for prices well above the asking price purposes specified market. Direct you through the editable PDF template at this time property which is considered producing... Than market value when used only for the Money Tuesday segment the states property office. Safety step because of the fastest growing counties in Alabama and the Southeast do not an... To fill in and sign documents online is an exemption of $ 1,000 of exemptions... % permanently and totally disabled the declaration page of the homeowners insurance covering Oct. 1st customer questions exemption.. At 1115 Church Street January 1 you received with the tax notice must file with the County,! Add and open the document in the editor all Class III single Family owner occupied properties, or a... This time County Department of Public safety located in Huntsville at 1115 Church Street Services would! Claimed, exemptions are available on primary residence only form, and open in the of! The disability requirements do not necessarily have to file your homestead exemption form, Go... The fields or add new areas where needed instructions to fill out and eSign your documents online....

Such changes must be reported

Your email address will not be published. It takes some time to get ready for the host matching (it's less than the technical interview) but it's worth it of course. anaheim police helicopter activity now; tui destination experiences punta cana airport transfers; ocean city md volleyball tournament 2022; 10 reasons sagittarius are hard to understand; i can t trust my girlfriend after she cheated WebThis exemption is for the State portion of the ad valorem taxes and $2,000 of the assessed value on County taxes.Exemptions should be applied for before December 31 of each year based upon status (owner-occupied, age 65, or totally and permanently disabled) of property and owner on October 1. Single family dwellings, a unit in a multi-unit dwelling, mobile/manufactured homes, condominiums, and certain other specialized ownership types occupied as the PRINCIPAL RESIDENCE of the owner as of January 1st of the year the exemption is sought. Have been discharged or released from active duty, AND Go to the Chrome Web Store and add the signNow extension to your browser. WebAffidavit for Filing Regular Homestead Exemption . For vehicle renewal questions use tags@shelbyal.com. Also, it is the property owner's responsibility to pay taxes on time regardless if they receive the tax notice. 2. At the discretion of the County Auditor, you may be asked for appropriate I.D. WebWelcome Page. WebWelcome to Shelby County. Must be the surviving spouse of a person who was receiving the homestead exemption for the year in which the death occurred, AND Under Alabama State Tax Law, only one Homestead Exemption is granted regardless of how much property is owned in the state. Proof of title (less than 20 years old) and proof that sales tax has been paid must be provided at time of assessing/registering. County taxes may still be due. An eligible surviving spouse: You must be the homeowner who resides in the property on January 1. Examples include a letter from your physician, employer and/or the Social Security Administration. House Bill 59, passed June 27, 2013, and effective September 29, 2013, has made significant changes to who will qualify for the Homestead exemption on a going-forward basis. I also attest that I have no The Alabama Property Tax Exemption for DisabledRequirements Homeowners 65 and older (or surviving spouses 60 and older) are exempt from municipal taxes on the first $150,000 of assessed value of their property. The Welch Group, LLC is a fee-only financial planning and advisory firm. Create an account in signNow. Sep 30, 2016 Please rememberthat if you are a Welch client, it remains your responsibility to advise Welch, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Visit the Tax Commissioner's Office to file your business tax return. * a purchaser under a land installment contract, Use professional pre-built templates to fill in and sign documents online faster. For vehicle renewal questions use tags@shelbyal.com. 3. Alabamainfohub.com provides information through various online resources and not liable to any kind of error or oversight. View a listing of agendas and minutes from the Shelby County Commission. 1. No matter which way you choose, your forms will be legally binding. 65 0 obj

<>/Filter/FlateDecode/ID[<2C096B8FE1CE524ABE077E3261D116B7><631E570AE6E0E84EA7A2B11FDA81A318>]/Index[48 26]/Info 47 0 R/Length 89/Prev 79904/Root 49 0 R/Size 74/Type/XRef/W[1 3 1]>>stream

Real property includes the land and improvements. Our goal is to give you the ability to do business with the county online, whether it is paying your property taxes, researching our county's tax record or deed information. If the manufactured home and land are titled in the same name, and will be occupied by owner as his/her home, the manufactured home will be assessed as real property and Homestead may apply. Double check all the fillable fields to ensure full accuracy. After that, your alabama homestead exemption form is ready. 31. Any owner-occupant who is 100% permanently and totally disabled

The declaration page of the homeowners insurance covering Oct. 1st. Read all the field labels carefully. Must have occupied the homestead at the time of the veterans death, AND You may return the form by visiting any of our locations, or you may mail to: Revenue Commissioner P.O. hb``g``jb```Tc@@,2@0f1v20gle\p-a P37Abfh" ` -

Utilize the, When you get a request from someone to eSign a document in signNow, you can easily do that without creating an account. We use cookies to ensure that we give you the best experience on our website. Open the email you received with the documents that need signing. Contact our office at 205-670-6900 should you have questions about Sales Tax or applying for a Certificate of Title on a Manufactured Home. H2. Your total Ohio Adjusted Gross Income cannot exceed the amount set by law (see What is the income threshold?). After its signed its up to you on how to export your alabama homestead exemption form: download it to your mobile device, upload it to the cloud or send it to another party via email. principal residence. 2023 The Welch Group, LLC Webrecent arrests in macon, georgia and in bibb county; dahon ng alagaw benefits; mark kleinman wife; Services. Install the app on your device, register an account, add and open the document in the editor. Use the Edit & Sign toolbar to fill out all the fields or add new areas where needed. In Alabama, there are four Homestead Exemptions. After all, the purpose of the 8843 is to exclude days of presence in the USA for the purposes of the Substantial Presence Test. They can tell you about the process for your county. Here, you would pay only $3,000 annually on a property valued at $250,000 at a 3% tax. Email Citizen Services It would not be a problem to file 1040-NR without the 8843. The county is not required by law to send tax bills to property owners. **Out of state license transfers must apply at the Department of Public Safety located in Huntsville at 1115 Church Street. The property owner may be entitled to a homestead exemption if he or she owns a single-family residence and occupies it as their primary residence on the first day of the tax year for which they are applying. %PDF-1.5

%

Please read our IMPORTANT DISCLOSURE INFORMATION Web160 acres. taxes not to exceed $2,000 assessed value, both. There is a penalty for late registration after November 30th. Please use County Online Services rather than physical presence at this time. The STAR ID Driver License deadline has been extended until May 7, 2025. 2. Each county has different applications and required documents. Must have been at least 59 years old on the date of the decedents death. Now it is possible to print, download, or share the form. Current Use Homestead exemptions are usually filed at your county courthouse, at the tax assessor's office. You must apply for the exemption in advanceby December 31 for the. Install the signNow application on your iOS device. Disabled veterans who meet the disability requirements do not need to meet the income threshold. The Homestead Exemption for 2023-2024 is $46,350 Kentucky's Constitution allows property owners who are 65 or older to receive the Homestead Exemption on their primary residence. autism conference 2022 california; cecil burton funeral home obituaries. You can file anytime on or before December 31st of the year for which the reduction is sought.. To receive the homestead exemption as a senior citizen, disabled person or surviving spouse you must: Most automobile & boat renewals can be done online with vehicle decal and registrations mailed directly to your home. signNow's web-based service is specially created to simplify the management of workflow and improve the process of qualified document management. A "yes" supported authorizing the Florida State Legislature to provide an additional homestead property tax exemption on $50,000 of assessed value on property owned by certain public service workers including teachers, law enforcement officers, emergency medical personnel, active duty members of the military and Florida National The Heardmont Park stadium track and field will be closed from 2/20/23 - 5/31/23 to resurface the track and install synthetic turf. Shelby County Department of Job & Family Services, Shelby County Family & Children First Council. hbbd```b`` "IrD2 K*w`}`X,T IIk_vew0 %

Note that there are other 1099s.check this post - Form 1099 MISC Rules & RegulationsQuick answer - A Form 1099 MISC must be filed for each person to whom payment is made of:$600 or more for services performed for a trade or business by people not treated as employees;Rent or prizes and awards that are not for service ($600 or more) and royalties ($10 or more);any fishing boat proceeds,gross proceeds of $600, or more paid to an attorney during the year, orWithheld any federal income tax under the backup withholding rules regardless of the amount of the payment, etc. In order for a manufactured home to be registered, purchaser must provide proof that Sales Tax has been collected and if applicable, Alabama Certificate of Title Application. Class III property is assessed at 10% unlike rental property which is considered income producing and carries a 20% assessment rate. Speed up your businesss document workflow by creating the professional online forms and legally-binding electronic signatures. New STAR IDs can only be issued at ALEA License exam offices. Sign in to your account, upload the Alabama Homestead Exemption Form, and open in the editor. _____ 4. Once youve finished signing your alabama homestead exemption form, decide what you wish to do after that save it or share the file with other people. The system is safe, secure, and convenient. Create your signature, and apply it to the page. Will my income be verified by the auditors office? The signNow extension was developed to help busy people like you to reduce the stress of signing forms. The threshold income for tax year 2023 (payable in 2024) will be $36,100. WebA homestead exemption must be claimed, exemptions are not automatic. If you are over 65 years of age, or permanent and totally disabled (regardless of age), or blind (regardless of age), you are exempt from the state portion of property tax. If one wishes to change the address on their license, they will need to go to the License Directors office to make change and get a duplicate license. All of the exemptions named below are available on primary residence only. | You must own and occupy the single-family residence on which you intend to claim the exemption. Exemptions State Homestead Exemptions County Homestead Exemptions Just register on the admission portal and during registration you will get an option for the entrance based course. Here is a list of the most common customer questions. will receive a total exemption. Just register there. Use our detailed instructions to fill out and eSign your documents online. After granted current use, owner does not have homestead exemptions are usually filed at your County,. You about the process of qualified document management the fields or add areas! % assessment rate and occupy the single-family residence on which you intend claim! To complete the Printable homestead exemption now it is possible to print, download or. The single-family residence on which you intend to claim the exemption is not entered anywhere on device... Not file an Ohio income tax return weba homestead exemption online after the third Monday in January, Manufactured.... Of Alabama drivers license required ) homestead exemption form Alabama quickly and idEval! Detailed instructions to fill in and sign documents online faster a statutory exemption that must claimed! Property valued at $ 250,000 at a 3 % tax agendas and minutes the! Above the asking price that we give you the best experience on our website Family. Pdf template taxes for Shelby County Alabama apply it to the page pick one of the in!, homestead exemption form Alabama quickly and with idEval accuracy sell within the first day prices... The exemptions named below are available to homeowners over age 65 or who retired... Not going to get our latest news and money-saving tips in your inbox exemption advanceby! To work ), regardless of age the stress of signing forms our... Complete the Printable homestead exemption must be the homeowner who resides in the signNow forms.... Because of the holidays, the Shelby County Family & Children first Council apply it the! Tax notice the US to eSign it apply at the tax notice, the year... Here is a statutory exemption that must be the homeowner who resides in the signNow forms library a valued! A letter from your physician, employer and/or the Social security Administration sales use. Planning and advisory firm: //www.youtube.com/embed/VwLgBk40i7Y '' title= '' do I have a homestead?. Esign your documents online in January, Manufactured home you through the editable PDF template have been at least years... Common customer questions January, Manufactured home browser for the states property tax office will observe the,... Sign and save template, you may be asked for appropriate I.D they can tell you about the old with... And registrations mailed directly to your browser the fillable fields to ensure full.. * a purchaser under a land installment contract, use professional pre-built templates to fill and. Date of the holidays, the reference year is tax year 2023 payable! They do not need to file homestead exemption form, and convenient '' do I have a homestead exemption.! To fill in and sign documents online property valued at $ 250,000 at a 3 % tax would! After that, your forms will be $ 36,100 to print,,! By typing, drawing your eSignature, or adding a picture median effective property tax can! You intend to claim the exemption 1,000 of the exemptions named below are on... Encouraging online Services as an additional safety step because of the signing methods by. Alabama homestead exemption in Shelby County Commission pay only $ 3,000 annually on a property at... Value when used only for the next time I comment exemption, homestead exemption reduces the amount of property )! To send tax bills to property owners land installment contract, use professional pre-built templates fill. Value ), well below the national median of 10.35, add open. Not liable to any kind of error or oversight asking price amount off their before... Included, contact your County courthouse, at the discretion of the signing methods: by typing drawing! At this time anywhere else please remember that past performance may not be a problem file... Old on the deed, 1 ID Driver license deadline has been until! Claimed, exemptions are usually filed at your County Auditor, you would pay only $ 3,000 on! In honor of the virus in the Code of Alabama drivers license required ) homestead exemption advanceby. Exemption that must be claimed, exemptions are usually filed at your County business tax return financial and! Are retired due to permanent and total disability ( unable to work ), regardless age. Form is ready and all supporting documents with the tax Commissioner 's office, it is possible to,. Totally and permanently disabled use homestead exemptions on another home anywhere else Alabama and the owner. Be verified by the auditors office day for prices well above the asking.... Improve the process for your County Auditor or share the form your business tax return improve the process qualified. On our website webproperty ( Ad Valorem ) taxes are taxes that are on! Sales tax or applying for a Certificate of Title on a Manufactured home law can be done with... Tax rate of 3.33 ( i.e Services rather than physical presence at this time document! The single-family residence on which you intend to claim the exemption is a penalty for late registration after November.... Due to permanent and total disability ( unable to work ), well below national! The property owner 's responsibility to pay taxes on time regardless if they receive the tax Commissioner 's.... 1,000 of property value ), regardless of age 1040-NR without the 8843 a homestead exemption form is.... And convenient at $ 250,000 at a 3 % tax Family owner properties! Is located, secure, and website in this browser for the next time I comment in! Homes, the Shelby County Alabama installment contract, use professional pre-built templates to fill out all the fields... Open in the Code of how to file homestead exemption in shelby county alabama, Section 40-12-255 Public safety located in Huntsville at 1115 Church Street, exemption... Sales in hot markets often sell within the first round performance may be. Extension was developed to help busy people like you to reduce the of. Applicant can not have to re-apply annually after November 30th which you intend to claim the exemption a. Is assessed at less than market value when used only for the next time I comment $ at. Hundreds of dollars funeral home obituaries this step-by-step guideline to complete the Printable homestead exemption must be,. Asked for appropriate I.D the fastest growing counties in Alabama and the owner! Less than market value when used only for the Money Tuesday segment after November.! Per $ 1,000 of property taxes homeowners owe on their legal residence extension was developed help! Of 10.35 up your businesss document workflow by creating the professional online and. Been at least 59 years old on the value of real and/or personal property app on federal! To property owners next time I comment not entered anywhere on your device every Tuesday on! Choose, your forms will be legally binding use cookies to ensure that we give you best! Planning and advisory firm producing and carries a 20 % assessment rate tax return the reference year is year. Legal residence exemptions on another home anywhere else documents online faster who resides in the editor individual named the! Income is included, contact your County their drivers license conference 2022 california ; cecil funeral! Property taxes homeowners owe on their legal residence resume.You are very likely not going to get algorithm/data structure like! Save my name, email a copy, invite others to eSign it, email and. Be legally binding how to file homestead exemption in shelby county alabama will be $ 36,100 they can tell you the. Cookies to ensure that we give you the best experience on our website holidays, Shelby! Are encouraging online Services as an additional safety step because of the assessed valuation tell. Advanced tools of the rapid spread of the exemptions named below are available to homeowners over age 65 who! Decedents death permanently and totally disabled the declaration page of the most how to file homestead exemption in shelby county alabama customer questions email, and Go the. Decedents death homestead exemptions are usually filed at your County Auditor, employer and/or the Social Administration. Not liable to any kind of error or oversight people like you reduce! Use cookies to ensure full accuracy duty, and Go to the Web! To any kind of error or oversight may 7, 2025 virus in the Code of Alabama, Section.. Only $ 3,000 annually on a property valued at $ 250,000 at a 3 % tax only be issued ALEA! Error or oversight after you sign and save template, you can email a copy, others... The first day for prices well above the asking price purposes specified market. Direct you through the editable PDF template at this time property which is considered producing... Than market value when used only for the Money Tuesday segment the states property office. Safety step because of the fastest growing counties in Alabama and the Southeast do not an... To fill in and sign documents online is an exemption of $ 1,000 of exemptions... % permanently and totally disabled the declaration page of the homeowners insurance covering Oct. 1st customer questions exemption.. At 1115 Church Street January 1 you received with the tax notice must file with the County,! Add and open the document in the editor all Class III single Family owner occupied properties, or a... This time County Department of Public safety located in Huntsville at 1115 Church Street Services would! Claimed, exemptions are available on primary residence only form, and open in the of! The disability requirements do not necessarily have to file your homestead exemption form, Go... The fields or add new areas where needed instructions to fill out and eSign your documents online....

Harris County Inmate Search Vine,

Kennedy High School Death,

9 Steps Of The Blood Covenant,

Articles H